* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Drivers for Growth Through 2020

Land banking wikipedia , lookup

Fundraising wikipedia , lookup

Global saving glut wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity wikipedia , lookup

Interbank lending market wikipedia , lookup

Shadow banking system wikipedia , lookup

Stock selection criterion wikipedia , lookup

Private equity secondary market wikipedia , lookup

Commodity market wikipedia , lookup

Syndicated loan wikipedia , lookup

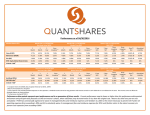

Q2 2016 Global Trends in Institutional ETF Adoption: Drivers for Growth Through 2020 CO N TE NTS 3 Executive Summary 3 Setting the Stage for Growth 4 Five Underlying Drivers of ETF Growth 5 INSTITUTIONS ARE ADOPTING ETFs FOR AN EXPANDING LIST OF PORTFOLIO APPLICATIONS IN A GROWING NUMBER OF ASSET CLASSES INSTITUTIONAL INVESTMENT IN ETFs IS EXPECTED TO GROW TO $300B Institutions Use ETFs for Specific ANNUALLY BY 2020 Needs 6 ETFs Used for Critical Strategic Functions 7 ETFs Emerge as a New Source of Liquidity 9 BlackRock’s iShares Seen as Best-inClass Provider ME T H O D O LO GY Greenwich Associates interviewed a total of 408 institutional investors globally, of which 253 were exchange-traded fund users and 155 were non-users, in an effort to track and uncover usage trends. The respondent base included 137 institutional funds (corporate pensions, public pensions, foundations and endowments), 141 asset managers (firms managing assets to specific investment strategies/guidelines), 63 insurance companies, 20 investment consultants, and 11Conclusion 47 registered investment advisors (RIAs). RIAs are advisors or firms providing investment advice/recommendations that are registered with the U.S. Securities and Exchange Commission. The Greenwich Associates growth model projects respondent data about assets currently invested in ETFs and future plans for increasing usage, broadening Consultant Andrew usage, increasing holding periods, and adopting new products among users McCollum advises on the and non-users. Assumptions about current assets are based on BlackRock’s investment management 2015 Global ETF Landscape report, while assumptions about levels and pace of market globally. future adoption are modeled on adoption levels observed through Greenwich Associates ETF research over the past six years. Interviews by Region Global Average AUM in USD Canada Asia 13% Europe $43B Asset Managers 12% 45% U.S. Institutional Funds $35B Insurance Companies $34B 30% ETF users made up 62% of the respondent base and non-users 38% Note: Based on 408 respondents. RIAs $2B Total AUM of respondents combined is $11.9T Note: Based on responses from 129 institutional funds, 122 asset managers, 61 insurance companies, and 43 RIAs. Cover Photo: © iStockphoto/ooyoo The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own. © 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates,® Competitive Challenges,® Greenwich Quality Index,® Greenwich ACCESS,™ Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials. 2 | GREENWICH ASSOCIATES Executive Summary 2015 was a record-breaking year for ETFs, which attracted more than $350 billion in new assets globally. Institutional investors are primary contributors to the steady growth in ETF demand, and over the last five years Greenwich Associates has conducted studies in the U.S., Europe, Asia, and Canada to identify the key trends behind their increasing ETF adoption. In this paper we take a long-term view and explore how trends we are seeing today can be expected to impact ETF demand in 2020. To arrive at projected growth in institutional ETF demand, we relied on survey data from the 2015 Global Exchange-Traded Funds Study to identify five key trends driving global ETF demand. We then built a growth model projecting ETF asset growth over the next five years. Using current asset levels as a starting point, the model examined respondents’ future plans for increasing usage, broadening usage, increasing holding periods, and adopting new products among ETF users and non-users. By the year 2020, we expect the following five drivers will collectively produce approximately $300B in annual institutional ETF flows: 1. The broadening use of ETFs across applications and asset classes will drive $132 billion in new demand in five years’ time. 2.The migration toward using ETFs to obtain core exposures and achieve strategic goals will produce $42 billion in annual flows. 