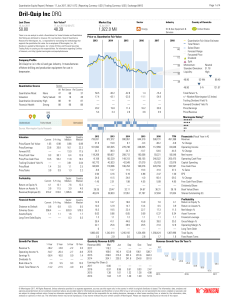

Dril-Quip Inc DRQ

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

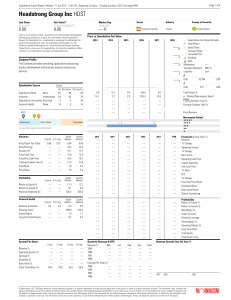

Headstrong Group Inc HDST

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

The Relationship between Organization Strategy, Fixed

... over-pursue the turnover of fixed assets. That means enterprises will have similar strategy if they improve quality, production cycle and relationship with partners and vendors by simulating each other. This will result in deterioration where there is no winner in the market so the investment risks ...

... over-pursue the turnover of fixed assets. That means enterprises will have similar strategy if they improve quality, production cycle and relationship with partners and vendors by simulating each other. This will result in deterioration where there is no winner in the market so the investment risks ...

Australian-Bankers-Association-Basel-III

... Basel Committee and FSB will be developing a D-SIFI framework for submission to the G-20 Ministers and Governors Meeting in November 2012. The ABA would be concerned if this resulted in a change to APRA’s current approach to addressing D-SIFI risk and resulted in additional capital requirements on D ...

... Basel Committee and FSB will be developing a D-SIFI framework for submission to the G-20 Ministers and Governors Meeting in November 2012. The ABA would be concerned if this resulted in a change to APRA’s current approach to addressing D-SIFI risk and resulted in additional capital requirements on D ...

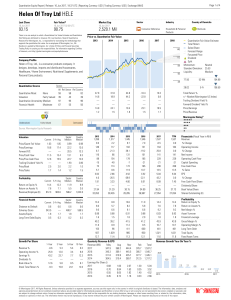

Helen Of Troy Ltd HELE

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

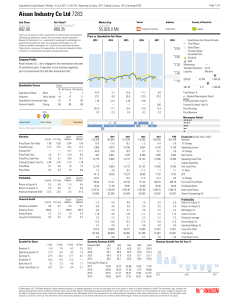

Aisan Industry Co Ltd 7283

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

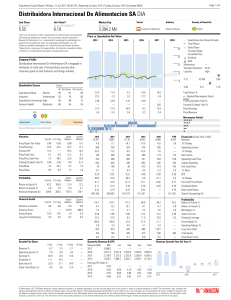

Distribuidora Internacional De Alimentacion SA DIA

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

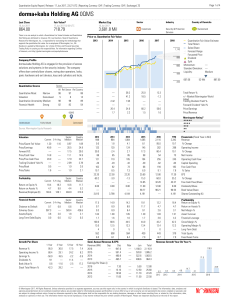

dorma+kaba Holding AG 0QMS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Co-operative Capital - Saint Mary`s University

... treat labour and materials as input costs to be minimized, if return on financial resources is to be maximized. 2. Co-operatives are open to all persons ‘able to use their services and willing to accept the responsibilities of membership.’ 11 Mutuality and participation are central to co-operation. ...

... treat labour and materials as input costs to be minimized, if return on financial resources is to be maximized. 2. Co-operatives are open to all persons ‘able to use their services and willing to accept the responsibilities of membership.’ 11 Mutuality and participation are central to co-operation. ...

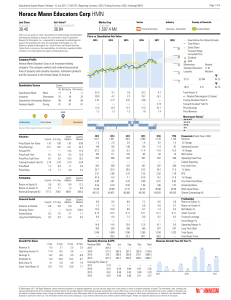

Horace Mann Educators Corp HMN

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

The relative asset pricing model

... spending objectives.8 In a survey of 32 global CIOs of a range of institutional funds, 62.5% stated that maximizing funded status was their primary objective (with additionally one response for “Fulfill obligations,” another for “Provide for as much as possible inflation adjusted pensions” and one f ...

... spending objectives.8 In a survey of 32 global CIOs of a range of institutional funds, 62.5% stated that maximizing funded status was their primary objective (with additionally one response for “Fulfill obligations,” another for “Provide for as much as possible inflation adjusted pensions” and one f ...

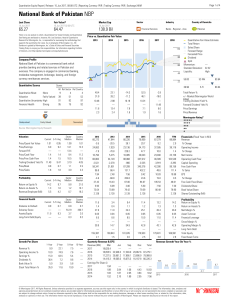

National Bank of Pakistan NBP

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

JZCP Annual Report and Financial Statements 2016

... longer-dated ZDPs with a 4.75% yield due October 2022. Furthermore, we completed a secondary sale of JZCP’s stake in six EuroMicrocap Fund 2010, L.P. (“EMC 2010”) assets to a major financial institution for its stated NAV of €96.3 million, which provides strong validation of our net asset value. JZC ...

