Calculator Output

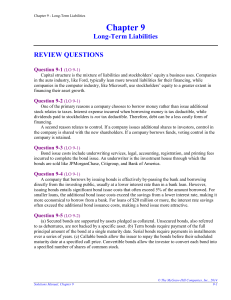

... in the auto industry, like Ford, typically lean more toward liabilities for their financing, while companies in the computer industry, like Microsoft, use stockholders’ equity to a greater extent in financing their asset growth. ...

... in the auto industry, like Ford, typically lean more toward liabilities for their financing, while companies in the computer industry, like Microsoft, use stockholders’ equity to a greater extent in financing their asset growth. ...

Why Does the Law of One Price Fail?

... mutual funds charge fees, showed how to calculate the impact of loads and expense ratios on portfolio value, and listed the expense ratio, load, and dollar cost of the expense ratio and load for a one-year $10,000 investment in each of the four funds participants could select. All of the fee sheet i ...

... mutual funds charge fees, showed how to calculate the impact of loads and expense ratios on portfolio value, and listed the expense ratio, load, and dollar cost of the expense ratio and load for a one-year $10,000 investment in each of the four funds participants could select. All of the fee sheet i ...

Beyond their Borders Evolution of foreign investment by

... retiring today than there were even a decade ago and their numbers will continue to increase in the coming years. This is putting pressure on pension funds’ investment strategies and calling into question their risk estimations. Moreover, the current economic scenario is characterised by low interes ...

... retiring today than there were even a decade ago and their numbers will continue to increase in the coming years. This is putting pressure on pension funds’ investment strategies and calling into question their risk estimations. Moreover, the current economic scenario is characterised by low interes ...

Comprehensive Annual Financial Report

... California) insulated us from some of the large challenges that other cities endured during the economic downturn, but it also slows our growth that aids in economic recovery. Increased housing values over the last year have had a positive impact on stabilizing the assessed values of properties with ...

... California) insulated us from some of the large challenges that other cities endured during the economic downturn, but it also slows our growth that aids in economic recovery. Increased housing values over the last year have had a positive impact on stabilizing the assessed values of properties with ...

Presentación de PowerPoint

... invitation to sell, exchange or buy, and it is not binding on the issuer in any way. The information about the plans of the Company, its evolution, its results and its dividends represents a simple forecast whose formulation does not represent a guarantee with respect to the future performance of th ...

... invitation to sell, exchange or buy, and it is not binding on the issuer in any way. The information about the plans of the Company, its evolution, its results and its dividends represents a simple forecast whose formulation does not represent a guarantee with respect to the future performance of th ...

Annual Report - Pershing Square Capital Management

... The turbulence experienced by the Company in the second half of 2015 continued into early 2016. Although the valuations of our portfolio companies have all been affected to a greater or lesser extent by the volatility in stock markets, movements in exchange rates, energy costs, and changes in the po ...

... The turbulence experienced by the Company in the second half of 2015 continued into early 2016. Although the valuations of our portfolio companies have all been affected to a greater or lesser extent by the volatility in stock markets, movements in exchange rates, energy costs, and changes in the po ...

S0110843_en.pdf

... Figure 1 Net official financial flows to developing countries........................................................... 8 Figure 2 Net official financial flows to Caribbean countries ............................................................ 8 Figure 3 Total net financial flows to Caribbean (US$ ...

... Figure 1 Net official financial flows to developing countries........................................................... 8 Figure 2 Net official financial flows to Caribbean countries ............................................................ 8 Figure 3 Total net financial flows to Caribbean (US$ ...

STUDY ON MERGERS: A RATIONALE FOR CONGLOMERATE MERGERS by NICOLAS S. MAJLUF Engineering, Universidad Catolica de Chile

... be sure, there is disagreement on details such as how large is a leading company, who is a genuine competitor, what is the relevant market, etc., but these are matters of detail, not of basic principle. (Steiner [87], p. 51). This view is reinforced with the 1968 dictation of merger guidelines by th ...

... be sure, there is disagreement on details such as how large is a leading company, who is a genuine competitor, what is the relevant market, etc., but these are matters of detail, not of basic principle. (Steiner [87], p. 51). This view is reinforced with the 1968 dictation of merger guidelines by th ...

