Global Business FBLA Study Guide Competency: Basic International

... The choice of optimal manufacturing location must consider country factors, technological factors, and product factors. What would be a country factor? Influence of factor costs A fundamental dilemma faced by all multinationals is how much should they emphasize or not emphasize responding to differe ...

... The choice of optimal manufacturing location must consider country factors, technological factors, and product factors. What would be a country factor? Influence of factor costs A fundamental dilemma faced by all multinationals is how much should they emphasize or not emphasize responding to differe ...

Lecture 2

... refers to fears of de-industrialization that gripped the Netherlands following the appreciation of Dutch guilder after the discovery of natural gas deposits in North Sea around 1960 Is it Dutch? Is it a disease? Some say No, viewing it simply as matter of one sector’s benefiting at the expense of ...

... refers to fears of de-industrialization that gripped the Netherlands following the appreciation of Dutch guilder after the discovery of natural gas deposits in North Sea around 1960 Is it Dutch? Is it a disease? Some say No, viewing it simply as matter of one sector’s benefiting at the expense of ...

Chapter 6 The Transition to a Monetary Union

... ERM-II) has replaced the old Exchange Rate Mechanism (ERM) since 1 January 1999 – Adherence to the mechanism is voluntary – Its operating procedures are determined in agreement between the ECB and the central banks of the 'outs' – ERM-II is based on central rates around which relatively wide margins ...

... ERM-II) has replaced the old Exchange Rate Mechanism (ERM) since 1 January 1999 – Adherence to the mechanism is voluntary – Its operating procedures are determined in agreement between the ECB and the central banks of the 'outs' – ERM-II is based on central rates around which relatively wide margins ...

Final Exam - Key MBA 774 Macroeconomics Prof. Greg Brown 2007

... 2. If the US dollar were to significantly appreciate against the Euro, then BMW potentially would have undertaken an expensive investment with little or no payoff. (i.e., it would be cheaper to produce in Europe again) 3. BMW might lose economies of scale in its production process. 4. There might be ...

... 2. If the US dollar were to significantly appreciate against the Euro, then BMW potentially would have undertaken an expensive investment with little or no payoff. (i.e., it would be cheaper to produce in Europe again) 3. BMW might lose economies of scale in its production process. 4. There might be ...

Fixed regime

... function of the authorities as between price and output stability; 2.the type of the shock impinging upon the economy; 3.the structural parameters of the ...

... function of the authorities as between price and output stability; 2.the type of the shock impinging upon the economy; 3.the structural parameters of the ...

No Slide Title

... the relative value of the domestic and foreign currency Total Return = Investment return plus return on foreign exchange Not possible to completely hedge a foreign investment ...

... the relative value of the domestic and foreign currency Total Return = Investment return plus return on foreign exchange Not possible to completely hedge a foreign investment ...

Open Economy Macro:

... For market-determined exchange rates: • An appreciation of a currency is when the value of the currency rises – e or R rises • A depreciation of a currency is when the value of the currency falls – e or R falls For fixed exchange rates: • Price set by government is the “parity.” • A revaluation is a ...

... For market-determined exchange rates: • An appreciation of a currency is when the value of the currency rises – e or R rises • A depreciation of a currency is when the value of the currency falls – e or R falls For fixed exchange rates: • Price set by government is the “parity.” • A revaluation is a ...

Chapter 6

... • Exchange rate systems normally fall into one of the following categories: ¤ fixed ¤ freely floating ¤ managed float ¤ pegged C6 - 4 ...

... • Exchange rate systems normally fall into one of the following categories: ¤ fixed ¤ freely floating ¤ managed float ¤ pegged C6 - 4 ...

Economic and Monetary Union

... are not members of EU, have signed monetary agreements with EU which allow them officially to adopt the euro and issue their own variant of euro coins. These states had all previously used one of the eurozone currencies replaced by the euro, or a currency pegged to one of them. These states are not ...

... are not members of EU, have signed monetary agreements with EU which allow them officially to adopt the euro and issue their own variant of euro coins. These states had all previously used one of the eurozone currencies replaced by the euro, or a currency pegged to one of them. These states are not ...

The Meiji Restoration

... • 1870 Hirobumi Ito (who later became Prime Minister) visited the US to study national banking • Recommended that Japan do the same • No central bank, but a series of national banks that could issue currency ...

... • 1870 Hirobumi Ito (who later became Prime Minister) visited the US to study national banking • Recommended that Japan do the same • No central bank, but a series of national banks that could issue currency ...

Principles of Economic Growth

... refers to fears of de-industrialization that gripped the Netherlands following the appreciation of Dutch guilder after the discovery of natural gas deposits in North Sea around 1960 Is it Dutch? Is it a disease? Some say No, viewing it simply as matter of one sector’s benefiting at the expense of ...

... refers to fears of de-industrialization that gripped the Netherlands following the appreciation of Dutch guilder after the discovery of natural gas deposits in North Sea around 1960 Is it Dutch? Is it a disease? Some say No, viewing it simply as matter of one sector’s benefiting at the expense of ...

Ch 33

... Under the gold standard, because all currencies had values fixed in units of gold, A. B. C. D. ...

... Under the gold standard, because all currencies had values fixed in units of gold, A. B. C. D. ...

Exchange Rate Determination: The Theoretical Thread

... • Methods of intervention are determined by magnitude of a country’s economy, magnitude of trading in it’s currency, and the country’s financial market development • Direct Intervention – the active buying and selling of the domestic currency against foreign currencies – If the goal is to increase t ...

