* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download History of Exchange Rate Regimes

Gold standard wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

International status and usage of the euro wikipedia , lookup

History of the euro wikipedia , lookup

History of monetary policy in the United States wikipedia , lookup

Currency war wikipedia , lookup

Reserve currency wikipedia , lookup

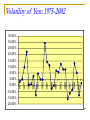

INBU 4200 INTERNATIONAL FINANCIAL MANAGEMENT Lecture 3: History of the International Monetary System (With Focus on Exchange Rate Regimes). The Euro-Zone. Recall from Lecture 2 the Definition of an Exchange Rate Regime Defined: The arrangement by which the price of the country’s currency is determined within foreign exchange markets. Arrangements ranging from: Floating Rate Managed Rate (“Dirty Float”) Pegged Rate Arrangement is determining by governments. History of Exchange Rate Regimes Over the past 200 years, the world has gone though major changes its global exchange rate environment. Starting with the gold standard in the latter part of the 19th century to today’s “mixed system” there are 3 distinct periods: Gold Standard: 1816 - 1914 Bretton Woods: 1945 - 1973 Mixed System: 1973 – the present Gold Standard: 1816 - 1914 During the 1800s the industrial revolution brought about a vast increase in the production of goods and widened the basis of world trade. At the time, trading countries believed that a necessary condition to facilitate world trade was a stable exchange rate system. Stable exchange rates were seen as necessary for encouraging and settling commercial transactions across borders (both by companies and by governments). By the second half of the 19th century, most countries had adopted the gold standard exchange rate regime. Basics of the Gold Standard The gold standard required that national money be defined as a specific weight of gold. During this period: The U.S. dollar had been defined as 0.0483% of an ounce of pure gold. The British pound as .23506% Thus, the dollar pound parity (exchange rate) was about $4.8665 per pound sterling (= .23506/.0483) Examples of Some Countries Joining the Gold Standard Country U.K. Australia Canada Germany France U.S. Japan Russia Mexico Date 1816 1852 1854 1871 1878 1879 1897 1897 1905 The Industrial Revolution and the British Empire The Industrial Revolution began in the 1760s. Centered in Northwest England, it quickly transformed the Britain from an agricultural economy to one based on the application of power-driven machinery to manufacturing. Resulted in the rise of factory production. As a result of Britain’s advantage in production, the amount of British products available for export (especially textiles) increased. The Industrial Revolution and the British Empire The search for overseas markets for British goods was the incentive for colonization and the creation of the 2nd British Empire in the 1800s. During its Industrial Revolution, Britain focused on markets in Asia and Africa. Trading posts were established in these colonies. Empire reached its apex by the end of World War I at which time it controlled a quarter of the world’s population 47% of the world’s holdings of international reserves was in the form of British pounds (1913) British Empire: Early th 20 Century WWI (1914 – 1919) World War I (August 1914) marks the beginning of the end of the Gold Standard. During the war, countries suspended the convertibility of their currencies into gold. After the war, many countries suffered hyperinflation and economic recessions. As one policy solution, many countries turned to competitive devaluations in an attempt to stimulate their export sectors and gain advantages in world export markets. In reality, however, one country’s competitive devaluation was followed by another country currency devaluation (as an offset). Interwar Period: 1919 - 1939 After WW I, various attempts were made to revive the “classical” gold standard. 1919: United States returns to a gold standard. 