liberty high yield fund

... Each of the interest rate securities acquired by the Fund will be purchased by the Responsible Entity at market value. Where the Fund acquires interest rate securities from a related party of the Responsible Entity (Related Party Issuers), the Responsible Entity will assess the market value of the a ...

... Each of the interest rate securities acquired by the Fund will be purchased by the Responsible Entity at market value. Where the Fund acquires interest rate securities from a related party of the Responsible Entity (Related Party Issuers), the Responsible Entity will assess the market value of the a ...

Debt Refinancing and Equity Returns∗

... Toft (1996) or Leland (1998). These models endogenize a firms’ optimal leverage and default decisions. Bhamra et al. (2010a,b) and Chen (2010) are among the first to discuss the asset pricing implications of dynamic leverage models and relate leverage and default decisions to the time-series pattern ...

... Toft (1996) or Leland (1998). These models endogenize a firms’ optimal leverage and default decisions. Bhamra et al. (2010a,b) and Chen (2010) are among the first to discuss the asset pricing implications of dynamic leverage models and relate leverage and default decisions to the time-series pattern ...

Disgorge the Cash - Roosevelt Institute

... “Marianne Lake, chief financial officer [of JPMorgan Chase & Co.], told analysts the company could reach the new target faster but wanted to be able to also do ‘capital distribution to you guys’, by releasing profits rather than retaining them.” “Issuing debt to buy equity has become more a$ractive in ...

... “Marianne Lake, chief financial officer [of JPMorgan Chase & Co.], told analysts the company could reach the new target faster but wanted to be able to also do ‘capital distribution to you guys’, by releasing profits rather than retaining them.” “Issuing debt to buy equity has become more a$ractive in ...

- Reliance Mutual Fund

... Documents is given in the aforesaid AMFI Guidelines, which is available on our website www.reliancemutual.com. Post Dated Cheques will not be accepted as a mode of payment for application of MICRO SIP. Reliance SIP Inasure facility will not be extended to investors applying under the category of Mic ...

... Documents is given in the aforesaid AMFI Guidelines, which is available on our website www.reliancemutual.com. Post Dated Cheques will not be accepted as a mode of payment for application of MICRO SIP. Reliance SIP Inasure facility will not be extended to investors applying under the category of Mic ...

Some Indicators of a Firm`s Risk and Debt Capacity

... than ICT'.FOR). For each firm, and in different economic environments, the relative importance of the various factors will differ. However, the manager should ensure that all the important factors have been analyzed. The first factor, flexibility, refers to the future financing options for managemen ...

... than ICT'.FOR). For each firm, and in different economic environments, the relative importance of the various factors will differ. However, the manager should ensure that all the important factors have been analyzed. The first factor, flexibility, refers to the future financing options for managemen ...

optimal capital structure

... We have studied three companies within the real estate industry due to comparable issues. Our result reveals that the companies do not use any mathematical model when deciding their capital structure but they do consider many important factors. The business and financial risk have the largest impact ...

... We have studied three companies within the real estate industry due to comparable issues. Our result reveals that the companies do not use any mathematical model when deciding their capital structure but they do consider many important factors. The business and financial risk have the largest impact ...

The Going-Public Decision and the Product Market

... Section 2) not only for the relationship between a firm’s ex ante product market characteristics and its going-public decision, but also for the dynamics of these characteristics before and after a firm’s IPO. Chemmanur and Fulghieri (1999) model the going-public decision in an environment of asymme ...

... Section 2) not only for the relationship between a firm’s ex ante product market characteristics and its going-public decision, but also for the dynamics of these characteristics before and after a firm’s IPO. Chemmanur and Fulghieri (1999) model the going-public decision in an environment of asymme ...

printmgr file - Morgan Stanley

... Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to su ...

... Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to su ...

UK Equities for income and total return

... (UK) Limited. Please note Fidelity Unit Trusts are not registered for sale in Jersey or Guernsey. Holdings can vary from those in the index quoted. For this reason the comparison index is used for reference only. This document may not be reproduced or circulated without prior permission. No statemen ...

