trs report - Illinois Retired Teacher`s Association

... Estate. As of March 31, 2013 the program had $4.6 billion in total invested asset representing 11.7% of the total TRS plan. The program has a long-term target of 60% in core investments and 40% in specialty/non-core investments. The ten-year performance return is 8.1%. ...

... Estate. As of March 31, 2013 the program had $4.6 billion in total invested asset representing 11.7% of the total TRS plan. The program has a long-term target of 60% in core investments and 40% in specialty/non-core investments. The ten-year performance return is 8.1%. ...

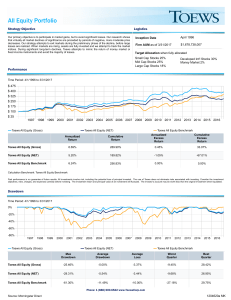

All Equity Portfolio

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

Slide 1

... on the US Economy Venture funded firms account for: 12.5 million jobs Annual revenues of $1.1 Trillion Impact on economy 6.7% of US company revenue 9.7% of US payroll 11.0% of US GDP Source: National Venture Capital Association and DRI-WEFA ...

... on the US Economy Venture funded firms account for: 12.5 million jobs Annual revenues of $1.1 Trillion Impact on economy 6.7% of US company revenue 9.7% of US payroll 11.0% of US GDP Source: National Venture Capital Association and DRI-WEFA ...

Do Firms` Intrinsically Determined Enterprise Values Corroborate

... In an influential study, Alford (1992) employs price-earnings multiple to empirically examine the accuracy of the P/E valuation method when comparable firms are selected on the basis of industry, risk, and earnings growth. The study points out that accuracy occurs when the portfolio is constrcuted u ...

... In an influential study, Alford (1992) employs price-earnings multiple to empirically examine the accuracy of the P/E valuation method when comparable firms are selected on the basis of industry, risk, and earnings growth. The study points out that accuracy occurs when the portfolio is constrcuted u ...

Finance Committee

... “Property”), on terms and conditions as authorized by the Chair of the Finance Committee of the Board of Visitors and the Executive Vice President and Chief Operating Officer of the University of Virginia; RESOLVED, the Board of Visitors approves the acquisition of the Property on terms and conditi ...

... “Property”), on terms and conditions as authorized by the Chair of the Finance Committee of the Board of Visitors and the Executive Vice President and Chief Operating Officer of the University of Virginia; RESOLVED, the Board of Visitors approves the acquisition of the Property on terms and conditi ...

RISK AND PROFITABILITY AS CAPITAL STRUCTURE

... equity proportionately to stay close to the target. Myers (1984), however, suggests that when the firm’s equity is under priced in the market, managers are reluctant to issue equity. The consequence is that potential investors tend to react negatively to an equity issue, because they perceive equity ...

... equity proportionately to stay close to the target. Myers (1984), however, suggests that when the firm’s equity is under priced in the market, managers are reluctant to issue equity. The consequence is that potential investors tend to react negatively to an equity issue, because they perceive equity ...

Survey - eVestment

... compared to more established holdings of private equity, venture capital and private equity real estate. The shift to private debt is likely driven by the emergence of opportunities, and demand for higher yielding and less correlated replacements to traditional fixed income instruments. At the expen ...

... compared to more established holdings of private equity, venture capital and private equity real estate. The shift to private debt is likely driven by the emergence of opportunities, and demand for higher yielding and less correlated replacements to traditional fixed income instruments. At the expen ...

diversified equity strategy fund

... prospects of particular companies and/or sectors in the economy. Investments in small and/or mid-sized company stocks typically involve greater risk, particularly in the short term, than those in larger, more established companies. Investments in either growth or value stocks may shift in and out of ...

... prospects of particular companies and/or sectors in the economy. Investments in small and/or mid-sized company stocks typically involve greater risk, particularly in the short term, than those in larger, more established companies. Investments in either growth or value stocks may shift in and out of ...