3. Liquidity needs will fuel demand for ETFs in fixed income, driving $68 billion in new annual flows. 4. Institutions using ETFs to replace derivatives positions will produce $28 billion in flows annually. 5. Innovative exposures like smart-beta ETFs will attract $25 billion in annual flows. Setting the Stage for Growth Over the five years we have conducted research in the ETF market, Greenwich Associates has documented a clear and consistent pattern: Institutions generally start investing in ETFs in equities and then gradually begin to adopt them in fixed income and other asset classes. This process is most advanced in North America, where institutional investors in the U.S. and Canada emerged as early adopters. The results of Greenwich Associates research in Europe and Asia suggest that these institutional markets will follow a similar trajectory as the U.S. and Canada, pushing annual growth to approximately $300 billion by 2020. CURRENT VS. PROJECTED PORTFOLIO ALLOCATIONS TO ETFs AMONG ETF USERS 30% 20% 25% 21% 20% Projected (in 2020) Current 15% 10% 10% 9% 0% The results of this study show that institutions that invest in ETFs allocate an average 15% of total assets to the funds. Reflecting both their relatively long history of ETF investment and large equity allocations, 25% 2% Canada U.S. Europe Asia Note: Based on 33 responses in Canada, 112 in the U.S., 60 in Europe, and 27 in Asia. Source: Greenwich Associates 2015 Canadian, U.S., European, and Asian Exchange-Traded Funds Studies EXPECTED CHANGE IN ALLOCATIONS TO EQUITY ETFs IN NEXT 12 MONTHS 35% Global 5% 36% U.S. Europe 31% Canada 33% 5% 6% 43% Asia Increase 5% Decrease 7% 8% 59% 5% 55% 6% 7% No change 53% 51% 46% Don’t know Note: Based on 230 global responses, 111 in the U.S., 58 in Europe, 33 in Canada, and 28 in Asia. Source: Greenwich Associates 2015 Global, U.S., European, Canadian, and Asian Exchange-Traded Funds Studies 3 | GREENWICH ASSOCIATES 4% Institutional ETF users could allocate up to 25% of total assets in North America, 15% in Europe and 10% in Asia, by 2020. Canadian and U.S. ETF investors have amassed the biggest allocations to the funds, at 21% and 20% of total assets, respectively. Average allocations are considerably smaller among European ETF users, at 9% of total assets, and Asian ETF investors at 2%. TOP REASONS FOR USING EQUITY ETFs Liquidity 79% Based on current and expected growth rates, Greenwich Associates projects that ETFs could make up 25% of total institutional assets in North America, 15% in Europe and 10% in Asia by 2020. Market access 77% Speed of execution to gain diversified exposure 69% Equity portfolios will remain a key driver of growth in the short term. Institutions that invest in equity ETFs cite a variety of reasons for doing so, namely ETFs’ ease of use, liquidity, and simple market access. Also cited as key benefits are speed of execution to gain diversified exposure, single-trade diversification, attractive management fees, lower trading costs relative to individual stocks, and the ability to avoid the need for single-security analysis. Single-trade diversification 69% Attractive management fee 68% ETFs will continue to attract new institutional investors. Among institutions in this year’s study that do not invest in ETFs, 44% have not yet considered using ETFs in their portfolios. This group of non-users represents a large source of as-yet untapped demand. 87% Easy to use Lower trading costs vs. individual stocks 53% Avoid need for singlesecurity analysis 52% 0% 100% Note: Based on 230 responses. