MARKET INFORMATION AND THE ELITE LAW FIRM

... In the age of increasingly sophisticated in-house counsel, what exactly are the benefits that law firms provide to their clients? Among law firms, what does the relative ranking or prestige of a law firm actually reflect? Although these questions are of enormous and urgent practical interest, the sc ...

... In the age of increasingly sophisticated in-house counsel, what exactly are the benefits that law firms provide to their clients? Among law firms, what does the relative ranking or prestige of a law firm actually reflect? Although these questions are of enormous and urgent practical interest, the sc ...

volatility as an asset class

... Volatility has become a key word of the recent financial crisis with realised volatilities of asset prices soaring and volatilities implied by option prices as measured by volatilities indices such as the EURO STOXX 50 Volatility Index (VSTOXX), VDAX or VSMI reaching unprecedented levels, reflecting ...

... Volatility has become a key word of the recent financial crisis with realised volatilities of asset prices soaring and volatilities implied by option prices as measured by volatilities indices such as the EURO STOXX 50 Volatility Index (VSTOXX), VDAX or VSMI reaching unprecedented levels, reflecting ...

Corporate Bond Trading on a Limit Order Book Exchange by

... bonds – $161 billion, ETNs (Exchange Traded Notes – substitutes for ETFs) – $26 billion.11 In addition, various types of options (on indices, stocks and exchange rates) are traded on the exchange. The participants in the Israeli market are quite similar to those in other developed markets. The main ...

... bonds – $161 billion, ETNs (Exchange Traded Notes – substitutes for ETFs) – $26 billion.11 In addition, various types of options (on indices, stocks and exchange rates) are traded on the exchange. The participants in the Israeli market are quite similar to those in other developed markets. The main ...

Medicaid and the Housing and Asset Decisions of the

... • After ERP – Face same asset and income requirements – House still not used to determine eligibility – At death, house eligible for recovery and cannot be bequeathed – Incentives to use trusts as substitute asset shelter • Put house into living trust ...

... • After ERP – Face same asset and income requirements – House still not used to determine eligibility – At death, house eligible for recovery and cannot be bequeathed – Incentives to use trusts as substitute asset shelter • Put house into living trust ...

DOES SHAREHOLDER COMPOSITION AFFECT STOCK RETURNS?

... investment style, whether they follow momentum trading strategies, and by their portfolio turnover. We find there is considerable heterogeneity in institutional investors' response to new information. When firms report earnings below analysts' expectations, the stock price response is more negative ...

... investment style, whether they follow momentum trading strategies, and by their portfolio turnover. We find there is considerable heterogeneity in institutional investors' response to new information. When firms report earnings below analysts' expectations, the stock price response is more negative ...

Can Decentralized Markets be More Efficient?

... consistent with how Duffie (2012, p.2) describes the typical negotiation process in OTC markets and the notion that each OTC dealer tries to maintain “a reputation for standing firm on its original quotes.” In the centralized market, these ultimatum price quotes can be interpreted as limit orders th ...

... consistent with how Duffie (2012, p.2) describes the typical negotiation process in OTC markets and the notion that each OTC dealer tries to maintain “a reputation for standing firm on its original quotes.” In the centralized market, these ultimatum price quotes can be interpreted as limit orders th ...

Information on risk, own funds and capital requirements

... The above mentioned criteria are taken into consideration in accordance with profile of the performed function, size of the area they manage, scope and character of the tasks performed in this area. Current practices meet requirements of provisions of law. Article 435.2.c the policy on diversity ...

... The above mentioned criteria are taken into consideration in accordance with profile of the performed function, size of the area they manage, scope and character of the tasks performed in this area. Current practices meet requirements of provisions of law. Article 435.2.c the policy on diversity ...

Capital`s Long March West: Saving and Investment Frictions in

... assess when—and under which conditions—a convergence towards more sustainable patterns would be possible. Over the last decade, the literature disproportionately discussed that issue through the lens of US interests. At the onset of the “Great Rebalancing”, observers and experts increasingly laid th ...

... assess when—and under which conditions—a convergence towards more sustainable patterns would be possible. Over the last decade, the literature disproportionately discussed that issue through the lens of US interests. At the onset of the “Great Rebalancing”, observers and experts increasingly laid th ...

working papers - Berkeley Research Group

... itself contributing to the economy’s weakness. For example, in a recent report Mark Zandi warned that sometimes sentiment can be so harmed that businesses, consumers and investors freeze up, turning a gloomy outlook into a self-fulfilling prophecy. This is one of those times.”2 It is likely that the ...

... itself contributing to the economy’s weakness. For example, in a recent report Mark Zandi warned that sometimes sentiment can be so harmed that businesses, consumers and investors freeze up, turning a gloomy outlook into a self-fulfilling prophecy. This is one of those times.”2 It is likely that the ...

Basics and Problems - Ace MBAe Finance Specialization

... These results indicate that Walgreens currently collects its accounts receivable in about 10 days on average, and this collection period has increased slightly over the recent five years. To determine whether these receivable collection numbers are good or bad, it is essential that they be related ...

... These results indicate that Walgreens currently collects its accounts receivable in about 10 days on average, and this collection period has increased slightly over the recent five years. To determine whether these receivable collection numbers are good or bad, it is essential that they be related ...

Investment consultants` recommendations of fund managers

... investment consultant. 23% of respondents rated investment consultants as “crucial” to the operation and success of their plans, with a further 40% (26%) rating consultants as very important (somewhat important). Only 4% of respondents considered consultants to be “not important”. As noted earlier, ...