Evidence from Real Estate Private Equity

... traditional asset classes, real estate private equity (REPE) funds (i.e., non-listed closed-end funds investing with a value-added or opportunistic approach in real estate) are increasingly favored by plan sponsors to gain real estate exposure outside of their home markets (Baum and Farrelly [2009]) ...

... traditional asset classes, real estate private equity (REPE) funds (i.e., non-listed closed-end funds investing with a value-added or opportunistic approach in real estate) are increasingly favored by plan sponsors to gain real estate exposure outside of their home markets (Baum and Farrelly [2009]) ...

sample letter

... funds) whose assets are treated as “plan assets” under Section 3(42) of ERISA (“Benefit Plan Investor”). The Rule expands the definition of who is a “fiduciary” in the context of marketing the private funds we advise (the “Funds”) to Benefit Plan Investors but provides certain fiduciary “carve-out” ...

... funds) whose assets are treated as “plan assets” under Section 3(42) of ERISA (“Benefit Plan Investor”). The Rule expands the definition of who is a “fiduciary” in the context of marketing the private funds we advise (the “Funds”) to Benefit Plan Investors but provides certain fiduciary “carve-out” ...

executive summary - Adelante Capital Management

... compensated in the past; however, highly publicized reductions in distributions have stemmed the tide from Japan in the past two quarters. Flows out of US and Global mutual funds registered in Japan are estimated to be $1.8 billion YTD in 2017 compared to inflows of $8.3 billion in First Quarter 201 ...

... compensated in the past; however, highly publicized reductions in distributions have stemmed the tide from Japan in the past two quarters. Flows out of US and Global mutual funds registered in Japan are estimated to be $1.8 billion YTD in 2017 compared to inflows of $8.3 billion in First Quarter 201 ...

read more

... never turned a corner uncovered and never contemplated only one exit strategy. We maintained maximum flexibility to address what might await at “the other side of the hill.” This is the same approach we take to investing on behalf of our institutional partners. Since early 2016, commercial banks hav ...

... never turned a corner uncovered and never contemplated only one exit strategy. We maintained maximum flexibility to address what might await at “the other side of the hill.” This is the same approach we take to investing on behalf of our institutional partners. Since early 2016, commercial banks hav ...

Standard Life MyFolio Market Funds

... portfolios. The strategic asset allocation for the funds is set by Standard Life Investments in consultation with Moody’s Analytics (formerly Barrie & Hibbert) who undertake a risk / return optimisation process using the strategic asset classes that are agreed with Standard Life Investments. Moody’s ...

... portfolios. The strategic asset allocation for the funds is set by Standard Life Investments in consultation with Moody’s Analytics (formerly Barrie & Hibbert) who undertake a risk / return optimisation process using the strategic asset classes that are agreed with Standard Life Investments. Moody’s ...

CHAPTER 9 The Cost of Capital

... Flotation costs are highest for common equity. However, since most firms issue equity infrequently, We will frequently ignore flotation costs when calculating the WACC. ...

... Flotation costs are highest for common equity. However, since most firms issue equity infrequently, We will frequently ignore flotation costs when calculating the WACC. ...

harvard, yale, and alternative investments: a post

... *Li, Zhang and Xhao, “Investing in Talents,” Journal of Financial and Quantitative Analysis, 2011 ...

... *Li, Zhang and Xhao, “Investing in Talents,” Journal of Financial and Quantitative Analysis, 2011 ...

1 | Page Author Jacob Braude is quoted as saying, “Always behave

... Poor’s 500 Index and the Dow Jones Industrial Average have spent the vast majority of the year mired in one of the longest and most narrow trading ranges in modern market history. If you just take a cursory look at those two indexes (or even the broad market, as illustrated by the Russell 3000 Index ...

