Market Structures Notes

... – Usually => more efficient use of FoP’s •Don’t allow monopolies (unfair power or trade) – Capitalism game *Rewards those who use resources efficiently => max profit •Profit - what is left after costs are met *Those who are inefficient => lose (go out of bus.) – Incentive of Capitalism is to Maximiz ...

... – Usually => more efficient use of FoP’s •Don’t allow monopolies (unfair power or trade) – Capitalism game *Rewards those who use resources efficiently => max profit •Profit - what is left after costs are met *Those who are inefficient => lose (go out of bus.) – Incentive of Capitalism is to Maximiz ...

NEW STANDARD ENERGY LIMITED SECURITIES TRADING

... The prohibition does not apply to acquisitions of shares or options by employees made under employee share or option schemes, nor does it apply to the acquisition of shares as a result of the exercise of options under an employee option scheme. However, the prohibition does apply to the sale of shar ...

... The prohibition does not apply to acquisitions of shares or options by employees made under employee share or option schemes, nor does it apply to the acquisition of shares as a result of the exercise of options under an employee option scheme. However, the prohibition does apply to the sale of shar ...

HYBRID Coating Technologies Inc.

... Approval to amend and restate the current Articles of Incorporation of the Company under the Nevada Revised Statutes ("NRS") requires the affirmative vote of the holders of a majority of the voting power of the Company. Section 78.320 of the NRS provides, in substance, that, unless the Company's Art ...

... Approval to amend and restate the current Articles of Incorporation of the Company under the Nevada Revised Statutes ("NRS") requires the affirmative vote of the holders of a majority of the voting power of the Company. Section 78.320 of the NRS provides, in substance, that, unless the Company's Art ...

decision drivers: stock prices versus gdp

... Austria, Belgium, Brazil, Canada, China, Egypt, France, Germany, Hong Kong, India, Indonesia, Italy, Japan, Malaysia, Mexico, Netherlands, Nigeria, Norway, Philippines, Poland, Russia, S. Korea, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, UAE, UK, USA ...

... Austria, Belgium, Brazil, Canada, China, Egypt, France, Germany, Hong Kong, India, Indonesia, Italy, Japan, Malaysia, Mexico, Netherlands, Nigeria, Norway, Philippines, Poland, Russia, S. Korea, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, UAE, UK, USA ...

Document

... This shows that for the price in excess of 90, this investor will earn more than 5, and for the price under 85, the investor will also earn more than 5. Therefore, the minimum earned on the option position is 5, while the net cost of the options is 5 – 2 = 3, for a total net gain of 5 – 3 = 2. Answe ...

... This shows that for the price in excess of 90, this investor will earn more than 5, and for the price under 85, the investor will also earn more than 5. Therefore, the minimum earned on the option position is 5, while the net cost of the options is 5 – 2 = 3, for a total net gain of 5 – 3 = 2. Answe ...

Crashing Hopes: The Great Depression

... 5. Lack of stock market regulation. At this time, there were no effective legal guidelines on buying and selling stock. Free from such limitations, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on cre ...

... 5. Lack of stock market regulation. At this time, there were no effective legal guidelines on buying and selling stock. Free from such limitations, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on cre ...

SOA Exam MFE Flash Cards

... Above: A gap option must be exercised when S K1 for a call or S K1 for a put. Since the owner can lose money at exercise, the term “option” is a bit of a misnomer. This possible negative payoff is reflected in a lower option price. Exchange Option An exchange option, also called an outperforman ...

... Above: A gap option must be exercised when S K1 for a call or S K1 for a put. Since the owner can lose money at exercise, the term “option” is a bit of a misnomer. This possible negative payoff is reflected in a lower option price. Exchange Option An exchange option, also called an outperforman ...

Ibbotson® SBBI - New York Life Investment Management

... by the 30-day U.S. Treasury bill, and inflation by the Consumer Price Index. Underlying data is from the Stocks, Bonds, Bills, and Inflation® (SBBI®) Yearbook by Roger G. Ibbotson and Rex Sinquefield, updated annually. An investment cannot be made directly into an index. Past performance is no guara ...

... by the 30-day U.S. Treasury bill, and inflation by the Consumer Price Index. Underlying data is from the Stocks, Bonds, Bills, and Inflation® (SBBI®) Yearbook by Roger G. Ibbotson and Rex Sinquefield, updated annually. An investment cannot be made directly into an index. Past performance is no guara ...

COMMON STOCK VALUATION (Dividend Models) A company can

... Relevant costs are also called differential costs. Making correct decisions is one of the most important tasks of a successful manager. Every decision involves a choice between at least two alternatives. The decision process may be complicated by volumes of data, irrelevant data, incomplete informat ...

