1. How Capital Markets Work

... 1. How Capital Markets Work 1.2.1. Why People Don’t Like Risk ➤ Why do people demand a risk premium? ■ Our "self-experiment" and empirical data from financial markets clearly show that people are risk averse and demand risk premiums for risky investments. ■ Now the question is, why do people behave ...

... 1. How Capital Markets Work 1.2.1. Why People Don’t Like Risk ➤ Why do people demand a risk premium? ■ Our "self-experiment" and empirical data from financial markets clearly show that people are risk averse and demand risk premiums for risky investments. ■ Now the question is, why do people behave ...

Research into the International Capital

... comparisons the 4 majors continue to present to shareholders, investors and the market their capital ratios, when harmonised with international peers, as being higher than reported under APRA regulation and supervision. This updated research report extends the research to include an analysis of APRA ...

... comparisons the 4 majors continue to present to shareholders, investors and the market their capital ratios, when harmonised with international peers, as being higher than reported under APRA regulation and supervision. This updated research report extends the research to include an analysis of APRA ...

The Macroeconomics of Shadow Banking Alan Moreira Alexi Savov July 2014

... consume a burst of wealth at high marginal utility, which necessitates a rapid sale of securities. As a result of this urgency, liquidity-event consumption must be financed by sales of liquid securities, namely those that can be traded quickly and in large quantities at low cost.2 We endogenize liqu ...

... consume a burst of wealth at high marginal utility, which necessitates a rapid sale of securities. As a result of this urgency, liquidity-event consumption must be financed by sales of liquid securities, namely those that can be traded quickly and in large quantities at low cost.2 We endogenize liqu ...

Thinking Alternative

... 500 Index since 1957 and before it other broad indices of large-cap U.S. stocks. The equity real yield is a 50/50 mix of two measures: Shiller’s (10year average, cyclically adjusted) Earnings/Price ratio * 1.075 and Dividend/Price + 1.5%. Scalars are used to account for long term real Earnings Per S ...

... 500 Index since 1957 and before it other broad indices of large-cap U.S. stocks. The equity real yield is a 50/50 mix of two measures: Shiller’s (10year average, cyclically adjusted) Earnings/Price ratio * 1.075 and Dividend/Price + 1.5%. Scalars are used to account for long term real Earnings Per S ...

Informed Trading, Liquidity Provision, and Stock Selection by Mutual

... As of 2007, US mutual fund managers collectively had over $12 trillion under their management with more than half of it in stocks. A signi…cant portion of this amount is actively managed, as indicated by a turnover rate in excess of 50% for stock funds.1 During 1980 to 2006, investors paid over 0:6 ...

... As of 2007, US mutual fund managers collectively had over $12 trillion under their management with more than half of it in stocks. A signi…cant portion of this amount is actively managed, as indicated by a turnover rate in excess of 50% for stock funds.1 During 1980 to 2006, investors paid over 0:6 ...

reinventing venture capital towards a new economic

... funds. Creating four or five private ‘super-funds’ would allow each fund to manage a portfolio of high-risk investments in the way that the leading US funds are able to do, rather than being forced into a ‘safety-first’ investment strategy through lack of funds. It would also enable the funds to mak ...

... funds. Creating four or five private ‘super-funds’ would allow each fund to manage a portfolio of high-risk investments in the way that the leading US funds are able to do, rather than being forced into a ‘safety-first’ investment strategy through lack of funds. It would also enable the funds to mak ...

NBER WORKING PAPER SERIES INDIVIDUAL INVESTOR MUTUAL-FUND FLOWS Zoran Ivkovich Scott Weisbenner

... net flows. However, as with fund performance, useful insights may be gleaned by breaking net flows into their two components. For example, expense ratios might have only a modest relation with net flows, yet could have strong positive effects both on “new” money flowing into the fund (e.g., high exp ...

... net flows. However, as with fund performance, useful insights may be gleaned by breaking net flows into their two components. For example, expense ratios might have only a modest relation with net flows, yet could have strong positive effects both on “new” money flowing into the fund (e.g., high exp ...

