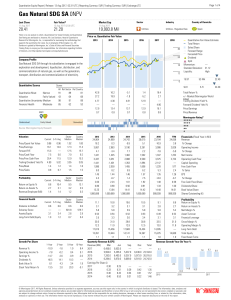

Gas Natural SDG SA 0NPV

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

DHFL Pramerica Dual Advantage Fund Series 1 to 3

... under the applicable regulations. Such investments shall be subject to the investment objective and strategy of the Scheme and the internal limits if any, as laid down from time to time. These include but are not limited to futures (both stock and index) and options (stock and index). Derivatives ar ...

... under the applicable regulations. Such investments shall be subject to the investment objective and strategy of the Scheme and the internal limits if any, as laid down from time to time. These include but are not limited to futures (both stock and index) and options (stock and index). Derivatives ar ...

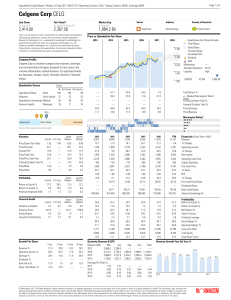

Celgene Corp CELG

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

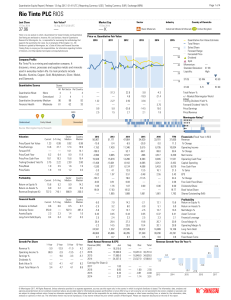

Rio Tinto PLC RIOS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

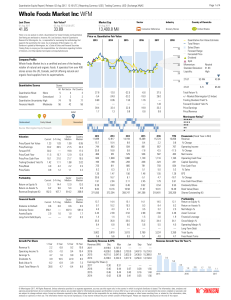

Whole Foods Market Inc WFM

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Annual Equity-Based Insurance Guarantees Conference

... management and risk management committees. He is a frequent speaker at industry meetings on ALM and actuarial topics such as the risk management of variable annuities, the impact of low interest rates on insurers and the transformation of actuarial functions. Andrew joined the company in 1984 in Met ...

... management and risk management committees. He is a frequent speaker at industry meetings on ALM and actuarial topics such as the risk management of variable annuities, the impact of low interest rates on insurers and the transformation of actuarial functions. Andrew joined the company in 1984 in Met ...

An investor`s guide to purchasing mutual funds and 529

... family to mutual fund family. As you consider investing in one or more mutual funds from a given family of mutual funds, be sure to discuss with your financial advisor the discounts that may be available to you. Class B shares. Class B shares typically have a “backend” sales charge, called a conting ...

... family to mutual fund family. As you consider investing in one or more mutual funds from a given family of mutual funds, be sure to discuss with your financial advisor the discounts that may be available to you. Class B shares. Class B shares typically have a “backend” sales charge, called a conting ...

CEO Pay and Firm Size: an Update after the Crisis

... it implies that as the size of large firms has increased over time, executive compensation has increased by a similar factor, as all firms have a higher willingness to pay for talent. GL, using data from 1970-2003, provide evidence consistent with the size of stakes view. In this paper, we examine w ...

... it implies that as the size of large firms has increased over time, executive compensation has increased by a similar factor, as all firms have a higher willingness to pay for talent. GL, using data from 1970-2003, provide evidence consistent with the size of stakes view. In this paper, we examine w ...

Do Institutional Investors Alleviate Agency Problems

... Easterbrook (1984) and Jensen (1986) develop an agency-based theory which implies that higher payouts keep managers in the capital markets where monitoring costs are lower than those alternatively incurred by current shareholders. Therefore, payouts reduce agency costs. Agency-based theory recognize ...

... Easterbrook (1984) and Jensen (1986) develop an agency-based theory which implies that higher payouts keep managers in the capital markets where monitoring costs are lower than those alternatively incurred by current shareholders. Therefore, payouts reduce agency costs. Agency-based theory recognize ...

