Overview

... People evaluate a share's price based on how they believe its price will behave in the future -- rise or fall. Many factors can influence this perception including how the issuing company is viewed, how much and what kind of stock the company issues, and the general state of the economy . For instan ...

... People evaluate a share's price based on how they believe its price will behave in the future -- rise or fall. Many factors can influence this perception including how the issuing company is viewed, how much and what kind of stock the company issues, and the general state of the economy . For instan ...

DEBT INSTRUMENTS Government Debt Securities (GDS

... Bonds are debt securities issued by the government or joint stock corporations for borrowing purposes. The maturity terms of private sector bonds can be one year or more and may be issued with fixed or variable interest rates. Private sector bonds are mostly sold through a consortium consisting of m ...

... Bonds are debt securities issued by the government or joint stock corporations for borrowing purposes. The maturity terms of private sector bonds can be one year or more and may be issued with fixed or variable interest rates. Private sector bonds are mostly sold through a consortium consisting of m ...

• Always deal with the market intermediaries registered with SEBI

... Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and c ...

... Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and c ...

CTRIP COM INTERNATIONAL LTD (Form: SC 13G/A

... on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his ...

... on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his ...

What is a rights issue of shares?

... ◦ In the beginning of time, we used Gold Currency. Because Gold was cheap. Market fixed the price of Gold and printed Rs. 1 on the Gold Coin. It was its face value, but after sometime, Gold's price increased. Same 1Rs. Gold Coin's ...

... ◦ In the beginning of time, we used Gold Currency. Because Gold was cheap. Market fixed the price of Gold and printed Rs. 1 on the Gold Coin. It was its face value, but after sometime, Gold's price increased. Same 1Rs. Gold Coin's ...

Mid Cap Index Fund - Nationwide Financial

... economic or political conditions can affect the credit quality or value of an issuers securities. Entities providing credit support or a maturity-shortening structure also can be affected by these types of changes. If the structure of a security fails to function as intended, the security could decl ...

... economic or political conditions can affect the credit quality or value of an issuers securities. Entities providing credit support or a maturity-shortening structure also can be affected by these types of changes. If the structure of a security fails to function as intended, the security could decl ...

W08-Quiz4

... Paige is a conservative investor. She is in the top income bracket and would like to receive a tax break on her investment. Which type of investment would you suggest for her? The investment will be non-tax sheltered. a) Global telecommunications mutual fund b) GICs c) Blue chip stock d) Venture cap ...

... Paige is a conservative investor. She is in the top income bracket and would like to receive a tax break on her investment. Which type of investment would you suggest for her? The investment will be non-tax sheltered. a) Global telecommunications mutual fund b) GICs c) Blue chip stock d) Venture cap ...

Your Money - CSUB Home Page

... (usually a certain % spent, regardless of income), savings & taxes more money, ability to save more Also varies with age As age increases, spend more (%) on food, utilities and health care; less on taxes, SS ...

... (usually a certain % spent, regardless of income), savings & taxes more money, ability to save more Also varies with age As age increases, spend more (%) on food, utilities and health care; less on taxes, SS ...

Chapter 3: How Securities Are Traded

... banker? Might they be better off expressing little interest, in the hope that this will drive down the offering price? Truth is the better policy in this case because truth telling is rewarded. Shares of IPOs are allocated across investors in part based on the strength of each investor’s expressed i ...

... banker? Might they be better off expressing little interest, in the hope that this will drive down the offering price? Truth is the better policy in this case because truth telling is rewarded. Shares of IPOs are allocated across investors in part based on the strength of each investor’s expressed i ...

Despatch of Information Memorandum to Security Holders

... Memorandum. Each CDI will, in general terms, be equivalent to one existing ordinary share in the Company. If shareholders do not submit an election form, they will receive CDIs in exchange for their shares in the Company. As has previously been advised, shareholders will be able to choose between tr ...

... Memorandum. Each CDI will, in general terms, be equivalent to one existing ordinary share in the Company. If shareholders do not submit an election form, they will receive CDIs in exchange for their shares in the Company. As has previously been advised, shareholders will be able to choose between tr ...

