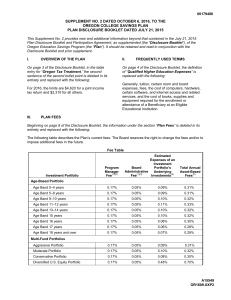

Disclosure Booklet - Oregon College Savings Plan

... Changes in interest rates can change the price of fixed-income investments. In general, changing interest rates could have unpredictable effects on the markets and may expose fixed-income and related markets to heightened volatility. The risk is heightened to the extent a mutual fund invests in long ...

... Changes in interest rates can change the price of fixed-income investments. In general, changing interest rates could have unpredictable effects on the markets and may expose fixed-income and related markets to heightened volatility. The risk is heightened to the extent a mutual fund invests in long ...

DHFL Pramerica Large Cap Fund

... higher than in May (5.76%). Most of the upward pressure came again from food inflation. Food inflation continued its upward journey printing at 7.4% as against 7.2% and 6.3% in the preceding two months, respectively. Core inflation offered some solace recording almost a 20 bps decline to 4.5% as com ...

... higher than in May (5.76%). Most of the upward pressure came again from food inflation. Food inflation continued its upward journey printing at 7.4% as against 7.2% and 6.3% in the preceding two months, respectively. Core inflation offered some solace recording almost a 20 bps decline to 4.5% as com ...

fao investment centre

... useful insights into performance to date, the relatively short period of existence of ...

... useful insights into performance to date, the relatively short period of existence of ...

Do Private Firms Perform Better than Public Firms?

... We note the earlier contribution by Ke, Petroni, and Safieddine (1999), who use a very small sample of public and private insurance companies to show that operating profitability of public and private firms are not significantly different from each other. 4 Bharath and Ditmar (2010) argue that finan ...

... We note the earlier contribution by Ke, Petroni, and Safieddine (1999), who use a very small sample of public and private insurance companies to show that operating profitability of public and private firms are not significantly different from each other. 4 Bharath and Ditmar (2010) argue that finan ...

Does Corporate Governance Affect Firm Value? Evidence from Korea

... for 540 companies based primarily on responses to a survey of listed companies conducted by the Korea Stock Exchange in Spring 2001. We find that a moderate improvement in corporate governance, say an increase of 10 points in the corporate governance index, predicts an increase in Tobin’s q of 15 pe ...

... for 540 companies based primarily on responses to a survey of listed companies conducted by the Korea Stock Exchange in Spring 2001. We find that a moderate improvement in corporate governance, say an increase of 10 points in the corporate governance index, predicts an increase in Tobin’s q of 15 pe ...

What are the relevant factors and risk characteristics that determined

... market, property type allocation is the most effective allocation strategy. The result of the pure factors is in most cases very different for the direct market when compared to the indirect market. We conclude that most differences are caused by the actual platform on which the assets are traded. I ...

... market, property type allocation is the most effective allocation strategy. The result of the pure factors is in most cases very different for the direct market when compared to the indirect market. We conclude that most differences are caused by the actual platform on which the assets are traded. I ...

FinancingPatterns Aug2004-revisions - Research portal

... in seven developed countries and find that variables which are commonly used to explain financial structure in the U.S. are also correlated with leverage in their sample of international firms. Booth, Aivazian, Demirguc-Kunt and Maksimovic (2001) consider financing choices in a sample of ten develo ...

... in seven developed countries and find that variables which are commonly used to explain financial structure in the U.S. are also correlated with leverage in their sample of international firms. Booth, Aivazian, Demirguc-Kunt and Maksimovic (2001) consider financing choices in a sample of ten develo ...

del09 Arndt new 9998297 en

... and cannot enter foreign markets because they make a bad productivity draw. In reality, firms that are small are also particularly disadvantaged on capital markets due to information asymmetries. Hence, they face an additional barrier to going international. Our data support this finding and suggest ...

... and cannot enter foreign markets because they make a bad productivity draw. In reality, firms that are small are also particularly disadvantaged on capital markets due to information asymmetries. Hence, they face an additional barrier to going international. Our data support this finding and suggest ...

IFRS 9 Financial Instruments

... accounting for financial instruments. The need for such guidance is crucial as financial instruments are a large part of the assets and liabilities of many companies, especially financial institutions. The standards require companies to disclose their exposure to financial instruments and to account ...

... accounting for financial instruments. The need for such guidance is crucial as financial instruments are a large part of the assets and liabilities of many companies, especially financial institutions. The standards require companies to disclose their exposure to financial instruments and to account ...

Homeownership 2.0 - Chicago Unbound

... many of the household's eggs in one basket not only runs counter to basic principles of portfolio diversification, but also motivates potentially costly basket-guarding behaviors.1 2 Moreover, households that lack the financial wherewithal or risk tolerance to take on such a large investment simply ...

... many of the household's eggs in one basket not only runs counter to basic principles of portfolio diversification, but also motivates potentially costly basket-guarding behaviors.1 2 Moreover, households that lack the financial wherewithal or risk tolerance to take on such a large investment simply ...

The Cost of Financial Frictions for Life Insurers

... for those companies that suffered larger balance sheet shocks (i.e., lower asset growth, higher leverage, and larger deficit in risk-based capital). This extraordinary pricing behavior coincided with two unusual circumstances. First, the financial crisis had an adverse impact on insurance companies’ ba ...

