Technical Analysis

... The following is a matrix of stocks that have made a new high or low price today subcategorized by exchange, volume and price. ...

... The following is a matrix of stocks that have made a new high or low price today subcategorized by exchange, volume and price. ...

National Institute of Securities Markets

... 2. Introduction to the Underlying Markets 2.1 Introduction to Equity Markets and Indices Provide a brief introduction to equity markets Understand the significance and economic purpose of Index List important attributes for construction of an Index Understand how index is constructed, maintained and ...

... 2. Introduction to the Underlying Markets 2.1 Introduction to Equity Markets and Indices Provide a brief introduction to equity markets Understand the significance and economic purpose of Index List important attributes for construction of an Index Understand how index is constructed, maintained and ...

Financial Markets in Electricity: Introduction to Derivative Instruments

... impact as a cash settled futures or forward contract where the buyer/seller pays the difference between the contract price and the price of a predetermined index, at the contract expiry date [see also cash settled above]. CME (Chicago Mercantile Exchange) One of two Chicago based exchange that trade ...

... impact as a cash settled futures or forward contract where the buyer/seller pays the difference between the contract price and the price of a predetermined index, at the contract expiry date [see also cash settled above]. CME (Chicago Mercantile Exchange) One of two Chicago based exchange that trade ...

HK`s formula for developing public confidence in exchanges

... today (June 3) shared with participants of an international forum in Beijing Hong Kong's formula for successfully building public confidence in stock exchanges, which is crucial to the development of exchanges. Speaking at the World Federation of Exchanges Forum for Developing Markets, Mr Ma said th ...

... today (June 3) shared with participants of an international forum in Beijing Hong Kong's formula for successfully building public confidence in stock exchanges, which is crucial to the development of exchanges. Speaking at the World Federation of Exchanges Forum for Developing Markets, Mr Ma said th ...

Ethan Frome - Eurex Exchange

... Options and futures trading begins with the determination of an opening price for each option series and each futures contract. The Opening Period comprises the Pre-Opening Period and the netting process. For the purpose of determining a particular opening price, additional orders and quotes may be ...

... Options and futures trading begins with the determination of an opening price for each option series and each futures contract. The Opening Period comprises the Pre-Opening Period and the netting process. For the purpose of determining a particular opening price, additional orders and quotes may be ...

Mechanics of Futures Markets

... – Too large traders who wish to hedge or speculate relatively small positions are unable to use this contract – Too small trading may be expensive since there is a transaction cost associated with each contract traded ※ Decide the appropriate contract size to maximize the trading volume ...

... – Too large traders who wish to hedge or speculate relatively small positions are unable to use this contract – Too small trading may be expensive since there is a transaction cost associated with each contract traded ※ Decide the appropriate contract size to maximize the trading volume ...

Hedge Accounts - Dorman Trading

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

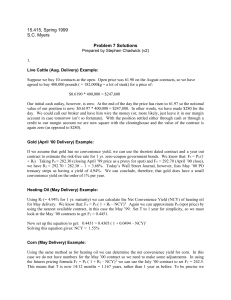

Problem Set 7 Solution

... Basis risk arises in the case of an imperfect hedging strategy. (A perfect hedge has no basis risk if held to maturity, though it is still possible to lose or gain money if the hedge is abandoned before its time.) There are two usual causes of basis risk: either the item being hedged is not the same ...

... Basis risk arises in the case of an imperfect hedging strategy. (A perfect hedge has no basis risk if held to maturity, though it is still possible to lose or gain money if the hedge is abandoned before its time.) There are two usual causes of basis risk: either the item being hedged is not the same ...

what is the “upstairs market?” the causes of market impact for block

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

Chap31

... Foreign exchange rates between major currencies are free to float, with market forces determining the relative value of a currency. Spot exchange rates adjust to compensate for the relative inflation rate between two countries. ...

... Foreign exchange rates between major currencies are free to float, with market forces determining the relative value of a currency. Spot exchange rates adjust to compensate for the relative inflation rate between two countries. ...

on futures contracts

... delivery takes place and what can be delivered • Cash Settlement: Some contracts are settled in cash rather than delivering the underlying assets ...

... delivery takes place and what can be delivered • Cash Settlement: Some contracts are settled in cash rather than delivering the underlying assets ...

contracts 9,899,780,283 traded

... hat has grown is the amount of business exchanges are doing, particularly the top five exchanges. As we have been writing for years in this space, electronic trading is having a major impact on volume (more on that later). Liquidity providers, no longer physically constrained by a trading pit, can ( ...

... hat has grown is the amount of business exchanges are doing, particularly the top five exchanges. As we have been writing for years in this space, electronic trading is having a major impact on volume (more on that later). Liquidity providers, no longer physically constrained by a trading pit, can ( ...

An approach on how to trade in commodities market

... item produced to satisfy wants or needs. In other words commodity is a raw material or primary agricultural product that can be bought and sold, such as copper or coffee. Now the next question arises - what are Commodity Markets??? So the answer is any place where all raw or primary products are exc ...