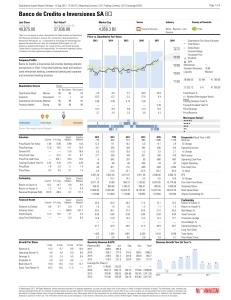

Banco de Credito e Inversiones SA BCI

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Costs of Eliminating Discretionary Broker Voting on Uncontested

... The portion of shares held by retail investors will significantly affect the cost of soliciting votes in an uncontested election of directors, as institutional investors are more likely to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for ...

... The portion of shares held by retail investors will significantly affect the cost of soliciting votes in an uncontested election of directors, as institutional investors are more likely to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for ...

NEWMONT MINING CORP /DE/ (Form: 8-K

... * Effective January 1, 2004, the Company began consolidating Batu Hijau and changed to co-product cost accounting for copper and gold, whereby production costs are allocated in proportion to the sales revenue generated by each product. As a result, reported cash costs are impacted by relative moveme ...

... * Effective January 1, 2004, the Company began consolidating Batu Hijau and changed to co-product cost accounting for copper and gold, whereby production costs are allocated in proportion to the sales revenue generated by each product. As a result, reported cash costs are impacted by relative moveme ...

Guide for Equity - Cayman Islands Stock Exchange

... IAS or acceptable local GAAP, covering at least the last three years • this can be varied for certain specialist issuers, see above • an accountants report is required where there has been any material change to the group structure, accounting policies, or a qualified audit in the past three years ...

... IAS or acceptable local GAAP, covering at least the last three years • this can be varied for certain specialist issuers, see above • an accountants report is required where there has been any material change to the group structure, accounting policies, or a qualified audit in the past three years ...

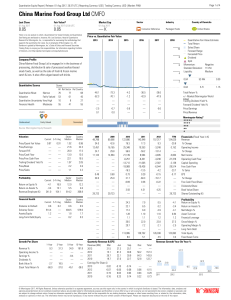

China Marine Food Group Ltd CMFO

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Do Chinese Investors Get What They Don`t Pay For? Expense

... List of Figures Figure 1: By Fund Type Expenses and Net Returns are Positively Correlated................. 10 Figure 2: Expenses and Net Returns for Bond Funds ........................................................... 11 Figure 3: Expenses and Net Returns for Blend Funds ......................... ...

... List of Figures Figure 1: By Fund Type Expenses and Net Returns are Positively Correlated................. 10 Figure 2: Expenses and Net Returns for Bond Funds ........................................................... 11 Figure 3: Expenses and Net Returns for Blend Funds ......................... ...

Dominated assets, the expected utility maxim, and mean

... dominated asset is included in the menu of investment opportunities. Asset A dominates asset B if (1) the cash payments to A are at least as high as those to B and strictly greater than the payoff to B in at least one possible state outcome, and (2) if the current price of A is less than or equal to ...

... dominated asset is included in the menu of investment opportunities. Asset A dominates asset B if (1) the cash payments to A are at least as high as those to B and strictly greater than the payoff to B in at least one possible state outcome, and (2) if the current price of A is less than or equal to ...

DOES SHAREHOLDER COMPOSITION AFFECT STOCK RETURNS?

... may revise expectations of future growth and therefore their valuation of the stock. We expect that when a larger proportion of stock is owned by aggressive growth or growth investors, the magnitude of the response to earnings news will be increased. To the extent value investors actually increase ...

... may revise expectations of future growth and therefore their valuation of the stock. We expect that when a larger proportion of stock is owned by aggressive growth or growth investors, the magnitude of the response to earnings news will be increased. To the extent value investors actually increase ...

The Adequacy of Investment Choices Offered By 401(k) Plans Edwin

... large number of science and technology funds offered at the date our sample was constructed suggests that some plan administrators were including the then-current “hot” sector. II. Adequacy of Investment Choices In this section we examine the adequacy of the investment choices offered by 401(k) plan ...