... • Methods of intervention are determined by magnitude of a country’s economy, magnitude of trading in it’s currency, and the country’s financial market development • Direct Intervention – the active buying and selling of the domestic currency against foreign currencies – If the goal is to increase t ...

euro EMBA

... in practice (2) • European Commission and ECB urged Stability Pact compliance for France & Germany • Nov 2003: finance ministers agreed France & Germany could cut less than Commission wanted – Gave France, Germany until 2005 to meet 3% limit – Effectively suspended Stability Pact ...

... in practice (2) • European Commission and ECB urged Stability Pact compliance for France & Germany • Nov 2003: finance ministers agreed France & Germany could cut less than Commission wanted – Gave France, Germany until 2005 to meet 3% limit – Effectively suspended Stability Pact ...

International Trade and Globalization

... Impacts on Scale, Distribution, Efficiency and Democracy ...

... Impacts on Scale, Distribution, Efficiency and Democracy ...

END - University of Victoria

... a. shift its IS and LM curves to the right (in the Y-e diagram), resulting in an appreciation of its exchange rate; b. shift its IS and LM curves to the left (in the Y-e diagram), resulting in a depreciation of its exchange rate; c. shift its IS curve to the left and its LM curve to the right (in th ...

... a. shift its IS and LM curves to the right (in the Y-e diagram), resulting in an appreciation of its exchange rate; b. shift its IS and LM curves to the left (in the Y-e diagram), resulting in a depreciation of its exchange rate; c. shift its IS curve to the left and its LM curve to the right (in th ...

Document

... • purpose of the EMS was therefore to create a zone of monetary and exchange rate stability. • drop in the exchange rate of Euro and there was a trend of being stable after 2003. ...

... • purpose of the EMS was therefore to create a zone of monetary and exchange rate stability. • drop in the exchange rate of Euro and there was a trend of being stable after 2003. ...

Policy Coordination

... and Coordination • There are two ways that nations may work together to achieve their economic objectives. • International Policy Cooperation is the adoption of institutions and procedures by which policymakers can inform each other of their objectives and share data. • International Policy Coordina ...

... and Coordination • There are two ways that nations may work together to achieve their economic objectives. • International Policy Cooperation is the adoption of institutions and procedures by which policymakers can inform each other of their objectives and share data. • International Policy Coordina ...

Exchange Rate Policy I. Foreign Exchange Market

... of exchange rate regimes. Prior to 1999, member countries of the IMF declared their exchange rate policies to the IMF according to their official or de jure exchange rate arrangements. The former IMF classification identifies three major exchange rate arrangements: fixed policies, limited flexib ...

... of exchange rate regimes. Prior to 1999, member countries of the IMF declared their exchange rate policies to the IMF according to their official or de jure exchange rate arrangements. The former IMF classification identifies three major exchange rate arrangements: fixed policies, limited flexib ...

Lecture Slides Chapter 13

... o assuming balance of payments deficit • gold outflow (under classical gold standard) • decrease money supply • reduce domestic price level • increase international competitiveness • increase exports and decrease imports • return to balance of payment equilibrium o assuming balance of payments surpl ...

... o assuming balance of payments deficit • gold outflow (under classical gold standard) • decrease money supply • reduce domestic price level • increase international competitiveness • increase exports and decrease imports • return to balance of payment equilibrium o assuming balance of payments surpl ...

14.02 Principles of Macroeconomics Problem Set 3 Fall 2004

... account deficit or surplus in Blanchardostan? In the Republic of Caballeria? 4. Draw a diagram to show equilibrium output and net exports for Blanchardostan. Label the equilibrium output Y0B and the output at which there is trade balance, YTB B. 5. Suppose the government of Blanchardostan wants to i ...

... account deficit or surplus in Blanchardostan? In the Republic of Caballeria? 4. Draw a diagram to show equilibrium output and net exports for Blanchardostan. Label the equilibrium output Y0B and the output at which there is trade balance, YTB B. 5. Suppose the government of Blanchardostan wants to i ...

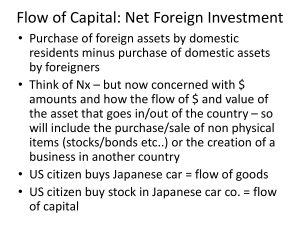

5. CH 29 NFI and B O P notes

... • When American citizens and firms exchange goods and services with foreign consumers and firms, payments are sent back and forth through major banks around the world. ………= • A country’s balance of payments accounts : record its international trading, borrowing, and ...

... • When American citizens and firms exchange goods and services with foreign consumers and firms, payments are sent back and forth through major banks around the world. ………= • A country’s balance of payments accounts : record its international trading, borrowing, and ...

PDF Download

... Although foreign exchange reserves are a useful shield against currency crises, by now China’s current level is fully adequate, and US treasury securities do not pay a high return. (3) It becomes increasingly difficult to sterilize the inflow over time. (4) Although external balance could be achieve ...

... Although foreign exchange reserves are a useful shield against currency crises, by now China’s current level is fully adequate, and US treasury securities do not pay a high return. (3) It becomes increasingly difficult to sterilize the inflow over time. (4) Although external balance could be achieve ...

Exchange rates

... FIXED, MANAGED FLOATING or FLOATING E.R.? 1. a rate which is set by the govt. only FIXED E.R. 2. a rate which is determined by the private market through supply and demand FLOATING E.R. 3. its value will decrease only if demand is low (and viceversa) FLOATING E.R. 4. it does not change before it is ...

... FIXED, MANAGED FLOATING or FLOATING E.R.? 1. a rate which is set by the govt. only FIXED E.R. 2. a rate which is determined by the private market through supply and demand FLOATING E.R. 3. its value will decrease only if demand is low (and viceversa) FLOATING E.R. 4. it does not change before it is ...