Dreyfus Variable Investment Fund: International Value Portfolio

... country; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales outside the United States. The fund may invest in companies of any size. The fund invests principally in common stocks, but its stock investm ...

... country; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales outside the United States. The fund may invest in companies of any size. The fund invests principally in common stocks, but its stock investm ...

Design of Financial Securities: Empirical Evidence from Private-label RMBS Deals

... We provide further evidence in support of private information content of equity tranche by exploiting the passage of Anti-Predatory Lending (APL) laws across several states during our sample period. These laws put stricter requirements on the lenders in terms of their lending practices and disclosur ...

... We provide further evidence in support of private information content of equity tranche by exploiting the passage of Anti-Predatory Lending (APL) laws across several states during our sample period. These laws put stricter requirements on the lenders in terms of their lending practices and disclosur ...

Endogenous risk in a DSGE model with capital-constrained …nancial intermediaries Hans Dewachter

... In this endogenous risk literature, …nancial risk is modelled consistently with the stochastic discount factor of the marginal investor. Typically, only …nancial intermediaries are assumed to invest directly in capital or in …rm assets and therefore, these institutions are key to risk pricing. Model ...

... In this endogenous risk literature, …nancial risk is modelled consistently with the stochastic discount factor of the marginal investor. Typically, only …nancial intermediaries are assumed to invest directly in capital or in …rm assets and therefore, these institutions are key to risk pricing. Model ...

How Ownership Structure Affects Capital Structure and Firm

... may give rise to serious agency problems due to deviation from one-share-one-vote, pyramiding schemes and/or crossholding. When a large shareholder keeps significant control rights with relatively small cash flow rights, s/he may be averse to increasing outside equity financing because the latter ma ...

... may give rise to serious agency problems due to deviation from one-share-one-vote, pyramiding schemes and/or crossholding. When a large shareholder keeps significant control rights with relatively small cash flow rights, s/he may be averse to increasing outside equity financing because the latter ma ...

Payoff complementarities and financial fragility Evidence from

... (NAV) investors get when they redeem their shares. Instead, they are mostly imposed on investors who keep their money in the fund. The reason is that the NAV at which investors can buy and sell their shares in the funds is calculated using the same-day market close prices of the underlying securitie ...

... (NAV) investors get when they redeem their shares. Instead, they are mostly imposed on investors who keep their money in the fund. The reason is that the NAV at which investors can buy and sell their shares in the funds is calculated using the same-day market close prices of the underlying securitie ...

Mobilizing Private Capital for Public Good: Priorities for Canada

... they are for-profit or non-profit enterprises, funds or other financial vehicles) are intentionally constructed to seek financial and social value. 3. Impact measurement: Investors and investees are able to demonstrate how these stated intentions translate into ...

... they are for-profit or non-profit enterprises, funds or other financial vehicles) are intentionally constructed to seek financial and social value. 3. Impact measurement: Investors and investees are able to demonstrate how these stated intentions translate into ...

Default Option Exercise over the Financial Crisis and Beyond

... regulatory antecedents to the 2000s mortgage crisis (see, for example, Gerardi, et al, 2008; Mayer, Pence and Sherlund, 2009; Demyanyk and Van Hemert, 2009; Mian and Sufi, 2009; Keys, et al, 2010; Haughwout, et al, 2011; An, Deng and Gabriel, 2011; Agarwal et al, 2011, 2012, 2013(a), 2013(b), 2015; ...

... regulatory antecedents to the 2000s mortgage crisis (see, for example, Gerardi, et al, 2008; Mayer, Pence and Sherlund, 2009; Demyanyk and Van Hemert, 2009; Mian and Sufi, 2009; Keys, et al, 2010; Haughwout, et al, 2011; An, Deng and Gabriel, 2011; Agarwal et al, 2011, 2012, 2013(a), 2013(b), 2015; ...

Understanding and measuring finance for productive investment

... heavily dependent on bank funding or internal funds. The investment decisions of small firms, which account for around 30% of total business investment, are likely to be sensitive to their access to external finance. Surveys show that small firm access to finance remains an issue, but it now affects ...

