New Media Announces Pricing of Public Offering of Common Stock

... the shares from time to time for sale in one or more transactions on the New York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. In co ...

... the shares from time to time for sale in one or more transactions on the New York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. In co ...

Chapter 11: The Efficient Market Hypothesis

... Types of Stock Analysis • Technical Analysis - using prices and volume information to predict future prices – Weak form efficiency & technical analysis • Fundamental Analysis - using economic and accounting information to predict stock prices – Semi strong form efficiency & fundamental analysis ...

... Types of Stock Analysis • Technical Analysis - using prices and volume information to predict future prices – Weak form efficiency & technical analysis • Fundamental Analysis - using economic and accounting information to predict stock prices – Semi strong form efficiency & fundamental analysis ...

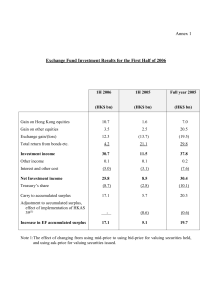

International Portfolio Investment

... spiders, investors can trade a whole stock market index as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shar ...

... spiders, investors can trade a whole stock market index as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shar ...

1. Application for quotation of added securities

... section 724 or section 1016E of the Act does not apply to any applications received by the listee in relation to any securities to be quoted and that no one has any right to return any securities to be quoted under sections 737, 738 or 1016F of the Act at the time that of this request that the secur ...

... section 724 or section 1016E of the Act does not apply to any applications received by the listee in relation to any securities to be quoted and that no one has any right to return any securities to be quoted under sections 737, 738 or 1016F of the Act at the time that of this request that the secur ...

A1.2 - DFSA

... Information on the disparity between price of Securities and the cash cost to Directors and Senior Management (5) Admission to trading 5.1 Details of admission to trading a. Proposed dates for (i) admission to the Official List of Securities; (ii) admission to trading on an AMI; and (iii) admission ...

... Information on the disparity between price of Securities and the cash cost to Directors and Senior Management (5) Admission to trading 5.1 Details of admission to trading a. Proposed dates for (i) admission to the Official List of Securities; (ii) admission to trading on an AMI; and (iii) admission ...

GLOSSARY

... Denominator: The top number in a mathematical expression written as a fraction. Employee discount: A set reduction in retail price given to an employee at the time of a sales transaction. Extension: The result of multiplying the number of units by the cost per unit. Final selling price: The price at ...

... Denominator: The top number in a mathematical expression written as a fraction. Employee discount: A set reduction in retail price given to an employee at the time of a sales transaction. Extension: The result of multiplying the number of units by the cost per unit. Final selling price: The price at ...

ALJ Regional Holdings, Inc. Commences Tender Offer to Purchase

... announced today that it intends to commence a modified “Dutch auction” tender offer for up to 30,000,000 shares of its common stock at a price per share not greater than $0.86 and not less than $0.84. Under the tender offer, stockholders will have the opportunity to tender some or all of their share ...

... announced today that it intends to commence a modified “Dutch auction” tender offer for up to 30,000,000 shares of its common stock at a price per share not greater than $0.86 and not less than $0.84. Under the tender offer, stockholders will have the opportunity to tender some or all of their share ...

Safety In Numbers

... New Constructs has provided Nashville Post with its unique research on 23 Nashville public companies. (This analysis took place in late August.) Company snapshots combine five equally weighted criteria: economic versus reported earnings per share (EPS), return on invested capital ranked by quintile, ...

... New Constructs has provided Nashville Post with its unique research on 23 Nashville public companies. (This analysis took place in late August.) Company snapshots combine five equally weighted criteria: economic versus reported earnings per share (EPS), return on invested capital ranked by quintile, ...

Boston Partners Global Equity Fund (BPGIX)

... The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.boston-partners.com. The investment return and principal value of an investment will ...

... The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.boston-partners.com. The investment return and principal value of an investment will ...

Tax Treatment of DRIPs

... Commission (aka Brokerage Fees): If paid by the DRIP company (which is common) . . . it is considered dividend income and will be included on the 1099-DIV form. Whether paid by you or the company . . . a commission increases the cost basis of the shares being purchased or sold. This means that a com ...

... Commission (aka Brokerage Fees): If paid by the DRIP company (which is common) . . . it is considered dividend income and will be included on the 1099-DIV form. Whether paid by you or the company . . . a commission increases the cost basis of the shares being purchased or sold. This means that a com ...

Dr. Edward Yardeni, Chief Economist

... This is a very simple stock valuation model. It should be used along with other stock valuation tools. Of course, there are numerous other more sophisticated and complex models. The Fed model is not a market-timing tool. As noted above, an overvalued (undervalued) market can become even more overva ...

... This is a very simple stock valuation model. It should be used along with other stock valuation tools. Of course, there are numerous other more sophisticated and complex models. The Fed model is not a market-timing tool. As noted above, an overvalued (undervalued) market can become even more overva ...

Southeastern Asset Management

... We also bought Yum China.Yum Brands was a long-term holding for us in our Partners Fund and global accounts for over 15 years. We’ve been watching it closely since we had sold it, and when it split into two companies, the China business was cheaper, and we’re very happy to own that one again. The ot ...

... We also bought Yum China.Yum Brands was a long-term holding for us in our Partners Fund and global accounts for over 15 years. We’ve been watching it closely since we had sold it, and when it split into two companies, the China business was cheaper, and we’re very happy to own that one again. The ot ...

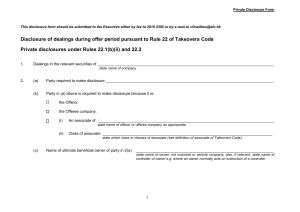

private disclosures under rules 22

... state identity of offeror or offeree company as appropriate; if the exempt fund manager is an associate by virtue of class (6) of the definition of associate, dealings must be disclosed publicly (see R22.1(b)(ii)) ...

... state identity of offeror or offeree company as appropriate; if the exempt fund manager is an associate by virtue of class (6) of the definition of associate, dealings must be disclosed publicly (see R22.1(b)(ii)) ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.