... Relevant costs are also called differential costs. Making correct decisions is one of the most important tasks of a successful manager. Every decision involves a choice between at least two alternatives. The decision process may be complicated by volumes of data, irrelevant data, incomplete informat ...

“Mini-Tender” Offer

... documentation. The TRC Capital mini-tender offer is also not related to Thomson Reuters own previously announced plans to repurchase up to US$1 billion of its shares by the end of 2015, which is being effected through the Toronto Stock Exchange’s normal course issuer bid rules. TRC Capital has made ...

... documentation. The TRC Capital mini-tender offer is also not related to Thomson Reuters own previously announced plans to repurchase up to US$1 billion of its shares by the end of 2015, which is being effected through the Toronto Stock Exchange’s normal course issuer bid rules. TRC Capital has made ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Shah Capital has suggested a number of strategic initiatives to the Board, which we believe will substantially increase the value of CYI to all its stakeholders. Below we briefly outline just a fraction of the tremendous strengths of CYI along with the disproportionate valuation it carries in compar ...

... Shah Capital has suggested a number of strategic initiatives to the Board, which we believe will substantially increase the value of CYI to all its stakeholders. Below we briefly outline just a fraction of the tremendous strengths of CYI along with the disproportionate valuation it carries in compar ...

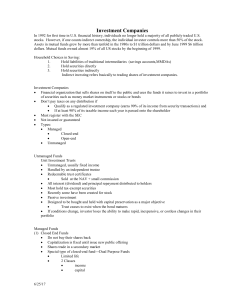

InOn Capital

... Asset Diversification Defini-on of diversifica-on: Distribu-ng the total amount of investment in different assets in order to reduce porLolio risk. In our opinion, diversifica-on consists in inves-ng not only in classical financial assets such as stocks, bonds, mutual funds ...

... Asset Diversification Defini-on of diversifica-on: Distribu-ng the total amount of investment in different assets in order to reduce porLolio risk. In our opinion, diversifica-on consists in inves-ng not only in classical financial assets such as stocks, bonds, mutual funds ...

Suggested Answers to Discussion Questions

... (b) Based on the comparison to industry average ratios, the financial condition of Otago Bay Marine Motors (OBMM) appears to be deteriorating. First, OBMM’s current ratio has declined 63%, indicating its ability to meet short-term obligations has weakened substantially. OBMM’s current liabilities, w ...

... (b) Based on the comparison to industry average ratios, the financial condition of Otago Bay Marine Motors (OBMM) appears to be deteriorating. First, OBMM’s current ratio has declined 63%, indicating its ability to meet short-term obligations has weakened substantially. OBMM’s current liabilities, w ...

All-Cap Value Portfolio - Iron Gate Global Advisors

... selling below their intrinsic value. The S&P 500 Index measures the performance of the 500 largest publicly held companies actively traded in the United States. The investment returns shown include capital gains and the reinvestment of dividends and coupon income. The returns have been adjusted to i ...

... selling below their intrinsic value. The S&P 500 Index measures the performance of the 500 largest publicly held companies actively traded in the United States. The investment returns shown include capital gains and the reinvestment of dividends and coupon income. The returns have been adjusted to i ...

Selling shares to finance the company startup

... • In our case we see that the investor after year 4 has put something less than 3 mill into the company, including the missing 25% interest. • In year5 (and we presume the following years) 1/3 of the profit (we disregard the tax here) will provide interest at 25% pa for more than 3 mill. • So invest ...

... • In our case we see that the investor after year 4 has put something less than 3 mill into the company, including the missing 25% interest. • In year5 (and we presume the following years) 1/3 of the profit (we disregard the tax here) will provide interest at 25% pa for more than 3 mill. • So invest ...

SEBI

... A market Index is a convenient and effective product because of the following reasons: - It acts as a barometer for market behavior; - It is used to benchmark portfolio performance; - It is used in derivative instruments like index futures and Index options ...

... A market Index is a convenient and effective product because of the following reasons: - It acts as a barometer for market behavior; - It is used to benchmark portfolio performance; - It is used in derivative instruments like index futures and Index options ...

multiple choice questions - TMC Finance Department Notes

... To diversify properly you need to buy 20 to 40 securities To diversify properly you need to buy about 5 securities You cannot diversify properly, no matter how many securities You don’t need to diversify if your securities are blue chips ...

... To diversify properly you need to buy 20 to 40 securities To diversify properly you need to buy about 5 securities You cannot diversify properly, no matter how many securities You don’t need to diversify if your securities are blue chips ...

tax loss selling strategies for closed-end fund investors

... BlackRock does not provide tax advice, and investors should consult their professional advisors before making any tax or investment decision. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quot ...

... BlackRock does not provide tax advice, and investors should consult their professional advisors before making any tax or investment decision. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quot ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.