2.03-PowerPoint

... The Stock Market’s Functions Provides companies with a way of issuing shares of stock to people who want to invest in the company. The sale of shares of stock is a way for the corporations to raise money. Provides a place for the buying, selling and trading of stocks (and other securities). ...

... The Stock Market’s Functions Provides companies with a way of issuing shares of stock to people who want to invest in the company. The sale of shares of stock is a way for the corporations to raise money. Provides a place for the buying, selling and trading of stocks (and other securities). ...

Slide 1

... intermediaries and management companies; 2. Unified and simplified procedure for admission to trading of foreign companies on the Bulgarian regulated market; 3. Transparency Directive and price-sensitive information disclosure; ...

... intermediaries and management companies; 2. Unified and simplified procedure for admission to trading of foreign companies on the Bulgarian regulated market; 3. Transparency Directive and price-sensitive information disclosure; ...

Chapter 4: Using Futures Markets

... A hedger is an individual who enters the futures market in order to reduce a preexisting risk. A preexisting position might include: 1. A commodity that you own: you have a silver mining company and have silver stored. You own the commodity. 2. An anticipatory hedge: a commodity that you will acquir ...

... A hedger is an individual who enters the futures market in order to reduce a preexisting risk. A preexisting position might include: 1. A commodity that you own: you have a silver mining company and have silver stored. You own the commodity. 2. An anticipatory hedge: a commodity that you will acquir ...

New EDHEC-Risk Institute research examines dynamic hedging of

... other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in the option position by dynamically trading the substitute asset. In general, however, correlation is not perfect, and the ...

... other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in the option position by dynamically trading the substitute asset. In general, however, correlation is not perfect, and the ...

Health Insurance Exchanges: Goals and Strategies SCI Annual

... – Publish average costs of licensing, regulatory fees, administrative costs, monies lost to ...

... – Publish average costs of licensing, regulatory fees, administrative costs, monies lost to ...

A Day in the Life of an ETF Portfolio Manager

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

Slide 1

... Advantages: ◦ Provide a guide to the general trend of exchange rates in particular circumstances. ◦ Serves an important reminder that exchange rate and the price level cannot be divorced from each other. ◦ Both exchange rates and prices respond to the same set of shocks and both can be influenced by ...

... Advantages: ◦ Provide a guide to the general trend of exchange rates in particular circumstances. ◦ Serves an important reminder that exchange rate and the price level cannot be divorced from each other. ◦ Both exchange rates and prices respond to the same set of shocks and both can be influenced by ...

Document

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

CFA-AFR-Dark-Pools-2.. - CFA Society Melbourne

... total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author of the report, estimated that there was a similar proportion in Europe. “The results suggest that dark trading does not harm market quality at its current levels but the gains are not indefinit ...

... total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author of the report, estimated that there was a similar proportion in Europe. “The results suggest that dark trading does not harm market quality at its current levels but the gains are not indefinit ...

The causal impact of algorithmic trading

... of all trading, one of the largest exchange in the world by transaction intensity. 2. Uses an exogenous event: Introduction of co-location services in Jan 2010, which was followed by an S-curve of adoption. 3. Data recorded well: Every order explicitly tagged as “AT” or “non-AT” for every security a ...

... of all trading, one of the largest exchange in the world by transaction intensity. 2. Uses an exogenous event: Introduction of co-location services in Jan 2010, which was followed by an S-curve of adoption. 3. Data recorded well: Every order explicitly tagged as “AT” or “non-AT” for every security a ...

Can Asia`s financial markets continue to grow without AEV`s

... engines, in some cases using a wide variety of order management systems leading to rise in demand for; – The rise in the need to effectively bridge platforms and markets for global price discovery and risk management purposes – Drive towards standardized connectivity to venues and counterparties acr ...

... engines, in some cases using a wide variety of order management systems leading to rise in demand for; – The rise in the need to effectively bridge platforms and markets for global price discovery and risk management purposes – Drive towards standardized connectivity to venues and counterparties acr ...