... (UK) Limited. Please note Fidelity Unit Trusts are not registered for sale in Jersey or Guernsey. Holdings can vary from those in the index quoted. For this reason the comparison index is used for reference only. This document may not be reproduced or circulated without prior permission. No statemen ...

Costs to Investors of Boycotting Fossil Fuels

... diversify risks. “Diversification” is a familiar concept from homely proverbs such as “don’t put all your eggs in one basket” or “what you gain on the swings, you lose on the roundabouts”. In finance, an investor diversifies by purchasing portfolios (groups of assets) where higher-return scenarios f ...

... diversify risks. “Diversification” is a familiar concept from homely proverbs such as “don’t put all your eggs in one basket” or “what you gain on the swings, you lose on the roundabouts”. In finance, an investor diversifies by purchasing portfolios (groups of assets) where higher-return scenarios f ...

Goodwill Capital

... the Coca-Cola business in 1891, if it would buy them the subsequent stream of revenues that the Coca-Cola brand produced. If matching CocaCola’s profits today were merely a matter of matching its current advertising outlays, there would be hundreds more equally profitable products on the market. Wha ...

... the Coca-Cola business in 1891, if it would buy them the subsequent stream of revenues that the Coca-Cola brand produced. If matching CocaCola’s profits today were merely a matter of matching its current advertising outlays, there would be hundreds more equally profitable products on the market. Wha ...

Outside Entrepreneurial Capital

... financing sought is related to information asymmetries faced by investors regarding the entrepreneurial firm’s quality (see, e.g., Jensen and Meckling, 1976). 1 Where entrepreneurs have information that investors do not have, external equity finance (which dilutes the entrepreneurs’ ownership share) ...

... financing sought is related to information asymmetries faced by investors regarding the entrepreneurial firm’s quality (see, e.g., Jensen and Meckling, 1976). 1 Where entrepreneurs have information that investors do not have, external equity finance (which dilutes the entrepreneurs’ ownership share) ...

The relationship between government bond yields and the market

... This evidence includes the following: a. The AER’s own DGM estimates indicate that the MRP has risen materially between the Guideline, the AER’s November 2014 draft decisions and the AER’s October 2015 preliminary decisions. b. The AER’s own Wright estimates indicate that the MRP has risen materiall ...

... This evidence includes the following: a. The AER’s own DGM estimates indicate that the MRP has risen materially between the Guideline, the AER’s November 2014 draft decisions and the AER’s October 2015 preliminary decisions. b. The AER’s own Wright estimates indicate that the MRP has risen materiall ...

15 THEORIES OF INVESTMENT EXPENDITURES

... knows IBM’s reputation and many analysts and investment advisors track IBM’s performance on a week-to-week basis. However, it would be difficult for a potential investor to get similar information about a tiny startup company. Since investors will not usually invest in firms they know nothing about, ...

... knows IBM’s reputation and many analysts and investment advisors track IBM’s performance on a week-to-week basis. However, it would be difficult for a potential investor to get similar information about a tiny startup company. Since investors will not usually invest in firms they know nothing about, ...

Transactions Costs and Capital Structure Choice: Evidence from

... Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed them far away from their optimal capital structures. To get their debt levels down, financially distressed firms ...

... Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed them far away from their optimal capital structures. To get their debt levels down, financially distressed firms ...

Diminishing returns: Why investors may need to lower their

... Amazon and Alibaba. One of the questions that our research raised was what the implications of these changing times could be for investors. This report is our first attempt at providing an answer. MGI does not make financial market forecasts. But by applying our research into the fundamental global ...

... Amazon and Alibaba. One of the questions that our research raised was what the implications of these changing times could be for investors. This report is our first attempt at providing an answer. MGI does not make financial market forecasts. But by applying our research into the fundamental global ...

Hereford-Funds-Semi-Annual-report-31.03.2014 1

... Initial subscription: 5 March 2014 Initial subscription: 31 January 2014 ...

... Initial subscription: 5 March 2014 Initial subscription: 31 January 2014 ...

mid cap: the goldilocks asset class

... cap as a sub-asset class within the greater global equity ~ Eagle Asset Management, 2012 asset class — in fact, as an essential component of a broad global equity allocation. As pointed out, many investors’ allocations will include large and small cap and overlook mid cap, or include it only haphaza ...

