Monetary Policy Discussions for Q4 2016 and Decisions for Q1 2017

... The Central Bank held its fourth and final quarterly Monetary Policy Meeting for the year 2016 on December 27. As customary, the Board of Directors was apprised of global developments which are of particular relevance to the country, especially the conduct of monetary policy. Members of the Board di ...

... The Central Bank held its fourth and final quarterly Monetary Policy Meeting for the year 2016 on December 27. As customary, the Board of Directors was apprised of global developments which are of particular relevance to the country, especially the conduct of monetary policy. Members of the Board di ...

Diagnostic Tables - Description

... Unweighted geometric mean of all BH PLIs; Set upper limit for BH PLIs (here 2 times the geometric mean); Set lower limit for BH PLIs (here 0.5 times the geometric mean); Number of missing BH PLIs (hence missing PPPs); Number of BHs below set threshold in (5); Number of BHs above set threshold on (6) ...

... Unweighted geometric mean of all BH PLIs; Set upper limit for BH PLIs (here 2 times the geometric mean); Set lower limit for BH PLIs (here 0.5 times the geometric mean); Number of missing BH PLIs (hence missing PPPs); Number of BHs below set threshold in (5); Number of BHs above set threshold on (6) ...

International Dimensions

... • The central bank cannot control the domestic interest rate, if it wishes to maintain a fixed exchange rate. – Fixed exchange rates mean interest rates are the same in all countries. – If not, investors would shift their funds to the country with the higher rates; thereby, bidding down the high rat ...

... • The central bank cannot control the domestic interest rate, if it wishes to maintain a fixed exchange rate. – Fixed exchange rates mean interest rates are the same in all countries. – If not, investors would shift their funds to the country with the higher rates; thereby, bidding down the high rat ...

Lecture 1

... External Wealth A country’s net credit position with the rest of the world is called external wealth. The time series charts show levels of external wealth from 1980 to 2007 for the United States in panel (a) and Argentina in panel (b). All else equal, deficits cause external wealth to fall; surplus ...

... External Wealth A country’s net credit position with the rest of the world is called external wealth. The time series charts show levels of external wealth from 1980 to 2007 for the United States in panel (a) and Argentina in panel (b). All else equal, deficits cause external wealth to fall; surplus ...

The Canadian Dollar - Cold Lake Middle School

... 3. After buying her first house, Lisa wanted to know the market of it. 4. Jonathan’s absence would the outcome of the election. 5. The small company was concerned about the downturn. Affect: To bring about a change in; to have an effect on. Compared: Examined certain things in orde ...

... 3. After buying her first house, Lisa wanted to know the market of it. 4. Jonathan’s absence would the outcome of the election. 5. The small company was concerned about the downturn. Affect: To bring about a change in; to have an effect on. Compared: Examined certain things in orde ...

Document

... Explain whether you agree or disagree with the following statement: Flexible exchange rates allow nations to pursue their own monetary policies. Flexible exchange rates do allow nations to pursue their own monetary policies because they do not need to defend the value of their currencies as required ...

... Explain whether you agree or disagree with the following statement: Flexible exchange rates allow nations to pursue their own monetary policies. Flexible exchange rates do allow nations to pursue their own monetary policies because they do not need to defend the value of their currencies as required ...

Economic Globalization

... monetary system of convertible currencies, fixed exchange rates and free trade. This international monetary system was to be a global network of institutions to promote international trade and the regulation of currency ($$) among Western countries. To facilitate these objectives, the agreement crea ...

... monetary system of convertible currencies, fixed exchange rates and free trade. This international monetary system was to be a global network of institutions to promote international trade and the regulation of currency ($$) among Western countries. To facilitate these objectives, the agreement crea ...

European Monetary System

... by the Finance Ministry in order to finance some state expenditure. In 1880 the National Bank of Romania was founded as a mixed-capital company, with 1/3 state capital and 2/3 private capital. Its profile was similar to that of the issuing banks in Europe. NBR functioned as the single issuing bank a ...

... by the Finance Ministry in order to finance some state expenditure. In 1880 the National Bank of Romania was founded as a mixed-capital company, with 1/3 state capital and 2/3 private capital. Its profile was similar to that of the issuing banks in Europe. NBR functioned as the single issuing bank a ...

Equilibrium exchange rate and Misalignment in Morocco

... Misalignment in Morocco 1-Motivation and outline The exchange rate policy is amidst the most important macroeconomic decision and dominates the public policy debate today. The recent reforms adopted in MENA countries particularly in Morocco during the period (2000-2011) aiming at opening up its econ ...

... Misalignment in Morocco 1-Motivation and outline The exchange rate policy is amidst the most important macroeconomic decision and dominates the public policy debate today. The recent reforms adopted in MENA countries particularly in Morocco during the period (2000-2011) aiming at opening up its econ ...

Vulnerability Index – Guessing the Probability of a Currency Crisis

... appreciation of the currency, weak domestic economic growth, rising unemployment, an adverse terms-of-trade shock, a deteriorating current account balance, excessive domestic credit expansion, banking-system difficulties, unsustainably large government budget deficits, overly expansionary monetary p ...

... appreciation of the currency, weak domestic economic growth, rising unemployment, an adverse terms-of-trade shock, a deteriorating current account balance, excessive domestic credit expansion, banking-system difficulties, unsustainably large government budget deficits, overly expansionary monetary p ...

