REPORT TO THE ANNUAL GENERAL MEETING

... of shareholder subscription rights as per article 71, paragraph 8 and article 186, paragraph 4 of the German Stock Corporation Act: The authorization to buy back shares that expires on January 20, 2011 is to be renewed by way of a resolution at the annual general meeting in order to give the company ...

... of shareholder subscription rights as per article 71, paragraph 8 and article 186, paragraph 4 of the German Stock Corporation Act: The authorization to buy back shares that expires on January 20, 2011 is to be renewed by way of a resolution at the annual general meeting in order to give the company ...

irrevocable stock or bond power form

... How to complete your gift of stock or bonds to Loyola University Chicago: The Irrevocable Stock or Bond Power Form is the legal document that officially transfers the ownership of shares from one registered shareowner to another. Below are instructions on how to make your gift and complete the Irre ...

... How to complete your gift of stock or bonds to Loyola University Chicago: The Irrevocable Stock or Bond Power Form is the legal document that officially transfers the ownership of shares from one registered shareowner to another. Below are instructions on how to make your gift and complete the Irre ...

Instructions Double-Oral Auction Market Experiment, Fall 2004

... market. Thus, this is the minimum price you are willing to accept in a market transaction. Enter this value in the appropriate column of your record sheet. As a SELLER you will be making offers to sell in the market. You can offer for any price above the price listed on your card. For example, if yo ...

... market. Thus, this is the minimum price you are willing to accept in a market transaction. Enter this value in the appropriate column of your record sheet. As a SELLER you will be making offers to sell in the market. You can offer for any price above the price listed on your card. For example, if yo ...

Northern Trust

... Important Disclosure Information (cont.) Structured securities, derivatives and options are complex instruments that are not suitable for every investor, may involve a high degree of risk, and may be appropriate investments only for sophisticated investors who are capable of understanding and assum ...

... Important Disclosure Information (cont.) Structured securities, derivatives and options are complex instruments that are not suitable for every investor, may involve a high degree of risk, and may be appropriate investments only for sophisticated investors who are capable of understanding and assum ...

Secrets for profiting in bull and bear markets

... Always have protective stop-loss. When set initial stop, pay less attention to 30 week MA and more to prior correction low. Place it below round number. After buy on breakout, place stop-loss below lower end of base. When trending, give it plenty of room and raise it after each substantial correctio ...

... Always have protective stop-loss. When set initial stop, pay less attention to 30 week MA and more to prior correction low. Place it below round number. After buy on breakout, place stop-loss below lower end of base. When trending, give it plenty of room and raise it after each substantial correctio ...

English

... shareholding in the company. Jean Pierre Cuoni, Chairman of EFG International, has announced his intention to step down as chairman by not seeking re-election at the Annual General Meeting in 2015, the twentieth anniversary year of the company he co-founded in 1995. He has taken this decision on acc ...

... shareholding in the company. Jean Pierre Cuoni, Chairman of EFG International, has announced his intention to step down as chairman by not seeking re-election at the Annual General Meeting in 2015, the twentieth anniversary year of the company he co-founded in 1995. He has taken this decision on acc ...

What is stock?

... in a company but typically doesn't come with the same voting rights. With preferred stock investors are usually guaranteed a fixed dividend forever. This is different than common stock, which has variable dividends that are affected by the market and never guaranteed. ...

... in a company but typically doesn't come with the same voting rights. With preferred stock investors are usually guaranteed a fixed dividend forever. This is different than common stock, which has variable dividends that are affected by the market and never guaranteed. ...

The Relationship between Share Price Gains, Corporate

... driven by their preference for the good performance of listed companies. The investors offer high for companies with good performance, and company can only bid low with their poor performance. The process makes capital cost difference, enables the optimization of resources allocation of stock market ...

... driven by their preference for the good performance of listed companies. The investors offer high for companies with good performance, and company can only bid low with their poor performance. The process makes capital cost difference, enables the optimization of resources allocation of stock market ...

O novo mercado ea regulamentação

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

securities trading policy

... Key Management Personnel need to be mindful of the market perception associated with any sale of Company securities and possibly the ability of the market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (ie a vo ...

... Key Management Personnel need to be mindful of the market perception associated with any sale of Company securities and possibly the ability of the market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (ie a vo ...

Basic Stock Valuation

... Subtract the firm’s debt to get the total value of equity. Divide by the number of shares to get the price per share. ...

... Subtract the firm’s debt to get the total value of equity. Divide by the number of shares to get the price per share. ...

Government Securities

... • a degree of capital protection with predictable returns • added diversification if you have a portfolio of higher-risk investments ...

... • a degree of capital protection with predictable returns • added diversification if you have a portfolio of higher-risk investments ...

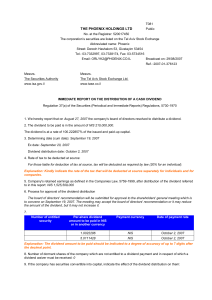

dividend

... 4. Rate of tax to be deducted at source: For those liable for deduction of tax at source, tax will be deducted as required by law (20% for an individual). Explanation: Kindly indicate the rate of the tax that will be deducted at source separately for individuals and for companies. 5. Company's retai ...

... 4. Rate of tax to be deducted at source: For those liable for deduction of tax at source, tax will be deducted as required by law (20% for an individual). Explanation: Kindly indicate the rate of the tax that will be deducted at source separately for individuals and for companies. 5. Company's retai ...

Lecture 9 Financial Exchanges

... If a regular “dumb” trader shows up and offers to buy, HFT firms will compete on price to fill the traders order. ...

... If a regular “dumb” trader shows up and offers to buy, HFT firms will compete on price to fill the traders order. ...

Lower Returns Likely in the Years Ahead

... The outlook for stocks: It is also easy to understand why we expect lower returns from stocks in the years ahead compared to the experience of recent years. The returns from stocks over the past five years have been outstanding, with the total return of the S&P 500 compounding at 17.3% annually. Mid ...

... The outlook for stocks: It is also easy to understand why we expect lower returns from stocks in the years ahead compared to the experience of recent years. The returns from stocks over the past five years have been outstanding, with the total return of the S&P 500 compounding at 17.3% annually. Mid ...

Technical Analysis - Feuz Cattle and Beef Market Analysis

... is trending lower, but occasionally it moves higher and corrects or retraces part of that move. After a brief correction, the market moves down again. Only in February and March was the market able to challenge the prior resistance plane. Sell orders placed just under the prior high would not have b ...

... is trending lower, but occasionally it moves higher and corrects or retraces part of that move. After a brief correction, the market moves down again. Only in February and March was the market able to challenge the prior resistance plane. Sell orders placed just under the prior high would not have b ...

DOC - LeMaitre Vascular

... Item 5.07. Submission of Matters to a Vote of Security Holders. On June 14, 2012, the Company held its Annual Meeting. A total of 15,219,922 shares of the Company’s common stock were entitled to vote as of April 16, 2012, the record date for the Annual Meeting, of which 13,484,306 were present in pe ...

... Item 5.07. Submission of Matters to a Vote of Security Holders. On June 14, 2012, the Company held its Annual Meeting. A total of 15,219,922 shares of the Company’s common stock were entitled to vote as of April 16, 2012, the record date for the Annual Meeting, of which 13,484,306 were present in pe ...

1 LISTING ON THE LUSAKA STOCK EXCHANGE (LuSE) Herewith

... minimum subscribed capital of K250,000.00 ...

... minimum subscribed capital of K250,000.00 ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.