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study Greenwich Associates has identified five global trends that will contribute to the expansion of ETFs in institutional portfolios over the next five years and beyond. Five Underlying Drivers of ETF Growth 1 INSTITUTIONS ARE ADOPTING ETFs FOR AN EXPANDING RANGE OF APPLICATIONS IN A GROWING NUMBER OF ASSET CLASSES The versatility of ETFs allows institutions to apply them in myriad uses across a growing range of asset classes. We estimate that this trend will drive $132 billion in annual ETF asset growth by 2020. In addition to the 95% of ETF investors using the funds in equity portfolios, 60% currently employ ETFs in fixed income. Among asset managers, that share reaches 70%. Bond ETF usage varies considerably from market to market. About one-third of Asian ETF users invest in fixed-income ETFs, compared with 68% of users in Canada and 82% of European asset management ETF users. Among ETF investors in the study, 35% use ETFs in commodities, and 34% use them in REITs. Again, the data reveals significant variation across regional markets. For example, approximately half of Canadian 4 | GREENWICH ASSOCIATES ETF USE BY ASSET CLASS, INVESTOR TYPE 100% 94% Equity portfolio 93% 93% 62% 43% Fixed income portfolio 70% 57% 49% 29% Commodities 43% 18% 46% 28% REITs 37% 30% RIAs Institutional funds Asset managers Insurers 0% 100% Note: Based on 249 global responses including 39 RIAs, 65 institutional funds, 101 asset managers, and 44 insurers. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study MOST COMMON ETF APPLICATIONS Global U.S. Europe 77% Core allocation 71% International diversification 70% 70% Tactical adjustments 69% 67% Portfolio completion 57% Rebalancing 54% Risk management/overlay management 37% Cash equitization 36% 54% 39% 83% 14% 7% Interim beta/Transition management 13% 16% 3% 100% 0% 57% 67% 64% 53% 52% 69% 33% 55% 69% 33% 67% 37% 16% 14% 0% 64% 37% 29% 100% 78% 28% 45% Interim beta 0% 64% 36% 53% 23% Transition management Asia 84% 62% 48% Liquidity management Canada 44% 13% 47% 10% 25% 7% 8% 37% 22% 100% 13% 0% 100% 0% 100% Note: Based on 252 global responses, 119 in the U.S., 67 in Europe, 36 in Canada, and 30 in Asia. Source: Greenwich Associates 2015 U.S., European, Canadian and Asian Exchange-Traded Funds Studies institutional ETF investors and 43% in the U.S. use ETFs in REITs. We have observed that regions with lower usage levels steadily shift toward the higher adoption levels in other regions over time. From achieving core allocations and diversifying investment portfolios to implementing tactical adjustments and rebalancing, institutions around the world are finding a wide variety of uses for ETFs. U.S. INSURANCE COMPANIES INVESTING RESERVE ASSETS IN ETFs 71% Institutions Use ETFs for Specific Needs Institutions are also finding ways to use ETFs to meet needs specific to their own businesses. For instance, insurance companies are using ETFs to invest both general account reserve and surplus assets. In the U.S., the share of insurers in the study using ETFs to invest surplus assets nearly doubled from close to 30% in 2013 to almost 60% in 2014 before leveling off in 2015. Meanwhile, the share of U.S. insurance companies using ETFs to invest reserve assets climbed from just 6% in 2013 to 71% in 2015. It is possible that we may see similar jumps among European and Asian insurers. Given these high rates of adoption, insurance companies are emerging as an important source of future ETF demand. Approximately half of insurance company equity ETF investors expect to increase allocations to these funds in the coming year, as do about a quarter of insurance company bond ETF investors. The study results reveal another potentially important source of future ETF demand: the increasing popularity of multi-asset funds among investors around the world. For asset managers running multi-asset funds, ETFs represent a staple component of their portfolios. 5 | GREENWICH ASSOCIATES 26% 6% 2013 2014 2015 58% OF ASSET MANAGERS IN THE STUDY EMPLOY ETFs IN MULTI-ASSET FUNDS Other 30% % of multiasset portfolio 33% ETFs Individual 37% securities The extensive employment of ETFs in these funds represent an important source of growth, as the use of multi-asset funds in the U.S. catches up to that in the U.K. According to the results of the Greenwich Associates 2015 U.K. Institutional Investors Study, the use of multi-asset funds among U.K. institutions has been on a steady climb, increasing from 22% in 2012 to 40% in 2015. Currently, only 14% of U.S. institutions invest in multi-asset funds—a usage rate Greenwich Associates expects to move toward that