Corporate earnings and the equity premium

... (2002, 2003) model the cash flows of individual firms in a way that allows aggregate dividends to differ from aggregate consumption.2 Modeling cash flows separately from aggregate consumption is crucial since corporate cash flows have historically been far more volatile and sensitive to economic shocks ...

... (2002, 2003) model the cash flows of individual firms in a way that allows aggregate dividends to differ from aggregate consumption.2 Modeling cash flows separately from aggregate consumption is crucial since corporate cash flows have historically been far more volatile and sensitive to economic shocks ...

Alternative risk premia investing: from theory to practice

... setting, reproducing the returns offered by trend-following strategies. These strategies are part of the family of alternative risk premia. The case for alternative risk premia Alternative risk premia are distinct from traditional risk premia. While the latter are captured by long-only investment in ...

... setting, reproducing the returns offered by trend-following strategies. These strategies are part of the family of alternative risk premia. The case for alternative risk premia Alternative risk premia are distinct from traditional risk premia. While the latter are captured by long-only investment in ...

DOC 477KB - Board of Taxation

... Prior to the introduction of the debt and equity rules, the distinction between debt and equity under general income tax principles could be said to have mainly manifested in a distinction between the costs of operations that produce assessable income (in particular, the cost of debt), and returns t ...

... Prior to the introduction of the debt and equity rules, the distinction between debt and equity under general income tax principles could be said to have mainly manifested in a distinction between the costs of operations that produce assessable income (in particular, the cost of debt), and returns t ...

Dividend Growth and the Quest for Yield

... NOBL’s total operating expenses are 0.35%. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original ...

... NOBL’s total operating expenses are 0.35%. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original ...

Domestic Saving and International Capital Flows

... generally, since the risks of investing in different countries and currencies are not perfectly correlated, individual and corporate investors will tend to choose a portfolio in which expected yields are not equal. For most investors, the uncertainties and risks associated with foreign investment ar ...

... generally, since the risks of investing in different countries and currencies are not perfectly correlated, individual and corporate investors will tend to choose a portfolio in which expected yields are not equal. For most investors, the uncertainties and risks associated with foreign investment ar ...

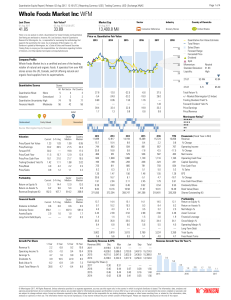

Whole Foods Market Inc WFM

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Ineffi cient Investment Waves - The University of Chicago Booth

... This argument holds because we assume that certain markets are missing. For example, …rms writing contracts ex ante on investment opportunities would insure each other against the gains and losses from ex post trading. Similarly, …rms able to pledge the output of their investment opportunities, woul ...

... This argument holds because we assume that certain markets are missing. For example, …rms writing contracts ex ante on investment opportunities would insure each other against the gains and losses from ex post trading. Similarly, …rms able to pledge the output of their investment opportunities, woul ...

Participating convertible preferred stock in venture capital

... PCP stake.1 Such an ex-post equilibrium can also give the entrepreneur ex ante incentives given that she typically is in control of the venture after a IPO. In contrast, the entrepreneur loses control of her venture after a trade sale. Therefore, provided it occurs when firm value is high, exit via ...

... PCP stake.1 Such an ex-post equilibrium can also give the entrepreneur ex ante incentives given that she typically is in control of the venture after a IPO. In contrast, the entrepreneur loses control of her venture after a trade sale. Therefore, provided it occurs when firm value is high, exit via ...

Corporate Performance and Military Production in

... Brzoska & Lock (1992) and Wulf (1993) provide surveys. The defence industrial sector can be defined as a number of industries that have the economic, as well as the military, characteristics of strategic industries. The economic characteristics of defence companies include: decreasing costs reflecti ...

... Brzoska & Lock (1992) and Wulf (1993) provide surveys. The defence industrial sector can be defined as a number of industries that have the economic, as well as the military, characteristics of strategic industries. The economic characteristics of defence companies include: decreasing costs reflecti ...

KDE Capital Asset Guide

... divided by useful life) must be used for all exhaustible assets. Inexhaustible assets, such as land, are not depreciable. Monthly, straight-line depreciation over the useful life of the asset must be used: starting with the first month of purchase. Depreciation functionality is provided within the M ...

... divided by useful life) must be used for all exhaustible assets. Inexhaustible assets, such as land, are not depreciable. Monthly, straight-line depreciation over the useful life of the asset must be used: starting with the first month of purchase. Depreciation functionality is provided within the M ...

Luxembourg GAAP compared to IFRS: An overview

... beginning 1 January 2013, whereby a qualifying investment fund is required to account for its investments in controlled entities as well as in associates and joint ventures at fair value through profit or loss with the exception of subsidiaries that are considered as an extension to the investment a ...