1925: Great Britain joins, followed by France and Switzerland. These attempts were all unsuccessful. At the time, countries were more concerned with their national economies than exchange rate stability. Especially true during the Great Depression (1929 - ) Countries abandoned the interwar gold standard during this period. Britain and Japan dropped it in 1931, the U.S. in 1933. Countries also erected high tariff walls to “protect” their domestic economy. Bretton Woods: July 1944 As World War II drew to a close, all 44 allied countries meet in Bretton Woods, New Hampshire (Mount Washington Hotel), to consider a new international monetary system. The Bretton Woods System was agreed upon at these meetings. During this time, U.S. economy is the world’s strongest, so U.S. dollar becomes the world’s key currency. Bretton Woods Agreements Fixed exchange rates were deemed desirable for “restarting” world trade and investment. U.S. dollar pegged to gold at $35 per ounce. All other countries peg their currencies to the U.S. dollar. Dollar is the only currency which is convertible into gold. Par values are set in relation to the U.S. dollar Countries agree to “support” their exchange rates within + or – 1% of these par values. To be done through the buying or selling of foreign exchange when market forces needed to be offset. Design of the Bretton Woods System Foreign currencies are linked to the U.S. Dollar which in turn is linked to gold BRITISH POUND Par Value $2.80/£ GERMAN MARK Par Value DM4.2/$ ITALIAN LIRA Par Value Lit625/$ U.S. DOLLAR GOLD $35 an ounce JAPANESE YEN Par Value ¥360/$ Bretton Woods Agreements Countries agreed not to devalue their currencies for trade gaining purposes (competitive devaluations are prohibited) But devaluation is allowed in response to “fundamental disequilibrium.” Chronic balance of payments deficit. U.S. dollar, however, is the one currency which is not permitted to change its value. Bretton Woods meetings also create: International Monetary Fund (IMF). World Bank. International Monetary Fund Created to “watch over” the international monetary system to ensure the maintenance of fixed-exchange rates. IMF agrees to lend country’s hard currency when needed to defend their central rate. Goal of the IMF: “To promote international monetary cooperation and facilitate the growth of international trade.” Stable exchange rates are seen as critical to this IMF goal. World Bank Also part of Bretton Woods Agreement Initial goal of World Bank was to rebuild Europe and Asia’s war-torn economies through financial aid. Channels “Marshall” aid funds to Europe and Asia. Eventually, the World Bank turns to ‘development’ issues. Lending money to developing countries. Agriculture Education Population control Urban development Assessment of Bretton Woods: 1944- 1960s During its first two decades, the Bretton Woods system is a “success.” Exchange rates are relatively stable and world trade grows. Some countries do devalue their currencies. This causes the U.S. dollar to effectively appreciate. 2.9 2.8 2.7 2.6 2.5 2.4 2.3 2.2 19 68 19 66 19 64 19 62 19 60 19 58 19 56 19 54 19 52 2.1 19 50 Dollar/Pound Stable Yen During Bretton Woods 363 362 360 359 358 357 356 68 19 66 19 64 19 62 19 60 19 58 19 56 19 54 19 52 19 50 355 19 Yen/Dollar 361 Seeds of Bretton Woods’ Demise In the 1960s, President Lyndon Johnson tries to finance both his “Great Society” programs at home and the American war in Vietnam. Produces a large Federal budget deficit, which, coupled with easy monetary policy, results in: High inflation in the United States and An increase in U.S. spending for cheaper imports As a result, the United States balance of payments moves into a deficit. Dollar is seen by the market as “overvalued.” Foreigners concerned about holding dollars at a rate of $35 an ounce. Price of one ounce of gold was $35 U.S. Balance of Payments: 1965 U.S. balance of payments measures move into deficit by mid-1960s. But, U.S. dollar still pegged at $35 per ounce. 