Presentation - NCDEX Institute of Commodity Markets and Research

... Firms benefit from arbitrage because of their better position in terms of transaction cost. Speculators? ...

... Firms benefit from arbitrage because of their better position in terms of transaction cost. Speculators? ...

Chapter 259 South African Rand/US Dollar (ZAR/USD)

... This chapter is limited in application to South African rand/U.S. dollar futures. In addition to this chapter, South African rand/U.S. dollar futures shall be subject to the general rules and regulations of the Exchange insofar as applicable. For purposes of this chapter, unless otherwise specified, ...

... This chapter is limited in application to South African rand/U.S. dollar futures. In addition to this chapter, South African rand/U.S. dollar futures shall be subject to the general rules and regulations of the Exchange insofar as applicable. For purposes of this chapter, unless otherwise specified, ...

Get the flexibility to determine a futures price without

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

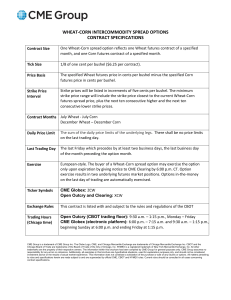

Wheat-Corn Intercommodity Spread Options Contract

... Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners. The information within this brochure has been compiled by CME Group for gen ...

... Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners. The information within this brochure has been compiled by CME Group for gen ...

Commodity Market - Learning Financial Management

... • These raw commodities are traded on regulated commodity exchanges, in which they are bought and sold in standardized contracts. It is similar to an equity market, but instead of buying or selling shares one buys or sells commodities. ...

... • These raw commodities are traded on regulated commodity exchanges, in which they are bought and sold in standardized contracts. It is similar to an equity market, but instead of buying or selling shares one buys or sells commodities. ...

ch01 - Class Index

... wheat, live cattle, gold, heating oil, foreign currency, U.S. Treasury bonds, and stock market indexes ...

... wheat, live cattle, gold, heating oil, foreign currency, U.S. Treasury bonds, and stock market indexes ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

Who we are

... PMEX aims to bring futures contracts of all the above commodities on its trading platform ...

... PMEX aims to bring futures contracts of all the above commodities on its trading platform ...

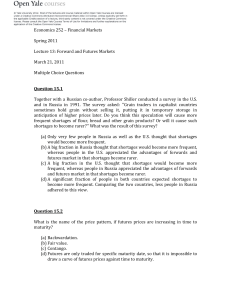

Derivatives - MyCourses

... OPTION: A privilege sold by one party to another that offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security at an agreed-upon price during a certain period of time or on a specific date. FUTURE: A contractual agreement, generally made on the trading floor of a fu ...

... OPTION: A privilege sold by one party to another that offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security at an agreed-upon price during a certain period of time or on a specific date. FUTURE: A contractual agreement, generally made on the trading floor of a fu ...

Commodity Marketing Activity

... • Forward Contracts were traded on street curbs and in public squares • 1850’s Chicago merchants began trading forward contracts for wheat for eastern millers and exporters • Board of Trade in Chicago had been established in 1848 to promote commerce ...

... • Forward Contracts were traded on street curbs and in public squares • 1850’s Chicago merchants began trading forward contracts for wheat for eastern millers and exporters • Board of Trade in Chicago had been established in 1848 to promote commerce ...