NBER WORKING PAPER SERIES AN EMPIRICAL INVESTIGATION

... major institutional reform and constitutional change in the past 2 years, including the 2003 FDI law that cuts the official procedures from 15 to 3 for foreign investors. Multinational companies such as Metro AG, PSA Peugeot Citroen, Vodafone PLC, and France Telekom are increasing their FDI to Turk ...

... major institutional reform and constitutional change in the past 2 years, including the 2003 FDI law that cuts the official procedures from 15 to 3 for foreign investors. Multinational companies such as Metro AG, PSA Peugeot Citroen, Vodafone PLC, and France Telekom are increasing their FDI to Turk ...

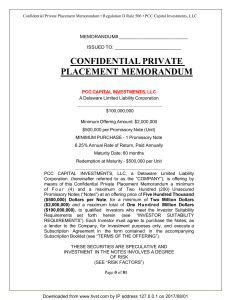

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

... 18156 Darnell Drive, Olney, MD 20832 Telephone: (301) 570-9100 Facsimile: 240-363-0062 [email protected] ...

... 18156 Darnell Drive, Olney, MD 20832 Telephone: (301) 570-9100 Facsimile: 240-363-0062 [email protected] ...

PDF

... major institutional reform and constitutional change in the past 2 years, including the 2003 FDI law that cuts the official procedures from 15 to 3 for foreign investors. Multinational companies such as Metro AG, PSA Peugeot Citroen, Vodafone PLC, and France Telekom are increasing their FDI to Turk ...

... major institutional reform and constitutional change in the past 2 years, including the 2003 FDI law that cuts the official procedures from 15 to 3 for foreign investors. Multinational companies such as Metro AG, PSA Peugeot Citroen, Vodafone PLC, and France Telekom are increasing their FDI to Turk ...

Capital resources

... liabilities may be different under different scenarios. For example, some assets on the balance sheet may lose some or all of their value in the event of a windup or run-off, for example, because of a forced sale. The value of an asset may also reduce in the event the insurer closes to new business. ...

... liabilities may be different under different scenarios. For example, some assets on the balance sheet may lose some or all of their value in the event of a windup or run-off, for example, because of a forced sale. The value of an asset may also reduce in the event the insurer closes to new business. ...

Is the Growth-value Anomaly Related to the Asset Growth Anomaly?

... forecasts are systemically higher than realized earnings for high total asset growth firms. Furthermore, Lam and Wei (2016) show that ex-ante expectation errors determine the anomaly. They identify ex-ante expectation errors by the extrapolative total asset growth expectation being inconsistent wit ...

... forecasts are systemically higher than realized earnings for high total asset growth firms. Furthermore, Lam and Wei (2016) show that ex-ante expectation errors determine the anomaly. They identify ex-ante expectation errors by the extrapolative total asset growth expectation being inconsistent wit ...

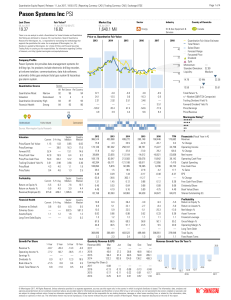

Pason Systems Inc PSI

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Schwab Performance Report | Q3 2016 Table of

... If you are a Client who has a managed account through Managed Account Select® ("Select"), Schwab Managed PortfoliosTM ("SMP"), or Managed Account Connection ® ("Connection"), and you wish to impose or modify any restrictions on the management of your managed account, or if you have had any changes t ...

... If you are a Client who has a managed account through Managed Account Select® ("Select"), Schwab Managed PortfoliosTM ("SMP"), or Managed Account Connection ® ("Connection"), and you wish to impose or modify any restrictions on the management of your managed account, or if you have had any changes t ...

Chapter 28 Investment Policy and the Framework of the CFA Institute

... 34. The first step a pension fund should take before beginning to invest is to __________. A. establish investment objectives B. develop a list of investment managers with superior records to interview C. establish asset allocation guidelines D. decide between active and passive management E. None o ...

... 34. The first step a pension fund should take before beginning to invest is to __________. A. establish investment objectives B. develop a list of investment managers with superior records to interview C. establish asset allocation guidelines D. decide between active and passive management E. None o ...

here - Labrador Ventures

... Types of Exits M & A: 85-90% of venture-backed exits Cash sale (typically with 1+ year, 10-20% escrow) Cash with earnout based on milestone metrics Combination of cash & stock (public or private) ...

... Types of Exits M & A: 85-90% of venture-backed exits Cash sale (typically with 1+ year, 10-20% escrow) Cash with earnout based on milestone metrics Combination of cash & stock (public or private) ...

Asset Write-down - Rutgers University

... removing assets which managers believe face obsolescence. When it comes to voluntary asset write-down, as is the case for EARLY firm, however, this action is more likely to be viewed as management's effort to restructure the organization in order to keep up the pace with technological innovations. T ...

