Understanding Investor Preferences for Mutual Fund Information

... » On average, investors consider nine discrete pieces of information about a fund before purchasing shares. Nearly three-quarters of recent fund investors wanted to know about the fund’s fees and expenses prior to purchasing shares in the fund, and more than two-thirds reviewed or asked questions ab ...

... » On average, investors consider nine discrete pieces of information about a fund before purchasing shares. Nearly three-quarters of recent fund investors wanted to know about the fund’s fees and expenses prior to purchasing shares in the fund, and more than two-thirds reviewed or asked questions ab ...

Does portfolio manager ownership affect fund performance? Finnish

... As a part of the increased regulation of mutual fund companies, the SEC has lately put a lot of effort to improve the transparency of the industry in the U.S. One of the new regulations came effective on March 2005, since when all portfolio managers have been required to disclose how much of their p ...

... As a part of the increased regulation of mutual fund companies, the SEC has lately put a lot of effort to improve the transparency of the industry in the U.S. One of the new regulations came effective on March 2005, since when all portfolio managers have been required to disclose how much of their p ...

Optimal Asset Location and Allocation with Taxable and Tax

... When investors have unrestricted borrowing opportunities in the taxable account, the optimal asset location policy involves allocating the entire taxdeferred account to taxable bonds. Investors then combine either borrowing or lending with investment in equity in the taxable account to achieve their ...

... When investors have unrestricted borrowing opportunities in the taxable account, the optimal asset location policy involves allocating the entire taxdeferred account to taxable bonds. Investors then combine either borrowing or lending with investment in equity in the taxable account to achieve their ...

Market Risk, Mortality Risk, and Sustainable Retirement

... stocks are less risky over longer time horizons than they are over shorter ones, (ii) the higher expected returns associated with equity are necessary to meet the higher obligations typically faced by younger investors, and (iii) younger people have more years in which to produce labor income with w ...

... stocks are less risky over longer time horizons than they are over shorter ones, (ii) the higher expected returns associated with equity are necessary to meet the higher obligations typically faced by younger investors, and (iii) younger people have more years in which to produce labor income with w ...

Chapter 15: Raising Capital

... ventures (private business enterprises) Individual venture capitalist - invest their own money Venture capital firms - specialize in pooling funds from various sources and investing them ...

... ventures (private business enterprises) Individual venture capitalist - invest their own money Venture capital firms - specialize in pooling funds from various sources and investing them ...

lloyds investment funds limited

... To be invested primarily in a diversified portfolio of European (excluding the United Kingdom) equities and from time to time in securities convertible into equities. ...

... To be invested primarily in a diversified portfolio of European (excluding the United Kingdom) equities and from time to time in securities convertible into equities. ...

IDRT

... plan participants. We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more than 90 days’ notice to participants when adding or closing an investment option(s) under the plan, including share class/rate leve ...

... plan participants. We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more than 90 days’ notice to participants when adding or closing an investment option(s) under the plan, including share class/rate leve ...

NBER WORKING PAPER SERIES RISK SHIFTING VERSUS RISK MANAGEMENT:

... increases in pension benefits. This works because pension benefits are tied to real wages, which are positively correlated with stock returns. Thus, if firms are investing optimally then their equity investing may be a hedge against increases in the wage-linked components of benefits.1 Another plau ...

... increases in pension benefits. This works because pension benefits are tied to real wages, which are positively correlated with stock returns. Thus, if firms are investing optimally then their equity investing may be a hedge against increases in the wage-linked components of benefits.1 Another plau ...

annual report

... standalone valuation well in excess of 50% of Amazon’s total enterof safe-haven assets as the low/negative interest rate environment prise value. A dominant platform in China’s social internet, Tencent continued to attract domestic and foreign investors to highreported revenue growth and margins tha ...

... standalone valuation well in excess of 50% of Amazon’s total enterof safe-haven assets as the low/negative interest rate environment prise value. A dominant platform in China’s social internet, Tencent continued to attract domestic and foreign investors to highreported revenue growth and margins tha ...

Proposals to Enhance Regulatory Safeguards for Investors in the

... (iii) Consignment arrangements – Where A purchases goods from B, but places the goods on consignment with B. B will act as agent for the purpose of sale of the goods, and if unable to find a buyer, will return the goods to A. (iv) Sale and lease-back arrangements – Where A purchases property from B, ...

... (iii) Consignment arrangements – Where A purchases goods from B, but places the goods on consignment with B. B will act as agent for the purpose of sale of the goods, and if unable to find a buyer, will return the goods to A. (iv) Sale and lease-back arrangements – Where A purchases property from B, ...

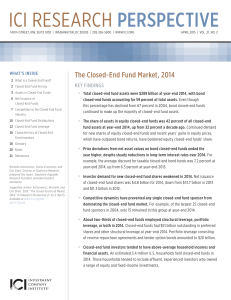

The Closed-End Fund Market, 2014

... common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also are permitted to issue one class of preferred shares in ad ...

... common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also are permitted to issue one class of preferred shares in ad ...

reinventing venture capital towards a new economic

... each fund is on a par with the leading US venture capital funds. Creating four or five private ‘super-funds’ would allow each fund to manage a portfolio of high-risk investments in the way that the leading US funds are able to do, rather than being forced into a ‘safety-first’ investment strategy th ...

... each fund is on a par with the leading US venture capital funds. Creating four or five private ‘super-funds’ would allow each fund to manage a portfolio of high-risk investments in the way that the leading US funds are able to do, rather than being forced into a ‘safety-first’ investment strategy th ...

overweight - TD Ameritrade

... Performance data quoted represents past performance, which does not guarantee future results. Investment return and principal value of investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than ...

