A New Approach to Equity Premium Prediction: Economic

... (2008) argue that a reasonable investor would not have used a model to forecast a negative equity premium. The positive forecast constraint is also implemented more recently by Pettenuzzo, Timmermann and Valkanov (2014), who motivate this constraint by arguing that risk-averse investors would not ho ...

... (2008) argue that a reasonable investor would not have used a model to forecast a negative equity premium. The positive forecast constraint is also implemented more recently by Pettenuzzo, Timmermann and Valkanov (2014), who motivate this constraint by arguing that risk-averse investors would not ho ...

Slide 1

... derivatives ( that were not effective hedging instruments) for the years FY ’08, ’09 , ’10 and ’11 the effect of which were under reporting of profits 1000 and 1500 for ’08 and ’09 respectively. Effect of ’10 and ’11 were over reporting of profit by 400 and 250 respectively. Derivatives get settled ...

... derivatives ( that were not effective hedging instruments) for the years FY ’08, ’09 , ’10 and ’11 the effect of which were under reporting of profits 1000 and 1500 for ’08 and ’09 respectively. Effect of ’10 and ’11 were over reporting of profit by 400 and 250 respectively. Derivatives get settled ...

Measuring the Benefits of Option Strategies For Portfolio Management

... the remainder of the year in order to preserve the current year gains. This can be accomplished via index put options, which generate income only when the stocks in the portfolio fall in value. A more detailed analysis of this example is presented in section 4. In summary, reasonable assumptions ab ...

... the remainder of the year in order to preserve the current year gains. This can be accomplished via index put options, which generate income only when the stocks in the portfolio fall in value. A more detailed analysis of this example is presented in section 4. In summary, reasonable assumptions ab ...

The Development of Collective Investment

... The Collective Investment Schemes (CIS) industry has been in existence in Uganda for six (6) years, the first and only Unit Trust Manager having started CIS operations in August 2004. In the last five (5) years the industry has grown from a Net Asset base of US$ 523,779 at the end of 2005 to US$ 1.9 ...

... The Collective Investment Schemes (CIS) industry has been in existence in Uganda for six (6) years, the first and only Unit Trust Manager having started CIS operations in August 2004. In the last five (5) years the industry has grown from a Net Asset base of US$ 523,779 at the end of 2005 to US$ 1.9 ...

The Emergence of the Corporate Form

... Things changed when, following the Civil War (1642-1648), the power of the English crown with respect to war and taxation was significantly limited.8 Consistently with our theory, in 1657 the new EIC charter granted by Cromwell provided the company with permanent capital. The Glorious Revolution (16 ...

... Things changed when, following the Civil War (1642-1648), the power of the English crown with respect to war and taxation was significantly limited.8 Consistently with our theory, in 1657 the new EIC charter granted by Cromwell provided the company with permanent capital. The Glorious Revolution (16 ...

Community Investment

... lend to enterprises that cannot offer personal guarantees, or have not built up sufficient reserves to cover the loan. Share capital offers an alternative way of raising investment finance. The money invested by shareholders is fully at risk: if the enterprise gets into financial difficulties and is ...

... lend to enterprises that cannot offer personal guarantees, or have not built up sufficient reserves to cover the loan. Share capital offers an alternative way of raising investment finance. The money invested by shareholders is fully at risk: if the enterprise gets into financial difficulties and is ...

Determinants of abnormal returns in mergers

... Acquisitions and mergers have become an important method for businesses to expand. In 2001, 8309 mergers and acquisitions were announced by U.S companies, with a value exceeding $700 billion. However, these amounts were even lower than the preceding years. In 2000, 1999 and 1998 the total value of m ...

... Acquisitions and mergers have become an important method for businesses to expand. In 2001, 8309 mergers and acquisitions were announced by U.S companies, with a value exceeding $700 billion. However, these amounts were even lower than the preceding years. In 2000, 1999 and 1998 the total value of m ...

