Heterogeneity and Portfolio Choice: Theory and

... consists of liquid assets (15.8% stocks, 7.6% bonds, and 24.4% cash), housing (41.3%), other real estate (4.8%), and the market value of private businesses (4.2%). Stocks and bonds in various types of accounts (e.g., retirement accounts, mutual funds, and brokerage accounts) are aggregated in these ...

... consists of liquid assets (15.8% stocks, 7.6% bonds, and 24.4% cash), housing (41.3%), other real estate (4.8%), and the market value of private businesses (4.2%). Stocks and bonds in various types of accounts (e.g., retirement accounts, mutual funds, and brokerage accounts) are aggregated in these ...

Spillover Effect of US Quantitative Easing From the

... For decades, the liberalisation of capital markets, as well as the opening of national economies to world market forces, has stimulated the development of a globally integrated economy. One might wonder the impact of such an environment. Over time, the economic realm has shown us that the world was ...

... For decades, the liberalisation of capital markets, as well as the opening of national economies to world market forces, has stimulated the development of a globally integrated economy. One might wonder the impact of such an environment. Over time, the economic realm has shown us that the world was ...

Mutual Fund Age, Performance, and the Optimal Track Record

... relationship between age and performance for actively managed equity mutual funds. This is interesting primarily in the context of investor behavior, as many investors require a multi-year track record before investing in a fund, which could be costly if new funds perform better than established fun ...

... relationship between age and performance for actively managed equity mutual funds. This is interesting primarily in the context of investor behavior, as many investors require a multi-year track record before investing in a fund, which could be costly if new funds perform better than established fun ...

Annual Report - Putnam Investments

... would put this plan on hold until the future rules of trade between the United Kingdom and the European Union become clearer. That process could literally take years to work out. With a range of companies putting investment decisions on hold, overall capital investment in the United Kingdom will lik ...

... would put this plan on hold until the future rules of trade between the United Kingdom and the European Union become clearer. That process could literally take years to work out. With a range of companies putting investment decisions on hold, overall capital investment in the United Kingdom will lik ...

Equity Auctions and the New Value Corollary to the

... bifurcate the undersecured mortgagee’s claim into a secured claim equal in amount to the value of the debtor’s’ property, and an unsecured deficiency claim in an amount equal to the difference between the value of the debtor’s property and the face amount of the mortgagee’s loan. The plan proposed p ...

... bifurcate the undersecured mortgagee’s claim into a secured claim equal in amount to the value of the debtor’s’ property, and an unsecured deficiency claim in an amount equal to the difference between the value of the debtor’s property and the face amount of the mortgagee’s loan. The plan proposed p ...

investment planning

... invest in a range of assets, typically shares, bonds and cash, with the allocation between the different types of assets left to the discretion of the fund manager. The fund manager will aim to build a portfolio with a mix of assets that is consistent with an investor’s identified risk objective. Th ...

... invest in a range of assets, typically shares, bonds and cash, with the allocation between the different types of assets left to the discretion of the fund manager. The fund manager will aim to build a portfolio with a mix of assets that is consistent with an investor’s identified risk objective. Th ...

Proposed Technical Information Paper 2 Depreciated Replacement

... the hypothetical buyer would consider as an alternative to the asset being valued. This then determines whether a replacement cost or a reproduction cost should be used in estimating the cost of the alternative asset. In this TIP these terms have the following meanings: Replacement cost - The curren ...

... the hypothetical buyer would consider as an alternative to the asset being valued. This then determines whether a replacement cost or a reproduction cost should be used in estimating the cost of the alternative asset. In this TIP these terms have the following meanings: Replacement cost - The curren ...

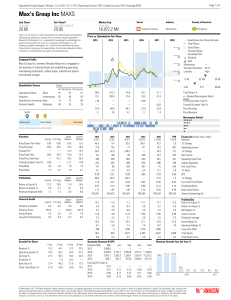

Max`s Group Inc MAXS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Asian Journal of Business Management 5(1): 60-76, 2013

... Abstract: This study looked at the profitability of the Telecommunications industry in Ghana from 2002 to 2006. This objective was accomplished by finding the correlation between any two of profitability non-ratio parameters such as NP, EBIT and so on and the correlation between any two of profitabi ...

... Abstract: This study looked at the profitability of the Telecommunications industry in Ghana from 2002 to 2006. This objective was accomplished by finding the correlation between any two of profitability non-ratio parameters such as NP, EBIT and so on and the correlation between any two of profitabi ...

