IOSR Journal of Economics and Finance (IOSR-JEF)

... From the aforementioned, derivatives refer to securities or to contracts that derive from another whose value depends on another contract or assets. As such the financial derivatives are financial instrument whose prices or values are derived from the prices of other underlying financial instruments ...

... From the aforementioned, derivatives refer to securities or to contracts that derive from another whose value depends on another contract or assets. As such the financial derivatives are financial instrument whose prices or values are derived from the prices of other underlying financial instruments ...

The Stock Market and the Economy

... actively traded large companies. The oldest and most widely followed index of stock market performance. NASDAQ Composite An index based on the stock prices of over 5,000 companies traded on the NASDAQ Stock Market. The NASDAQ market takes its name from the National Association of Securities Dealers ...

... actively traded large companies. The oldest and most widely followed index of stock market performance. NASDAQ Composite An index based on the stock prices of over 5,000 companies traded on the NASDAQ Stock Market. The NASDAQ market takes its name from the National Association of Securities Dealers ...

stock market extremes - Towneley Capital Management

... days or months, was not news. What surprised us, however, was the conclusion that practically all of the market's gains or losses over several decades occurred during only a handful of days or months. For example, in the original study, 95% of market gains between 1963 and 1993 were generated during ...

... days or months, was not news. What surprised us, however, was the conclusion that practically all of the market's gains or losses over several decades occurred during only a handful of days or months. For example, in the original study, 95% of market gains between 1963 and 1993 were generated during ...

The place for listing Alternative Investment Funds

... perform high quality accounting of alternative funds with the specific aspects of consolidation and IFRS reporting. In addition, distribution aspects like shareholder monitoring (e.g. hot issues, capital calls and side pockets) and performance fee management (e.g. computation, shareholder equalisati ...

... perform high quality accounting of alternative funds with the specific aspects of consolidation and IFRS reporting. In addition, distribution aspects like shareholder monitoring (e.g. hot issues, capital calls and side pockets) and performance fee management (e.g. computation, shareholder equalisati ...

Order Exposure and Liquidity Coordination

... (i.e., overbidding). Our key results are therefore driven by the interaction of both mechanisms, liquidity competition in the primary exchange and order flow attraction from latent investors. A central finding of our study is that due to mis-coordination (large) hidden orders can significantly harm ...

... (i.e., overbidding). Our key results are therefore driven by the interaction of both mechanisms, liquidity competition in the primary exchange and order flow attraction from latent investors. A central finding of our study is that due to mis-coordination (large) hidden orders can significantly harm ...

Internationalization of Stock Markets: Potential Problems for United

... shareholders when the corporations in which they own stock list and offer equity securities on stock exchanges in foreign countries. In some ways, the Comment is in search of a question. It must be noted at the outset that no case law and very little commentary currently exist on this topic.' Conseq ...

... shareholders when the corporations in which they own stock list and offer equity securities on stock exchanges in foreign countries. In some ways, the Comment is in search of a question. It must be noted at the outset that no case law and very little commentary currently exist on this topic.' Conseq ...

Twitter Volume Spikes: Analysis and Application in Stock Trading

... trading volume on that day. To shed lights on whether Twitter volume spikes are expected or not, we compare the implied volatility of a stock before and after a Twitter volume spike occurs. Specifically, assume that for a stock, a Twitter volume spike happens on day t. Then we calculate the implied ...

... trading volume on that day. To shed lights on whether Twitter volume spikes are expected or not, we compare the implied volatility of a stock before and after a Twitter volume spike occurs. Specifically, assume that for a stock, a Twitter volume spike happens on day t. Then we calculate the implied ...

Electronic Market-Makers: Empirical Comparison

... A Myopically Optimizing Market-Maker A Myopically Optimizing MarketMaker uses an algorithm developed by Das in [5]. The key aspect of the algorithm is that the market-maker uses the information conveyed in trades to update its beliefs about the true value of the stock, and then it sets buy/ask price ...

