Currency derivatives Currency derivatives are a contract between

... Option: It is a contract between two parties to buy or sell a given amount of asset at a prespecified price on or before a given date. We will now use the above example, to define certain important terms relating to options. • The right to buy the asset is called call option and the right to sell th ...

... Option: It is a contract between two parties to buy or sell a given amount of asset at a prespecified price on or before a given date. We will now use the above example, to define certain important terms relating to options. • The right to buy the asset is called call option and the right to sell th ...

Lecture 14

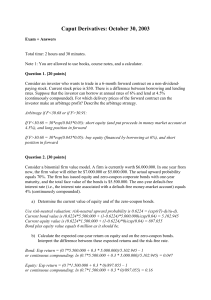

... Delta-Hedging Example Find the value of ∆ of a 6-month European call option on a stock with a strike price equal to the current stock price ( t = 0). The interest rate is 6% p.a. The volatility σ = 0.16. Solution: we have ∆ = N (d1 ) , where d1 = ...

... Delta-Hedging Example Find the value of ∆ of a 6-month European call option on a stock with a strike price equal to the current stock price ( t = 0). The interest rate is 6% p.a. The volatility σ = 0.16. Solution: we have ∆ = N (d1 ) , where d1 = ...

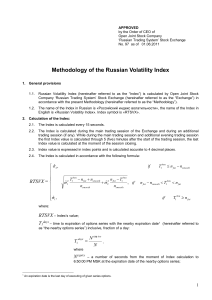

Full text

... • For high forward price the delta is close to 1 as the probability of finishing in the money is high • The delta becomes steeper as the option maturity decreases as the probability of the option finishing in the money becomes more sensitive to small changes in the forward price close to the strike ...

... • For high forward price the delta is close to 1 as the probability of finishing in the money is high • The delta becomes steeper as the option maturity decreases as the probability of the option finishing in the money becomes more sensitive to small changes in the forward price close to the strike ...

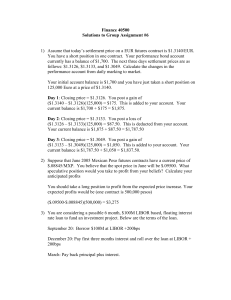

Question 1

... The difference between the forward and spot currency rate is completely determined by the maturity and the difference between the domestic and foreign interest rate. Therefore, it does not directly reflect any market expectations on the development of the currency rate. Only if there is no risk prem ...

... The difference between the forward and spot currency rate is completely determined by the maturity and the difference between the domestic and foreign interest rate. Therefore, it does not directly reflect any market expectations on the development of the currency rate. Only if there is no risk prem ...

Chapter Five

... Short essay/problems 1. Comment on the following statement: “It seems to me that with at-the-money options on a given stock, the calls usually sell for more than the puts.” ANSWER: This is true because of put/call parity. 2. Suppose you look in the newspaper and see that an option has changed price ...

... Short essay/problems 1. Comment on the following statement: “It seems to me that with at-the-money options on a given stock, the calls usually sell for more than the puts.” ANSWER: This is true because of put/call parity. 2. Suppose you look in the newspaper and see that an option has changed price ...

Solutions

... future spot rates, you are unlikely to make money. 5) Suppose that the 3 month dollar LIBOR is 4.5% annualized while the Euro LIBOR rate is 3.75% annualized. If the current spot price of Euro is $1.25, calculate the price of a 3 month Euro forward contract. Note: A 4.5% annual rate equals a 1.125% 3 ...

... future spot rates, you are unlikely to make money. 5) Suppose that the 3 month dollar LIBOR is 4.5% annualized while the Euro LIBOR rate is 3.75% annualized. If the current spot price of Euro is $1.25, calculate the price of a 3 month Euro forward contract. Note: A 4.5% annual rate equals a 1.125% 3 ...

Investments

... underlying asset. At-the-money - The exercise price is equal to the spot price of the underlying asset. Out-of-the-money - The exercise price is more than the spot price of the underlying asset. ...

... underlying asset. At-the-money - The exercise price is equal to the spot price of the underlying asset. Out-of-the-money - The exercise price is more than the spot price of the underlying asset. ...