... for those companies that suffered larger balance sheet shocks (i.e., lower asset growth, higher leverage, and larger deficit in risk-based capital). This extraordinary pricing behavior coincided with two unusual circumstances. First, the financial crisis had an adverse impact on insurance companies’ ba ...

Thesis - Kyiv School of Economics

... economies. However, for developing countries distance was important in most of the cases. The capital flows were divided into three broad categories: government bonds, corporate bonds and corporate equities. For all of the capital categories market interest rate volatility as well as inflation vola ...

... economies. However, for developing countries distance was important in most of the cases. The capital flows were divided into three broad categories: government bonds, corporate bonds and corporate equities. For all of the capital categories market interest rate volatility as well as inflation vola ...

Capital gains tax: historical trends and forecasting

... Individuals appear to be highly reluctant to realise losses, however, for both shares and real estate, where the realisation rates are around 4 and 2 per cent respectively. This is in marked contrast to companies and superannuation funds (see below). Individuals tend to wait until an asset is in a g ...

... Individuals appear to be highly reluctant to realise losses, however, for both shares and real estate, where the realisation rates are around 4 and 2 per cent respectively. This is in marked contrast to companies and superannuation funds (see below). Individuals tend to wait until an asset is in a g ...

Good Practices on Reducing Reliance on CRAs in Asset

... Credit rating agencies (CRAs) play a prominent role in the global financial markets. CRAs provide external credit ratings of individual financial instruments and issuers that express a view on the instrument or entity’s overall creditworthiness (hereafter “credit ratings”) 1. The role of CRAs has co ...

... Credit rating agencies (CRAs) play a prominent role in the global financial markets. CRAs provide external credit ratings of individual financial instruments and issuers that express a view on the instrument or entity’s overall creditworthiness (hereafter “credit ratings”) 1. The role of CRAs has co ...

NBER WORKING PAPER SERIES ASSET LIQUIDITY AND INTERNATIONAL PORTFOLIO CHOICE Athanasios Geromichalos

... price. To the best of our knowledge, this is the first paper in which assets, other than fiat money, are endowed with liquidity properties, thus allowing us to bring the money-search literature closer to questions related to international portfolio diversification. It should be pointed out that in W ...

... price. To the best of our knowledge, this is the first paper in which assets, other than fiat money, are endowed with liquidity properties, thus allowing us to bring the money-search literature closer to questions related to international portfolio diversification. It should be pointed out that in W ...

Two Essays on Adverse Selection in Annuity Markets

... will want to borrow in the last years of their lives. However, as by doing so they would reveal their health status and be forced to pay a much higher rate, they will instead impose a voluntary credit constraint on themselves. Our conclusion that a pooling equilibrium will prevail in the annuity mar ...

... will want to borrow in the last years of their lives. However, as by doing so they would reveal their health status and be forced to pay a much higher rate, they will instead impose a voluntary credit constraint on themselves. Our conclusion that a pooling equilibrium will prevail in the annuity mar ...

Capital gains tax - Treasury Research Institute

... Individuals appear to be highly reluctant to realise losses, however, for both shares and real estate, where the realisation rates are around 4 and 2 per cent respectively. This is in marked contrast to companies and superannuation funds (see below). Individuals tend to wait until an asset is in a g ...

... Individuals appear to be highly reluctant to realise losses, however, for both shares and real estate, where the realisation rates are around 4 and 2 per cent respectively. This is in marked contrast to companies and superannuation funds (see below). Individuals tend to wait until an asset is in a g ...

Chapter 6.

... be associated with a lasting relationship. As well as funds, direct investors may supply additional contributions such as know-how, technology, management, and marketing. Furthermore, enterprises in a direct investment relationship are more likely to trade with and finance each other. 6.5 In contras ...

... be associated with a lasting relationship. As well as funds, direct investors may supply additional contributions such as know-how, technology, management, and marketing. Furthermore, enterprises in a direct investment relationship are more likely to trade with and finance each other. 6.5 In contras ...

Improving international access to credit markets report

... us to highlight precisely which credit markets within each of the world’s regions are currently ...

... us to highlight precisely which credit markets within each of the world’s regions are currently ...

Evaluating the Riskiness of Initial Public Offerings: 1980-2000

... is inherently fraught with danger. This paper asks the question, Have IPOs indeed become more perilous to the investing public over time? I employ two approaches to investigate the post-issue riskiness of IPOs for the 1980-2000 period. First, I compare the stock price volatility for issuing and noni ...

... is inherently fraught with danger. This paper asks the question, Have IPOs indeed become more perilous to the investing public over time? I employ two approaches to investigate the post-issue riskiness of IPOs for the 1980-2000 period. First, I compare the stock price volatility for issuing and noni ...

Client Investing Guide

... Our discretionary investment services are suitable for both inexperienced investors who want to access a sophisticated investment management service and sophisticated investors who do not wish to manage their own investments. Our typical clients are private individuals, trusts, charities and pension ...

... Our discretionary investment services are suitable for both inexperienced investors who want to access a sophisticated investment management service and sophisticated investors who do not wish to manage their own investments. Our typical clients are private individuals, trusts, charities and pension ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.