... removing assets which managers believe face obsolescence. When it comes to voluntary asset write-down, as is the case for EARLY firm, however, this action is more likely to be viewed as management's effort to restructure the organization in order to keep up the pace with technological innovations. T ...

Does pension funds` fiduciary duty prohibit the integration of

... hypothetical pension fund portfolios with five different degrees of responsibility in five different corporate environmental responsibility criteria (one aggregated measure and four disaggregated measures). It appears very reliably, as our econometric analysis explains between 89% and 98% of any pe ...

... hypothetical pension fund portfolios with five different degrees of responsibility in five different corporate environmental responsibility criteria (one aggregated measure and four disaggregated measures). It appears very reliably, as our econometric analysis explains between 89% and 98% of any pe ...

Credit Suisse Global Investment Returns Yearbook 2013

... USA, 3.9% in the UK, and 3.3% across all Yearbook countries. Rates were much lower before this, from 1900 to 1980, when the average annual rate was 0.7% for the USA, 0.4% for the UK, and –0.6% when averaged across all countries, including those impacted by episodes of high inflation. Viewed through ...

... USA, 3.9% in the UK, and 3.3% across all Yearbook countries. Rates were much lower before this, from 1900 to 1980, when the average annual rate was 0.7% for the USA, 0.4% for the UK, and –0.6% when averaged across all countries, including those impacted by episodes of high inflation. Viewed through ...

1 CHAPTER-1 INTRODUCTION 1.0 INDIAN STOCK MARKET

... The high volatility is due to much foreign equity inflows. This results into dependence of Indian equity market on global capital market variations. It means any happening outside India will have its impact here as well. As when US economy was improving, resulted into falling rupee led negative sent ...

... The high volatility is due to much foreign equity inflows. This results into dependence of Indian equity market on global capital market variations. It means any happening outside India will have its impact here as well. As when US economy was improving, resulted into falling rupee led negative sent ...

managed futures and hedge funds: a match made in

... of their portfolio without, under the assumptions made, giving up much in terms of expected return. ...

... of their portfolio without, under the assumptions made, giving up much in terms of expected return. ...

Investor Flows and Fragility in Corporate Bond Funds

... so are more likely to internalize the negative externalities generated by their outflows. Indeed, consistent with this hypothesis, we find that the effect of illiquidity on the sensitivity of outflows to bad performance diminishes when the fund is held mostly by institutional investors. Sixth, the d ...

... so are more likely to internalize the negative externalities generated by their outflows. Indeed, consistent with this hypothesis, we find that the effect of illiquidity on the sensitivity of outflows to bad performance diminishes when the fund is held mostly by institutional investors. Sixth, the d ...

Griffin Institutional Access Real Estate Fund (Form: N

... The portfolio management team continues to work diligently to determine the optimal mix of private and public real estate securities that maximize risk-adjusted returns for our shareholders. Given the amount of volatility and uncertainty surrounding the U.S. election, the United Kingdom’s decision t ...

... The portfolio management team continues to work diligently to determine the optimal mix of private and public real estate securities that maximize risk-adjusted returns for our shareholders. Given the amount of volatility and uncertainty surrounding the U.S. election, the United Kingdom’s decision t ...

Europe`s ETF Primary Market

... The ETF Arbitrage Mechanism “Only authorised participants (specialists, market makers, institutions) transact directly with the ETF. Participants and the ETF engage in ‘in-kind’ transactions, trading baskets of securities for very large blocks of shares called ‘creation units’. These transactions, ...

... The ETF Arbitrage Mechanism “Only authorised participants (specialists, market makers, institutions) transact directly with the ETF. Participants and the ETF engage in ‘in-kind’ transactions, trading baskets of securities for very large blocks of shares called ‘creation units’. These transactions, ...

Documento gestión proyecto

... Recent performance of Roca and Sanitec has been based on a combination of organic growth and acquisitions in the industry. Once both groups reached a certain market share in the worldwide sanitary industry, acquisitions became more important in their expansion strategy. Therefore we can affirm that ...

... Recent performance of Roca and Sanitec has been based on a combination of organic growth and acquisitions in the industry. Once both groups reached a certain market share in the worldwide sanitary industry, acquisitions became more important in their expansion strategy. Therefore we can affirm that ...

FREE Sample Here - Find the cheapest test bank for your

... Which of the following statements is CORRECT? a. Back before the SEC was created in the 1930s, companies would declare reverse splits in order to boost their stock prices. However, this was determined to be a deceptive practice, and it is illegal today. b. Stock splits create more administrative pro ...

... Which of the following statements is CORRECT? a. Back before the SEC was created in the 1930s, companies would declare reverse splits in order to boost their stock prices. However, this was determined to be a deceptive practice, and it is illegal today. b. Stock splits create more administrative pro ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.