... A Myopically Optimizing Market-Maker A Myopically Optimizing MarketMaker uses an algorithm developed by Das in [5]. The key aspect of the algorithm is that the market-maker uses the information conveyed in trades to update its beliefs about the true value of the stock, and then it sets buy/ask price ...

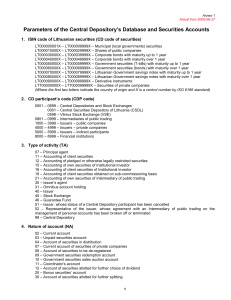

1. ISIN code of Lithuanian securities (CD code of securities)

... 02 – Current account 03 – Unpaid securities account 04 – Account of securities in distribution 07 – Current account of securities of private companies 08 – Account of securities to be de-registered 09 – Government securities redemption account 10 – Government securities sales auction account 11 – Co ...

... 02 – Current account 03 – Unpaid securities account 04 – Account of securities in distribution 07 – Current account of securities of private companies 08 – Account of securities to be de-registered 09 – Government securities redemption account 10 – Government securities sales auction account 11 – Co ...

GCC Markets Monthly Report

... in a YTD-15 return of 11.8%, the strongest in the GCC. After breaching the 9,000 mark on the very first day of February-15, the index was up by almost 27% from its lows recorded during December-14. Markets sentiments continue to remain elevated on the back of improving oil prices coupled with a stab ...

... in a YTD-15 return of 11.8%, the strongest in the GCC. After breaching the 9,000 mark on the very first day of February-15, the index was up by almost 27% from its lows recorded during December-14. Markets sentiments continue to remain elevated on the back of improving oil prices coupled with a stab ...

Weekend Effect of Stock Returns in the Indian Market

... other than Thursday and Friday give the buyer two calendar days before losing funds for stock purchases. These two days are the two business days meant for the settlement process. However, payment (final payment occurs during settlement) for stock purchased on a Thursday will not occur until Monday ...

... other than Thursday and Friday give the buyer two calendar days before losing funds for stock purchases. These two days are the two business days meant for the settlement process. However, payment (final payment occurs during settlement) for stock purchased on a Thursday will not occur until Monday ...

Market E¢ciency and Price Formation when Dealers are Asymmetrically Informed ¤ R. Calcagno

... out revealing completely his information. By contrast, the transparency of quotes makes di¢cult for the informed dealer to exploit his advantage without revealing it, but it makes easier for him to in‡uence uninformed agents. What is the net e¤ect on the informational e¢ciency of the market? How ca ...

... out revealing completely his information. By contrast, the transparency of quotes makes di¢cult for the informed dealer to exploit his advantage without revealing it, but it makes easier for him to in‡uence uninformed agents. What is the net e¤ect on the informational e¢ciency of the market? How ca ...

Listing on the FTSE-100: Does it matter?

... index is of interest because it is an event that should be dependent on information that is public at that time. In contrast to the S&P 500 Index, changes in the composition of the FTSE 100 Index are based purely on the relative market capitalisation of the respective firms. If its inclusion in the ...

... index is of interest because it is an event that should be dependent on information that is public at that time. In contrast to the S&P 500 Index, changes in the composition of the FTSE 100 Index are based purely on the relative market capitalisation of the respective firms. If its inclusion in the ...

The First Fundamental Theorem of Asset Pricing

... The origins of FTAP and other crucial results in Mathematical Finance are inseparably linked to the work of Black and Scholes (1973) and Merton (1973). What is now know as the Black-Scholes model based on the proposed by Samuelson (1965) geometric Brownian motion S = (St )0≤t≤T provides a well known ...

... The origins of FTAP and other crucial results in Mathematical Finance are inseparably linked to the work of Black and Scholes (1973) and Merton (1973). What is now know as the Black-Scholes model based on the proposed by Samuelson (1965) geometric Brownian motion S = (St )0≤t≤T provides a well known ...