Examples

... The participating preferred should protect the VC in the case of mediocre performances Unique investment structure: only have to put in money if milestones are met; combination of cumulative non-convertible preferred stock and regular convertible preferred has benefit that VC will be paid back most ...

... The participating preferred should protect the VC in the case of mediocre performances Unique investment structure: only have to put in money if milestones are met; combination of cumulative non-convertible preferred stock and regular convertible preferred has benefit that VC will be paid back most ...

The Case for Strategic Convertible Allocations

... and therefore convertible strategies may be used to diversify a traditional fixed-income portfolio (i.e., government bonds) as a high yield corporate bond allocation might. Additionally, convertibles with a range of characteristics can be used within alternative allocations, such as hedge strategies ...

... and therefore convertible strategies may be used to diversify a traditional fixed-income portfolio (i.e., government bonds) as a high yield corporate bond allocation might. Additionally, convertibles with a range of characteristics can be used within alternative allocations, such as hedge strategies ...

MyNorth PIMCO Diversified Fixed Interest Fund PDS

... AMP Capital. As part of the AMP Group we share a heritage that spans over 160 years. The Responsible Entity is responsible for the overall operation of the Fund and can be contacted on 1800 658 404. AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) - referred to in this PDS as 'AMP Cap ...

... AMP Capital. As part of the AMP Group we share a heritage that spans over 160 years. The Responsible Entity is responsible for the overall operation of the Fund and can be contacted on 1800 658 404. AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) - referred to in this PDS as 'AMP Cap ...

Friends Life Investment Bond Fund Guide

... tend to be much less volatile than other investments such as equities, a drawback is that the interest paid by the borrower can be lower than the rate of inflation and/or the charges for a Money Market fund, meaning that, in real terms, the investment may fall in value. Investments will typically in ...

... tend to be much less volatile than other investments such as equities, a drawback is that the interest paid by the borrower can be lower than the rate of inflation and/or the charges for a Money Market fund, meaning that, in real terms, the investment may fall in value. Investments will typically in ...

Optimal Consumption and Portfolio Choices with Risky

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

Forward Looking Statements Non-GAAP

... Facilities decrease is due to renewal timing. Retention: 90%. Facilities new business: $1.0M Lawyers’ professional liability is flat . Retention: 84%. LPL new business of $900,000 Medical technology nominally up due to higher premium rates on renewal business. New business: $1.2 mil offsetting reten ...

... Facilities decrease is due to renewal timing. Retention: 90%. Facilities new business: $1.0M Lawyers’ professional liability is flat . Retention: 84%. LPL new business of $900,000 Medical technology nominally up due to higher premium rates on renewal business. New business: $1.2 mil offsetting reten ...

Victory Capital Management Inc ADV Part 2A

... discussions only with certain clients in its sole discretion. Victory Capital will not, as a result of any such discussion, be limited in any way from purchasing or selling investments of any such issuer, including investments that may be or appear to be inconsistent with the views expressed in such ...

... discussions only with certain clients in its sole discretion. Victory Capital will not, as a result of any such discussion, be limited in any way from purchasing or selling investments of any such issuer, including investments that may be or appear to be inconsistent with the views expressed in such ...

CoCos: a primer - Bank for International Settlements

... specifically, since CoCos must be priced jointly with common equity, a dilutive CoCo conversion rate could make it possible for more than one pair of CoCo prices and equity prices to exist for any given combination of bank asset values and non-CoCo debt levels. Furthermore, under certain circumstanc ...

... specifically, since CoCos must be priced jointly with common equity, a dilutive CoCo conversion rate could make it possible for more than one pair of CoCo prices and equity prices to exist for any given combination of bank asset values and non-CoCo debt levels. Furthermore, under certain circumstanc ...

