ADDING COLOUR AND CONSCIENCE TO MARKETS:

... world cotton market passed with distinction at New York University in 2005 and won the best dissertation award in social sciences from Middle East Studies Association. His research maps global markets as articulated in different locales. A certificated commodity futures and options trader, Caliskan ...

... world cotton market passed with distinction at New York University in 2005 and won the best dissertation award in social sciences from Middle East Studies Association. His research maps global markets as articulated in different locales. A certificated commodity futures and options trader, Caliskan ...

risk management strategies

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

Options on Futures Contracts - Feuz Cattle and Beef Market Analysis

... Buyers and Sellers Put Options Buyers: can exercise the right to a short position in futures at the strike price anytime before the option expires. For this right, they pay the option premium. Sellers (writers): must provide the option buyer with a short futures position if the option is exerc ...

... Buyers and Sellers Put Options Buyers: can exercise the right to a short position in futures at the strike price anytime before the option expires. For this right, they pay the option premium. Sellers (writers): must provide the option buyer with a short futures position if the option is exerc ...

The Stock Exchange Corner

... What are the benefits of owning stocks? It gives the investor an opportunity to participate in the success of a company through increasing dividends or increasing asset value. What risks are involved in owning common stocks? The risk that the companies who have issued the stocks are unsuccessful or ...

... What are the benefits of owning stocks? It gives the investor an opportunity to participate in the success of a company through increasing dividends or increasing asset value. What risks are involved in owning common stocks? The risk that the companies who have issued the stocks are unsuccessful or ...

download soal

... Jawaban Soal 1 When a central bank buys (sells) foreign currency, its international reserves increase (decrease), and the money supply increases (decreases) simultaneously. To offset the effect on the money supply, the foreign exchange intervention can be sterilized; that is, the central bank can p ...

... Jawaban Soal 1 When a central bank buys (sells) foreign currency, its international reserves increase (decrease), and the money supply increases (decreases) simultaneously. To offset the effect on the money supply, the foreign exchange intervention can be sterilized; that is, the central bank can p ...

united states international university - africa

... Examination of the implications of the globalization of financial markets, financial instruments in a global market, composition of world bond and equity markets, foreign exchange markets, interest rate and currency swaps, global interest rate links, and cross-currency and cross-border arbitrages. ...

... Examination of the implications of the globalization of financial markets, financial instruments in a global market, composition of world bond and equity markets, foreign exchange markets, interest rate and currency swaps, global interest rate links, and cross-currency and cross-border arbitrages. ...

Contract Specifications for Option Contract on EURUSD

... USD 1 billion equivalent, whichever is higher. b) Position limits for other clients Gross open position across all contracts not to exceed 6% of the total open interest or USD 100 million equivalent, whichever is higher 1.18 Price Bands A contract specific price range based on its delta value comput ...

... USD 1 billion equivalent, whichever is higher. b) Position limits for other clients Gross open position across all contracts not to exceed 6% of the total open interest or USD 100 million equivalent, whichever is higher 1.18 Price Bands A contract specific price range based on its delta value comput ...

colour ppt

... Everyone has options. When buying a car, we can add more equipment to the automobile that is “optional at extra cost”. In this sense, an option is a choice. Every option is either a call option or a put option. • Call option: a security that gives its owner the right, but not the obligation, to purc ...

... Everyone has options. When buying a car, we can add more equipment to the automobile that is “optional at extra cost”. In this sense, an option is a choice. Every option is either a call option or a put option. • Call option: a security that gives its owner the right, but not the obligation, to purc ...

The course presents an introduction to financial intermediation and

... aspects by means of theoretical models that simplify the analysis along several dimensions. We’ll start introducing the traditional banking model which highlights the role financial intermediaries have in insuring borrowers. We will then move to the trading in ...

... aspects by means of theoretical models that simplify the analysis along several dimensions. We’ll start introducing the traditional banking model which highlights the role financial intermediaries have in insuring borrowers. We will then move to the trading in ...

The COT reports consist of three different reports

... The Commitment of Traders (COT) reports help us assess how different market players are positioned in the futures and options markets. The reports are released every Friday by the Commodity Futures Trading Commission (CFTC) and are an important tool to understanding price movements on US commodity e ...

... The Commitment of Traders (COT) reports help us assess how different market players are positioned in the futures and options markets. The reports are released every Friday by the Commodity Futures Trading Commission (CFTC) and are an important tool to understanding price movements on US commodity e ...

FREE Sample Here

... 69. The exchange with the largest dollar volume in major companies and which has the most restrictive listing requirements is A. The New York Stock Exchange b. The American Exchange c. The NASDAQ Stock Market d. The Securities Exchange ...

... 69. The exchange with the largest dollar volume in major companies and which has the most restrictive listing requirements is A. The New York Stock Exchange b. The American Exchange c. The NASDAQ Stock Market d. The Securities Exchange ...

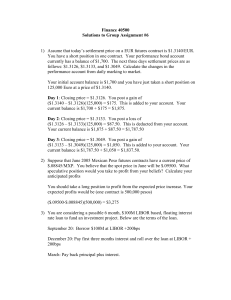

Solutions

... future spot rates, you are unlikely to make money. 5) Suppose that the 3 month dollar LIBOR is 4.5% annualized while the Euro LIBOR rate is 3.75% annualized. If the current spot price of Euro is $1.25, calculate the price of a 3 month Euro forward contract. Note: A 4.5% annual rate equals a 1.125% 3 ...