... item produced to satisfy wants or needs. In other words commodity is a raw material or primary agricultural product that can be bought and sold, such as copper or coffee. Now the next question arises - what are Commodity Markets??? So the answer is any place where all raw or primary products are exc ...

Inside Information and Resumption of Trading

... The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and the Inside Information provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). At around 11:20 p.m. on 12 August 2015, an explosion occurred at a warehouse for dangerous materials ow ...

... The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and the Inside Information provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). At around 11:20 p.m. on 12 August 2015, an explosion occurred at a warehouse for dangerous materials ow ...

After the close recap The bean market set the pace

... The market received a rare treat this morning with a fresh export announcement of 191,000 tons of corn to Mexico. The last time there was a new corn announcement was back on September 1st also destined for Mexico. This morning’s export inspection data was good for corn, average for wheat, but disapp ...

... The market received a rare treat this morning with a fresh export announcement of 191,000 tons of corn to Mexico. The last time there was a new corn announcement was back on September 1st also destined for Mexico. This morning’s export inspection data was good for corn, average for wheat, but disapp ...

A Direct Hedge of Forward Exposure to the Price of Cheese

... dry whey represent the product and by-product values respectively. Thus, all products in this crush will be available for direct hedging. The Cheese futures price will reflect the market’s valuation of cheese at a forward date. Cheese consumption has been increasing in the United States. The size of ...

... dry whey represent the product and by-product values respectively. Thus, all products in this crush will be available for direct hedging. The Cheese futures price will reflect the market’s valuation of cheese at a forward date. Cheese consumption has been increasing in the United States. The size of ...

(BN) China Cuts Transaction Fees for Share Trading to Boost Mark

... lowered fees charged for trading A shares by 25 percent on June 1. Trading fees in China’s financial markets have been cut three times this year, which “alleviates market costs and reflects regulator’s confidence and determination to protect the interest of investors and boost the healthy developmen ...

... lowered fees charged for trading A shares by 25 percent on June 1. Trading fees in China’s financial markets have been cut three times this year, which “alleviates market costs and reflects regulator’s confidence and determination to protect the interest of investors and boost the healthy developmen ...

Gleadell Market Report

... EU exports continue to drag, reported at just under 8mln t as of 27 Oct, down 27% year-on-year. This pace points to an end-of-season figure of 25mln t, leaving stocks well over 20mln t. The UK market is down 75p on the week as sterling continues to soar, limiting export opportunities. Delivery premi ...

... EU exports continue to drag, reported at just under 8mln t as of 27 Oct, down 27% year-on-year. This pace points to an end-of-season figure of 25mln t, leaving stocks well over 20mln t. The UK market is down 75p on the week as sterling continues to soar, limiting export opportunities. Delivery premi ...

Trading Corner - Eurex Exchange

... the futures contracts is settled on a daily basis, through variation margin. Scenario 1: EUR has risen against the USD, to 1.3500 At maturity, the value of the receivables has diminished by EUR 423,446.16 (EUR 7,830,853.56 at a rate of 1.2770 compared to EUR 7,407,407.41 at a rate of 1.3500). At the ...

... the futures contracts is settled on a daily basis, through variation margin. Scenario 1: EUR has risen against the USD, to 1.3500 At maturity, the value of the receivables has diminished by EUR 423,446.16 (EUR 7,830,853.56 at a rate of 1.2770 compared to EUR 7,407,407.41 at a rate of 1.3500). At the ...

Operating Instruction nº 54/2017 INITIAL

... 1.- Take as a reference price the closing price of the session of July 13 , the expected last trading day in the segment of Growing Companies belonging to Mercado Alternativo Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the refer ...

... 1.- Take as a reference price the closing price of the session of July 13 , the expected last trading day in the segment of Growing Companies belonging to Mercado Alternativo Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the refer ...

CE91 - MexDer

... Trading hours for the 91-Day Cetes Futures Contract will be Bank Business Days from 7:30 to 14:00 hours, Mexico City time. Also, trading hours will be understood to include the period for trading at Daily Settlement Price and auctions convened by MexDer in accordance with provisions of point (IV.3.d ...

... Trading hours for the 91-Day Cetes Futures Contract will be Bank Business Days from 7:30 to 14:00 hours, Mexico City time. Also, trading hours will be understood to include the period for trading at Daily Settlement Price and auctions convened by MexDer in accordance with provisions of point (IV.3.d ...

Lecture 3

... Forward contracts are often not easy to change hands. Standardized forward contracts began to emerge: futures contract. A counterparty to every trade – its members buy every contract that traders sell and sell every contract that traders buy: cleaning house. Exchanges in Chicago and New York began t ...

... Forward contracts are often not easy to change hands. Standardized forward contracts began to emerge: futures contract. A counterparty to every trade – its members buy every contract that traders sell and sell every contract that traders buy: cleaning house. Exchanges in Chicago and New York began t ...

on futures contracts

... delivery takes place and what can be delivered • Cash Settlement: Some contracts are settled in cash rather than delivering the underlying assets ...

... delivery takes place and what can be delivered • Cash Settlement: Some contracts are settled in cash rather than delivering the underlying assets ...