Alessandro Mauro - Black Swan Risk Advisors

... companies He has built and managed middle office functions, shaping business processes that have been monitoring trading activity and consistently delivering key risk indicators. In the nineties, Alessandro pioneered the application of modern risk measurement tecniques, Value-atRisk, to energy marke ...

... companies He has built and managed middle office functions, shaping business processes that have been monitoring trading activity and consistently delivering key risk indicators. In the nineties, Alessandro pioneered the application of modern risk measurement tecniques, Value-atRisk, to energy marke ...

С П Е Ц И Ф И К А Ц И Я

... The Contract remaining open at the end of trading on the last Contract trading day shall be settled by transfer of the variation margin on the Contract settlement date. The Contract settlement price shall be an arithmetic mean value of the PLATT’S High and Low closing prices for the underlying asset ...

... The Contract remaining open at the end of trading on the last Contract trading day shall be settled by transfer of the variation margin on the Contract settlement date. The Contract settlement price shall be an arithmetic mean value of the PLATT’S High and Low closing prices for the underlying asset ...

Answers to Chapter 23 Questions

... By comparison, a hedge with an option contract completely offsets losses but only partly offsets gains. That is, gains and losses from hedging with options are no longer symmetric for interest rate increases and decreases. For example, if the FI loses value on the bond due to an interest rate increa ...

... By comparison, a hedge with an option contract completely offsets losses but only partly offsets gains. That is, gains and losses from hedging with options are no longer symmetric for interest rate increases and decreases. For example, if the FI loses value on the bond due to an interest rate increa ...

Total Return Swap

... According to reg. 2012, a Brazilian resident may trade derivatives with non-residents, effect payments through the free FX market (avoiding the CC-5 vehicle) and be exempt of income tax if the transaction is aimed at hedging cash flows commited in a foreign currency and / or foreign interest rate ...

... According to reg. 2012, a Brazilian resident may trade derivatives with non-residents, effect payments through the free FX market (avoiding the CC-5 vehicle) and be exempt of income tax if the transaction is aimed at hedging cash flows commited in a foreign currency and / or foreign interest rate ...

甲醇中远期现货交易电子交易合同

... 11.1 In case of the earthquake, typhoon, fire disaster and the significant change of state's policy or the force majeure where the contract is not fully or partially implemented. The liabilities thereof shall be fully or partially exempted according to the influence of force majeure. In case that fa ...

... 11.1 In case of the earthquake, typhoon, fire disaster and the significant change of state's policy or the force majeure where the contract is not fully or partially implemented. The liabilities thereof shall be fully or partially exempted according to the influence of force majeure. In case that fa ...

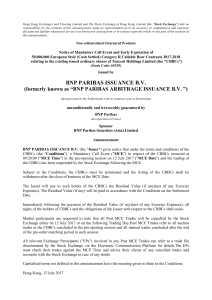

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

CEE Trader - Wiener Börse

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

SU54 - CMAPrepCourse

... – Two parties agree that, at a future date, one will perform and the other will pay a specified amount. – Retailer / Wholesaler example – Buyer has taken a long position while the seller has taken a short position. – Both parties are contractually obligated to perform ...

... – Two parties agree that, at a future date, one will perform and the other will pay a specified amount. – Retailer / Wholesaler example – Buyer has taken a long position while the seller has taken a short position. – Both parties are contractually obligated to perform ...

foreign exchange market (forex)

... – Transfer purchasing power between countries • This is necessary as international trade and capital transactions normally involve parties living in countries with different national currencies ...

... – Transfer purchasing power between countries • This is necessary as international trade and capital transactions normally involve parties living in countries with different national currencies ...

RMS Policy ESTEE ADVISORS PRIVATE LTD. RMS PROCESS

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first ...

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first ...

The Futures Market

... 5. The net change is the difference between the last price anyone paid during trading on the given date and the previous trading day. It is important for an individual to monitor the daily prices so he or she can offset his or her position before the contract expires. Otherwise, the individual will ...

... 5. The net change is the difference between the last price anyone paid during trading on the given date and the previous trading day. It is important for an individual to monitor the daily prices so he or she can offset his or her position before the contract expires. Otherwise, the individual will ...