... Poor’s 500 Index and the Dow Jones Industrial Average have spent the vast majority of the year mired in one of the longest and most narrow trading ranges in modern market history. If you just take a cursory look at those two indexes (or even the broad market, as illustrated by the Russell 3000 Index ...

the theory of privatization

... plants, 29 energy generation and distribution units and 5 real estates have been taken into the scope of privatization portfolio. Later, 22 of these companies, 4 power generators and 4 real estates were excluded from the portfolio for various reasons. Currently there are 38 companies and some real e ...

... plants, 29 energy generation and distribution units and 5 real estates have been taken into the scope of privatization portfolio. Later, 22 of these companies, 4 power generators and 4 real estates were excluded from the portfolio for various reasons. Currently there are 38 companies and some real e ...

(Attachment: 5)Report (79K/bytes)

... the Bond yield level. Most other asset classes are basing their levels from this yield as with yields currently low, investors are seeking returns wherever they can find them. Also, the only issue of note on the medium horizon is the US Federal Reserve statement on cutting its bond holdings. It is e ...

... the Bond yield level. Most other asset classes are basing their levels from this yield as with yields currently low, investors are seeking returns wherever they can find them. Also, the only issue of note on the medium horizon is the US Federal Reserve statement on cutting its bond holdings. It is e ...

stocks - Seattle University

... Shares represent a claim on the investment portfolio of mutual funds Mutual funds can invest in stocks, bonds, real estate, gold, etc. etc. ...

... Shares represent a claim on the investment portfolio of mutual funds Mutual funds can invest in stocks, bonds, real estate, gold, etc. etc. ...

BAE Systems Pension Scheme Additional Voluntary Contributions

... b) I wish my Additional Voluntary Contributions to be invested in the Pension Lifestyle Profile Lifestyle Profile notes: 1. Selection of a) or b) above covers your entire contribution: it is not possible to combine either Profile with any of the available standalone funds. The only exception to this ...

... b) I wish my Additional Voluntary Contributions to be invested in the Pension Lifestyle Profile Lifestyle Profile notes: 1. Selection of a) or b) above covers your entire contribution: it is not possible to combine either Profile with any of the available standalone funds. The only exception to this ...

foundation market-based investment funds

... The asset targets for this fund are 85% invested in investment grade intermediate term debt obligations, 10% in high yield bonds and 5% in cash. There may be some fluctuation in principal values as assets may be sold before they mature to provide liquidity, and the asset values will fluctuate on a d ...

... The asset targets for this fund are 85% invested in investment grade intermediate term debt obligations, 10% in high yield bonds and 5% in cash. There may be some fluctuation in principal values as assets may be sold before they mature to provide liquidity, and the asset values will fluctuate on a d ...

Seminar on JESSICA and State Aid Provisions – Brussels, 4

... • In order to limit State aid intervention and at the same time benefit as much as possible from market players’ intelligence, the UDF may not finance a UDP without market oriented co-financing sharing investment risks. • Co-financing must be significant, e. g. not smaller than 30% of a UDP. • Co-fi ...

... • In order to limit State aid intervention and at the same time benefit as much as possible from market players’ intelligence, the UDF may not finance a UDP without market oriented co-financing sharing investment risks. • Co-financing must be significant, e. g. not smaller than 30% of a UDP. • Co-fi ...

Bucharest-Dec9-Presentazione EIBA panel COST

... Case studies on Chinese firms acquiring Icelandic lands: Beijing Zhongkun Investment Group Co. Ltd. and National Bluestar Group Co. Ltd company Only the first firm was able to accomplish its deal since it was an indirect acquisition (through a Norwegian Subsidiary), while the second firm was stopped ...

... Case studies on Chinese firms acquiring Icelandic lands: Beijing Zhongkun Investment Group Co. Ltd. and National Bluestar Group Co. Ltd company Only the first firm was able to accomplish its deal since it was an indirect acquisition (through a Norwegian Subsidiary), while the second firm was stopped ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.