Liquidity article - Zebra Capital Management

... for which the investors should be compensated, resulting in lower valuation for a lowvolume stock. However, in another study, Lee and Swaminathan (1998) show that the liquidity hypothesis is not totally consistent with their evidence. They study the joint interaction between past stock price momentu ...

... for which the investors should be compensated, resulting in lower valuation for a lowvolume stock. However, in another study, Lee and Swaminathan (1998) show that the liquidity hypothesis is not totally consistent with their evidence. They study the joint interaction between past stock price momentu ...

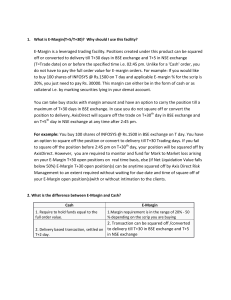

E-Margin is a leveraged trading facility. Positions

... E-Margin is a leveraged trading facility. Positions created under this product can be squared off or converted to delivery till T+30 days in BSE exchange and T+5 in NSE exchange (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full o ...

... E-Margin is a leveraged trading facility. Positions created under this product can be squared off or converted to delivery till T+30 days in BSE exchange and T+5 in NSE exchange (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full o ...

The Trading Behavior of Institutions and Individuals in Chinese

... sophisticated and wealthier individuals are likely to pursue momentum buy-investing, and at the same time they also exhibit a strong disposition effect. Our study therefore proceeds to investigate how the above documented trading behavior contributes to future stock volatility and future stock retu ...

... sophisticated and wealthier individuals are likely to pursue momentum buy-investing, and at the same time they also exhibit a strong disposition effect. Our study therefore proceeds to investigate how the above documented trading behavior contributes to future stock volatility and future stock retu ...

transparency in electronic business negotiations

... The dataset extracted from reverse auction software was processed and used for statistical examination. Evidenced based analysis in this field has several circumstances. First, economic indicators as savings are not so easy to be calculated. The problem is which price can be compared to winning pric ...

... The dataset extracted from reverse auction software was processed and used for statistical examination. Evidenced based analysis in this field has several circumstances. First, economic indicators as savings are not so easy to be calculated. The problem is which price can be compared to winning pric ...

Forecasting – where computational intelligence meets the stock

... on major currency exchanges without incurring extra risk. This is significant because the results suggested that patterns can be found in historical prices and those patterns appeared to repeat themselves. Moreover, this work gave evidence that genetic programming can be used to find such patterns. ...

... on major currency exchanges without incurring extra risk. This is significant because the results suggested that patterns can be found in historical prices and those patterns appeared to repeat themselves. Moreover, this work gave evidence that genetic programming can be used to find such patterns. ...

SMG Teachers Guide - The Stock Market Game

... It is not necessary for students to enter trades at every meeting -- but they can. The team meetings are opportune times for students to review stock holdings and to discuss whether to buy, sell, or hold. Many students often do their company and stock or fund research and reading of current economic ...

... It is not necessary for students to enter trades at every meeting -- but they can. The team meetings are opportune times for students to review stock holdings and to discuss whether to buy, sell, or hold. Many students often do their company and stock or fund research and reading of current economic ...

Volume and Liquidity After Cross

... outcome. Positive trading externalities arise from the fact that participation by other investors reduces the adverse price effect of one’s orders, both in models with imperfectly competitive, risk-averse investors and in models with asymmetric information. Pagano (1989) makes this point in a settin ...

... outcome. Positive trading externalities arise from the fact that participation by other investors reduces the adverse price effect of one’s orders, both in models with imperfectly competitive, risk-averse investors and in models with asymmetric information. Pagano (1989) makes this point in a settin ...

VERISIGN INC/CA (Form: 4, Received: 08/29/2003 14:40:40)

... By: Donald T Rozak Jr, as attorney-in-fact For: Dana L. Evan ...

... By: Donald T Rozak Jr, as attorney-in-fact For: Dana L. Evan ...

THE PRIVATISATION OF THE COMMODITIES EXCHANGE AND

... negotiated trading platforms. The forward markets, on the other hand, are for trading arrangements in commodities not meant for immediate payment and delivery. Before trading can be permitted to take place, the seller must have deposited the commodities in any NCX accredited warehouse or in any war ...

... negotiated trading platforms. The forward markets, on the other hand, are for trading arrangements in commodities not meant for immediate payment and delivery. Before trading can be permitted to take place, the seller must have deposited the commodities in any NCX accredited warehouse or in any war ...

H R Khan: Promoting retail investor participation in government bonds

... debt market. Given the low level of participation of retail investors in equity and more so in debt markets, the specific theme of the conference aimed at the retail investors is most appropriate. Retail participation in financial instruments has assumed critical importance as the decline in the ove ...

... debt market. Given the low level of participation of retail investors in equity and more so in debt markets, the specific theme of the conference aimed at the retail investors is most appropriate. Retail participation in financial instruments has assumed critical importance as the decline in the ove ...

Becoming a Millionaire - Frederick H. Willeboordse

... pooled and then invested by the fund manager according to the nature of the fund. Since ‘shares’ only indicate how much is contributed to the pool, it is not necessary to buy entire shares and one can buy e.g. 0.1234 shares. In fact, usually one would buy for a round sum e.g. $100 rather than a cert ...

... pooled and then invested by the fund manager according to the nature of the fund. Since ‘shares’ only indicate how much is contributed to the pool, it is not necessary to buy entire shares and one can buy e.g. 0.1234 shares. In fact, usually one would buy for a round sum e.g. $100 rather than a cert ...