To hedge or not to hedge? Evaluating currency

... 4 One could argue for a dynamic, yet strategic, approach to currency management to capture the dynamic nature of currency-asset correlations. Although this is not our approach here, see Opie, Brown, and Dark (2012) for a discussion of dynamic currency hedging. 5 It is important to remember that a ...

... 4 One could argue for a dynamic, yet strategic, approach to currency management to capture the dynamic nature of currency-asset correlations. Although this is not our approach here, see Opie, Brown, and Dark (2012) for a discussion of dynamic currency hedging. 5 It is important to remember that a ...

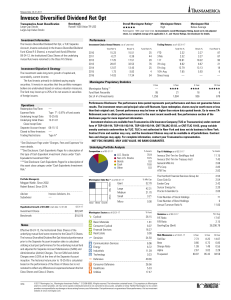

Invesco Diversified Dividend Ret Opt

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

PNC Capital Advisors, LLC

... including, but not limited to, potential growth, account size, and services rendered. As a result of mergers or acquisitions, PNC Capital Advisors also manages certain accounts on pre-existing legacy fee schedules that are different from those described above. In addition, PNC Capital Advisors provi ...

... including, but not limited to, potential growth, account size, and services rendered. As a result of mergers or acquisitions, PNC Capital Advisors also manages certain accounts on pre-existing legacy fee schedules that are different from those described above. In addition, PNC Capital Advisors provi ...

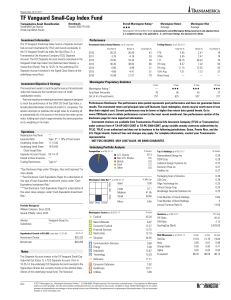

TF Vanguard Small-Cap Index Fund

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

A CLEAR AND SIMPLE

... We’ve summarised the main asset types below. Deposits This term is used to describe investments such as cash. They work in much the same way as a bank or building society account. Investments are put on deposit with a financial institution where they earn interest. Deposits are generally considered ...

... We’ve summarised the main asset types below. Deposits This term is used to describe investments such as cash. They work in much the same way as a bank or building society account. Investments are put on deposit with a financial institution where they earn interest. Deposits are generally considered ...

annex - Financial Ombudsman

... Splits generally held shares yielding roughly twice as much as the market and such shares had recently been out of favour. The report felt the claims of the zero holders would take most of the capital growth achieved and stated “The only shareholders who are set to do as well as they are expected ar ...

... Splits generally held shares yielding roughly twice as much as the market and such shares had recently been out of favour. The report felt the claims of the zero holders would take most of the capital growth achieved and stated “The only shareholders who are set to do as well as they are expected ar ...

here - TIAA

... Lifecycle Funds from a beta perspective (i.e., a broadening of the investment universe), and given the risk profile of real estate, should provide substantial diversification benefits. Historically, direct real estate has exhibited low performance correlations to equities and fixed income, and has p ...

... Lifecycle Funds from a beta perspective (i.e., a broadening of the investment universe), and given the risk profile of real estate, should provide substantial diversification benefits. Historically, direct real estate has exhibited low performance correlations to equities and fixed income, and has p ...

Dreyfus Variable Investment Fund: International Value Portfolio

... country; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales outside the United States. The fund may invest in companies of any size. The fund invests principally in common stocks, but its stock investm ...

... country; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales outside the United States. The fund may invest in companies of any size. The fund invests principally in common stocks, but its stock investm ...

Balanced Income Portfolio Interim Management Report of Fund

... Information presented is for the period from December 15, 2015 to December 31, 2015. Ratio has been annualized. This information is presented as at June 30, 2016 and December 31 of the period(s) shown. Management expense ratio is based on the total expenses of the pool (excluding commissions and oth ...

... Information presented is for the period from December 15, 2015 to December 31, 2015. Ratio has been annualized. This information is presented as at June 30, 2016 and December 31 of the period(s) shown. Management expense ratio is based on the total expenses of the pool (excluding commissions and oth ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.