The Nasdaq-100 Index Option - The New York Stock Exchange

... The exercise-settlement value, NDS, is calculated based on the NASDAQ Official Opening Price (NOOP) for each of the component securities on the last business day before the expiration date (usually a Friday). In the event a component security in the NASDAQ 100 Index does not have a NASDAQ Official O ...

... The exercise-settlement value, NDS, is calculated based on the NASDAQ Official Opening Price (NOOP) for each of the component securities on the last business day before the expiration date (usually a Friday). In the event a component security in the NASDAQ 100 Index does not have a NASDAQ Official O ...

RMS Policy - Adinath Capital Services Limited

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying: A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first t ...

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying: A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first t ...

Chapter 1: An Introduction to Corporate Finance

... • A total return swap exchanges an interest rate return for the total return on an equity index plus or minus a spread. For example, first an investor could enter into an interest rate swap to convert fixed rate bond payments into payments that vary with a float rate, such as LIBOR. Then, the invest ...

... • A total return swap exchanges an interest rate return for the total return on an equity index plus or minus a spread. For example, first an investor could enter into an interest rate swap to convert fixed rate bond payments into payments that vary with a float rate, such as LIBOR. Then, the invest ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

MATH2510 MATH2510 This paper consists of 3 printed Only

... B1. A bond pays a dividend of £2 in 4 months. The current price of the bond is 96.4. The yield curve is flat; the continuously compounded interest rate is is 5%. What is the arbitrage-free price of a 6-month forward contract on the bond? B2. How would the answer to B1 change if the yield curve were ...

... B1. A bond pays a dividend of £2 in 4 months. The current price of the bond is 96.4. The yield curve is flat; the continuously compounded interest rate is is 5%. What is the arbitrage-free price of a 6-month forward contract on the bond? B2. How would the answer to B1 change if the yield curve were ...

International financial and foreign exchange markets Tentative

... FX market efficiency and the art of exchange rate forecasting (A. Ziliotto) Theoretical overview and available empirical evidence: could there be profitable trading strategies? Textbook chapter: XVI The infrastructure of international finance: historical evolution and current situation (G. Schlitzer ...

... FX market efficiency and the art of exchange rate forecasting (A. Ziliotto) Theoretical overview and available empirical evidence: could there be profitable trading strategies? Textbook chapter: XVI The infrastructure of international finance: historical evolution and current situation (G. Schlitzer ...

April 18

... • Suppose that a future price is currently trading at 35. A European call option and a European put option on the futures with a strike price of 34 are both priced at 2 in the market today. The risk-free interest rate is 10 percent ...

... • Suppose that a future price is currently trading at 35. A European call option and a European put option on the futures with a strike price of 34 are both priced at 2 in the market today. The risk-free interest rate is 10 percent ...

Set 8 - Matt Will

... A profit opportunity from change in the traditional basis spread between index prices and index futures prices The basis spread between the index and index futures contract should be constant. Spreads which are larger or smaller than normal will result in arbitrage opportunities. ...

... A profit opportunity from change in the traditional basis spread between index prices and index futures prices The basis spread between the index and index futures contract should be constant. Spreads which are larger or smaller than normal will result in arbitrage opportunities. ...

CHAPTER 32. INTERNATIONAL CORPORATE FINANCE. I. The

... Dutch guilders (DG) per US $ : DG2.00/US$ Canadian dollars(C$) per US $ : C$ 1.25/US$ Then the cross rate between Dutch guilders and Canadian $ is DG1.60 / C$ However, the cross rate is not the same as the actual quotation of DG1.70 / C$ ...

... Dutch guilders (DG) per US $ : DG2.00/US$ Canadian dollars(C$) per US $ : C$ 1.25/US$ Then the cross rate between Dutch guilders and Canadian $ is DG1.60 / C$ However, the cross rate is not the same as the actual quotation of DG1.70 / C$ ...

Capital Market

... Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include shares issued by companies, unit trusts, derivatives, pooled investment pro ...

... Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include shares issued by companies, unit trusts, derivatives, pooled investment pro ...

Chapter 5

... A futures contract is like a forward contract: It specifies that a certain currency will be exchanged for another at a specified time in the future at prices specified today. A futures contract is different from a forward ...