Entry into the First Ever Pure-play Online Securities Business in

... SBI Thai Online Securities, which is owned 55% by the SBI Group and 45% by Finansia Syrus Securities, will provide securities services such as stock trading and derivatives trading over the Internet to local investors including Japanese living in Thailand. While securities trading services are alrea ...

... SBI Thai Online Securities, which is owned 55% by the SBI Group and 45% by Finansia Syrus Securities, will provide securities services such as stock trading and derivatives trading over the Internet to local investors including Japanese living in Thailand. While securities trading services are alrea ...

I 1) Which of the following is NOT an example of a

... 11) Taking position in futures opposite to that in cash market for protecting cash market holdings is : a) Speculating b) Arbitrage c) Hedging d) None of the above. 12) Derivatives are highly leveraged, which implies that a) You can take a higher position with smaller investments using derivatives b ...

... 11) Taking position in futures opposite to that in cash market for protecting cash market holdings is : a) Speculating b) Arbitrage c) Hedging d) None of the above. 12) Derivatives are highly leveraged, which implies that a) You can take a higher position with smaller investments using derivatives b ...

The Stock Market and the Economy

... • The price of a stock may also be driven up not by the discounted value of expected future dividends, but by people’s views of what others will pay for the stock in the future. • One might call this a bubble because the stock price depends on what people expect that other people expect, etc. ...

... • The price of a stock may also be driven up not by the discounted value of expected future dividends, but by people’s views of what others will pay for the stock in the future. • One might call this a bubble because the stock price depends on what people expect that other people expect, etc. ...

Derivatives Trading and Its Impact on the Volatility of NSE, India

... the existence of derivatives markets in particular, might affect the volatility of the underlying asset market. In recent past, the volatility of stock returns has been a major topic in finance literature. Empirical researchers have tried to find a pattern in stock return movements or factors deter ...

... the existence of derivatives markets in particular, might affect the volatility of the underlying asset market. In recent past, the volatility of stock returns has been a major topic in finance literature. Empirical researchers have tried to find a pattern in stock return movements or factors deter ...

PR_material_embedded_0112

... Financial markets, perhaps because of their fluid nature as a second-order, exchange role markets (Aspers, 2005) have already proven a fertile field for studies of the ongoing performance of economic relationships. The social embeddedness of financial markets was investigated (even before Granovette ...

... Financial markets, perhaps because of their fluid nature as a second-order, exchange role markets (Aspers, 2005) have already proven a fertile field for studies of the ongoing performance of economic relationships. The social embeddedness of financial markets was investigated (even before Granovette ...

On a long-term chart, trend lines drawn with closing price are more

... Closing Price ............................................................................................................................... 10 Log or Normal Scale?.................................................................................................................. 11 Normal Scale..... ...

... Closing Price ............................................................................................................................... 10 Log or Normal Scale?.................................................................................................................. 11 Normal Scale..... ...

A Study on Lock-In Effect of Capital Gains Tax for Securities in

... volume, the empirical results on the American Stock Exchange indicate only a negligible effect. Therefore, it remains unclear whether the increase in trading volume was caused by the tax cut, the stock market boom at that time, or other factors. Gemmill (1956) [15] posited that most investors aim to ...

... volume, the empirical results on the American Stock Exchange indicate only a negligible effect. Therefore, it remains unclear whether the increase in trading volume was caused by the tax cut, the stock market boom at that time, or other factors. Gemmill (1956) [15] posited that most investors aim to ...

Attracting Foreign Investment

... Discussing proposed Project Thusanang Phase I approach Provide Phase I funding options ...

... Discussing proposed Project Thusanang Phase I approach Provide Phase I funding options ...

the efficient market hypothesis in developing

... in time, the price of securities is an unbiased reflection of all the available information including the discounted future cash flows and risk involved in owning such a security (Reilly and Brown 2003). Such an Exchange presents correct signals for the garnering of resources as stock market prices ...

... in time, the price of securities is an unbiased reflection of all the available information including the discounted future cash flows and risk involved in owning such a security (Reilly and Brown 2003). Such an Exchange presents correct signals for the garnering of resources as stock market prices ...