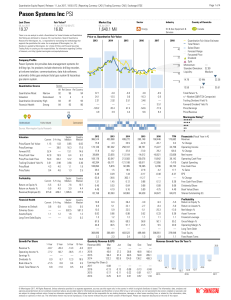

Pason Systems Inc PSI

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

CHAPTER 2

... Benser’s profitability, as measured by the amount of income available for each share of common stock, increased by 33 percent (($1.29 – $0.97)/$0.97) during 2014. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we canno ...

... Benser’s profitability, as measured by the amount of income available for each share of common stock, increased by 33 percent (($1.29 – $0.97)/$0.97) during 2014. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we canno ...

FREE Sample Here - Find the cheapest test bank for your

... shares when they decide to sell them, so today stock dividends are used far more often than stock splits. c. When a company declares a stock split, the price of the stock typically declines—by about 50% after a 2-for-1 split—and this necessarily reduces the total market value of the equity. d. If a ...

... shares when they decide to sell them, so today stock dividends are used far more often than stock splits. c. When a company declares a stock split, the price of the stock typically declines—by about 50% after a 2-for-1 split—and this necessarily reduces the total market value of the equity. d. If a ...

Gold and Precious Metals Fund

... In accordance with its power to decide whether the Contribution to the Receiving Fund is in the interest of shareholders as provided in article 5 of the articles of incorporation of Schroder Alternative Solutions, the board of directors of Schroder Alternative Solutions, after considerable analysis ...

... In accordance with its power to decide whether the Contribution to the Receiving Fund is in the interest of shareholders as provided in article 5 of the articles of incorporation of Schroder Alternative Solutions, the board of directors of Schroder Alternative Solutions, after considerable analysis ...

Evaluation of Firm Performance

... performance It is important to keep in mind that it is not necessary to use all of these ratios in performing a ratio analysis. Selection of the ratios to be examined will depend on the particular individual’s perspective and objectives. For example, suppliers and short-term creditors are likely to ...

... performance It is important to keep in mind that it is not necessary to use all of these ratios in performing a ratio analysis. Selection of the ratios to be examined will depend on the particular individual’s perspective and objectives. For example, suppliers and short-term creditors are likely to ...

QUESTIONS

... more accurate than the carrying values if the historical cost figures are out of date. Answer (D) is incorrect. The amount another company would pay would be based on fair values, not book values. ...

... more accurate than the carrying values if the historical cost figures are out of date. Answer (D) is incorrect. The amount another company would pay would be based on fair values, not book values. ...

Information Statement MNTRUST

... with a fixed maturity. All Participants of the Fund are eligible to participate in any Term Series Portfolio. Each Participant determines whether to participate in a Term Series Portfolio, and makes its own independent investment decision. The Investment Advisor selects investments for the Term Seri ...

... with a fixed maturity. All Participants of the Fund are eligible to participate in any Term Series Portfolio. Each Participant determines whether to participate in a Term Series Portfolio, and makes its own independent investment decision. The Investment Advisor selects investments for the Term Seri ...

2nd Con Doc on NBNI G

... (NBNI) financial entities. In response to the G20 request, the FSB tasked its Workstream on Other Shadow Banking Entities (WS3) to prepare, in consultation with IOSCO, proposed assessment methodologies for identifying NBNI global systemically important financial institutions (NBNI G-SIFIs), as part ...

... (NBNI) financial entities. In response to the G20 request, the FSB tasked its Workstream on Other Shadow Banking Entities (WS3) to prepare, in consultation with IOSCO, proposed assessment methodologies for identifying NBNI global systemically important financial institutions (NBNI G-SIFIs), as part ...

Property Portfolio - Falcon Real Estate Investment

... investors in U.S. real estate. Many of the services provided to our clients are similar to those provided by international private banks. The real estate professionals on Falcon’s staff are selected because they understand the need to provide expert real estate advice, while at the same time providi ...

... investors in U.S. real estate. Many of the services provided to our clients are similar to those provided by international private banks. The real estate professionals on Falcon’s staff are selected because they understand the need to provide expert real estate advice, while at the same time providi ...

An Evaluation of Money Market Fund Reform Proposals

... risk-taking. Of the reform proposals, only capital-based solutions reduce ex ante incentives for risktaking. Capital-based solutions also maintain the current fixed NAV structure for ordinary MMF investors and thus preserve any transactional benefits those investors reap from the existing system. In ...

... risk-taking. Of the reform proposals, only capital-based solutions reduce ex ante incentives for risktaking. Capital-based solutions also maintain the current fixed NAV structure for ordinary MMF investors and thus preserve any transactional benefits those investors reap from the existing system. In ...

FORM 10-Q - Investor Overview

... Financial Condition and Results of Operations”) that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expec ...

... Financial Condition and Results of Operations”) that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expec ...

Successful Activist Board Engagement

... whose shares they hold. In sum, hedge funds are better positioned to act as informed monitors than other institutional investors. The growing literature with respect to shareholder activism identifies a significant positive stock price reaction for targeted companies with the announcement of an acti ...

... whose shares they hold. In sum, hedge funds are better positioned to act as informed monitors than other institutional investors. The growing literature with respect to shareholder activism identifies a significant positive stock price reaction for targeted companies with the announcement of an acti ...

long-term portfolio guide - Responsible Investment Association

... portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of institutional investors and many public companies continue to exhibit excessive short-termism, which is often reinf ...

... portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of institutional investors and many public companies continue to exhibit excessive short-termism, which is often reinf ...

Brand equity, Age and the number of employees are in all models

... 3.5 Scope of the paper This research will examine an in depth view on attitudinal measures in their relationship with firm value controlling for company variables (e.g. age, r&d, number of employees). Including a more detailed set of mind metrics (e.g. dimensions) on attitudinal measures (e.g. brand ...

... 3.5 Scope of the paper This research will examine an in depth view on attitudinal measures in their relationship with firm value controlling for company variables (e.g. age, r&d, number of employees). Including a more detailed set of mind metrics (e.g. dimensions) on attitudinal measures (e.g. brand ...

hedge fund headlines mislead

... With over 10,000 hedge funds finding and repeatedly exploiting opportunities in financial markets and many funds following similar strategies, trades can become “crowded,” reducing their potential risk-adjusted return. The flow of capital to passive investment management has negatively affected grow ...

... With over 10,000 hedge funds finding and repeatedly exploiting opportunities in financial markets and many funds following similar strategies, trades can become “crowded,” reducing their potential risk-adjusted return. The flow of capital to passive investment management has negatively affected grow ...

Moving from private to public ownership: Selling out to

... public firms. He suggests that the transactions result from synergy considerations, not corporate control issues. Camerlynck and Ooghe (2000) examine a sample of private Belgium firm takeovers from 1992-1994. They also find that private firms involved in sell-outs are, on average, more profitable t ...

... public firms. He suggests that the transactions result from synergy considerations, not corporate control issues. Camerlynck and Ooghe (2000) examine a sample of private Belgium firm takeovers from 1992-1994. They also find that private firms involved in sell-outs are, on average, more profitable t ...

The properties of hedge fund investors* actual returns

... existing evidence is based on self-reported data with attendant self-selection biases, e.g., Fung and Hsieh (1997b), Brown, Goetzmann and Ibbotson (1999) and Brown, Goetzmann and Park (2001). Specifically, since poor-performing funds are less likely to report their results, the resulting sample has ...

... existing evidence is based on self-reported data with attendant self-selection biases, e.g., Fung and Hsieh (1997b), Brown, Goetzmann and Ibbotson (1999) and Brown, Goetzmann and Park (2001). Specifically, since poor-performing funds are less likely to report their results, the resulting sample has ...

collective investment schemes in emerging markets

... pool resources of many small savers, generating a large pool of resources which they then invest in a variety of assets like shares, bonds, futures and property with the sole purpose of generating high returns. Consequently, CIS have been instrumental in raising the financial sophistication of the p ...

... pool resources of many small savers, generating a large pool of resources which they then invest in a variety of assets like shares, bonds, futures and property with the sole purpose of generating high returns. Consequently, CIS have been instrumental in raising the financial sophistication of the p ...

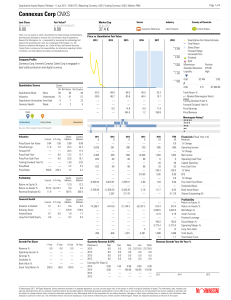

Connexus Corp CNXS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

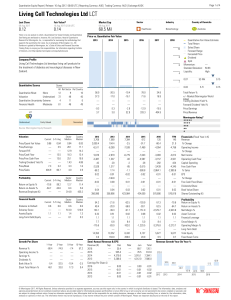

Living Cell Technologies Ltd LCT

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Liquidity Shocks and the Business Cycle: What next?

... classes deterministic steady states.4 One region is entirely governed by the dynamics of real business cycle model. In the other region liquidity shocks play the role of shocks to the efficiency of investment providing an additional source of fluctuations.5 This region is characterized by binding en ...

... classes deterministic steady states.4 One region is entirely governed by the dynamics of real business cycle model. In the other region liquidity shocks play the role of shocks to the efficiency of investment providing an additional source of fluctuations.5 This region is characterized by binding en ...

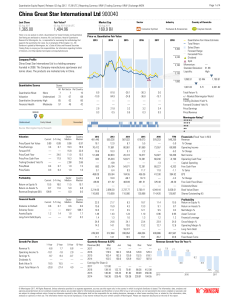

China Great Star International Ltd 900040

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

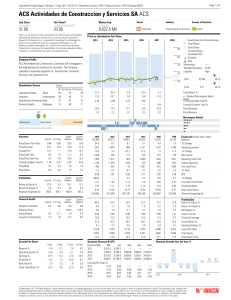

ACS Actividades de Construccion y Servicios SA ACS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

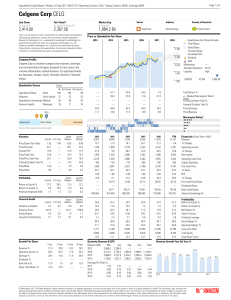

Celgene Corp CELG

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

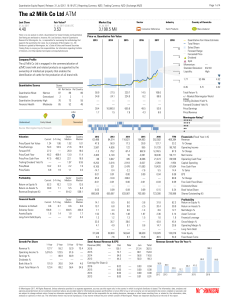

The a2 Milk Co Ltd ATM

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.