... A futures contract is like a forward contract: It specifies that a certain currency will be exchanged for another at a specified time in the future at prices specified today. A futures contract is different from a forward ...

rainbow trading corporation spyglass trading. lp

... • Some short term trades using long index options or long put or call equity spreads • May execute long or short positions in stock ...

... • Some short term trades using long index options or long put or call equity spreads • May execute long or short positions in stock ...

Referee report on Ph.D. dissertation “Essays on the Behavior of

... The first paper of the dissertation “Detecting Information-driven Trading in a Dealers Market” is a joint work with Jan Hanousek. The paper deals with detecting differences in the information content of trades of particular market makers on the Prague Stock Exchange (PSE). The main hypothesis is tha ...

... The first paper of the dissertation “Detecting Information-driven Trading in a Dealers Market” is a joint work with Jan Hanousek. The paper deals with detecting differences in the information content of trades of particular market makers on the Prague Stock Exchange (PSE). The main hypothesis is tha ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Transmission of global commodity prices did not really occur ...

... Transmission of global commodity prices did not really occur ...

short selling regulations

... Designated Securities provided he has first obtained the approval of the Chairman of the Board, which may be given either orally or in writing. Notice of such restriction or prohibition to the Exchange Participant, whether oral or written, shall take effect immediately upon communication to or servi ...

... Designated Securities provided he has first obtained the approval of the Chairman of the Board, which may be given either orally or in writing. Notice of such restriction or prohibition to the Exchange Participant, whether oral or written, shall take effect immediately upon communication to or servi ...

RMS Policy - Dyna Securities Ltd.

... purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first transaction would ...

... purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first transaction would ...

CHAPTER 10: Equity Markets

... 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas the OTC market or NASDAQ is more like dealer markets. NASDAQ stands for the National Association of Securities Dealers Automated Quotation s ...

... 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas the OTC market or NASDAQ is more like dealer markets. NASDAQ stands for the National Association of Securities Dealers Automated Quotation s ...

The Hunger-Makers: How Deutsche Bank, Goldman

... have to be enough market participants present who trade only with these futures, looking to earn money in this way. This activity has nothing to do with the actual physical business. It is the traditional role of speculators who, in a certain number, are indispensable for the functioning of commodit ...

... have to be enough market participants present who trade only with these futures, looking to earn money in this way. This activity has nothing to do with the actual physical business. It is the traditional role of speculators who, in a certain number, are indispensable for the functioning of commodit ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... currency futures introduced by the International Monetary Market (IMM) following the Smithsonian Agreements of 1971 and 1973 • The second wave of modern derivatives were interest rate futures introduced by the Chicago Board of Trade (CBT) after the Fed started to target nonborrowed reserves in the l ...

... currency futures introduced by the International Monetary Market (IMM) following the Smithsonian Agreements of 1971 and 1973 • The second wave of modern derivatives were interest rate futures introduced by the Chicago Board of Trade (CBT) after the Fed started to target nonborrowed reserves in the l ...

The list of Financial inst The list of Financial instruments trading

... The list of Financial instruments trading places of JSC "Meridian Trade Bank" JSC "Meridian Trade Bank" is a member of stock exchange and is entitled to direct access to: Riga Stock Exchange/ NASDAQ OMX Group. JSC "Meridian Trade Bank" has access to the following trading places through stockbrokers: ...

... The list of Financial instruments trading places of JSC "Meridian Trade Bank" JSC "Meridian Trade Bank" is a member of stock exchange and is entitled to direct access to: Riga Stock Exchange/ NASDAQ OMX Group. JSC "Meridian Trade Bank" has access to the following trading places through stockbrokers: ...

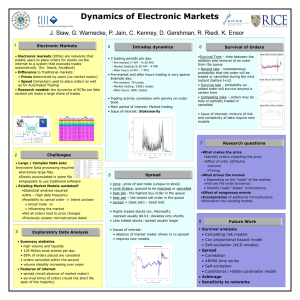

SciDAC Poster: INCITE

... • Pre-market and after hours trading is very sparse Example day: – Pre-market: 79 trades – Market trading: 33961 trades – After hours: 4091 trades ...

... • Pre-market and after hours trading is very sparse Example day: – Pre-market: 79 trades – Market trading: 33961 trades – After hours: 4091 trades ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... whereas Helsinki accommodates more liquidity ...

... whereas Helsinki accommodates more liquidity ...