... cap as a sub-asset class within the greater global equity ~ Eagle Asset Management, 2012 asset class — in fact, as an essential component of a broad global equity allocation. As pointed out, many investors’ allocations will include large and small cap and overlook mid cap, or include it only haphaza ...

Do Shareholder Preferences Affect Corporate

... industries with similar characteristics, while others tend to hold stocks that are overleveraged. Furthermore, I show that the preferences of the institutional investors that hold a firm’s stock are related to the firm’s future financial and investment policies. Institutional investors can have hete ...

... industries with similar characteristics, while others tend to hold stocks that are overleveraged. Furthermore, I show that the preferences of the institutional investors that hold a firm’s stock are related to the firm’s future financial and investment policies. Institutional investors can have hete ...

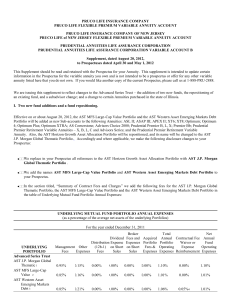

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... This supplement sets forth changes to the Prospectus, dated April 30, 2012 (the Prospectus), of Advanced Series Trust (the Trust). The Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your ...

... This supplement sets forth changes to the Prospectus, dated April 30, 2012 (the Prospectus), of Advanced Series Trust (the Trust). The Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your ...

NTMA Annual Report 2014 - National Treasury Management Agency

... of the ISIF – to invest in projects which generate commercial investment returns and have an economic impact - represents a new approach to investing. The ISIF’s investment strategy is based on developing a broad based long-term portfolio across sectors and asset classes. It will target sectors with ...

... of the ISIF – to invest in projects which generate commercial investment returns and have an economic impact - represents a new approach to investing. The ISIF’s investment strategy is based on developing a broad based long-term portfolio across sectors and asset classes. It will target sectors with ...

Does The Firm Information Environment Influence Financing

... relevant to their formation of earnings expectations. In fact, the “majority of sell-side analysts say they regularly requested and received earnings guidance prior to Reg FD,” (Wang 2007, 1303). Furthermore, the earnings guidance was considered to be either similarly or more important than other so ...

... relevant to their formation of earnings expectations. In fact, the “majority of sell-side analysts say they regularly requested and received earnings guidance prior to Reg FD,” (Wang 2007, 1303). Furthermore, the earnings guidance was considered to be either similarly or more important than other so ...

1/20/04 All rights reserved IS EQUITY

... on the two issues raised in the prior paragraph. First, we will examine the expected employee-level deferral benefit of equity compensation. We will see that there is an apparent symmetry between the benefit of deferral in a rising market and a disadvantage in a flat or declining market that might l ...

... on the two issues raised in the prior paragraph. First, we will examine the expected employee-level deferral benefit of equity compensation. We will see that there is an apparent symmetry between the benefit of deferral in a rising market and a disadvantage in a flat or declining market that might l ...

Drivers for Growth Through 2020

... Institutions that invest in equity ETFs cite a variety of reasons for doing so, namely ETFs’ ease of use, liquidity, and simple market access. Also cited as key benefits are speed of execution to gain diversified exposure, single-trade diversification, attractive management fees, lower trading costs ...

... Institutions that invest in equity ETFs cite a variety of reasons for doing so, namely ETFs’ ease of use, liquidity, and simple market access. Also cited as key benefits are speed of execution to gain diversified exposure, single-trade diversification, attractive management fees, lower trading costs ...

Templeton Global Balanced Fund Annual Report

... maturity schedules and borrowing requirements; a company’s changing financial condition and market recognition of the change; and a security’s relative value based on such factors as anticipated cash flow, interest or dividend coverage, asset coverage and earnings prospects. With respect to sovereig ...

... maturity schedules and borrowing requirements; a company’s changing financial condition and market recognition of the change; and a security’s relative value based on such factors as anticipated cash flow, interest or dividend coverage, asset coverage and earnings prospects. With respect to sovereig ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.