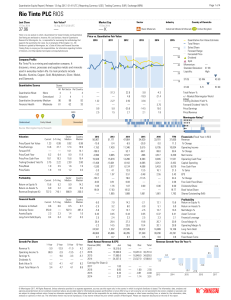

Rio Tinto PLC RIOS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

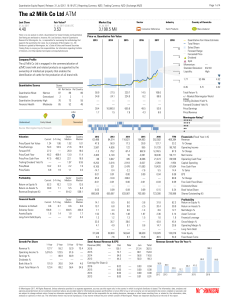

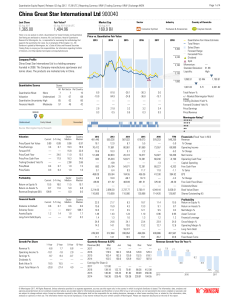

China Great Star International Ltd 900040

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

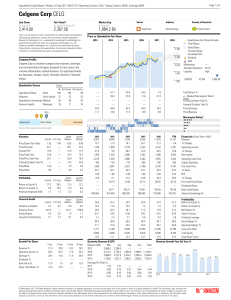

Celgene Corp CELG

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

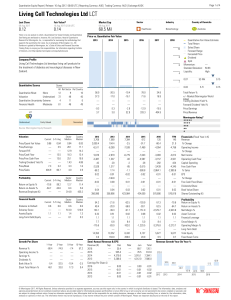

Living Cell Technologies Ltd LCT

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

the relationship between transaction costs of external financing and

... Myers and Majluf (1984), Alli et al. argued that companies experiencing high growth rates should be characterised by low dividend payout ratios since they generally have large investment requirements. They examined this relationship by including expected capital expenditure (EXCAP) and growth (GROWT ...

... Myers and Majluf (1984), Alli et al. argued that companies experiencing high growth rates should be characterised by low dividend payout ratios since they generally have large investment requirements. They examined this relationship by including expected capital expenditure (EXCAP) and growth (GROWT ...

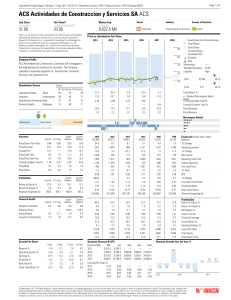

ACS Actividades de Construccion y Servicios SA ACS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

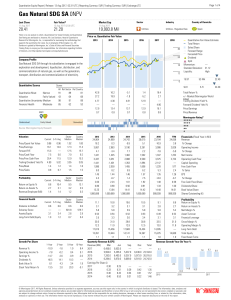

Gas Natural SDG SA 0NPV

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Offering and Investor Fees - Handout

... Administration fees are non-contingent fees generally used by the issuer to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, covering the cost of a wire ...

... Administration fees are non-contingent fees generally used by the issuer to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, covering the cost of a wire ...

Important Information about Certificates of Deposit

... Interest-bearing CDs with a maturity of more than one year will not be issued with original issue discount. In addition to interest reportable on your method of accounting (cash or accrual, as the case may be), an interestbearing CD with a maturity of more than one year that is purchased after the d ...

... Interest-bearing CDs with a maturity of more than one year will not be issued with original issue discount. In addition to interest reportable on your method of accounting (cash or accrual, as the case may be), an interestbearing CD with a maturity of more than one year that is purchased after the d ...

Annual Results Presentation 2016

... average closing FCG share price ($5.50) across the year; 3. Includes sales to other strategic platforms ...

... average closing FCG share price ($5.50) across the year; 3. Includes sales to other strategic platforms ...

policy for nonprofit endowment funds

... The East Texas Communities Foundation ("Foundation") encourages donors to create Nonprofit Endowment Funds for support of the charitable purposes of various nonprofit organizations ("Nonprofits"). However, in order to protect its status as a public charity and the corresponding tax deductions of its ...

... The East Texas Communities Foundation ("Foundation") encourages donors to create Nonprofit Endowment Funds for support of the charitable purposes of various nonprofit organizations ("Nonprofits"). However, in order to protect its status as a public charity and the corresponding tax deductions of its ...

Understanding Privet Placement Trading Platforms

... lead to a flood of inexperienced brokers and want to be brokers into the market. When you combine the recent increase in participation, with private nature of these programs, it can be like swimming in shark infested waters if you are not properly informed. It can sometimes take years of going throu ...

... lead to a flood of inexperienced brokers and want to be brokers into the market. When you combine the recent increase in participation, with private nature of these programs, it can be like swimming in shark infested waters if you are not properly informed. It can sometimes take years of going throu ...

Estimating Firm Value

... The betas for all of the firms are adjusted down toward one. For Amazon, the average beta of stable specialty retailers (1.10) is used as the stable period beta. For Cisco and Motorola, you moved the beta to the average for the market since the sectors to which they belong are still in high growth a ...

... The betas for all of the firms are adjusted down toward one. For Amazon, the average beta of stable specialty retailers (1.10) is used as the stable period beta. For Cisco and Motorola, you moved the beta to the average for the market since the sectors to which they belong are still in high growth a ...

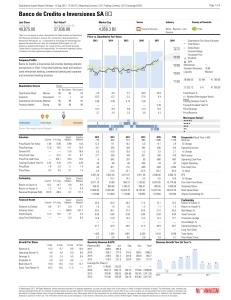

Banco de Credito e Inversiones SA BCI

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.