* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Exchange Rate Systems

Reserve currency wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Bretton Woods system wikipedia , lookup

Currency war wikipedia , lookup

International monetary systems wikipedia , lookup

Foreign exchange market wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

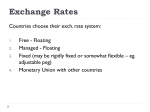

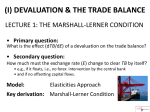

Exchange Rate Systems Floating exchange rate systems Fixed exchange rate systems Semi fixed exchange rate systems Freely floating exchange rate • a system whereby the price of one currency is determined by the forces of supply and demand Fixed exchange rate • an exchange rate system in which the value of one currency has a fixed value against another countries Semi-fixed exchange rate • an exchange rate system that allows a currency’s value to fluctuate within a permitted band of fluctuation. Freely floating exchange rate • The value of the pound is determined purely by market demand and supply of the currency • Both trade flows and capital flows affect the exchange rate under a floating system • No target for the exchange rate is set by the Government • There is no need for official intervention in the currency market by the central bank Demand and Supply There are 3 main reasons why foreign exchange is bought and sold: 1. International trade • Imports and exports (X-M) 2. Short-term capital flows • Speculative demand • ‘Hot money’ 3. Long-term capital movements • Investment (FDI) • Demand for the £ has risen • £ is now worth more, it has appreciated in relation to the $ • £ has appreciated - worth more in terms of the $ Demand for £ rises • Changes the prices of imports and exports: • Price of UK goods in the US has increased • When a currency appreciates exports increase in price, imports decrease in price • When a currency depreciates exports decrease in price, imports increase in price Supply of $ increases June 2014 Advantages of a freely floating system • Reduced need for currency reserves – Needed for semi fixed systems • Freedom for domestic monetary policy – Interest rates and QE • Useful instrument for macroeconomic adjustment – controlling AD and inflation – (X-M); W and J • Partial automatic correction of a trade deficit – Marshall-Lerner condition Disadvantages • Uncertainty – fluctuations • Lack of investment – Weak £ a sign of weak economy? • The floating exchange rate can be inflationary if price stability not prioritised. – Weak £ imports expensive (cost push) • Does a floating rate automatically remedy a trade deficit? – J-curve (remember!) Marshall-Lerner condition • Can you remember what this is? The Marshall-Lerner Condition • If demand for exports is first assumed to be relatively price elastic then the fall in the price of exports caused by the fall in the exchange rate will lead to a proportionately greater increase in the quantity of exports demanded. This would improve the balance of payments. • If demand for imports is also assumed to be relatively price elastic then the rise in the price of imports caused by the fall in the exchange rate will lead to a proportionately greater decrease in the quantity demanded of imports. • So, providing the sum of the elasticity's is greater than -1, there will be an improvement in the Balance of Payments on current account (balance of trade improves) Marshall-Lerner condition • If you look at Net Exports (X-M) you can tell if the PEDXN is > 1 or < 1. Marshall-Lerner condition • If PED > 1 = Elastic • If PED < 1 = Inelastic Marshall-Lerner condition • Effect on the Balance of Payments on current account? 1. 2. 3. 4. If If If If the currency the currency the currency the currency weakens and PED > 1 weakens and PED < 1 appreciates (PED > 1) appreciates (PED < 1) The J-Curve • Short term • Long term Evaluation • The extent to which a floating system is advantageous for a country depends upon the price elasticity of imports and exports. • Marshall-Lerner Condition – BoP will only improve if imports/exports are price responsive. • J-curve – BoP may get worse before it gets better Inflation and the exchange rate • With the use of a diagram, explain the effect of a fall in the exchange rate in the UK on the rate of inflation. (10) Mark scheme • For providing a relevant definition, eg, exchange rate, inflation (up to 2 marks).- maximum 2 marks for definitions • A fall in the exchange rate will reduce export prices and/or increase the price of imports (1 mark) this will increase the demand for UK products (1 mark). The rise in AD will create a buoyant environment in which firms can increase prices (1 mark) leading to demand-pull inflation (1 mark). This initial increase in prices will lead to higher wage demands (1 mark) increasing firms’ costs and hence prices (1 mark). Award one mark for each link in a logical chain of reasoning. • Diagram (2 marks) • Question (Jan 2012) To what extent would a significant fall in the exchange rate of the pound sterling achieve a sustained reduction in unemployment in the UK? (25 marks) Fixed Exchange rates ‘Pegged’ • Not popular recently but were fixed between 1944 and 1972 and 1990/91 (ERM) • Commitment to a single fixed exchange rate • No permitted fluctuations from the central rate • Achieves exchange rate stability but perhaps at the expense of domestic economic stability • Bretton-Woods System 1944-1972 where currencies were tied to the US dollar • Gold Standard in the inter-war years currencies linked with gold Advantages of Fixed Exchange Rates 1. Avoid Currency Fluctuations. If the value of currencies fluctuate significantly this can cause problems for firms engaged in trade. 1. For example if a firm is exporting to the US, a rapid appreciation in sterling would make its exports uncompetitive and therefore may go out of business. 