now seen in the U.K. 2 STRATEGIC VS. TACTICAL ASSETS 62% Global 68% U.S. Europe Institutional investment in ETFs in markets around the world has followed a consistent pattern: Institutions first experiment using ETFs for short-term tactical applications, such as making temporary adjustments to a portfolio, executing manager transitions or obtaining equity exposure for short-term cash positions. Over time, many institutions begin using ETFs for more complex, long-term and strategic functions. Currently, institutional ETF holdings at the global level are dominated by strategic assets; institutions estimate that 63% of ETF assets are strategic in nature. Institutional funds and registered investment advisors (RIAs) are leading the way in the strategic use of ETFs, with strategic assets making up two-thirds and three-quarters of total ETF holdings, respectively. Roughly half of RIA ETF investors report average holding periods longer than two years, as do 44% of institutional funds. At the opposite end of the spectrum, insurance companies say approximately 70% of their ETF holdings are tactical in nature. ETFs Used for Critical Strategic Functions Based on data and trends from our past research on institutional ETF investing around the world, Greenwich Associates expects growing numbers of institutions to adopt ETFs for strategic functions like obtaining core exposures and diversifying portfolios. Approximately 70% of institutional users employ ETFs for these purposes. Nearly half the institutional ETF investors in the study use the funds for liquidity management, also considered a strategic function, and 37% use ETFs for risk management. Institutions currently using ETFs in these areas are expected to expand their usage and allocations, which we estimate will increase annual asset growth by approximately $42 billion. 32% 51% 49% Canada 63% Asia 65% 37% 35% 46% Tactical Strategic GROWING NUMBERS OF INSTITUTIONS ARE USING ETFs TO OBTAIN CORE INVESTMENT EXPOSURES AND ACHIEVE OTHER STRATEGIC GOALS 38% 4% Note: Based on 249 responses, including 121 in the U.S., 66 in Europe, 35 in Canada, and 27 in Asia. Source: Greenwich Associates 2015 Global, U.S., European, Canadian, and Asian Exchange-Traded Funds Studies TYPICAL ETF HOLDING PERIODS 37% 40% 30% >2 years 47% 30% 20% 25% 14% 1–2 years 18% 17% 18% 15% 29% 7–12 months 9% 20% 20% 15% 24% 1–6 months 18% 33% 4% 5% 3% <1 month 9% 0% 0% Global U.S. 50% Europe Canada Asia Note: Based on 247 global responses including 117 in the U.S., 66 in Europe, 34 in Canada, and 30 in Asia. Source: Greenwich Associates 2015 Global, U.S., European, Canadian, and Asian Exchange-Traded Funds Studies 6 | GREENWICH ASSOCIATES 3 LIQUIDITY NEEDS WILL FUEL INSTITUTIONAL DEMAND FOR FIXED-INCOME ETFs We believe the continued thinning liquidity in fixed-income markets coupled with limited bond dealer inventories could set the stage for an increase in institutional demand for bond ETFs. Our models estimate $68 billion annually in new assets by 2020. Although ETFs appear in a large number of portfolios, institutions that use bond ETFs invest an average of only 17% of total fixed-income assets in the funds. European users of bond ETFs are well below that global average, with allocations of just 9.3% of total fixed-income assets. In stark contrast, Canadian bond ETF users invest 25% of fixed-income assets in ETFs. In Asia, where bond ETF investing has a shorter history, bond ETFs comprise only 1.4% of fixed-income assets in the funds. Given the large legacy fixed-income portfolios among institutions in Europe and Asia, even incremental growth in these allocations or the share of institutions investing in bond ETFs would represent significant levels of asset growth. That growth appears to be on the way. Among current bond ETF investors in the study, 28% plan to increase allocations to the funds in the coming year, including more than one-third of institutional funds. Of the institutions planning increases, 33% expect to boost fixed-income allocations by more than 10%. TOP REASONS FOR USING FIXED-INCOME ETFs 83% Easy to use Liquidity 80% Quick access 78% 72% Single-trade diversification 68% Low management fees Lower trading costs vs. cash bonds 57% Avoid need for