... beginning 1 January 2013, whereby a qualifying investment fund is required to account for its investments in controlled entities as well as in associates and joint ventures at fair value through profit or loss with the exception of subsidiaries that are considered as an extension to the investment a ...

Product Disclosure Statement

... The Fund is not and will not be registered as an investment company under the U.S. Investment Company Act of 1940. Investment in units of the Fund by or on behalf of U.S. persons is not permitted. Units in the Fund may not at any time be offered, sold, transferred or delivered within the U.S. or to, ...

... The Fund is not and will not be registered as an investment company under the U.S. Investment Company Act of 1940. Investment in units of the Fund by or on behalf of U.S. persons is not permitted. Units in the Fund may not at any time be offered, sold, transferred or delivered within the U.S. or to, ...

1.8 billion.

... KSC Trust was sold in January 2008. Moorebank Industrial Property Trust (“MIPT”) interest was acquired in December 2007. Stockland has significant influence over MIPT, but not control due to Stockland having less than half the voting rights. The Anglo Halladale No. 2 Limited Partnership changed its ...

... KSC Trust was sold in January 2008. Moorebank Industrial Property Trust (“MIPT”) interest was acquired in December 2007. Stockland has significant influence over MIPT, but not control due to Stockland having less than half the voting rights. The Anglo Halladale No. 2 Limited Partnership changed its ...

The role of information asymmetry and financial reporting quality in

... increasing from $8 billion in 1991 to $144.6 billion in 2003 (Loan Pricing Corporation (LPC), 2003). The market expanded in both par and distressed loans; the trading volume of loans traded at par and of distressed loans reached $87 billion and $57 billion in 2003, respectively. Leveraged loans (def ...

... increasing from $8 billion in 1991 to $144.6 billion in 2003 (Loan Pricing Corporation (LPC), 2003). The market expanded in both par and distressed loans; the trading volume of loans traded at par and of distressed loans reached $87 billion and $57 billion in 2003, respectively. Leveraged loans (def ...

Institutional Presence - American Economic Association

... whether this proximity is mutually beneficial for companies located close to institutional investors. This study seeks to fill this gap by examining potential advantages to being located near institutional investors. Consider two large, thriving urban cities for which one has a substantially greater ...

... whether this proximity is mutually beneficial for companies located close to institutional investors. This study seeks to fill this gap by examining potential advantages to being located near institutional investors. Consider two large, thriving urban cities for which one has a substantially greater ...

Journal of Finance and Investment Analysis, vol. 4, no.2, 2015,... ISSN: 2241-0998 (print version), 2241-0996(online)

... other – be explained? One possibility is that naïve diversification strategies are used only in cases of complete uncertainty. However, individuals tend to be uncertainty averse, preferring some information to no information at all. Due among other things to cognitive limits, information capacities ...

... other – be explained? One possibility is that naïve diversification strategies are used only in cases of complete uncertainty. However, individuals tend to be uncertainty averse, preferring some information to no information at all. Due among other things to cognitive limits, information capacities ...

Business Partners: Complementary Assets, Financing, and Invention

... of skills, contacts, and also financing. While we have not found much literature on the performance impacts of the provisions of complementary assets by partners, the provision of early-stage financing by business partners is somewhat documented, as reported below. Obtaining financing is thought by ...

... of skills, contacts, and also financing. While we have not found much literature on the performance impacts of the provisions of complementary assets by partners, the provision of early-stage financing by business partners is somewhat documented, as reported below. Obtaining financing is thought by ...

Towards a framework for calibrating macroprudential leverage limits

... potential financial stability risks stemming from the asset management industry.92 Importantly, the Financial Stability Board (FSB) has recently published its proposed policy recommendations to address structural vulnerabilities from asset management activities.93 Apart from regulatory responses to ...

... potential financial stability risks stemming from the asset management industry.92 Importantly, the Financial Stability Board (FSB) has recently published its proposed policy recommendations to address structural vulnerabilities from asset management activities.93 Apart from regulatory responses to ...

a PDF of the full article

... funds (AIFs), or that provide a third-party portfolio management investment service, but it may also be of use to investment services providers that provide the same service. The examples shown herein are not applicable simultaneously and to all funds/portfolios, but AMCs may be able to use them dep ...

... funds (AIFs), or that provide a third-party portfolio management investment service, but it may also be of use to investment services providers that provide the same service. The examples shown herein are not applicable simultaneously and to all funds/portfolios, but AMCs may be able to use them dep ...

MARKET INFORMATION AND THE ELITE LAW FIRM

... In the age of increasingly sophisticated in-house counsel, what exactly are the benefits that law firms provide to their clients? Among law firms, what does the relative ranking or prestige of a law firm actually reflect? Although these questions are of enormous and urgent practical interest, the sc ...

... In the age of increasingly sophisticated in-house counsel, what exactly are the benefits that law firms provide to their clients? Among law firms, what does the relative ranking or prestige of a law firm actually reflect? Although these questions are of enormous and urgent practical interest, the sc ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.