Individual investment behaviour: a brief review of research (PDF

... There seems to be very little data about whether or not people make sensible choices when switching funds. One study in Australia highlighted problems with the advice provided to superannuation scheme members around fund switching, which involved advice to switch to higher fee funds with no counterv ...

... There seems to be very little data about whether or not people make sensible choices when switching funds. One study in Australia highlighted problems with the advice provided to superannuation scheme members around fund switching, which involved advice to switch to higher fee funds with no counterv ...

Decomposition of technical reserves of pension funds in price

... Insurance technical reserves have attracted much attention recently. It is at the heart of pension fund management and forms the basis of current and future benefits of millions of people. As technical reserves2 have been rising during the last years in the Netherlands (Chart 1), one may wonder whic ...

... Insurance technical reserves have attracted much attention recently. It is at the heart of pension fund management and forms the basis of current and future benefits of millions of people. As technical reserves2 have been rising during the last years in the Netherlands (Chart 1), one may wonder whic ...

The Information Content of the NCREIF Index

... impacted by infrequent appraisals, are often labeled as smoothed, and hence, do not update information as quickly. Recent studies of NCREIF, for example, attempt to refine the measurement of return indexes, and interpret the significance of various measures.2 The relation between the unsecuritized a ...

... impacted by infrequent appraisals, are often labeled as smoothed, and hence, do not update information as quickly. Recent studies of NCREIF, for example, attempt to refine the measurement of return indexes, and interpret the significance of various measures.2 The relation between the unsecuritized a ...

CAM Government Securities Investment Fund ANNUAL REPORT

... investment funds that we plan to launch in the future, we believe Capital Asset Management cjsc can offer local and foreign investors a strong alternative to bank deposits and other traditional investment instruments. Investment funds are available to institutional as well as retail clients and may ...

... investment funds that we plan to launch in the future, we believe Capital Asset Management cjsc can offer local and foreign investors a strong alternative to bank deposits and other traditional investment instruments. Investment funds are available to institutional as well as retail clients and may ...

Asset correlations and credit portfolio risk

... We first find substantial time variation in asset correlations both for the market model and the sector model. This suggests that asset correlation estimates should be regularly validated. For example, the median inferred asset correlation in the market model ranges from 4% to 16% during our sample pe ...

... We first find substantial time variation in asset correlations both for the market model and the sector model. This suggests that asset correlation estimates should be regularly validated. For example, the median inferred asset correlation in the market model ranges from 4% to 16% during our sample pe ...

The performance of hedge funds and mutual funds in

... an investment focus in emerging markets. Most studies only consider either hedge funds or mutual funds; we analyze both investment vehicles active in this growing market.6 Our analysis builds upon the Center for International Securities and Derivatives Markets (CISDM) database, which is one of the l ...

... an investment focus in emerging markets. Most studies only consider either hedge funds or mutual funds; we analyze both investment vehicles active in this growing market.6 Our analysis builds upon the Center for International Securities and Derivatives Markets (CISDM) database, which is one of the l ...

Fair Value Measurements and Disclosures (Topic 820)

... values as defined in the Master Glossary of the FASB Accounting Standards Codification™ (because, for example, those investments are not listed on national exchanges or over-the-counter markets such as the National Association of Securities Dealers Automated Quotation System). Examples of these inve ...

... values as defined in the Master Glossary of the FASB Accounting Standards Codification™ (because, for example, those investments are not listed on national exchanges or over-the-counter markets such as the National Association of Securities Dealers Automated Quotation System). Examples of these inve ...

GLOBAL INSIGHT

... In the U.S., RBC Wealth Management operates as a division of RBC Capital Markets, LLC. In Canada, RBC Wealth Management includes, without limitation, RBC Dominion Securities Inc., which is a foreign affiliate of RBC Capital Markets, LLC. This report has been prepared by RBC Capital Markets, LLC whic ...

... In the U.S., RBC Wealth Management operates as a division of RBC Capital Markets, LLC. In Canada, RBC Wealth Management includes, without limitation, RBC Dominion Securities Inc., which is a foreign affiliate of RBC Capital Markets, LLC. This report has been prepared by RBC Capital Markets, LLC whic ...

Morningstar and Barron`s 2014-2015 Alternative Investment Survey

... Multistrategy funds a top pick for both advisors and institutions. g Multistrategy funds were listed as a top current allocation, as well as a top strategy for future allocations, by both advisors and institutions. Multistrategy funds allow advisors to effectively outsource much of the responsibilit ...

