O novo mercado ea regulamentação

... adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater financial and functional independence The Brazilian legal system does not have an appropriate str ...

... adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater financial and functional independence The Brazilian legal system does not have an appropriate str ...

Chap024

... • The account will be debited or credited every day. • Although there is a large variety of futures contracts available, many firms may not be able to hedge the exact quantity, quality, and/or delivery date they desire Copyright © 2005 McGraw-Hill Ryerson Limited. All rights reserved. ...

... • The account will be debited or credited every day. • Although there is a large variety of futures contracts available, many firms may not be able to hedge the exact quantity, quality, and/or delivery date they desire Copyright © 2005 McGraw-Hill Ryerson Limited. All rights reserved. ...

I_Ch03

... – Level 3 (for dealers): receive all bid and asked quotes and can input the bid and asked prices for their own – Level 2 (for brokers): receive all bid and asked quotes – Level 1 (for investors who is not actively trading securities but interested in current prices): receive the highest bid and lowe ...

... – Level 3 (for dealers): receive all bid and asked quotes and can input the bid and asked prices for their own – Level 2 (for brokers): receive all bid and asked quotes – Level 1 (for investors who is not actively trading securities but interested in current prices): receive the highest bid and lowe ...

gmma relationships

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

Option Derivatives in Electricity Hedging

... The result is that the intended hedging transaction becomes to speculative position after a margin call that we are not able to pay for. In the second case, we can consider an unhedged price risk, which results from inadequate hedging of open positions. This case very often occurs and is associated ...

... The result is that the intended hedging transaction becomes to speculative position after a margin call that we are not able to pay for. In the second case, we can consider an unhedged price risk, which results from inadequate hedging of open positions. This case very often occurs and is associated ...

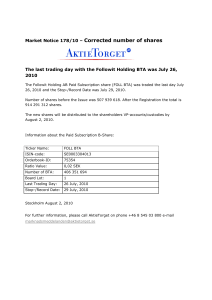

Market Notice 178/10 – Corrected number of shares

... The last trading day with the Followit Holding BTA was July 26, ...

... The last trading day with the Followit Holding BTA was July 26, ...

Market based Mechanisms to fight Climate Change

... Every year, industrial installations have the obligation to restitute as many allowances as actual CO2 emissions; Two market periods: 2005-2007 and 2008-2012; Free banking and borrowing during each period; Limited possibilities of banking and borrowing between the two periods. ...

... Every year, industrial installations have the obligation to restitute as many allowances as actual CO2 emissions; Two market periods: 2005-2007 and 2008-2012; Free banking and borrowing during each period; Limited possibilities of banking and borrowing between the two periods. ...

OPTIONS AND FUTURES CONTRACTS IN ELECTRICITY FOR

... it can happen with a futures contract ( see Black, 1976). Whether it should be replaced by another contract, then it would have to be dissolved by agreement and a new contract should be created. If a futures market were available, a broad range of trade could be conceived. The futures market allows ...

... it can happen with a futures contract ( see Black, 1976). Whether it should be replaced by another contract, then it would have to be dissolved by agreement and a new contract should be created. If a futures market were available, a broad range of trade could be conceived. The futures market allows ...

Chapter1

... 2. Asymmetric information effect *quotes change because traders fear they are quoting prices to someone who knows more than they do about current market conditions *even without any public news, traders transmit news in the act of trading *If Ingrid at Chase posts a quote of 125.00-.10 and is calle ...

... 2. Asymmetric information effect *quotes change because traders fear they are quoting prices to someone who knows more than they do about current market conditions *even without any public news, traders transmit news in the act of trading *If Ingrid at Chase posts a quote of 125.00-.10 and is calle ...

Chapter: 351 EXCHANGES (SPECIAL LEVY) ORDINANCE Gazette

... In this Ordinance, unless the context otherwise requires"Commission" (監察委員會) means the Securities and Futures Commission established by section 3 of the Securities and Futures Commission Ordinance (Cap 24); (Added 71 of 1993 s. 2) "facility letters" (提供貸款通知書) means the facility letters entered into ...

... In this Ordinance, unless the context otherwise requires"Commission" (監察委員會) means the Securities and Futures Commission established by section 3 of the Securities and Futures Commission Ordinance (Cap 24); (Added 71 of 1993 s. 2) "facility letters" (提供貸款通知書) means the facility letters entered into ...

Tom Lawless

... Market Structure & Regulatory environment Recognise the contradiction in that the objectives of the market regulators may not always be the same as those of the participants ...

... Market Structure & Regulatory environment Recognise the contradiction in that the objectives of the market regulators may not always be the same as those of the participants ...

Slide 1 - UTA.edu

... • Consider a trader that wishes to short yen. They can use a put option. Suppose they have access to an August put with a strike price of 100.00 (all contracts are listed as cents per unit of foreign currency…except ¥, which is listed as cents per 100 units of foreign currency). Trader wishes to sel ...

... • Consider a trader that wishes to short yen. They can use a put option. Suppose they have access to an August put with a strike price of 100.00 (all contracts are listed as cents per unit of foreign currency…except ¥, which is listed as cents per 100 units of foreign currency). Trader wishes to sel ...