1970 and 1971: Bretton Woods Begins to Unravel By 1970, markets are unwilling to hold the overvalued dollar. Dollars are sold on foreign exchange markets Central banks engage in massive intervention in an attempt to hold their Bretton Woods par values. They buy U.S. dollars as they are sold in markets. Foreign holdings of dollars exceed U.S. holdings of gold (by 1971, gold coverage had dropped to 22%). Dollar convertibility into gold is suspended in August 1971 Dollar trades lower in response (foreign currencies appreciate) U.S. expresses an interested in forging a fixed exchange rate system, but without “gold.” Smithsonian Agreements, 1971 In December 1971, major counties meet in Washington, D.C. Leads to the Smithsonian Agreements. Countries agree to revalue their currencies (yen 17%, mark 13.5%, pound and franc 9%) In return, the U.S. agrees to raise the dollar price of gold from $35 to $38 an ounce. Combined, this was equivalent to a “effective” dollar devaluation of 8.57%. However, this dollar devaluation had no significance because the dollar remained inconvertible Currencies now allowed to fluctuate + or – 2.25%. Renewed Attacks on the Dollar, 1973 13 months after the Smithsonian Agreements, the dollar comes under renewed attack. February 1973, markets sell off dollars. Central banks again intervene and buy dollars. In February 1973 the dollar is devalued further to $42 Foreign exchange markets closed until March 1973. The Collapse of Bretton Woods In March 1973, foreign exchange markets reopen and countries are “allowed” to “float” their currencies: In March 1973, Japan and most of Western Europe let their currencies float against the dollar. Bretton Woods effectively ends. Early Post Bretton Woods During the years immediately after the collapse of Bretton Woods, the dollar fluctuates, but no discernable trend is seen at first. Early Post Bretton Woods Agreements In January 1975, IMF member countries meet in Jamaica (Jamaican Agreement) and agree: To accept a flexible exchange rate regime. That central banks should intervene in foreign exchange markets to deal with unwarranted volatilities. Mid 1970s until 1980: the U.S. dollar weakens. Then from 1980 to February 1985: the dollar appreciates. Relatively high U.S. interest rates attracted capital inflows and offset the trade deficit. In April 1981, the U.S. government announces that they will no longer intervene in foreign exchange markets. Roller Coaster Decade of the 1980s Strong Dollar Period: 1980 - 1985 1985: Plaza Accord In September 1985, G7 countries meeting at the Plaza Hotel in New York (Plaza Accord) Agree to coordinated intervention in foreign exchange markets to deal with the US trade deficit. The dollar had strengthened from 1980 to 1985. They agree to sell U.S. dollars (increase supply) and lower its value. G7 felt a weak dollar was needed to offset U.S. trade deficit. Dollar weakens in response to central bank intervention. Longer term it continues to weaken in response to a worsening U.S. trade deficit. The dollar embarks on about a 10 year period of weakness. Roller Coaster Decade of the 1980s WEAK DOLLAR 1987: Louvre Accord In February 1987, G7 meet in Paris, France (Louvre Accord): Dollar continues to be weak until the mid-1990s. Trade Weighted Exchange Rate U.S. Dollar Index Countries agree to cooperate to achieve greater exchange rate stability, and To consult and coordinate their macroeconomic policies. 140 130 120 110 100 90 80 83 9 84 9 85 9 86 9 87 9 88 9 89 9 90 9 91 9 92 9 93 9 94 9 95 9 1 1 1 1 1 1 1 1 1 1 1 1 1 Years (monthly average; May 1973 = 100) Mid 1990s to Present Time From 1996 through 2001 the dollar strengthens. Strong U.S. economic performance attracts capital inflows. From 2002 on it weakens again. U.S. deficits become a concern again. Trade Weighted Exchange Rate U.S. Dollar Index Economic performance offsets trade deficit concerns. 110 105 100 95 90 85 80 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Years (monthly average; May 1973 = 100) Where are we Today? “Mixed” International Monetary System consisting of: Floating exchange rate regimes: Managed (dirty float) rate regimes: Market forces determine the relative value of a currency. Government manages its currency’s value with regard to a reference currency. Market moves currency, but governments are managing the process and intervening when necessary. Pegged exchange rate regimes: Government fixes (links) the value of its currency relative to a reference currency. Post Bretton Woods Summary Since March 1973, major currencies of the world operate under a floating exchange rate system. Market forces drive currency values! Post Bretton Woods has resulted exchange rates