... longer-dated ZDPs with a 4.75% yield due October 2022. Furthermore, we completed a secondary sale of JZCP’s stake in six EuroMicrocap Fund 2010, L.P. (“EMC 2010”) assets to a major financial institution for its stated NAV of €96.3 million, which provides strong validation of our net asset value. JZC ...

Vanguard Growth Index Fund

... investment vehicle) can rise or fall independently of changes in the broad market. The Fund is generally well protected from security specific risk through diversifying its holdings across a wide selection of available securities in the index. ▪ Derivative risk – A derivative is a contract or financ ...

... investment vehicle) can rise or fall independently of changes in the broad market. The Fund is generally well protected from security specific risk through diversifying its holdings across a wide selection of available securities in the index. ▪ Derivative risk – A derivative is a contract or financ ...

Why doesn’t Capital Flow from Rich to Poor Countries? An

... evidence shows that, for the period 1971−1998, the most important variable in explaining the Lucas paradox is the institutional quality. We find that this is a causal relationship that holds true even after controlling for other variables that might determine capital inflows. The work on institution ...

... evidence shows that, for the period 1971−1998, the most important variable in explaining the Lucas paradox is the institutional quality. We find that this is a causal relationship that holds true even after controlling for other variables that might determine capital inflows. The work on institution ...

the relationship betweeen financial leverage and

... securing financial leverage for such businesses may come at the cost of unfavorable interest rates and higher dividend payments for stockholders, which makes it more difficult to improve profitability. Businesses offering products or services with a demonstrable track record with consumers can often ...

... securing financial leverage for such businesses may come at the cost of unfavorable interest rates and higher dividend payments for stockholders, which makes it more difficult to improve profitability. Businesses offering products or services with a demonstrable track record with consumers can often ...

May 22, 2015 Investor Class shares to convert to Class A shares

... conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liqu ...

... conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liqu ...

1 - Sidley Austin LLP

... concern that if significant redemptions occur, the more liquid assets will be disposed of first, exposing the remaining shareholders to a fund with even less liquid assets. If such less liquid assets are sold to fund redemptions, the fund may only be able to sell such assets at prices that incorpora ...

... concern that if significant redemptions occur, the more liquid assets will be disposed of first, exposing the remaining shareholders to a fund with even less liquid assets. If such less liquid assets are sold to fund redemptions, the fund may only be able to sell such assets at prices that incorpora ...

Ethical Investment and Portfolio Theory

... rities’ avoidance index. This appears to make most FTSE investors sub-optimal, in that they could have produced better returns and lower risk simply by avoiding firms carrying out activities which (according to many charities) harm society. Note, however, that the increased return is only 0.08% high ...

... rities’ avoidance index. This appears to make most FTSE investors sub-optimal, in that they could have produced better returns and lower risk simply by avoiding firms carrying out activities which (according to many charities) harm society. Note, however, that the increased return is only 0.08% high ...

Corporate Governance and Investment in the 20th Century Japan: A

... ownership structure ranged from family firms with the high ownership of the founder to public firms with the relatively dispersed ownership. ...

... ownership structure ranged from family firms with the high ownership of the founder to public firms with the relatively dispersed ownership. ...

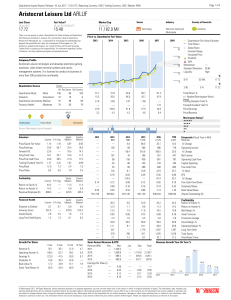

Aristocrat Leisure Ltd ARLUF

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Mutual Fund Performance and the Incentive to Generate Alpha

... (2012) suggest that competition in the broker-sold segment is likely to focus on characteristics other than alpha, such as the level of broker compensation. The weaker the sensitivity of investor flows to alpha, the weaker the incentive to generate alpha. Indeed, we find strong evidence that the un ...

... (2012) suggest that competition in the broker-sold segment is likely to focus on characteristics other than alpha, such as the level of broker compensation. The weaker the sensitivity of investor flows to alpha, the weaker the incentive to generate alpha. Indeed, we find strong evidence that the un ...

Investors` Horizons and the Amplification of Market Shocks

... returns after large price drops indicate that investors’ sales are not information driven (see, for instance, Coval and Stafford (2007)). Besides showing that the horizon of the shareholders holding a stock affects price drops and reversals in a robust way, we provide evidence supporting the causal ...

... returns after large price drops indicate that investors’ sales are not information driven (see, for instance, Coval and Stafford (2007)). Besides showing that the horizon of the shareholders holding a stock affects price drops and reversals in a robust way, we provide evidence supporting the causal ...

Student Study Notes - Chapter 5

... business will likely find that its ability to borrow money is severely diminished. If ...

... business will likely find that its ability to borrow money is severely diminished. If ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.