... Multistrategy funds a top pick for both advisors and institutions. g Multistrategy funds were listed as a top current allocation, as well as a top strategy for future allocations, by both advisors and institutions. Multistrategy funds allow advisors to effectively outsource much of the responsibilit ...

Agarwal Daniel Naik

... Flows, Performance, and Managerial Incentives in the Hedge Fund Industry In recent years, the hedge fund industry has emerged as an alternative investment vehicle to the traditional mutual fund industry. It differs from the mutual fund industry in two important ways. First, hedge funds are much les ...

... Flows, Performance, and Managerial Incentives in the Hedge Fund Industry In recent years, the hedge fund industry has emerged as an alternative investment vehicle to the traditional mutual fund industry. It differs from the mutual fund industry in two important ways. First, hedge funds are much les ...

International Financial Reporting Standard 13 Fair Value

... Fair value is a market-based measurement, not an entity-specific measurement. For some assets and liabilities, observable market transactions or market information might be available. For other assets and liabilities, observable market transactions and market information might not be available. Howe ...

... Fair value is a market-based measurement, not an entity-specific measurement. For some assets and liabilities, observable market transactions or market information might be available. For other assets and liabilities, observable market transactions and market information might not be available. Howe ...

NBER WORKING PAPER SERIES THE MARGINAL PRODUCT OF CAPITAL Francesco Caselli James Feyrer

... will vary substantially from country to country. In the latter case, the world foregoes an opportunity to increase global GDP by reallocating capital from low to high M P K countries. The policy implications are far reaching. Given the enormous cross-country differences in observed capital-labor rat ...

... will vary substantially from country to country. In the latter case, the world foregoes an opportunity to increase global GDP by reallocating capital from low to high M P K countries. The policy implications are far reaching. Given the enormous cross-country differences in observed capital-labor rat ...

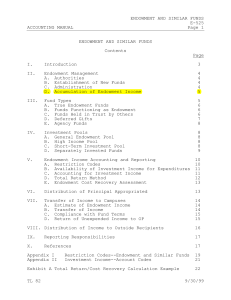

Endowment and Similar Funds

... campus at which such funds are to be used. The Gifts and Bequests Review Committee is authorized to allocate and reallocate gifts and bequests a) in accordance with terms specified by the donor, to designate the purpose for which, and the location at which the income/or principal shall be used; and ...

... campus at which such funds are to be used. The Gifts and Bequests Review Committee is authorized to allocate and reallocate gifts and bequests a) in accordance with terms specified by the donor, to designate the purpose for which, and the location at which the income/or principal shall be used; and ...

uba capital plc - The Nigerian Stock Exchange

... in an orderly transaction in the principal (or most advantageous) market at the measurement date under current market conditions. Fair value under IFRS 13 is an exit price regardless of whether that price is directly observable or estimated using another valuation technique. Also, IFRS 13 includes e ...

... in an orderly transaction in the principal (or most advantageous) market at the measurement date under current market conditions. Fair value under IFRS 13 is an exit price regardless of whether that price is directly observable or estimated using another valuation technique. Also, IFRS 13 includes e ...

Systemic Risk in Hedge Funds

... information concerning their asset holding. Hence, hedge funds attract different types of investors. According to Liang (1998), hedge funds are either limited partnerships with no more than 500 investors [within the U.S.] or offshore corporations [outside the U.S.]. This regulatory oversight gives h ...

... information concerning their asset holding. Hence, hedge funds attract different types of investors. According to Liang (1998), hedge funds are either limited partnerships with no more than 500 investors [within the U.S.] or offshore corporations [outside the U.S.]. This regulatory oversight gives h ...

Vanguard Windsor Funds Statement of Additional Information

... cases, be able to cure such failure, including by paying a fund-level tax, paying interest, making additional distributions, or disposing of certain assets. If the Fund is ineligible to or otherwise does not cure such failure for any year, it will be subject to tax on its taxable income at corporate ...

... cases, be able to cure such failure, including by paying a fund-level tax, paying interest, making additional distributions, or disposing of certain assets. If the Fund is ineligible to or otherwise does not cure such failure for any year, it will be subject to tax on its taxable income at corporate ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.