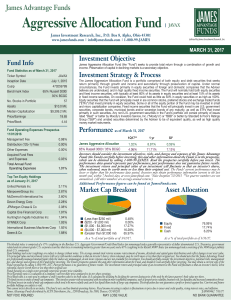

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Topic No. D-82 Topic: Effect of Preferred Stock Dividends

... Topic: Effect of Preferred Stock Dividends Payable in Common Shares on Computation of Income Available to Common Stockholders ...

... Topic: Effect of Preferred Stock Dividends Payable in Common Shares on Computation of Income Available to Common Stockholders ...

Factors to Consider When Thinking About Purchasing a Short Sale

... often, it can leave the winning bidder with some uncertainty about spending money on the place or moving in because it can be taken away from them in the first eight months following the sale. REO purchases are less risky than buying at a foreclosure auction, but contain considerably more risk that ...

... often, it can leave the winning bidder with some uncertainty about spending money on the place or moving in because it can be taken away from them in the first eight months following the sale. REO purchases are less risky than buying at a foreclosure auction, but contain considerably more risk that ...

term sheet for series a preferred stock

... Stock on an as-converted basis, and not as a separate class, except (i) the Series A Preferred as a class shall be entitled to elect one (1) member of the Board (the "Series A Director"): (ii) as provided under "Protective Provisions" below; or (iii) as required by law. The Company's Amended and Res ...

... Stock on an as-converted basis, and not as a separate class, except (i) the Series A Preferred as a class shall be entitled to elect one (1) member of the Board (the "Series A Director"): (ii) as provided under "Protective Provisions" below; or (iii) as required by law. The Company's Amended and Res ...

Weekly roundup - Jesmond Mizzi Financial Advisors

... 2005 in order to consider and approve, the Company’s Financial Statements for the period ending 30th June, 2005. ...

... 2005 in order to consider and approve, the Company’s Financial Statements for the period ending 30th June, 2005. ...

FORM 4

... 16(a) of the Securities Exchange Act of 1934, as amended, and the rules thereunder; (2) do and perform any and all acts for and on behalf of the undersigned which may be necessary or desirable to complete and execute any such Form 3, 4 or 5 report and timely file such report with the United States S ...

... 16(a) of the Securities Exchange Act of 1934, as amended, and the rules thereunder; (2) do and perform any and all acts for and on behalf of the undersigned which may be necessary or desirable to complete and execute any such Form 3, 4 or 5 report and timely file such report with the United States S ...

Reorganizing and Evolving Corporate Structures of

... • Only one class of shares, with full voting rights: one share, one vote • Full tag along rights – Higher disclosure Standards • Annual financial statements in IFRS or US GAAP • Improved Quarterly Reports (ITRs), including an English version, consolidated financial statements and cash flow statement ...

... • Only one class of shares, with full voting rights: one share, one vote • Full tag along rights – Higher disclosure Standards • Annual financial statements in IFRS or US GAAP • Improved Quarterly Reports (ITRs), including an English version, consolidated financial statements and cash flow statement ...

Principles of Portfolio Construction: Lord Abbett Smid

... calculated by dividing a stock’s share price by its cash f low per share. Price/sales ratio is a ratio f or valuing a stock relative to its sales. It is calculated by dividing a stock’s current price by its revenue per share f or the trailing 12 months. A Note about Risk: The value of investments i ...

... calculated by dividing a stock’s share price by its cash f low per share. Price/sales ratio is a ratio f or valuing a stock relative to its sales. It is calculated by dividing a stock’s current price by its revenue per share f or the trailing 12 months. A Note about Risk: The value of investments i ...

1. Without the participation of financial intermediaries in financial

... 46. Investors sell a security short when they expect the price of the security to (Points: 6) increase substantially. ...

... 46. Investors sell a security short when they expect the price of the security to (Points: 6) increase substantially. ...

securities trading policy

... or the Company has had a number of consecutive prohibited periods and the restricted person could not reasonably have been expected to exercise it at a time when free to do so; or trade under a non-discretionary trading plan for which prior written clearance has been provided in accordance with proc ...

... or the Company has had a number of consecutive prohibited periods and the restricted person could not reasonably have been expected to exercise it at a time when free to do so; or trade under a non-discretionary trading plan for which prior written clearance has been provided in accordance with proc ...