Deutsche AM Flagship Fund Reporting

... When the custodian sets the price on the last trading day of the month there can be a difference of up to ten hours between the times at which the fund price and the benchmark are calculated. In the event of strong market movements during this period, this may result in the over- or understatement o ...

... When the custodian sets the price on the last trading day of the month there can be a difference of up to ten hours between the times at which the fund price and the benchmark are calculated. In the event of strong market movements during this period, this may result in the over- or understatement o ...

MULTINATIONAL FINANCIAL MANAGEMENT: AN OVERVIEW

... globalized. It is thus essential for financial managers to fully understand vital international dimensions of financial management. In order to cater to needs/demand of huge world population, a country can engage itself in multi trading activities among various nations. In the post WTO regime (after ...

... globalized. It is thus essential for financial managers to fully understand vital international dimensions of financial management. In order to cater to needs/demand of huge world population, a country can engage itself in multi trading activities among various nations. In the post WTO regime (after ...

An Equity Valuation and Analysis of Havertys Furniture Companies

... should be aligned with the firm’s key success factors in order to create value. The flexible accounting policies for Havertys, as with most firms in the home furnishings industry, revolve primarily around operating leases. The showrooms these firms need are very large and often firms in this industr ...

... should be aligned with the firm’s key success factors in order to create value. The flexible accounting policies for Havertys, as with most firms in the home furnishings industry, revolve primarily around operating leases. The showrooms these firms need are very large and often firms in this industr ...

essays on market frictions in the real estate market

... relative ease with which trades can be made without resulting in a significant change in price. The less liquid the market, the harder it is to complete a market transaction. In extreme cases, the market completely shuts down such that it ceases to exist. Therefore, segmentation is about limited ris ...

... relative ease with which trades can be made without resulting in a significant change in price. The less liquid the market, the harder it is to complete a market transaction. In extreme cases, the market completely shuts down such that it ceases to exist. Therefore, segmentation is about limited ris ...

cm advisors small cap value fund cm advisors fixed income fund

... of a company’s future earnings stream. Since the market price of a stock changes continuously based upon investors’ collective perceptions of future earnings, stock prices will generally decline when investors anticipate or experience rising interest rates. In addition, to the extent the Advisors Fu ...

... of a company’s future earnings stream. Since the market price of a stock changes continuously based upon investors’ collective perceptions of future earnings, stock prices will generally decline when investors anticipate or experience rising interest rates. In addition, to the extent the Advisors Fu ...

Is the Risk-Return Tradeoff Hypothesis valid: Should an

... EMH: i) weak-form efficiency ii) semi-strong form efficiency and iii) strong-form efficiency. The weak-form efficiency implies that stock prices only reflect all historical information; historical prices, trading volumes etcetera, and using only historical data to predict future stock price movement ...

... EMH: i) weak-form efficiency ii) semi-strong form efficiency and iii) strong-form efficiency. The weak-form efficiency implies that stock prices only reflect all historical information; historical prices, trading volumes etcetera, and using only historical data to predict future stock price movement ...

(Amendment) Law, 2015 - Cayman Islands Monetary Authority

... in paragraph (e) by inserting after the words “a regulated mutual fund” the words “or a regulated EU Connected Fund”; (c) in subsection (2) by inserting after the words “a regulated mutual fund” the words “or a regulated EU Connected Fund”; (d) in subsection (3) by inserting after the words “a regul ...

... in paragraph (e) by inserting after the words “a regulated mutual fund” the words “or a regulated EU Connected Fund”; (c) in subsection (2) by inserting after the words “a regulated mutual fund” the words “or a regulated EU Connected Fund”; (d) in subsection (3) by inserting after the words “a regul ...

IDRT

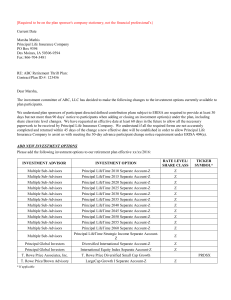

... The investment committee of ABC, LLC has decided to make the following changes to the investment options currently available to plan participants. We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more tha ...

... The investment committee of ABC, LLC has decided to make the following changes to the investment options currently available to plan participants. We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more tha ...

