Profit-oriented pricing

... good or service will increase when demand is great and decrease when demand is low 12. Market price: Actual price that prevails in a market at any particular moment 13. Market share: An organization’s portion of the total industry sales in a specific market 14. Mark-up: The difference between the co ...

... good or service will increase when demand is great and decrease when demand is low 12. Market price: Actual price that prevails in a market at any particular moment 13. Market share: An organization’s portion of the total industry sales in a specific market 14. Mark-up: The difference between the co ...

buying and selling securities (Quote and deal)

... Trading individual securities on a Quote and Deal basis allows you to see the trading price before you decide whether or not to continue with the transaction. You can also trade At Best, which is where orders across Elevate can be grouped and traded together to potentially reduce trading charges, al ...

... Trading individual securities on a Quote and Deal basis allows you to see the trading price before you decide whether or not to continue with the transaction. You can also trade At Best, which is where orders across Elevate can be grouped and traded together to potentially reduce trading charges, al ...

Information Regarding Optional Dividend

... You are requested to indicate your choice within the determined period, through your bank or stockbroker to ABN AMRO Bank N.V. (“ABN AMRO”), f.a.o. Corporate Broking (HQ7050), Antwoordnummer 46340, 1060 VD Amsterdam, the Netherlands. If you hold your shares in a custody account with a bank or stock ...

... You are requested to indicate your choice within the determined period, through your bank or stockbroker to ABN AMRO Bank N.V. (“ABN AMRO”), f.a.o. Corporate Broking (HQ7050), Antwoordnummer 46340, 1060 VD Amsterdam, the Netherlands. If you hold your shares in a custody account with a bank or stock ...

Further Reforms after the “BIG BANG”: The JGB Market

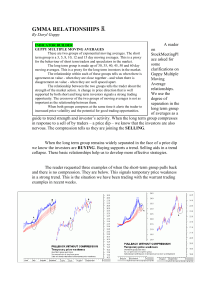

... Relation between the Hang Seng Index futures market and the underlying HIS component stock market strengthens with the introduction of short sales a. Contemporaneous Correlation ...

... Relation between the Hang Seng Index futures market and the underlying HIS component stock market strengthens with the introduction of short sales a. Contemporaneous Correlation ...

8.1 random walks and the efficient market hypothesis

... P/E ratio stocks have higher returns than do the portfolios of high P/E ratio stocks. Small firm (Size) Effect: Banz shows the historical performance of portfolios formed by dividing the NYSE into 10 porfolios each year according to the size. And found that average annual returns are higher on small ...

... P/E ratio stocks have higher returns than do the portfolios of high P/E ratio stocks. Small firm (Size) Effect: Banz shows the historical performance of portfolios formed by dividing the NYSE into 10 porfolios each year according to the size. And found that average annual returns are higher on small ...

Monthly Property Status Report

... Monthly Property Status Report To be submitted every 30 days from the original list date. Attach copies of advertising and MLS printout. ...

... Monthly Property Status Report To be submitted every 30 days from the original list date. Attach copies of advertising and MLS printout. ...

duETS™ US Commercial Property 2X

... The hypothetical returns provided in this document do not reflect actual trading and do not reflect the impact that material economic and market factors may have on those returns. Investors may experience materially different results from the returns depicted here. More complete information about ho ...

... The hypothetical returns provided in this document do not reflect actual trading and do not reflect the impact that material economic and market factors may have on those returns. Investors may experience materially different results from the returns depicted here. More complete information about ho ...

Vietnam Today: GAS leads market higher to break four-day

... Copyright 2013 Viet Capital Securities Company “VCSC”. All rights reserved. This report has been prepared on the basis of information believed to be reliable at the time of publication. VCSC makes no representation or warranty regarding the completeness and accuracy of such information. Opinions, es ...

... Copyright 2013 Viet Capital Securities Company “VCSC”. All rights reserved. This report has been prepared on the basis of information believed to be reliable at the time of publication. VCSC makes no representation or warranty regarding the completeness and accuracy of such information. Opinions, es ...

JETBLUE AIRWAYS CORP (Form: 3, Received: 03/02

... Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. If the form is filed by more than one reporting person, see Instruction 5(b)(v). ...

... Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. If the form is filed by more than one reporting person, see Instruction 5(b)(v). ...