MacroMarkets Announces Collaboration with WisdomTree To

... This Information does not represent an offer to sell securities of the MacroShares Trusts and it is not soliciting an offer to buy securities of these Trusts. There can be no assurance that the Trusts will achieve their investment objectives. An investment in the MacroShare Trusts involves significa ...

... This Information does not represent an offer to sell securities of the MacroShares Trusts and it is not soliciting an offer to buy securities of these Trusts. There can be no assurance that the Trusts will achieve their investment objectives. An investment in the MacroShare Trusts involves significa ...

Important Information on Penny Stocks

... Before you buy penny stock, federal law requires your salesperson to tell you the “offer” and the “bid” on the stock, and the “compensation” the salesperson and the firm receive for the trade. The firm also must send a confirmation of these prices to you after the trade. You will need this price inf ...

... Before you buy penny stock, federal law requires your salesperson to tell you the “offer” and the “bid” on the stock, and the “compensation” the salesperson and the firm receive for the trade. The firm also must send a confirmation of these prices to you after the trade. You will need this price inf ...

Wells Fargo Securities_Sales and Trading Analystx

... need. The program is an initial two-year commitment with an opportunity to stay longer at the firm’s discretion. Analyst opportunities are available in Charlotte, New York, and San Francisco within one of the following teams: ...

... need. The program is an initial two-year commitment with an opportunity to stay longer at the firm’s discretion. Analyst opportunities are available in Charlotte, New York, and San Francisco within one of the following teams: ...

chapter 32

... The decline of the dollar increases the value of a U.S. company’s dollar earnings to a foreign buyer. In other words, the foreign buyer can obtain the U.S. dollar earnings at a lower cost, measured in the foreign currency, than prior to the decline, so a foreign takeover of a U.S. company appears mo ...

... The decline of the dollar increases the value of a U.S. company’s dollar earnings to a foreign buyer. In other words, the foreign buyer can obtain the U.S. dollar earnings at a lower cost, measured in the foreign currency, than prior to the decline, so a foreign takeover of a U.S. company appears mo ...

Stock Market Activity - keeferhonecon

... 1. What do you feel you have learned from completing this activity? How could the stock market affect your future especially if the recession becomes a depression or if a bull market takes hold? 2. If you could go back and do a part of this activity over again, which part(s) would you change and why ...

... 1. What do you feel you have learned from completing this activity? How could the stock market affect your future especially if the recession becomes a depression or if a bull market takes hold? 2. If you could go back and do a part of this activity over again, which part(s) would you change and why ...

Reducing US Stocks to Bring Balanced Portfolios Closer to Long

... bank loans. Like high yield bonds, these loans are rated below investment grade, but they have two differences. Firstly, they have a senior claim on assets in the event of a default. Secondly, the interest rate is not fixed. In our opinion, one of the attractive features of bank loans in a rising ra ...

... bank loans. Like high yield bonds, these loans are rated below investment grade, but they have two differences. Firstly, they have a senior claim on assets in the event of a default. Secondly, the interest rate is not fixed. In our opinion, one of the attractive features of bank loans in a rising ra ...

Description of Financial Instruments and Principal

... delivery of physical goods or securities. In effect CFDs are financial derivatives that allow traders to take advantage of prices moving up (long positions) or prices moving down (short positions) on underlying financial instruments and are often used to speculate on those markets. Traders in CFDs a ...

... delivery of physical goods or securities. In effect CFDs are financial derivatives that allow traders to take advantage of prices moving up (long positions) or prices moving down (short positions) on underlying financial instruments and are often used to speculate on those markets. Traders in CFDs a ...

Measures to Reduce Price Volatility

... Market problems in 2012 but no need for the Rapid Response Forum • US drought affects maize prices and wheat prices follow – grain prices increase 25% in July • Need for a meeting of the RRF? • Why it was not a “crisis” • Black Sea region drought adds to problems – continuing threat ...

... Market problems in 2012 but no need for the Rapid Response Forum • US drought affects maize prices and wheat prices follow – grain prices increase 25% in July • Need for a meeting of the RRF? • Why it was not a “crisis” • Black Sea region drought adds to problems – continuing threat ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.