... Performance data quoted represents past performance, which does not guarantee future results. Investment return and principal value of investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than ...

De Nederlandsche Bank Monetary and Economic Policy

... where δ it is the adjustment parameter representing the magnitude of adjustment during one period (also termed the adjustment speed). If δ it = 1 full adjustment is achieved within one period and actual leverage at the end of the period will equal the target as set at the beginning of that period. N ...

... where δ it is the adjustment parameter representing the magnitude of adjustment during one period (also termed the adjustment speed). If δ it = 1 full adjustment is achieved within one period and actual leverage at the end of the period will equal the target as set at the beginning of that period. N ...

Towards Efficient Benchmarks for Infrastructure Equity Investments

... are relationship-specific i.e. they have little or no value outside of the contractual relationship in question, in particular, they have no value if they are not used. In this respect they are the opposite of real assets since they have no intrinsic value. From the relationship specificity of infra ...

... are relationship-specific i.e. they have little or no value outside of the contractual relationship in question, in particular, they have no value if they are not used. In this respect they are the opposite of real assets since they have no intrinsic value. From the relationship specificity of infra ...

Returning Cash to the Owners: Dividend Policy

... • (b) If companies pay too much in cash, they can issue new stock, with no flotation costs or signaling consequences, to replace this cash. • (c) If companies pay too little in dividends, they do not use the excess cash for bad projects or acquisitions. ...

... • (b) If companies pay too much in cash, they can issue new stock, with no flotation costs or signaling consequences, to replace this cash. • (c) If companies pay too little in dividends, they do not use the excess cash for bad projects or acquisitions. ...

Luxembourg GAAP compared to IFRS: An overview

... beginning 1 January 2013, whereby a qualifying investment fund is required to account for its investments in controlled entities as well as in associates and joint ventures at fair value through profit or loss with the exception of subsidiaries that are considered as an extension to the investment a ...

... beginning 1 January 2013, whereby a qualifying investment fund is required to account for its investments in controlled entities as well as in associates and joint ventures at fair value through profit or loss with the exception of subsidiaries that are considered as an extension to the investment a ...

a century of stock market liquidity and trading

... Since the proportional commission depends only on the share price, it is possible to estimate the weighted average commission rate during the fixed commission regime by looking only at the cross-sectional distribution of share prices and the total volume of trade. Other than ignoring odd lot transac ...

... Since the proportional commission depends only on the share price, it is possible to estimate the weighted average commission rate during the fixed commission regime by looking only at the cross-sectional distribution of share prices and the total volume of trade. Other than ignoring odd lot transac ...

Corruption`s Impact on Liquidity, Investment

... corruption. This research suggests a possible nonlinear relation between corruption and the economy because, at some levels, corruption can be beneficial (i.e., it greases the wheels of commerce) and, at other levels, corruption might be harmful (thus, putting sand in the wheels of an economy). Mos ...

... corruption. This research suggests a possible nonlinear relation between corruption and the economy because, at some levels, corruption can be beneficial (i.e., it greases the wheels of commerce) and, at other levels, corruption might be harmful (thus, putting sand in the wheels of an economy). Mos ...

Intertemporal capital budgeting

... changes in customer demand. Those changes do not necessarily warrant an immediate response entailing capital investment, but, if they turn out to be permanent or become more pronounced, do so in the future. Division managers are also likely to be better informed than headquarters about the probabili ...

... changes in customer demand. Those changes do not necessarily warrant an immediate response entailing capital investment, but, if they turn out to be permanent or become more pronounced, do so in the future. Division managers are also likely to be better informed than headquarters about the probabili ...

Client focused Outcome orientated

... security of its members. Two crucial decisions in the latter stages of this journey exemplify the benefit that P-Solve (a member of the Group), as the Plan’s investment consultant, has been able to bring. As of mid-2016 the J Whitaker & Sons Limited Final Salary Plan had almost completed a more than ...

... security of its members. Two crucial decisions in the latter stages of this journey exemplify the benefit that P-Solve (a member of the Group), as the Plan’s investment consultant, has been able to bring. As of mid-2016 the J Whitaker & Sons Limited Final Salary Plan had almost completed a more than ...

Document

... Structural deficits of the public purse exist everywhere, and well beyond the point where stimulus spending runs out Ageing demographics come with increasing funding gaps for social security, public pensions and health costs With a smaller portion of the population engaged in producing GDP in the re ...

... Structural deficits of the public purse exist everywhere, and well beyond the point where stimulus spending runs out Ageing demographics come with increasing funding gaps for social security, public pensions and health costs With a smaller portion of the population engaged in producing GDP in the re ...

Fair Value Measurements and Disclosures (Topic 820)

... Codification™ (because, for example, those investments are not listed on national exchanges or over-the-counter markets such as the National Association of Securities Dealers Automated Quotation System). Examples of these investees (also referred to as alternative investments) may include hedge fund ...

... Codification™ (because, for example, those investments are not listed on national exchanges or over-the-counter markets such as the National Association of Securities Dealers Automated Quotation System). Examples of these investees (also referred to as alternative investments) may include hedge fund ...

Debt Refinancing and Equity Returns

... become shorter). These findings are consistent with the notion that shareholders demand a premium for holding high- instead of low-leverage firms and that this premium increases with the immediacy of debt refinancing. Using equally-weighted portfolios, we find that buying high- and selling low-lever ...

... become shorter). These findings are consistent with the notion that shareholders demand a premium for holding high- instead of low-leverage firms and that this premium increases with the immediacy of debt refinancing. Using equally-weighted portfolios, we find that buying high- and selling low-lever ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.