The Fourth Dimension: Derivatives and Financial Dominance

... whose risk is the domestic currency appreciation and an importing company that fears depreciation of the domestic currency in relation to the foreign currency. In this case, the derivative exchange serves two agents with hedge motivations and provides a risk reduction for both by ensuring the future ...

... whose risk is the domestic currency appreciation and an importing company that fears depreciation of the domestic currency in relation to the foreign currency. In this case, the derivative exchange serves two agents with hedge motivations and provides a risk reduction for both by ensuring the future ...

Question 1 Miss Maple is considering two securities, A and B, and

... 2. Comment on the following quotation from a leading investment analyst. Stocks that move perfectly with the market have a beta of 1. Betas get higher as volatility goes up and lower as it goes down. Thus, Southern Co, a utility whose share have traded close to $12 for most of the past three years, ...

... 2. Comment on the following quotation from a leading investment analyst. Stocks that move perfectly with the market have a beta of 1. Betas get higher as volatility goes up and lower as it goes down. Thus, Southern Co, a utility whose share have traded close to $12 for most of the past three years, ...

The Relationship between Information Asymmetry and Stock Return

... dealers who have less information. And as all dealers seek optimal diversification to minimize risk, only the team which has more information succeed, and this leads to asymmetry in risk and abnormal profits to who has information. Another study performed by (Gul & Qiu, 2002) aimed to test the relat ...

... dealers who have less information. And as all dealers seek optimal diversification to minimize risk, only the team which has more information succeed, and this leads to asymmetry in risk and abnormal profits to who has information. Another study performed by (Gul & Qiu, 2002) aimed to test the relat ...

12. Dealing in Tasmines`Securities

... The information described under 12 above must be provided to the Company Secretary within 3 business days of the transaction to allow the Company Secretary adequate time for any follow up, completion and release of the notification to ASIC on the Director’s behalf. Details of any changes in Director ...

... The information described under 12 above must be provided to the Company Secretary within 3 business days of the transaction to allow the Company Secretary adequate time for any follow up, completion and release of the notification to ASIC on the Director’s behalf. Details of any changes in Director ...

Why Has Swedish Stock Market Volatility Increased?

... public discussion. All big news media today have daily coverage of the latest developments at the stock markets. Sudden shifts in the value of the stock market and periods of higher than usual financial volatility get a lot of attention. The tight media coverage is an indication that it is perceived ...

... public discussion. All big news media today have daily coverage of the latest developments at the stock markets. Sudden shifts in the value of the stock market and periods of higher than usual financial volatility get a lot of attention. The tight media coverage is an indication that it is perceived ...

ICICI Prudential PMS Absolute Return Portfolio

... documents carefully and in its entirety and consult their legal, tax and financial advisors to determine possible legal, tax and financial or any other consequences of investing under this Portfolio, before making an investment decision. The Stock(s)/Sector(s) mentioned in this material do not const ...

... documents carefully and in its entirety and consult their legal, tax and financial advisors to determine possible legal, tax and financial or any other consequences of investing under this Portfolio, before making an investment decision. The Stock(s)/Sector(s) mentioned in this material do not const ...

Adaptive Expectations and Stock Market Crashes.

... Our theory is related to the “volatility feedback” effect first studied by French et al. (1987), Malkiel (1979), and Pindyck (1984). They point out that greater stock market volatility can lead to a higher risk premium and thus to lower stock prices.5 Campbell and Hentschel (1992) show that this eff ...

... Our theory is related to the “volatility feedback” effect first studied by French et al. (1987), Malkiel (1979), and Pindyck (1984). They point out that greater stock market volatility can lead to a higher risk premium and thus to lower stock prices.5 Campbell and Hentschel (1992) show that this eff ...

Information Trading

... created portfolios of 49 stocks in three sectors, based upon earnings revisions, and reported earning an excess return on 4.7% over the following four months on the stocks with the most positive revisions. Hawkins, in 1983, reported that a portfolio of stocks with the 20 largest upward revisions in ...

... created portfolios of 49 stocks in three sectors, based upon earnings revisions, and reported earning an excess return on 4.7% over the following four months on the stocks with the most positive revisions. Hawkins, in 1983, reported that a portfolio of stocks with the 20 largest upward revisions in ...

markets work in war

... relatively unbiased basis, and carefully collects the relevant information. In the extreme case, even one such trader can drive the market price to the underlying equilibrium price.9 The analysis of break points undertaken here does not identify historical facts, but rather the acquisition and asses ...

... relatively unbiased basis, and carefully collects the relevant information. In the extreme case, even one such trader can drive the market price to the underlying equilibrium price.9 The analysis of break points undertaken here does not identify historical facts, but rather the acquisition and asses ...

Derivatives and Volatility on Indian Stock Markets

... (namely Dax index) on which derivative products are not introduced. This study shows that unlike the findings by Antoniou and Holmes (1995) for the London Stock Exchange (LSE), the introduction of index future, per se, has actually reduced the stock price volatility. Bologna and Covalla also found t ...

... (namely Dax index) on which derivative products are not introduced. This study shows that unlike the findings by Antoniou and Holmes (1995) for the London Stock Exchange (LSE), the introduction of index future, per se, has actually reduced the stock price volatility. Bologna and Covalla also found t ...

PDF

... management must be related to the policy goals that are established. Reserve stocks provide a means of softening the effects of periodic fluctuations in grain supplies by leveling off the peaks of surplus production and filling in the troughs of short crops or large export demands. Limited stocks of ...

... management must be related to the policy goals that are established. Reserve stocks provide a means of softening the effects of periodic fluctuations in grain supplies by leveling off the peaks of surplus production and filling in the troughs of short crops or large export demands. Limited stocks of ...