... large number of science and technology funds offered at the date our sample was constructed suggests that some plan administrators were including the then-current “hot” sector. II. Adequacy of Investment Choices In this section we examine the adequacy of the investment choices offered by 401(k) plan ...

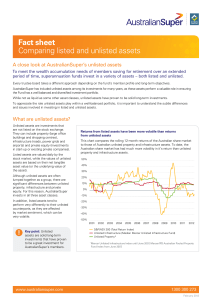

Fact sheet Comparing listed and unlisted assets

... allows a fund to have available cash flow after interest to meet ongoing capital requirements, pay down debt or distribute income to investors. This increased flexibility reduces a fund’s risk of not being able to refinance its existing debts. Many listed property assets had high debt levels, couple ...

... allows a fund to have available cash flow after interest to meet ongoing capital requirements, pay down debt or distribute income to investors. This increased flexibility reduces a fund’s risk of not being able to refinance its existing debts. Many listed property assets had high debt levels, couple ...

Statement of Advice sample wording

... Established in 1835, ANZ is one of the largest companies in Australia and New Zealand and among the top 50 international banking and financial service providers. ANZ has more than six million personal, private banking, small business, corporate, institutional, and asset finance customers worldwide. ...

... Established in 1835, ANZ is one of the largest companies in Australia and New Zealand and among the top 50 international banking and financial service providers. ANZ has more than six million personal, private banking, small business, corporate, institutional, and asset finance customers worldwide. ...

Measuring Brand Equity of Restaurant Chains

... service operations. However, even successful food service operations find it difficult to acquire new investment funds for the purpose of expansion and growth. One reason for this is the problem associated with assessing "added value or intangible assets." It is difficult to assess or evaluate "adde ...

... service operations. However, even successful food service operations find it difficult to acquire new investment funds for the purpose of expansion and growth. One reason for this is the problem associated with assessing "added value or intangible assets." It is difficult to assess or evaluate "adde ...

The framework of capital requirements for UK banks

... Importantly, standards for the total loss-absorbing capacity (TLAC) that globally systemic banks must hold have also been agreed at the international level; these determine the amount and nature of gone concern loss absorbing resources these banks must hold. As set out in Box 2, these standards effe ...

... Importantly, standards for the total loss-absorbing capacity (TLAC) that globally systemic banks must hold have also been agreed at the international level; these determine the amount and nature of gone concern loss absorbing resources these banks must hold. As set out in Box 2, these standards effe ...

role of capital market

... continues to be a cause of concern. It has been ascertained that the total number of retail investors is much less than 1% of the total Indian population. While on one hand, the number of retail investors is low, on the other hand substantial amount of household savings are available which can be ch ...

... continues to be a cause of concern. It has been ascertained that the total number of retail investors is much less than 1% of the total Indian population. While on one hand, the number of retail investors is low, on the other hand substantial amount of household savings are available which can be ch ...

CREDIT FUNDS INSIGHT 01 May 2016 Issue 6, May 2016

... Needless to say, certain of the key features identified above are attractive to borrowers, such as there being a reduced need to service amortisation during the life of the facility and the higher leverage that may be available (particularly if that higher leverage results in a lower minimum equity ...

... Needless to say, certain of the key features identified above are attractive to borrowers, such as there being a reduced need to service amortisation during the life of the facility and the higher leverage that may be available (particularly if that higher leverage results in a lower minimum equity ...

Chapter 28 Investment Policy and the Framework of the CFA Institute

... 13. An important benefit of Keogh plans is that A. they are not taxable until funds are withdrawn as benefits. B. they are protected against inflation. C. they are automatically insured by the Federal government. D. they are not taxable until funds are withdrawn as benefits and they are protected ag ...

... 13. An important benefit of Keogh plans is that A. they are not taxable until funds are withdrawn as benefits. B. they are protected against inflation. C. they are automatically insured by the Federal government. D. they are not taxable until funds are withdrawn as benefits and they are protected ag ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.