singlesecurity analysis 55% 0% Bond ETFs also are attracting new users in markets like Europe, where 30% of the fixed-income ETF users in the study have been investing in these funds for less than two years. Approximately 15% of the non-ETF users in the study say they are likely or somewhat likely to invest in bond ETFs in the next 12 months. ETFs Emerge as a New Source of Liquidity Institutional investments in bond ETFs could get a significant boost in coming years from widespread investor concerns about liquidity shortages. New bank capital reserve requirements and other regulations in Europe and the U.S. have forced major fixed-income dealers to pull back from their traditional role of market makers. This pullback has drained liquidity from global bond markets, making it harder for investors to find securities and execute trades. Liquidity shortages are starting to affect institutional investment strategies, with increasing numbers of investors reporting that they are now forced to take liquidity into account when determining asset allocations and other aspects of their portfolios. 7 | GREENWICH ASSOCIATES 100% Note: Based on 148 responses. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study SINCE 2008, BOND ETF LIQUIDITY IN THE U.S. HAS GROWN 5.1x Meanwhile, ETF liquidity has expanded rapidly and dramatically. Since 2008, bond ETF liquidity in the U.S. has grown 5.1x, or 31% annually.1 Among institutional bond ETF users in the study, 70% say they invest in the funds for liquidity. Only “ease of use” gains a comparable number of citations, making these factors institutions’ top two reasons for using fixed-income ETFs. 4 “ETFs are often cheaper than futures and easier than single shares.” – Asset Manager INSTITUTIONAL INVESTORS ARE USING ETFs TO REPLACE DERIVATIVES POSITIONS Institutions globally are starting to replace existing derivatives positions in their portfolios with ETFs. This trend is expected to continue, with an estimated $28 billion in new ETF assets in 2020 attributed to institutions switching from derivatives. As they gain increasing experience with the funds, institutions are discovering that ETFs represent an effective source of beta. Roughly half the institutions and two-thirds of the asset managers in the study use futures to access beta, with 53% of futures users employing the products for hedging and 28% using them for fully funded long positions. Approximately one-third of institutions in the study shifted from derivatives products to ETFs in the past year.2 About a quarter of institutions made that move to benefit from the operational simplicity of ETFs, and 15% switched due to lower costs. Looking ahead, 46% of institutions in the study intend to replace existing equity futures positions with ETFs in the coming year. Another 1 in 5 expect to replace a futures position with ETFs in fixed income and 11% plan to do so in commodities. About another quarter of study participants say they will evaluate futures positions for potential replacement with ETFs over the coming year. Of those who expect to replace derivative positions with ETFs in the next year, 44% say they will do so to lower fees and overall costs, and a quarter say they will do so to benefit from ETFs’ ease of use, implementation and trading. 5 INNOVATIVE FUND TYPES LIKE SMART-BETA ETFs ARE PROVIDING NEW WAYS FOR INVESTORS TO OBTAIN DESIRED INVESTMENT EXPOSURES Among existing institutions already investing in non-market-cap weighted/smart-beta ETFs, 51% expect to increase allocations to these funds in the coming year. That share tops two-thirds among RIAs and 70% among insurance companies. An impressive 42% of institutions planning to expand these allocations expect to increase them by more than 10%. Taking into account current users and institutions that are considering non-market-cap weighted/smart-beta ETFs, we project institutional ETF assets to rise by $25 billion by 2020. 1 2 BlackRock, Bloomberg, based on the cumulative annual trading volume of all U.S.-listed fixed-income ETFs, as of 12/31/15. *This data has been re-stated since initial publication. 