Surveillance in a changing SecuritieS market landScape

... Vice President, Market Regulation Department at FINRA. “It’s critically important that we as regulators and market participants embrace efforts to monitor this new world.” To this end, exchanges and market participants need to dedicate an appropriate amount of technology and human resources to their ...

... Vice President, Market Regulation Department at FINRA. “It’s critically important that we as regulators and market participants embrace efforts to monitor this new world.” To this end, exchanges and market participants need to dedicate an appropriate amount of technology and human resources to their ...

Stocks, Bonds, And Futures

... List the main reasons people choose to purchase stock. How do an investor purchase stock? How do corporate finances, investor expectations, and external forces influence stock prices? How does the futures market offer risks to sellers as well as to investors? ...

... List the main reasons people choose to purchase stock. How do an investor purchase stock? How do corporate finances, investor expectations, and external forces influence stock prices? How does the futures market offer risks to sellers as well as to investors? ...

ppt

... reaction than similar companies issuing equity in the United States Non-U.S. companies listing in the United States often increase in value ...

... reaction than similar companies issuing equity in the United States Non-U.S. companies listing in the United States often increase in value ...

Kevin Houstoun

... Examining one recommendation “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate fo ...

... Examining one recommendation “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate fo ...

Optimal Hedge Ratio and Hedge Efficiency

... The evidence on options can be divided into five areas: (i) The effect of listing of options on volatility and liquidity (bid-ask spread) of underlying cash market (Trennepohl and Dukes, 1979; Skinner, 1989; Watt, Yadav and Draper, 1992; Chamberlain, Cheung and Kwan, 1993; Kumar, Sarin and Shastri, ...

... The evidence on options can be divided into five areas: (i) The effect of listing of options on volatility and liquidity (bid-ask spread) of underlying cash market (Trennepohl and Dukes, 1979; Skinner, 1989; Watt, Yadav and Draper, 1992; Chamberlain, Cheung and Kwan, 1993; Kumar, Sarin and Shastri, ...

Risk-Neutral Valuation in Practice:

... • Equivalent to penalty-free lapse and re-entry • If replacement contract is fairly priced (ft = 0) then can model as anti-selective lapse ...

... • Equivalent to penalty-free lapse and re-entry • If replacement contract is fairly priced (ft = 0) then can model as anti-selective lapse ...

Germersheim Distribution Center Opens in Germany

... costs – savings that will ultimately result in additional support of military communities around the world. Since the 1960s, merchandise was shipped to Exchanges across Europe and the Middle East from the Giessen Distribution Center. Logistic leadership were on hand as the final operations came to a ...

... costs – savings that will ultimately result in additional support of military communities around the world. Since the 1960s, merchandise was shipped to Exchanges across Europe and the Middle East from the Giessen Distribution Center. Logistic leadership were on hand as the final operations came to a ...

An Equilibrium Model of Catastrophe Insurance Futures and Spreads

... Even though the contracts are called catastrophe futures, in fact all losses for the specified perils and line of business are included in the loss pool. However, the losses in the pool are expected to be highly correlated with property catastrophe losses because the included perils were chosen as t ...

... Even though the contracts are called catastrophe futures, in fact all losses for the specified perils and line of business are included in the loss pool. However, the losses in the pool are expected to be highly correlated with property catastrophe losses because the included perils were chosen as t ...

Derivatives and their feedback effects on the spot markets

... Derivatives are the fastest-growing, most dynamic segment of the modern financial markets. They complement spot market instruments and create new opportunities for the transfer of risk among market participants. Derivatives trading is contributing increasingly to price discovery on financial markets ...

... Derivatives are the fastest-growing, most dynamic segment of the modern financial markets. They complement spot market instruments and create new opportunities for the transfer of risk among market participants. Derivatives trading is contributing increasingly to price discovery on financial markets ...

Demutualizing African Stock Exchanges

... Small markets by international standards – Market capitalization to GDP as low as 4% in some markets Low liquidity Limited listings Preponderance of listings by subsidiaries of multinationals has “domesticated” listings i.e. no incentive to migrate or cross list ...

... Small markets by international standards – Market capitalization to GDP as low as 4% in some markets Low liquidity Limited listings Preponderance of listings by subsidiaries of multinationals has “domesticated” listings i.e. no incentive to migrate or cross list ...

SAVVIS selected by the Montréal Exchange for online trading

... The Montréal Exchange Enhances Electronic Trading Floor Using SAVVIS Network HERNDON, VA, April 24, 2002 – SAVVIS Communications (NASDAQ: SVVS), the premier provider of virtual private networks (VPNs) and managed hosting to the global financial markets, announced today that Bourse de Montréal Inc., ...

... The Montréal Exchange Enhances Electronic Trading Floor Using SAVVIS Network HERNDON, VA, April 24, 2002 – SAVVIS Communications (NASDAQ: SVVS), the premier provider of virtual private networks (VPNs) and managed hosting to the global financial markets, announced today that Bourse de Montréal Inc., ...