CG CC 6473 Real Time Convergence Energy Settlement 5.1

... Convergence bidding tends to cause DAM and RTM prices to move closer together, or "converge," thus the term convergence bidding. The narrowing of price differences between the two markets reduces incentives for under-scheduling Load in the DAM by reducing potential financial benefits for waiting unt ...

... Convergence bidding tends to cause DAM and RTM prices to move closer together, or "converge," thus the term convergence bidding. The narrowing of price differences between the two markets reduces incentives for under-scheduling Load in the DAM by reducing potential financial benefits for waiting unt ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

PAUL BRITT

... Volatility 101: Very Liquid; High Turnover iPath S&P 500 VIX Short-Term Futures ETN (VXX): ...

... Volatility 101: Very Liquid; High Turnover iPath S&P 500 VIX Short-Term Futures ETN (VXX): ...

The Dark Side of Trading - The University of Chicago Booth School

... volatility of stock returns because of the reduction of estimation risk in pricing company fundamentals. If trading leads to the incorporation of relevant fundamental information in security prices, and prices can be thought of as fundamental value plus estimation noise, then the evolution of prices ...

... volatility of stock returns because of the reduction of estimation risk in pricing company fundamentals. If trading leads to the incorporation of relevant fundamental information in security prices, and prices can be thought of as fundamental value plus estimation noise, then the evolution of prices ...

Description of Investment Instruments and Warning of

... Liquidity refers to the possibility of buying or selling a security or closing out a position at the current market price at any time. The market in a particular security is said to be liquid if an average sell instruction (measured by the usual trading volume) does not cause perceptible price fluct ...

... Liquidity refers to the possibility of buying or selling a security or closing out a position at the current market price at any time. The market in a particular security is said to be liquid if an average sell instruction (measured by the usual trading volume) does not cause perceptible price fluct ...

Understanding Competitive Pricing and Market Power in Wholesale

... higher prices and greater contributions to fixed costs. In a competitive market, this process of entry and exit occurs until, in long-run equilibrium, all generators in the market are able to cover their fixed costs and no other generator could enter and cover its fixed costs at the current market p ...

... higher prices and greater contributions to fixed costs. In a competitive market, this process of entry and exit occurs until, in long-run equilibrium, all generators in the market are able to cover their fixed costs and no other generator could enter and cover its fixed costs at the current market p ...

Chapter 8 Heath–Jarrow–Morton (HJM) Methodology

... → original article by Heath, Jarrow and Morton [10], MR[20](Chapter 13.1), Z[28](Chapter 4.4), etc. As we have seen in the previous section, short rate models are not always flexible enough to calibrating them to the observed initial yield curve. Heath, Jarrow and Morton (HJM, 1992) [10] proposed a ...

... → original article by Heath, Jarrow and Morton [10], MR[20](Chapter 13.1), Z[28](Chapter 4.4), etc. As we have seen in the previous section, short rate models are not always flexible enough to calibrating them to the observed initial yield curve. Heath, Jarrow and Morton (HJM, 1992) [10] proposed a ...

does anonymity matter in electronic limit order markets?1

... In the last decade, the security industry has witnessed a proliferation of electronic trading systems. Several of these new trading venues (e.g. Island for equity markets, Reuters D2000-2 for the foreign exchange market or MTS in bond markets) are organized as limit order markets where traders can e ...

... In the last decade, the security industry has witnessed a proliferation of electronic trading systems. Several of these new trading venues (e.g. Island for equity markets, Reuters D2000-2 for the foreign exchange market or MTS in bond markets) are organized as limit order markets where traders can e ...

News Release Bats Welcomes New Issuer

... CBOE Holdings, Inc. (BATS: CBOE | NASDAQ: CBOE), owner of the Chicago Board Options Exchange, the Bats exchanges, CBOE Futures Exchange (CFE) and other subsidiaries, is one of the world’s largest exchange holding companies and a leader in providing global investors cutting-edge trading and investmen ...

