chapter 2: the structure of options markets

... such as, MSFT\12B17\20.0. The last number represents the calendar date, the 20th of the month in this example. ...

... such as, MSFT\12B17\20.0. The last number represents the calendar date, the 20th of the month in this example. ...

Institute of Actuaries of India May 2013 Examinations INDICATIVE SOLUTIONS

... To show equivalence we need to create two portfolios with identical pay-off and show that there price at time 0 should be equal. We start at the end of day 0 and go long for future contracts and increase the same for number of contracts every day till n. So, by beginning of day i we will have contra ...

... To show equivalence we need to create two portfolios with identical pay-off and show that there price at time 0 should be equal. We start at the end of day 0 and go long for future contracts and increase the same for number of contracts every day till n. So, by beginning of day i we will have contra ...

VARIABLE STRIKE OPTIONS and GUARANTEES in LIFE

... and hedging strategies, overcoming the traditional risk profile. The innovation process leads to new kinds of exotic options and it modifies the typical elements such as the underlying, the strike price, the maturity. In this note, we are especially interested with the development of the strike pric ...

... and hedging strategies, overcoming the traditional risk profile. The innovation process leads to new kinds of exotic options and it modifies the typical elements such as the underlying, the strike price, the maturity. In this note, we are especially interested with the development of the strike pric ...

Modeling Asset Prices in Continuous Time

... This involves: • Fully covering the option as soon as it moves in the money • Staying naked the rest of the time This “deceptively simple” hedging strategy does NOT work well! Underlying must be bought slightly above X and sold slightly below X. ...

... This involves: • Fully covering the option as soon as it moves in the money • Staying naked the rest of the time This “deceptively simple” hedging strategy does NOT work well! Underlying must be bought slightly above X and sold slightly below X. ...

Binomial Trees

... The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it is the stock that really plays the hedging role. The optimal hedge ratio when hedging options using stocks is defined as the ratio o ...

... The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it is the stock that really plays the hedging role. The optimal hedge ratio when hedging options using stocks is defined as the ratio o ...

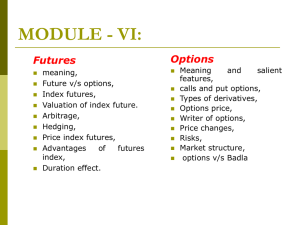

colour ppt

... Everyone has options. When buying a car, we can add more equipment to the automobile that is “optional at extra cost”. In this sense, an option is a choice. Every option is either a call option or a put option. • Call option: a security that gives its owner the right, but not the obligation, to purc ...

... Everyone has options. When buying a car, we can add more equipment to the automobile that is “optional at extra cost”. In this sense, an option is a choice. Every option is either a call option or a put option. • Call option: a security that gives its owner the right, but not the obligation, to purc ...

Monte Carlo Simulation

... • An option is a financial derivative – Its value is derived from some other object, such as a stock • Payoff is dependent upon the value of the stock at the expiration date of the option – For a call option, the owner has the right to buy or sell the underlying asset at a specified price, known as ...

... • An option is a financial derivative – Its value is derived from some other object, such as a stock • Payoff is dependent upon the value of the stock at the expiration date of the option – For a call option, the owner has the right to buy or sell the underlying asset at a specified price, known as ...

Lecture 3

... Hedge funds are not subject to these constraints. Hedge funds use complex trading strategies are big users of derivatives for hedging, speculation and arbitrage ...

... Hedge funds are not subject to these constraints. Hedge funds use complex trading strategies are big users of derivatives for hedging, speculation and arbitrage ...