2. If a firm relied on imported raw materials a devaluation would increase the costs of imports and would reduce profitability 2. Stability encourages investment. The uncertainty of exchange rate fluctuations can reduce the incentive for firms to invest in export capacity. Some Japanese firms have said that the UK's reluctance to join the Euro and provide a stable exchange rates maker the UK a less desirable place to invest. 3. Keep inflation Low. Governments who allow their exchange rate to devalue may cause inflationary pressures to occur. This is because AD increases, import prices increase and firms have less incentive to cut costs. 4. A rapid appreciation in the exchange rate will badly effect manufacturing firms who export, this may also cause a worsening of the current account. 5. Joining a fixed exchange rate may cause inflationary expectations to be lower Fixed rate Fixed rate To maintain the ER • supply foreign currency (from reserves) • Restrict the demand for foreign currency • What problems might result from using the interest rate to manage the exchange rate? Black Wednesday • A run on the currency (ERM) • Speculators thought the £ was overvalued against the DM • Sold £ and buy back once £ had fallen in value • BoE would have to support £ to maintain its value • http://www.youtube.com/watch?v=oD1n Gruqnyw Price of £ in DM 2.95 Demand & supply of sterling Disadvantage of Fixed Exchange Rates 1. Conflict with other objectives. To maintain a fixed level of the exchange rate may conflict with other macroeconomic objectives. – – – If a currency is falling below its band the government will have to intervene. It can do this by buying sterling but this is only a short term measure. The most effective way to increase the value of a currency is to raise interest rates. This will increase hot money flows and also reduce inflationary pressures. However higher interest rates will cause lower AD and economic growth, if the economy is growing slowly this may cause a recession and rising unemployment Disadvantage of Fixed Exchange Rates 1. Less Flexibility. It is difficult to respond to temporary shocks. For example an oil importer may face a balance of payments deficit if oil price increases, but in a fixed exchange rate there is little chance to devalue. 2. Join at the Wrong Rate. It is difficult to know the right rate to join at. If the rate is too high, it will make exports uncompetitive. If it is too low, it could cause inflation. 3. Current Account Imbalances. Fixed exchange rates can lead to current account imbalances. For example, an overvalued exchange rate could cause a current account deficit Semi-fixed system ‘managed float’ • ER is allowed to ‘float’ between undisclosed levels • Price ceilings and price floors are used • ERM Semi-fixed exchange rate £/€ D S Ceiling Floor Q • ‘dirty’ float • Governments manipulate their currency to give an advantage over trading partners • Examples of a fixed exchange rate system – Denmark is fixed against the Euro – Bulgaria, the Euro – Saudi Arabia, Qatar, fixed against $ Economic Integration • What is economic integration? – Economic integration refers to trade unification between different states by the partial or full abolishing of customs tariffs on trade taking place within the borders of each state. • What is a trade agreement? – A trade agreement is a contract/agreement/pact between two or more nations that outlines how they will work together to ensure mutual benefit in the field of trade and investment. – Trade agreements are often regional, involving only a relatively small number of countries. – Trade agreements are either bilateral, involving only two countries, or multilateral, involving more than two countries Economic Integration • What is a trade bloc? – A trade bloc is a type of intergovernmental agreement, where regional barriers to trade, (tariffs and non-tariff barriers) are reduced or eliminated among the participating states. • What is a Free Trade Area (FTA) – A free-trade area is a trade bloc whose member countries have signed a free-trade agreement (FTA), which eliminates tariffs, import quotas, and preferences on most (if not all) goods and services traded between them. Economic Integration • What is a Customs Union? – An agreement among countries to have free trade among themselves and to adopt common external barriers against any other country interested in exporting to these countries • What is a Common Market? – A type of custom union where there are common policies on product regulation, and free movement of goods and services, capital and labour. • What is an Economic & Monetary Union? – A common market with common currency, where more than two countries use the same currency. Economic Integration • What is Complete Economic Integration? – Individual countries have no control of economic policy, full monetary union and complete harmonization of fiscal policy Free trade agreements • https://youtu.be/UKqXbSLYOm8 Trade creation • takes place when domestic consumers in member countries import more goods from other members as import prices fall due to a removal of tariff and quotas; production will shift to lower cost producer. Trade creation Trade Diversion • When a customs union is created and tariffs differentials between members and non-member result in trade flows being diverted toward higher cost producers. Essay (June 2011) An economy which is enjoying rapid economic growth experiences a significant rise in the external value of its currency within a floating exchange rate system. 1 1 Explain the factors which may lead to a rise in the exchange rate of a currency within a floating exchange rate system. (15 marks) 1 2 Evaluate the possible macroeconomic consequences for an economy of a rise in the exchange rate of its currency. (25 marks)