... future spot rates, you are unlikely to make money. 5) Suppose that the 3 month dollar LIBOR is 4.5% annualized while the Euro LIBOR rate is 3.75% annualized. If the current spot price of Euro is $1.25, calculate the price of a 3 month Euro forward contract. Note: A 4.5% annual rate equals a 1.125% 3 ...

day 6

... Understanding financial derivatives • The potential gain or loss in value of the derivative is huge. – If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. – For the interest rate swap, a 1% interest rate change can cause thousands of dollars per yea ...

... Understanding financial derivatives • The potential gain or loss in value of the derivative is huge. – If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. – For the interest rate swap, a 1% interest rate change can cause thousands of dollars per yea ...

Institute of Actuaries of India INDICATIVE SOLUTION

... borrowed and repaid later incurring a loss of interest on this amount which would push down the cash flow in six months time. It is likely that the broker may allow the brokerage on stocks to be adjusted with the margin but not on the futures in which case it will only be the interest on Rs 10. All ...

... borrowed and repaid later incurring a loss of interest on this amount which would push down the cash flow in six months time. It is likely that the broker may allow the brokerage on stocks to be adjusted with the margin but not on the futures in which case it will only be the interest on Rs 10. All ...

forwards

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

OCA - Federation of European Securities Exchanges

... • Interacting with CESR on the list of ‘liquid shares’ Commission pressure to deliver on Post-trade services • Negotiating mutual recognition of post-trade access and interoperability rights through the adoption of a Code of Conduct on Clearing and Settlement and the signature of European Access and ...

... • Interacting with CESR on the list of ‘liquid shares’ Commission pressure to deliver on Post-trade services • Negotiating mutual recognition of post-trade access and interoperability rights through the adoption of a Code of Conduct on Clearing and Settlement and the signature of European Access and ...

David Sobotka

... TRADING AND THE DEVELOPMENT OF FUTURES MARKETS FOR CRUDE OIL AND REFINED PRODUCTS. BASED ON THE VOLATILITY PRESENT IN THE ENERGY MARKETS AT THAT TIME, IT DID NOT TAKE FINANCIAL INSTITUTIONS LONG TO FIGURE OUT THAT 1) THERE WERE PROFITABLE TRADING OPPORTUNITIES AVAILABLE AND 2) THEIR CUSTOMERS WERE I ...

... TRADING AND THE DEVELOPMENT OF FUTURES MARKETS FOR CRUDE OIL AND REFINED PRODUCTS. BASED ON THE VOLATILITY PRESENT IN THE ENERGY MARKETS AT THAT TIME, IT DID NOT TAKE FINANCIAL INSTITUTIONS LONG TO FIGURE OUT THAT 1) THERE WERE PROFITABLE TRADING OPPORTUNITIES AVAILABLE AND 2) THEIR CUSTOMERS WERE I ...

Markets

... • Help firms and governments raise cash by selling securities • Channel funds from savers to borrowers • Provide a place where investors can act on their beliefs • Help allocate cash to where it is most productive • Help lower the cost of exchange ...

... • Help firms and governments raise cash by selling securities • Channel funds from savers to borrowers • Provide a place where investors can act on their beliefs • Help allocate cash to where it is most productive • Help lower the cost of exchange ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... sharply, or eliminate, risk posed by traders exceeding their margin limits. Interactive Brokers, for example, marks its customers’ positions to market in real-time and will not allow customers to trade in excess of their buying power during the trading day. Likewise, all our customers agree when the ...

... sharply, or eliminate, risk posed by traders exceeding their margin limits. Interactive Brokers, for example, marks its customers’ positions to market in real-time and will not allow customers to trade in excess of their buying power during the trading day. Likewise, all our customers agree when the ...

ITEM

... Assesses the effectiveness of coverage of an asset by the derivative Identify the value under coverage for a given derivative, and assess the hedge or the potential risk Identify net positions ...

... Assesses the effectiveness of coverage of an asset by the derivative Identify the value under coverage for a given derivative, and assess the hedge or the potential risk Identify net positions ...

commodity trading and financial markets

... As LNG develops, gas may be traded internationally in sufficient volumes to offset regional price differences, but a global gas price has not happened yet. For now, LNG traders have more limited arbitrage opportunities. In practice, they must decide on the final destination for their LNG on the tran ...

... As LNG develops, gas may be traded internationally in sufficient volumes to offset regional price differences, but a global gas price has not happened yet. For now, LNG traders have more limited arbitrage opportunities. In practice, they must decide on the final destination for their LNG on the tran ...

Description of FX Margin Trading and related

... • you fully understand how they operate, including all of the risks and costs involved, • you are aware that the greater the leverage, the greater the risk, • you understand that your position can be closed whether or not you agree with the decision to close your position, ...

... • you fully understand how they operate, including all of the risks and costs involved, • you are aware that the greater the leverage, the greater the risk, • you understand that your position can be closed whether or not you agree with the decision to close your position, ...