chapter overview

... risk, (2) differences in the degree of liquidity and (3) differences in tax obligations. The next section discusses ways in which investors can hedge against interest rate risk using derivatives. The section points out that forward exchange contracts are simply one example of a derivative security. ...

... risk, (2) differences in the degree of liquidity and (3) differences in tax obligations. The next section discusses ways in which investors can hedge against interest rate risk using derivatives. The section points out that forward exchange contracts are simply one example of a derivative security. ...

ethiopian commodity exchange - Making The Connection: Value

... ticker boards around the country. The ECX website is the second most visited website of Electronic price ticker board at ECX ...

... ticker boards around the country. The ECX website is the second most visited website of Electronic price ticker board at ECX ...

The Greek Letters

... HA: Required position in asset for delta hedging HF: Alternative required position in futures contracts for delta hedging ...

... HA: Required position in asset for delta hedging HF: Alternative required position in futures contracts for delta hedging ...

VALUATION IN DERIVATIVES MARKETS

... A large section of the derivatives market use valuation techniques with parameters implied from known points. ...

... A large section of the derivatives market use valuation techniques with parameters implied from known points. ...

Part 5 Clearing and settlement facilities

... obligations under a credit contract (other than a lien or charge arising by operation of any law or by custom); (g) a guarantee related to a mortgage mentioned in paragraph (f); (h) a guarantee of obligations under a credit contract; (i) a facility for making non-cash payments (within the meaning of ...

... obligations under a credit contract (other than a lien or charge arising by operation of any law or by custom); (g) a guarantee related to a mortgage mentioned in paragraph (f); (h) a guarantee of obligations under a credit contract; (i) a facility for making non-cash payments (within the meaning of ...

NBER Reporter Summary of My Commodity Research

... joint work with Cheng and Andrei Kirilenko provides a vivid example of how financial distress experienced by financial traders during the recent financial crisis may cause them to consume rather than provide liquidity in commodity futures markets.7 By using changes in the VIX to proxy for shocks to ...

... joint work with Cheng and Andrei Kirilenko provides a vivid example of how financial distress experienced by financial traders during the recent financial crisis may cause them to consume rather than provide liquidity in commodity futures markets.7 By using changes in the VIX to proxy for shocks to ...

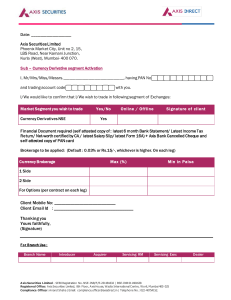

Derivatives in India

... specifically allowed by the Reserve Bank of India (RBI) or, in the case of commodities (which are regulated by the Forward Markets Commission), those that trade informally in “havala” or forwards markets. An exchange-traded contract, such as a futures contract, has a standardized format that specifi ...

... specifically allowed by the Reserve Bank of India (RBI) or, in the case of commodities (which are regulated by the Forward Markets Commission), those that trade informally in “havala” or forwards markets. An exchange-traded contract, such as a futures contract, has a standardized format that specifi ...

Chapter 3: Over-the-Counter Derivatives

... See www.fasb.org/summary/stsum133.shtml. This rule is not without controversy. See, for example, www.cmegroup.com/ education/files/derivatives-and-hedge-accounting.pdf. ...

... See www.fasb.org/summary/stsum133.shtml. This rule is not without controversy. See, for example, www.cmegroup.com/ education/files/derivatives-and-hedge-accounting.pdf. ...

No Slide Title

... • Contracts to exchange something at an agreed time in the future at a price agreed upon today – Swaps • Contracts between two counterparties to exchange cash flows on a notional principal amount at regular intervals during a stated period – OTC options • Contracts that give the buyer, in exchange f ...

... • Contracts to exchange something at an agreed time in the future at a price agreed upon today – Swaps • Contracts between two counterparties to exchange cash flows on a notional principal amount at regular intervals during a stated period – OTC options • Contracts that give the buyer, in exchange f ...

(the “Stock Exchange”) take no responsi

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 12 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 12 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

(the “Stock Exchange”) take no responsi

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 11 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 11 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

In segregating responsibilities, this office reconciles payments with

... 16. Which of the following is the exposure to a change in value of some market variables, such as interest rates, foreign exchange rates, equity or commodity prices? (A) credit risk (B) market risk (C) contract risk (D) value - at - risk ...

... 16. Which of the following is the exposure to a change in value of some market variables, such as interest rates, foreign exchange rates, equity or commodity prices? (A) credit risk (B) market risk (C) contract risk (D) value - at - risk ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... options in NSE explains the progress in detail. Currency futures has proved to be a good tool for hedging the risk involved in the currency of a country (currency risk). It is hoped that the currency futures market will develop faster and it will be a good choice for all the market participants in t ...