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... WHEREAS, the Common Stock of this corporation is listed for trading on the American Stock Exchange ("AMEX"); and WHEREAS, it has been proposed to this Board of Directors that the Common Stock of this corporation be withdrawn from listing and resignation on AMEX and listed for trading on the Nasdaq N ...

... WHEREAS, the Common Stock of this corporation is listed for trading on the American Stock Exchange ("AMEX"); and WHEREAS, it has been proposed to this Board of Directors that the Common Stock of this corporation be withdrawn from listing and resignation on AMEX and listed for trading on the Nasdaq N ...

Tips for Investors in Volatile Markets

... In a volatile market, the limit order--an order placed with a brokerage to buy or sell at a predetermined amount of shares, and at or better than a specified price--is your friend. Limit orders typically cost slightly more than market orders but are always a good idea to use because the price at whi ...

... In a volatile market, the limit order--an order placed with a brokerage to buy or sell at a predetermined amount of shares, and at or better than a specified price--is your friend. Limit orders typically cost slightly more than market orders but are always a good idea to use because the price at whi ...

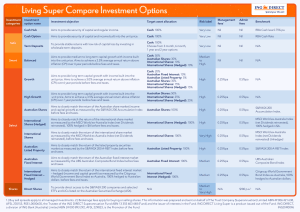

Living Super Compare Investments Options

... Aims to closely match the return of the international fixed interest market – hedged (income and capital growth) as measured by the Citigroup World Government Bond Index ex Australia, 100% hedged to Australian dollars before fees and taxes. ...

... Aims to closely match the return of the international fixed interest market – hedged (income and capital growth) as measured by the Citigroup World Government Bond Index ex Australia, 100% hedged to Australian dollars before fees and taxes. ...

4th Quarter 2013 Investor Newsletter

... malcy. Going forward, it would be reasonable to expect yields to continue to rise and bond prices to continue to fall, albeit ...

... malcy. Going forward, it would be reasonable to expect yields to continue to rise and bond prices to continue to fall, albeit ...

EquityCompass Share Buyback Strategy

... presented herein are as of the date indicated and are subject to change. EquityCompass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc., a wholly owned subsidiary and affiliated SEC registered investment adviser of Stifel Financial Corp. Portfolios based on Eq ...

... presented herein are as of the date indicated and are subject to change. EquityCompass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc., a wholly owned subsidiary and affiliated SEC registered investment adviser of Stifel Financial Corp. Portfolios based on Eq ...

Problem Set #1 Answers

... projected to be $300,000. EBIT will be 11 percent of sales, and the firm's tax rate is 40 percent. If AEC refinances its high interest bonds, what will be its projected ...

... projected to be $300,000. EBIT will be 11 percent of sales, and the firm's tax rate is 40 percent. If AEC refinances its high interest bonds, what will be its projected ...

The Great Depression

... Imagine that you were a wealthy stock market investor in the Roaring Twenties that has now been dramatically effected by the Great Depression. Write a letter (at least 3 paragraphs) to a friend or family member talking about your experiences with TWO of the following: Black Tuesday (you lost almos ...

... Imagine that you were a wealthy stock market investor in the Roaring Twenties that has now been dramatically effected by the Great Depression. Write a letter (at least 3 paragraphs) to a friend or family member talking about your experiences with TWO of the following: Black Tuesday (you lost almos ...

mid cap stocks - Disciplined Growth Investors

... with a market capitalization of $50 billion or above) have been the stars of this market cycle since 1994. With the exception of the Internet stocks, the broad stock market has been virtually ignored. Notwithstanding the recent stellar performance of the mega-cap stocks, it is our contention that th ...

... with a market capitalization of $50 billion or above) have been the stars of this market cycle since 1994. With the exception of the Internet stocks, the broad stock market has been virtually ignored. Notwithstanding the recent stellar performance of the mega-cap stocks, it is our contention that th ...

Buy 10 stocks. $10000 of each

... Diversify with at least three sectors and cap size As your students are choosing stocks for their portfolio, they should be including the sector/industry and cap size. I will use www.finance.yahoo.com for this example. ...

... Diversify with at least three sectors and cap size As your students are choosing stocks for their portfolio, they should be including the sector/industry and cap size. I will use www.finance.yahoo.com for this example. ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.