... heavily dependent on bank funding or internal funds. The investment decisions of small firms, which account for around 30% of total business investment, are likely to be sensitive to their access to external finance. Surveys show that small firm access to finance remains an issue, but it now affects ...

Promotion of unregulated collective investment schemes

... scheme funds that are not structured as unregulated collective investment schemes are outside of the scope. A number of other arrangements which are fund like but do not take the form of a non mainstream pooled investment will therefore remain unaffected by the new rules. The FCA have also confirmed ...

... scheme funds that are not structured as unregulated collective investment schemes are outside of the scope. A number of other arrangements which are fund like but do not take the form of a non mainstream pooled investment will therefore remain unaffected by the new rules. The FCA have also confirmed ...

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

... Corporation (hereinafter referred to as the “COMPANY”), is offering by means of this Confidential Private Placement Memorandum a minimum of F o u r (4) and a maximum of Two Hundred (200) Unsecured Promissory Notes (“Notes”) at an offering price of Five Hundred Thousand ($500,000) Dollars per Note, f ...

... Corporation (hereinafter referred to as the “COMPANY”), is offering by means of this Confidential Private Placement Memorandum a minimum of F o u r (4) and a maximum of Two Hundred (200) Unsecured Promissory Notes (“Notes”) at an offering price of Five Hundred Thousand ($500,000) Dollars per Note, f ...

Basics and Problems - Ace MBAe Finance Specialization

... The comparison to the aggregate economy is important because almost all firms are influenced by the economy’s expansions and contractions (recessions) in the business cycle. For example, it is unreasonable to expect an increase in the profit margin for a firm during a recession; a stable margin migh ...

... The comparison to the aggregate economy is important because almost all firms are influenced by the economy’s expansions and contractions (recessions) in the business cycle. For example, it is unreasonable to expect an increase in the profit margin for a firm during a recession; a stable margin migh ...

Tilburg University The Economic Benefits of Political Connections in

... The increase in links between business and politics between 1895 and 1900 is fairly large. The average MP elected in 1900 held 1.29 directorships, compared to 1.08 in 1895. This increase came from more directorships held by English and Welsh MPs, and the increase was felt in London, provincial citi ...

... The increase in links between business and politics between 1895 and 1900 is fairly large. The average MP elected in 1900 held 1.29 directorships, compared to 1.08 in 1895. This increase came from more directorships held by English and Welsh MPs, and the increase was felt in London, provincial citi ...

14-0187 Attachment - Settlement Agreement - Afam Elue

... Services Inc., IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficient and competitive capital markets. IIROC carries out its regulatory responsibilities through setting and enforcing rules regarding the pr ...

... Services Inc., IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficient and competitive capital markets. IIROC carries out its regulatory responsibilities through setting and enforcing rules regarding the pr ...

“ЗАТВЕРДЖЕНО”

... Securities value, which Fund owns on the proprietary right shall be not less than 70 (seventy) % of average annual Fund’s assets value; Securities value, which Fund owns on the proprietary right and which don’t have quotation in stock exchange or TIS can’t be more than 50 (fifty) percent of average ...

... Securities value, which Fund owns on the proprietary right shall be not less than 70 (seventy) % of average annual Fund’s assets value; Securities value, which Fund owns on the proprietary right and which don’t have quotation in stock exchange or TIS can’t be more than 50 (fifty) percent of average ...

Safe Primer - Y Combinator

... 3. A simple equity security has the potential to become standardized, and a standardized form has the benefits of certainty and speed, which in turn results in lower (or zero) transaction costs for companies and investors. When Most startups need to raise money soon after formation in order to fund ...

... 3. A simple equity security has the potential to become standardized, and a standardized form has the benefits of certainty and speed, which in turn results in lower (or zero) transaction costs for companies and investors. When Most startups need to raise money soon after formation in order to fund ...

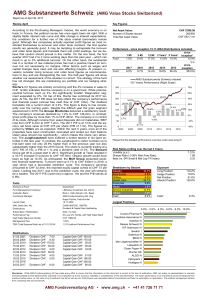

AMG Substanzwerte Schweiz (AMG Value Stocks

... track. In France, the political course has once again been set right. With a slightly flatter interest rate curve and little change in interest expectations, the conditions for a further rise of the stock market barometers remain good. Although few companies actually reported profit figures as most ...

