Information to clients concerning the properties and special

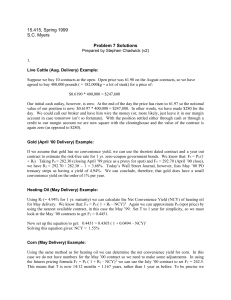

... As mentioned above some derivative trades may entail the client having to provide separate security (margin requirement), for example in the case of the sale of options without owning the underlying shares or corresponding options, and the purchase and sale of forward/futures contracts and swap agre ...

... As mentioned above some derivative trades may entail the client having to provide separate security (margin requirement), for example in the case of the sale of options without owning the underlying shares or corresponding options, and the purchase and sale of forward/futures contracts and swap agre ...

an investor`s guide to index futures

... sale of a particular asset at a specific future date. The price at which the asset would change hands in the future is agreed upon at the time of entering into the contract. The actual purchase or sale of the underlying involving payment of cash and delivery of the instrument does not take place unt ...

... sale of a particular asset at a specific future date. The price at which the asset would change hands in the future is agreed upon at the time of entering into the contract. The actual purchase or sale of the underlying involving payment of cash and delivery of the instrument does not take place unt ...

Hedging Interest Rate Risk

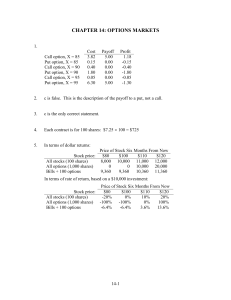

... Barrier options: The payoff is contingent on whether or not the underlying commodity has reached a predetermined price Compound Options: The underlying commodity is an option Digital Option: Also known as a binary option – the payout is fixed once the strike price has been reached. ...

... Barrier options: The payoff is contingent on whether or not the underlying commodity has reached a predetermined price Compound Options: The underlying commodity is an option Digital Option: Also known as a binary option – the payout is fixed once the strike price has been reached. ...