DHFL Pramerica Dual Advantage Fund Series 1 to 3

... The Scheme may invest in various derivative instruments which are permissible under the applicable regulations. Such investments shall be subject to the investment objective and strategy of the Scheme and the internal limits if any, as laid down from time to time. These include but are not limited t ...

... The Scheme may invest in various derivative instruments which are permissible under the applicable regulations. Such investments shall be subject to the investment objective and strategy of the Scheme and the internal limits if any, as laid down from time to time. These include but are not limited t ...

Underwriting Costs of Seasoned Equity Offerings

... contribute substantially to cross-sectional variation among firms in their cost of raising capital. The total cost to a firm of accessing external equity finance through an SEO is calculated as the rate of return demanded by investors who purchase the stock (the total amount of stock sold multiplied ...

... contribute substantially to cross-sectional variation among firms in their cost of raising capital. The total cost to a firm of accessing external equity finance through an SEO is calculated as the rate of return demanded by investors who purchase the stock (the total amount of stock sold multiplied ...

Why were there fire sales of mortgage

... whereby capital requirements and fair value accounting rules may combine to create an incentive to sell illiquid distressed securities at fire-sale prices (capital requirement forced sale hypothesis). A forced sale does not have to take place at prices below fundamental values. In well-functioning, ...

... whereby capital requirements and fair value accounting rules may combine to create an incentive to sell illiquid distressed securities at fire-sale prices (capital requirement forced sale hypothesis). A forced sale does not have to take place at prices below fundamental values. In well-functioning, ...

Individual Investor Mutual Fund Flows

... made in the period from January of 1991 to November of 1996, comes from a large discount broker. Mutual funds are the second most frequently used investment vehicle in the data set, accounting for 18% of the overall value of all the trades investors in the sample made over the six-year period. They ...

... made in the period from January of 1991 to November of 1996, comes from a large discount broker. Mutual funds are the second most frequently used investment vehicle in the data set, accounting for 18% of the overall value of all the trades investors in the sample made over the six-year period. They ...

Investor Sentiment and Chinese A

... O-score (O-score), stock issuance growth (Issue), total accruals (Accruals), net operating assets (Opa), profit premium (Profit), growth of assets (GA), return on assets (ROA), return on equities (ROE) and investment to assets (ITA). We also investigate the relationship between investor sentiment an ...

... O-score (O-score), stock issuance growth (Issue), total accruals (Accruals), net operating assets (Opa), profit premium (Profit), growth of assets (GA), return on assets (ROA), return on equities (ROE) and investment to assets (ITA). We also investigate the relationship between investor sentiment an ...

STRONG ORDER BOOKINGS INCREASED MARKET RISK

... In order to strengthen the company’s financial flexibility, the long-term external funding was increased by MSEK 425 and the short-term external funding was increased by MSEK 2 412 during the first half-year 2015. As at 30 June 2015, short-term investments and liquid assets amounted to MSEK 2,754. C ...

... In order to strengthen the company’s financial flexibility, the long-term external funding was increased by MSEK 425 and the short-term external funding was increased by MSEK 2 412 during the first half-year 2015. As at 30 June 2015, short-term investments and liquid assets amounted to MSEK 2,754. C ...

as a PDF - CiteSeerX

... Most literature addressing the structure of corporate ownership compares dispersed ownership (DO) with a controlled structure (CS) in which a large blockholder owns a majority or large plurality of a company’s shares. This paper, by contrast, examines an ownership structure in which a shareholder ex ...

... Most literature addressing the structure of corporate ownership compares dispersed ownership (DO) with a controlled structure (CS) in which a large blockholder owns a majority or large plurality of a company’s shares. This paper, by contrast, examines an ownership structure in which a shareholder ex ...

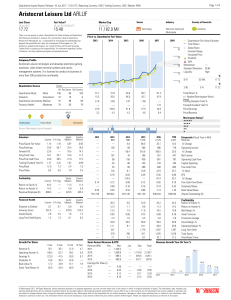

Aristocrat Leisure Ltd ARLUF

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.