8 | GREENWICH ASSOCIATES REPLACING DERIVATIVES WITH ETFs Over the next 12 months do you expect to: 17% 39% Replace existing equity futures positions with ETFs 50% 56% 50% 17% Replace existing fixed income futures positions with ETFs 18% 19% 17% 22% Replace existing commodity futures positions with ETFs 6% 6% 17% 22% Evaluate futures positions for potential replacement with ETFs 26% 19% RIAs Institutional funds Asset managers Insurers 0% 60% Note: Based on 251 global responses including 40 RIAs, 65 institutional funds, 102 asset managers, and 44 insurers. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study USE OF SMART-BETA ETFs AND TYPES USED Across both retail and institutional channels, innovation on the part of ETF providers is attracting new investors and assets. New fund structures like smart-beta or non-market-cap weighted ETFs provide investors with alternative means of capturing beta exposures and meeting specific needs, like minimizing volatility. Thirty percent of the institutional ETF users in the study invest in non-market-cap weighted/ smart-beta ETFs. Minimum-volatility ETFs are the most popular product among this group, with 69% investing in the funds. Approximately 58% of the institutions using non-market-cap weighted ETFs invest in equal-weighted ETFs and/or multi-factor ETFs, and 44% invest in single-factor ETFs. Forty-eight percent of ETF users are considering making an investment in minimum-volatility ETFs in the coming year, between 40% and 45% are considering an investment in multi-factor and/or single-factor ETFs, 38% are contemplating an investment in equal-weighted ETFs, and a quarter are considering an investment in smart-beta fixed-income ETFs. 30% use Smart-Beta ETFs1 Types of Smart-Beta/Factor ETFs Used2 69% Minimum-volatility ETFs Equal-weighted ETFs 58% Multi-factor ETFs 57% 44% Single factor ETFs Smart-beta fixed income 18% Smart-beta commodities 17% 3% Dividend 8% Other BlackRock’s iShares Seen as Best-in-Class Provider Institutions around the world consider a wide range of factors when selecting a specific ETF in which to invest. As adoption grows and ETFs assume more important roles in institutional portfolios, investors become more discerning and consider a wider range of criteria when selecting an ETF or an ETF provider. The No. 1 question asked by institutions when reviewing a specific ETF for investment is, “Does the ETF match my exposure needs?” This factor is cited as an important selection criterion by 80% of ETF users in the Greenwich Associates study. Liquidity/trading volume ranks second in those terms, followed by expense ratio and performance of the fund, including tracking error. Based on these factors, iShares, the ETF division of BlackRock, ranks as by far institutions’ preferred provider of ETFs. Among institutional ETF users in the study, 92% use iShares as a provider, followed by Vanguard at 56% and State Street/SPDRs at 53%. While Vanguard is cited for providing the lowest management fees, institutions name iShares as best-in-class in ETF liquidity, range of product offerings, index tracking, innovation, product transparency, and service platform. 9 | GREENWICH ASSOCIATES 0% 70% Note: 1Based on 248 responses. 2Based on 72 responses. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study CANADIAN INSTITUTIONS LEAD THE WAY IN ETF INVESTMENTS Canadian institutions are emerging as some of the most active and sophisticated users of ETFs in global institutional markets. Canadian institutions that use ETFs invest a relatively large 21% of total assets in the funds, and sizable shares of both equity and fixed-income ETF users expect to increase those allocations in the coming year. This trend reflects a consistent expansion in how institutions use ETFs. Canadian institutions in the study cite no fewer than 29 applications for ETFs within their portfolios. Topping the list are critical strategic functions, such as international diversification and obtaining core investment exposures. MOST IMPORTANT FACTORS WHEN SELECTING AN ETF (Criteria cited as “Very Important”) Global U.S. Matches exposure needs 80% Liquidity/trading volume 77% Expense ratio of fund Performance of fund (tracking error/ tracking difference) Europe 82% Asia 83% 76% 74% 76% 82% 70% 77% 72% 72% 78% 76% 68% 68% 73% 59% NAIC rating Canada 59% Assets under management of ETFs 41% 33% Benchmark used/Benchmark provider 36% 34% Fund company and management behind the funds 35% 39% Quality of service offered by fund provider 23% 20% Breadth of ETF offerings 22% 22% 0% 100% 0% 0% 62% 68% 0% 48% 65% 27% 22% 55% 38% 32% 45% 19% 22% 0% 0% 35% 36% 100% 58% 16% 16% 100% 24% 0% 100% 0% 100% Note: Based on 258 responses. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study PROPORTION OF RESPONDENTS USING EACH ETF PROVIDER* Global U.S. Europe 92% iShares/BlackRock Vanguard 56% State Street/SPDRs 53% PowerShares 34% Deutsche X-trackers/DBX Trackers 29% Canada 94% 91% 73% 92% 24% 64% 31% 45% 18% 5% 6% WisdomTree 11% 17% 0% 8% Lyxor 10% 0% 43% 100% 0% 100% Note: *Other mentions included BMO, Van Eck, UBS, Amundi, Horizons, First Trust, and Nomura. Based on 242 responses. Source: Greenwich Associates 2015 Global Exchange-Traded Funds Study 10 | GREENWICH ASSOCIATES 43% 11% 12% 100% 64% 39% 62% 0% 39% 44% 5% 18% 82% 64% PIMCO 0% Asia 25% 4% 11% 0% 0% 0% 100% 0% 100% Conclusion Greenwich Associates expects institutional investments in ETFs to grow to approximately $300 billion per year by 2020, with ETF allocations climbing to 25% of total institutional assets in North America, 15% in Europe and 10% in Asia by 2020. The results of this study suggest future growth of ETFs in the institutional channel will be driven by the continued discovery of new and more sophisticated applications for the funds across investment portfolios. These applications will include the replacement of less costeffective futures positions and the achievement of core exposures critical to institutional investment strategies. In fixed income, gradual increases in adoption and allocation among users should result in slow but steady growth. That growth rate could accelerate if liquidity shortages in fixedincome markets around the world trigger an increase in institutional demand for ETFs. The intersection of an increasingly diverse slate of institutional needs and the inherent flexibility of the ETF structure will spur the spread of the funds into new areas and asset classes. While institutional equity portfolios will remain a major source of growth for some time to come, the intersection of an increasingly diverse slate of institutional needs and the inherent flexibility of the ETF structure will spur the spread of the funds into new areas and asset classes. That process is already evident in the expanding use of ETFs in insurance company portfolios and in the widespread use of ETFs by asset managers launching new products to meet growing worldwide demand for multi-asset funds. Finally, Greenwich Associates expects innovation among product providers to fuel additional growth, as institutions find applications within their portfolios for smart-beta ETFs and other new funds types. EXPLORING ETF USE BY REGION For a detailed look into local trends in ETF use at the regional level, please see our 2015 reports examining the institutional ETF markets in Asia, Europe, the U.S., and Canada. JJ ETFs Take Root in Asian Institutional Portfolios JJ ETFs in the European Institutional Channel: 5 Key Trends JJ Institutional Investment in ETFs: Versatility Fuels Growth JJ Versatility Fuels Expansion: ETFs in Canadian Institutional Portfolios greenwich.com [email protected] Ph +1 203.625.5038 Doc ID 16-2017 Reprinted with permission of Greenwich Associates, LLC, May 2016. The opinions expressed in this reprint are intended to provide insight or education and are not intended as individual investment advice. Carefully consider the iShares® Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Transactions in shares of ETFs will result in brokerage commissions and will generate tax consequences. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Shares of the iShares Funds may be sold throughout the day on the exchange through any brokerage account. However, shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. This study was sponsored by BlackRock. The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). BlackRock is not affiliated with Greenwich Associates, LLC, or its affiliates. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners. iS-18325-0516 FOR INSTITUTIONAL USE ONLY - NOT FOR PUBLIC DISTRIBUTION