... track. In France, the political course has once again been set right. With a slightly flatter interest rate curve and little change in interest expectations, the conditions for a further rise of the stock market barometers remain good. Although few companies actually reported profit figures as most ...

Revenue Sharing Fund Families

... certain elements of the fund’s shareholder information. We charge these remaining funds a networking fee of up to $11 per year per position held by our clients. Although Morgan Stanley provides additional services to funds where positions are held on an omnibus basis, the fact that the administrativ ...

... certain elements of the fund’s shareholder information. We charge these remaining funds a networking fee of up to $11 per year per position held by our clients. Although Morgan Stanley provides additional services to funds where positions are held on an omnibus basis, the fact that the administrativ ...

Inside Debt and Corporate Investment

... debtholders) after initiating debt financing is commonly referred to as “asset substitution” or “risk-shifting.” Fixed claimants, of course, understand these incentives and will protect themselves by charging higher interest rates, by imposing restrictive covenants or collateral requirements, and th ...

... debtholders) after initiating debt financing is commonly referred to as “asset substitution” or “risk-shifting.” Fixed claimants, of course, understand these incentives and will protect themselves by charging higher interest rates, by imposing restrictive covenants or collateral requirements, and th ...

proyecto de escisión - Precio de Cementos Pacasmayo

... The main economic factors that support the Spin-off are: ...

... The main economic factors that support the Spin-off are: ...

A Proposal to Limit the Anti-Competitive Power of Institutional Investors

... policy makers. Institutional investors, often considered a benign force in capital markets, have reduced competition in some sectors of the US economy. The tool to counteract anticompetitive investments, the Clayton Act, is of course already in force. Long ago the Supreme Court established the relev ...

... policy makers. Institutional investors, often considered a benign force in capital markets, have reduced competition in some sectors of the US economy. The tool to counteract anticompetitive investments, the Clayton Act, is of course already in force. Long ago the Supreme Court established the relev ...

Infrastructure Investment Policy Blueprint

... Viable role for investors. Prioritize projects for private-sector financing that are most likely to interest investors and achieve value for money for the public. Capital recycling, whereby existing brownfield assets are either leased or sold to raise funds for greenfield projects, should be c ...

... Viable role for investors. Prioritize projects for private-sector financing that are most likely to interest investors and achieve value for money for the public. Capital recycling, whereby existing brownfield assets are either leased or sold to raise funds for greenfield projects, should be c ...

FinancingPatterns Aug2004-revisions - Research portal

... has been receiving subsidies from national or local authorities. Most importantly, we also have information on how important firms consider financing obstacles to be in affecting the operation and growth of their business. Using this information to distinguish financially-constrained from unconstra ...

... has been receiving subsidies from national or local authorities. Most importantly, we also have information on how important firms consider financing obstacles to be in affecting the operation and growth of their business. Using this information to distinguish financially-constrained from unconstra ...

A Natural Experiment on Dynamic Asset Allocation

... setting. Shefrin and Statman (2000) develop a behavioral portfolio theory in which multiple layers of investments are segmented from one another. They argue that popular advice is constructed as a pyramid: cash in the bottom (risk-free) layer, bonds in the middle (less risky) layer, and stocks in t ...

... setting. Shefrin and Statman (2000) develop a behavioral portfolio theory in which multiple layers of investments are segmented from one another. They argue that popular advice is constructed as a pyramid: cash in the bottom (risk-free) layer, bonds in the middle (less risky) layer, and stocks in t ...

Cowen Group, Inc. - Investor Overview

... Financial Condition and Results of Operations”) that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expec ...

... Financial Condition and Results of Operations”) that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expec ...

Volatility and Premiums in US Equity Returns

... uncertainty about investment outcomes (labeled Prob < 0, E(RM – RF) uncertain). Uncertainty about true expected premiums has little effect on the uncertainty about the premiums for a one-year holding period. For example, recognizing our uncertainty about the expected value increases the probability ...

... uncertainty about investment outcomes (labeled Prob < 0, E(RM – RF) uncertain). Uncertainty about true expected premiums has little effect on the uncertainty about the premiums for a one-year holding period. For example, recognizing our uncertainty about the expected value increases the probability ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.