... CBOE Holdings, Inc. (BATS: CBOE | NASDAQ: CBOE), owner of the Chicago Board Options Exchange, the Bats exchanges, CBOE Futures Exchange (CFE) and other subsidiaries, is one of the world’s largest exchange holding companies and a leader in providing global investors cutting-edge trading and investmen ...

What pieces of limit order book information are informative?

... Our empirical study does not provide additional insights about the beneficial or pervasive effects of pre-trade transparency, but it sheds some light on who benefits from an open LOB in an electronic order-driven market and provides a measurement of how much valuable is the book information beyond t ...

... Our empirical study does not provide additional insights about the beneficial or pervasive effects of pre-trade transparency, but it sheds some light on who benefits from an open LOB in an electronic order-driven market and provides a measurement of how much valuable is the book information beyond t ...

PackaTAC: A Conservative Trading Agent

... After this initial ordering, the agent tried to maintain a target inventory level. This was set to 1500, which would last for at least nine days of production. Whenever the inventory for any supply went below the target level PackaTAC would reorder that supply. However, to prevent PackaTAC from over ...

... After this initial ordering, the agent tried to maintain a target inventory level. This was set to 1500, which would last for at least nine days of production. Whenever the inventory for any supply went below the target level PackaTAC would reorder that supply. However, to prevent PackaTAC from over ...

Liquidation Strategies in a Long-Short Equity Portfolio

... which side that initiates the trade. The side that initiates the trade is called liquidity taker whereas the passive side is called liquidity provider. Moro et al. [10] compares market impact between orders that are executed by liquidity takers and liquidity providers. They find that both strategies ...

... which side that initiates the trade. The side that initiates the trade is called liquidity taker whereas the passive side is called liquidity provider. Moro et al. [10] compares market impact between orders that are executed by liquidity takers and liquidity providers. They find that both strategies ...

W Evaluating Trading Strategies C R. H

... the advent of machine learning is relatively new to investment management, similar situations involving a large number of tests have been around for many years in other sciences. It makes sense that there may be some insights outside of finance that are relevant to finance. Our first example is the ...

... the advent of machine learning is relatively new to investment management, similar situations involving a large number of tests have been around for many years in other sciences. It makes sense that there may be some insights outside of finance that are relevant to finance. Our first example is the ...

1 WORKDAY, INC. POLICY ON HEDGING IN SECURITIES The

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

Efficiency in Bangladesh Stock Market Behavior

... Lock-in system and circuit breaker exist in the trading system. Lock-in system implies restrictions on trading in secondary market for certain period of time. Besides, all securities traded on the stock exchange are subject to daily price limitations in an attempt to discourage speculative investors ...

... Lock-in system and circuit breaker exist in the trading system. Lock-in system implies restrictions on trading in secondary market for certain period of time. Besides, all securities traded on the stock exchange are subject to daily price limitations in an attempt to discourage speculative investors ...

Comparison of Option Price from Black

... way of modeling the real data. While the lines follow the overall trend of an increase in option value over the 240 trading days, neither one predicts the changes in volatility at certain points in time. For example a significant drop in value between September and October can be observed in the S&P ...

... way of modeling the real data. While the lines follow the overall trend of an increase in option value over the 240 trading days, neither one predicts the changes in volatility at certain points in time. For example a significant drop in value between September and October can be observed in the S&P ...

“Mini-Tender” Offer

... unsolicited mini-tender offer by TRC Capital Corporation (TRC Capital) to purchase up to 2.5 million Thomson Reuters common shares, or approximately 0.31% of the common shares outstanding, at a price of C$39.75 per share. Thomson Reuters does not endorse this unsolicited mini-tender offer and recomm ...

... unsolicited mini-tender offer by TRC Capital Corporation (TRC Capital) to purchase up to 2.5 million Thomson Reuters common shares, or approximately 0.31% of the common shares outstanding, at a price of C$39.75 per share. Thomson Reuters does not endorse this unsolicited mini-tender offer and recomm ...

HouseStyle

... Financial Services Authority and to be admitted to trading by the London Stock Exchange plc on its main market for listed securities (together, “Admission”). Admission is expected to take place, settlement to occur and dealing in the New Ordinary Shares to commence at 8.00 a.m. on 23 March 2012. Fol ...