... investment consultant. 23% of respondents rated investment consultants as “crucial” to the operation and success of their plans, with a further 40% (26%) rating consultants as very important (somewhat important). Only 4% of respondents considered consultants to be “not important”. As noted earlier, ...

METLIFE INC (Form: 8-K, Received: 05/21/2013 06

... expectations or forecasts of future events and use words such as “anticipate”, “estimate,” “expect,” “project” and other terms of similar meaning. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward ...

... expectations or forecasts of future events and use words such as “anticipate”, “estimate,” “expect,” “project” and other terms of similar meaning. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward ...

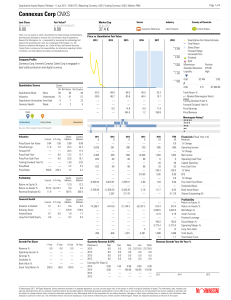

Connexus Corp CNXS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Chapter 11

... a return of 7 percent. It was financed by debt costing 6 percent. In August, Mr. Rambo came up with an “entire bug colony destroying” device that had a return of 12 percent. The Chief Financial Officer, Mr. Roach, told him it was impractical because it would require the issuance of common stock at a ...

... a return of 7 percent. It was financed by debt costing 6 percent. In August, Mr. Rambo came up with an “entire bug colony destroying” device that had a return of 12 percent. The Chief Financial Officer, Mr. Roach, told him it was impractical because it would require the issuance of common stock at a ...

#32842_30_Mutual Fund Regulation_P1 1..72

... market fund to (i) determine the fair value of short-term debt securities for which market quotations were not readily available by reference generally to current market factors, and (ii) calculate its price per share to an accuracy of within 0.10% (that is, $0.01 based on a share price of $10). The ...

... market fund to (i) determine the fair value of short-term debt securities for which market quotations were not readily available by reference generally to current market factors, and (ii) calculate its price per share to an accuracy of within 0.10% (that is, $0.01 based on a share price of $10). The ...

Does Financial Distress Risk Drive the Momentum Anomaly?

... Alternative Investment Market (AIM), third market, or over-the-counter. Additionally, a firm that is classified under Financials or Mining Finance by the London Stock Exchange during any month is also excluded for that month. ...

... Alternative Investment Market (AIM), third market, or over-the-counter. Additionally, a firm that is classified under Financials or Mining Finance by the London Stock Exchange during any month is also excluded for that month. ...

clear invest

... range of assets increases the diversification of each Multi Asset Portfolio Fund. We recommend that you diversify your investment by not putting all your ‘eggs in one basket’ and these funds allow you to do just that. Greater diversification also aims to reduce the volatility of the fund, which is a ...

... range of assets increases the diversification of each Multi Asset Portfolio Fund. We recommend that you diversify your investment by not putting all your ‘eggs in one basket’ and these funds allow you to do just that. Greater diversification also aims to reduce the volatility of the fund, which is a ...

Estimating the country risk premium in emerging markets: the case

... considered to be free from the risk of default. The beta of a security measures the sensitivity of the returns on the security to changes in systematic factors. The market risk premium is the excess return of the market as a whole, over the riskfree rate. As Watson and Head (2007) note, in the CAPM ...

... considered to be free from the risk of default. The beta of a security measures the sensitivity of the returns on the security to changes in systematic factors. The market risk premium is the excess return of the market as a whole, over the riskfree rate. As Watson and Head (2007) note, in the CAPM ...

Liquidity Pricing of Illiquid Assets

... to transact from the buy side, finds that time to transact is time varying and that transactions were conducted more rapidly during the boom phase of the UK real estate cycle. The nature of real estate markets (heterogeneous assets with limited numbers of buyers and sellers operating under various e ...

... to transact from the buy side, finds that time to transact is time varying and that transactions were conducted more rapidly during the boom phase of the UK real estate cycle. The nature of real estate markets (heterogeneous assets with limited numbers of buyers and sellers operating under various e ...

Document

... 3. There is no reliable evidence that risk-targeted portfolios suffer a drag on returns from selling ‘after the horse has bolted.’ Evidence of the risk benefits, on the other hand, is pervasive. ...

... 3. There is no reliable evidence that risk-targeted portfolios suffer a drag on returns from selling ‘after the horse has bolted.’ Evidence of the risk benefits, on the other hand, is pervasive. ...

Liquidity article - Zebra Capital Management

... for which the investors should be compensated, resulting in lower valuation for a lowvolume stock. However, in another study, Lee and Swaminathan (1998) show that the liquidity hypothesis is not totally consistent with their evidence. They study the joint interaction between past stock price momentu ...

... for which the investors should be compensated, resulting in lower valuation for a lowvolume stock. However, in another study, Lee and Swaminathan (1998) show that the liquidity hypothesis is not totally consistent with their evidence. They study the joint interaction between past stock price momentu ...

smart beta in the limelight

... underperformance. This has led to an interest in understanding the merits of employing multiple factor strategies. In this paper, we present research focused on factor portfolios invested in global equities, and make four key points. The first point is that factor investing continues to gain momentu ...

... underperformance. This has led to an interest in understanding the merits of employing multiple factor strategies. In this paper, we present research focused on factor portfolios invested in global equities, and make four key points. The first point is that factor investing continues to gain momentu ...

The Leverage Rotation Strategy

... time as well as volatility regimes under which leverage is more or less beneficial. As such, one can combine these two concepts to create a strategy that employs the use of leverage only during periods which have a higher probability of success. In doing so, one can achieve higher returns with less ...

... time as well as volatility regimes under which leverage is more or less beneficial. As such, one can combine these two concepts to create a strategy that employs the use of leverage only during periods which have a higher probability of success. In doing so, one can achieve higher returns with less ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.