become much more volatile and less predictable then they were during fixed exchange rate eras. This volatility complicates the management of global companies. Yen Volatility Post-Bretton Woods Year 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 Rate 291.53 296.69 296.38 267.80 208.42 218.19 226.63 220.63 249.06 237.55 237.45 238.47 168.35 144.60 128.17 138.07 % Change -1.77% 0.10% 9.64% 22.17% -4.69% -3.87% 2.65% -12.89% 4.62% 0.04 % -0.43% 29.40% 14.10% 11.35% -7.72% Year Rate % Change 1990 145.00 -5.02% 1991 134.71 7.10% 1992 126.78 5.89% 1993 111.08 12.38% 1994 102.18 8.01% 1995 93.96 8.05% 1996 108.78 -15.77% 1997 120.99 -11.22% 1998 130.99 -8.27% 1999 113.73 13.18% 2000 107.77 5.20% 2001 121.53 -12.77% 2002 125.39 -3.18% 2003 115.94 7.41% 2004 108.15 6.72% Note: High Rate: 1995 Low Rate: 1975 Rates: Averages for year. Volatility of Yen: 1975-2002 35.00% 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% -15.00% -20.00% 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 -10.00% 1977 -5.00% 1975 0.00% Volatility of Pound: 1975-2002 15.00% 10.00% 5.00% -10.00% -15.00% -20.00% -25.00% 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 -5.00% 1975 0.00% Foreign Exchange Regime Changes Currently the majority of the world’s countries maintain pegged or highly managed exchange rate regimes. However, a growing number of countries are adopting more flexible (e.g., floating rate) regimes. Letting the markets determine the exchange rate. Examples over the last 10 years: Brazil, Chile, Poland. Exchange Rate Regimes, 1982 - 2001 Number of Countries Exchange Rate Arrangements: 1982-2001 200 180 160 140 120 100 80 60 40 20 0 IMF Countries Floating Rate Managed Rate Pegged Rate 82 984 986 988 990 992 994 996 998 000 9 1 1 1 1 1 1 1 1 1 2 Year The Euro-Zone: A Currency Union Today, 12 countries within the 25 member European Union have adopted a single currency, the euro, as their legal tender. As of January 2002, the national currencies of these 12 countries have been withdrawn as legal tender. The Euro Time Line: Pre Euro 1979: European Monetary System is created. Designed to promote exchange rate stability within the European Community. Currencies tied into one another, but essentially into the German mark. Series of crises within the EMS, but it survives 1991: Maastricht Treaty signed Called for the adoption of a “single” currency in Europe by 1999 Countries needed to meet specified economic and financial criteria and could elect not to join (U.K. ops out). The Euro Time Line: Introducing the Euro January 1, 1999. The European Monetary Union (EMU) is created. Eleven countries irrevocably lock their national currencies to the euro. For Example: 1,936.27 Italian lira = 1 euro; 1.95583 German marks = 1 euro, etc. These rates based on exchange rates between national currencies on January 1, 1999. January 1, 2002. euro notes and coins are introduced into circulation, all national money is withdrawn. Greece joins the Euro zone on January 1, 2002 The U.K., Denmark, and Sweden remain out. Countries in the Euro-Zone Today In Euro-zone (12): Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain. Out of Euro Zone (But in the EU): The U.K., Denmark, Sweden and the 10 countries that joined the European Union on May 1, 2004. Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, Slovenia Bulgaria and Romania hope to join the EU by 2007. The European Central Bank As part of the European Monetary Union, the European Central Bank is created. Headquartered in Frankfurt, Germany Primary objective to maintain price stability within the euro-zone. Modeled after the German Bundesbank. Thus, highly independent. Defined at less then 2% Achieved through interest rate policies. Many see the ECB as operating within too narrow a mandate. The Euro-Zone In essence, the single currency has removed exchange rate issues for transactions within the euro-zone. However, the euro itself is a floating currency against the other currencies of the world. Thus, exchange rate issues exist for foreign companies (e.g., American) doing business in the euro-zone and euro-zone countries doing business outside of the singe currency area. Performance of the Euro: Jan 1, 1999 Note: Exchange rate on first trading day: $1.18/EUR