... Financial Services Authority and to be admitted to trading by the London Stock Exchange plc on its main market for listed securities (together, “Admission”). Admission is expected to take place, settlement to occur and dealing in the New Ordinary Shares to commence at 8.00 a.m. on 23 March 2012. Fol ...

Options Scanner Manual

... Moneyness – the amount any contract or strategy is in-, out- or at-the money Expiry – the amount of time left on the option Liquidity – how often a given option trades Risk – measured by calculations known as the “Greeks”. The Basic view measures time decay (for buyers) and a contract’s sens ...

... Moneyness – the amount any contract or strategy is in-, out- or at-the money Expiry – the amount of time left on the option Liquidity – how often a given option trades Risk – measured by calculations known as the “Greeks”. The Basic view measures time decay (for buyers) and a contract’s sens ...

TRADING RULE PROFITS AND FOREIGN EXCHANGE MARKET

... supply-demand phenomenon. Thus, changes in the demand and/or supply of foreign currency will affect the equilibrium exchange rate. Demand and supply changes are the result of decisions taken by buyers and sellers of foreign currency who do so in order to finance international trade, invest abroad or ...

... supply-demand phenomenon. Thus, changes in the demand and/or supply of foreign currency will affect the equilibrium exchange rate. Demand and supply changes are the result of decisions taken by buyers and sellers of foreign currency who do so in order to finance international trade, invest abroad or ...

Measuring the Beta

... What does the term “relevant risk” mean in the context of the CAPM? – It is generally assumed that all investors are wealth maximizing risk averse people – It is also assumed that the markets where these people trade are highly efficient – In a highly efficient market, the prices of all the securiti ...

... What does the term “relevant risk” mean in the context of the CAPM? – It is generally assumed that all investors are wealth maximizing risk averse people – It is also assumed that the markets where these people trade are highly efficient – In a highly efficient market, the prices of all the securiti ...

Statutory Regulation of Insider Trading in Impersonal Markets

... These goals are not all feasible, or even appropriate, in all circumstances. For example, the goal of rapid public disclosure of material information is irrelevant when the corporation has a legitimate business purpose for secrecy. Nor is compensation an appropriate regulatory goal under such circum ...

... These goals are not all feasible, or even appropriate, in all circumstances. For example, the goal of rapid public disclosure of material information is irrelevant when the corporation has a legitimate business purpose for secrecy. Nor is compensation an appropriate regulatory goal under such circum ...

List of KASE internal documents and amendments to KASE internal

... accordance with which the competency of the Expert Committee of the Exchange’s Board of Directors (Committee) includes definition of some parameters necessary for valuation of government securities (GS), namely notes of the National Bank, MEKKAM, MEOKAM and MEUKAM. In this respect, powers of the Com ...

... accordance with which the competency of the Expert Committee of the Exchange’s Board of Directors (Committee) includes definition of some parameters necessary for valuation of government securities (GS), namely notes of the National Bank, MEKKAM, MEOKAM and MEUKAM. In this respect, powers of the Com ...

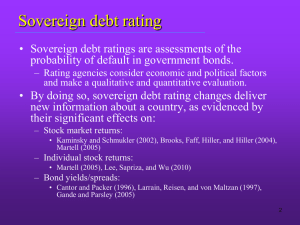

Sovereign Debt Rating and Stock Liquidity around the World

... – which, in turn, limits liquidity due to limited diffusion of information in the global capital markets (high information asymmetry). • Sovereign ceiling lite (Ferri , Lui, and Majnoni, 2001; Ferri and Liu, 2002; Kaminsky and Schmukler, 2002; Borensztein, Cowan, and Valenzuela, 2007) • More informa ...

... – which, in turn, limits liquidity due to limited diffusion of information in the global capital markets (high information asymmetry). • Sovereign ceiling lite (Ferri , Lui, and Majnoni, 2001; Ferri and Liu, 2002; Kaminsky and Schmukler, 2002; Borensztein, Cowan, and Valenzuela, 2007) • More informa ...