... options in NSE explains the progress in detail. Currency futures has proved to be a good tool for hedging the risk involved in the currency of a country (currency risk). It is hoped that the currency futures market will develop faster and it will be a good choice for all the market participants in t ...

1 The Greek Letters

... Vega (n) is the rate of change of the value of a derivatives portfolio with respect to volatility See Figure 15.11 for the variation of n with respect to the stock price for a call or put option ...

... Vega (n) is the rate of change of the value of a derivatives portfolio with respect to volatility See Figure 15.11 for the variation of n with respect to the stock price for a call or put option ...

Introduction to the Mexican Derivative market (MexDer)

... ISDA did a survey of derivatives usage by the world's 500 largest companies. "According to this survey, 94% of these companies use derivatives instruments to manage and hedge their business and financial risks" (ISDA, 2009) ...

... ISDA did a survey of derivatives usage by the world's 500 largest companies. "According to this survey, 94% of these companies use derivatives instruments to manage and hedge their business and financial risks" (ISDA, 2009) ...

Why YOU Should Trade CME Currency Futures Instead

... They told me that other banks were “not quoting them prices” and they had to wait until someone showed them an offer before filling my stop loss order. In other words, they waited until they had ZERO risk and could assure themselves a profit before filling my order. That’s NOT what happens when you ...

... They told me that other banks were “not quoting them prices” and they had to wait until someone showed them an offer before filling my stop loss order. In other words, they waited until they had ZERO risk and could assure themselves a profit before filling my order. That’s NOT what happens when you ...

Hong Kong Exchanges and Clearing Limited and The Stock

... Mandatory Call Event (“MCE”) in respect of the CBBCs occurred in the continuous trading session of the Stock Exchange at the time (the “MCE Time”) specified in the table below on 23 Jun 2017 (the "MCE Date") and the CBBCs have automatically expired. As a result, trading in the CBBCs on the Stock Exc ...

... Mandatory Call Event (“MCE”) in respect of the CBBCs occurred in the continuous trading session of the Stock Exchange at the time (the “MCE Time”) specified in the table below on 23 Jun 2017 (the "MCE Date") and the CBBCs have automatically expired. As a result, trading in the CBBCs on the Stock Exc ...

Energy Derivatives

... Futures A standardized forward contract which is traded on an organized futures exchange. ...

... Futures A standardized forward contract which is traded on an organized futures exchange. ...

$doc.title

... tion with daily mean zero and daily standard deviation 2.5 basis points. There are 252 business days in the coming year. Price the following OTC options: ...

... tion with daily mean zero and daily standard deviation 2.5 basis points. There are 252 business days in the coming year. Price the following OTC options: ...

C14_Reilly1ce

... • Futures Contract Mechanics • Futures exchange requires each customer to post an initial margin account in the form of cash or government securities when the contract is originated • The margin account is marked to market at the end of each trading day according to that day’s price movements • Forw ...

... • Futures Contract Mechanics • Futures exchange requires each customer to post an initial margin account in the form of cash or government securities when the contract is originated • The margin account is marked to market at the end of each trading day according to that day’s price movements • Forw ...

Document

... forward and futures contracts? • What do the payoff diagrams look like for investments in forward and futures contracts? • What do the payoff diagrams look like for investments in put and call option contracts? • How are forward contracts, put options, and call options related to one another? ...

... forward and futures contracts? • What do the payoff diagrams look like for investments in forward and futures contracts? • What do the payoff diagrams look like for investments in put and call option contracts? • How are forward contracts, put options, and call options related to one another? ...

Futurization of Swaps

... U.S. swaps markets, the SEC and the CFTC, have been worried only about geographic regulatory arbitrage, or the movement of swaps transactions out of the country. But in testimony in December before a subcommittee of the House Financial Services Committee, a number of market participants said a diffe ...

... U.S. swaps markets, the SEC and the CFTC, have been worried only about geographic regulatory arbitrage, or the movement of swaps transactions out of the country. But in testimony in December before a subcommittee of the House Financial Services Committee, a number of market participants said a diffe ...

The Treasury Bill Futures Market and Market Expectations of Interest

... In the case of the futures market in Treasury bills, the yields on futures contracts indicate the pattern of interest rates expected by market participants to prevail in certain months in the future, given currently available information. Any expectation of future interest rates, however arrived at, ...

... In the case of the futures market in Treasury bills, the yields on futures contracts indicate the pattern of interest rates expected by market participants to prevail in certain months in the future, given currently available information. Any expectation of future interest rates, however arrived at, ...

- Advisor To Client

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...