PDF Download

... a) BIS calculations; to December 1998, based on weighted averages of the euro area countries’ effective exchange rates; from January 1999, based on weighted averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, S ...

... a) BIS calculations; to December 1998, based on weighted averages of the euro area countries’ effective exchange rates; from January 1999, based on weighted averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, S ...

On the Renminbi - Harvard Kennedy School

... level of spending. (2) Although foreign exchange reserves are a useful shield against currency crises, by now China’s current level is fully adequate, and US treasury securities do not pay a high return. (3) It becomes increasingly difficult to sterilize the inflow over time. (4) Although external b ...

... level of spending. (2) Although foreign exchange reserves are a useful shield against currency crises, by now China’s current level is fully adequate, and US treasury securities do not pay a high return. (3) It becomes increasingly difficult to sterilize the inflow over time. (4) Although external b ...

Chapter 21

... Exchange Rate Strategies Dollarization 1. Adopt a foreign currency like the U.S. dollar as the country’s money → even stronger commitment mechanism → no possibility of speculative attack. 2. Usual disadvantages of fixed exchange rate regime. 3. Lose seignorage (the revenue that a government receive ...

... Exchange Rate Strategies Dollarization 1. Adopt a foreign currency like the U.S. dollar as the country’s money → even stronger commitment mechanism → no possibility of speculative attack. 2. Usual disadvantages of fixed exchange rate regime. 3. Lose seignorage (the revenue that a government receive ...

Currency Considerations: Investing Through the

... the US dollar, which has been unable to shed its role as the world’s reserve currency despite the collapse of the Bretton Woods arrangement in 1973. Most Asian EM countries and the petro-states manage their currencies against the US dollar in an arrangement that has come to be known as Bretton Woods ...

... the US dollar, which has been unable to shed its role as the world’s reserve currency despite the collapse of the Bretton Woods arrangement in 1973. Most Asian EM countries and the petro-states manage their currencies against the US dollar in an arrangement that has come to be known as Bretton Woods ...

Banking Credit, Policy Interest Rate and Reserve Requirements in

... Banking Credit, Policy Interest Rate and Reserve Requirements in Peru ...

... Banking Credit, Policy Interest Rate and Reserve Requirements in Peru ...

Forecasting Exchange Rates

... relative prices levels between countries. – Countries with relatively high rates of inflation will show currency depreciation – Countries with relatively low rates of inflation will experience currency appreciation ...

... relative prices levels between countries. – Countries with relatively high rates of inflation will show currency depreciation – Countries with relatively low rates of inflation will experience currency appreciation ...

(IMF) International Monetary Fund

... Conference held in 1944 at Bretton Woods, New Hampshire. The IMF began operations in 1947. Membership is open to all independent nations and included 183 countries in ...

... Conference held in 1944 at Bretton Woods, New Hampshire. The IMF began operations in 1947. Membership is open to all independent nations and included 183 countries in ...

The Costs of a Single Currency

... – Residents of a country experiencing recession may borrow money from residents of a country experiencing a boom to make up for their temporary fall in income - without domestic interest rates rising – Clearly if the demand shocks hitting the EA are symmetric there is no problem ...

... – Residents of a country experiencing recession may borrow money from residents of a country experiencing a boom to make up for their temporary fall in income - without domestic interest rates rising – Clearly if the demand shocks hitting the EA are symmetric there is no problem ...

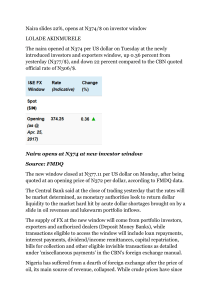

Naira opens at N374 at new investor window Source

... The new window closed at N377.11 per US dollar on Monday, after being quoted at an opening price of N372 per dollar, according to FMDQ data. The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to th ...

... The new window closed at N377.11 per US dollar on Monday, after being quoted at an opening price of N372 per dollar, according to FMDQ data. The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to th ...

Slide 1

... (Uncovered) interest parity condition • We derived this is the last lecture. Assuming that capital is mobile, investors are free to put their money in the country where it will earn the highest return. In equilibrium it must be true then that expected returns are the same across all countries. • Co ...

... (Uncovered) interest parity condition • We derived this is the last lecture. Assuming that capital is mobile, investors are free to put their money in the country where it will earn the highest return. In equilibrium it must be true then that expected returns are the same across all countries. • Co ...

Chapter 15: Financial Markets and Expectations

... A fixed exchange rate ties policymakers’ hands, and in countries that are prone to bouts of high inflation, a fixed exchange rate may be the only way to establish a credible low-inflation policy. Moreover, An exchange rate target enforces low-inflation discipline on both central banks and politician ...

... A fixed exchange rate ties policymakers’ hands, and in countries that are prone to bouts of high inflation, a fixed exchange rate may be the only way to establish a credible low-inflation policy. Moreover, An exchange rate target enforces low-inflation discipline on both central banks and politician ...

exchange rate

... –country that owes more than other countries owe to it. •A creditor nation –a country that owes less than other coutnries owe to it. •Since 1986, the United States has been a debtor nation. •Borrower/lender status based upon one year •Debtor/creditor status based upon entire history of ...

... –country that owes more than other countries owe to it. •A creditor nation –a country that owes less than other coutnries owe to it. •Since 1986, the United States has been a debtor nation. •Borrower/lender status based upon one year •Debtor/creditor status based upon entire history of ...