Collective investment funds

... The société d’investissement à capital variable (SICAV), like investment companies, these have shareholders with voting rights and boards of directors. Luxembourg is their favoured home and many are sold right across Europe. And like unit trusts, they are able to take in new money by issuing new sha ...

... The société d’investissement à capital variable (SICAV), like investment companies, these have shareholders with voting rights and boards of directors. Luxembourg is their favoured home and many are sold right across Europe. And like unit trusts, they are able to take in new money by issuing new sha ...

Format of holding of specified securities Name of Listed Entity: Scrip

... (1) PAN would not be displayed on website of Stock Exchange(s). (2) The above format needs to be disclosed along with the name of following persons: Institutions/Non Institutions holding more than 1% of total number of shares. (3) W.r.t. the information pertaining to Depository Receipts, the same ma ...

... (1) PAN would not be displayed on website of Stock Exchange(s). (2) The above format needs to be disclosed along with the name of following persons: Institutions/Non Institutions holding more than 1% of total number of shares. (3) W.r.t. the information pertaining to Depository Receipts, the same ma ...

Perspectives September 2001.indd

... simultaneously sliding into a protracted recession and will support the capital markets in doing so. Putting Events in Perspective The prevailing gloom notwithstanding, there is good reason to be optimistic regarding the outlook for the equity markets and your portfolio over the coming year. The pas ...

... simultaneously sliding into a protracted recession and will support the capital markets in doing so. Putting Events in Perspective The prevailing gloom notwithstanding, there is good reason to be optimistic regarding the outlook for the equity markets and your portfolio over the coming year. The pas ...

Where Does Underwriting Fit in the Acquisition Process

... An LOI is signed giving buyer exclusive right to purchase the asset for a period of time and the buyer’s puts up a deposit (typically 10% of the purchase price). Buyer & seller begin negotiating PSA ...

... An LOI is signed giving buyer exclusive right to purchase the asset for a period of time and the buyer’s puts up a deposit (typically 10% of the purchase price). Buyer & seller begin negotiating PSA ...

Rare earth metals – will the next boom start here?

... As an investor seeking leverage to all resources, I have a well-documented bias towards precious metals stocks but I have also maintained an interest in rare elements and exotic metals - a subsector that few people seem aware of. As new technologies and high-tech products are developed, more and mor ...

... As an investor seeking leverage to all resources, I have a well-documented bias towards precious metals stocks but I have also maintained an interest in rare elements and exotic metals - a subsector that few people seem aware of. As new technologies and high-tech products are developed, more and mor ...

Market measures of performance and value

... of this company both internally and in the market. An important issue discussed in this chapter is why markets often value firms at many times their book value. Part of the explanation for this is that book values do not represent the current market value of all the assets listed in the balance shee ...

... of this company both internally and in the market. An important issue discussed in this chapter is why markets often value firms at many times their book value. Part of the explanation for this is that book values do not represent the current market value of all the assets listed in the balance shee ...

L4 bond1 - people.bath.ac.uk

... The quoted price is called the clean price In reality, investors pay the "dirty price", which is more than the clean price due to the accrued interests When the buyer buys the bond between two coupon payments, he must compensate the seller for the interest for the coupon interest earned since the la ...

... The quoted price is called the clean price In reality, investors pay the "dirty price", which is more than the clean price due to the accrued interests When the buyer buys the bond between two coupon payments, he must compensate the seller for the interest for the coupon interest earned since the la ...

Qunar Cayman Islands Limited - corporate

... the extraordinary general meeting, the shareholders of the Company voted to authorize and approve the Merger Agreement, the plan of merger substantially in the form attached as Annex A to the Merger Agreement (the “Plan of Merger”) and the transactions contemplated by the Merger Agreement, including ...

... the extraordinary general meeting, the shareholders of the Company voted to authorize and approve the Merger Agreement, the plan of merger substantially in the form attached as Annex A to the Merger Agreement (the “Plan of Merger”) and the transactions contemplated by the Merger Agreement, including ...

TITLE: Hidden `costs` with every choice we take AUTHOR: Dr

... Consumers, on the other hand, are assumed to have good knowledge of both. Indeed freemarket economics rests more heavily on the assumption that individuals know what’s best for them than on any other assumption. While it is relatively clear that individuals are best placed to decide what they want f ...

... Consumers, on the other hand, are assumed to have good knowledge of both. Indeed freemarket economics rests more heavily on the assumption that individuals know what’s best for them than on any other assumption. While it is relatively clear that individuals are best placed to decide what they want f ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.