Document

... Doomsday Machine by Martin Cohen and Andrew McKillop ]) that what is often not appreciated in debates about the economics of nuclear power is that the cost of equity, that is companies using their own money to pay for new plants, is generally higher than the cost of debt.The Doomsday Machine, Cohen ...

... Doomsday Machine by Martin Cohen and Andrew McKillop ]) that what is often not appreciated in debates about the economics of nuclear power is that the cost of equity, that is companies using their own money to pay for new plants, is generally higher than the cost of debt.The Doomsday Machine, Cohen ...

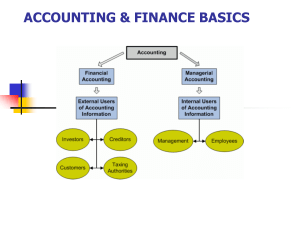

WIS ACCOUNTING BASICS

... Friends Company transfers $500 of assets to its owners. This is an asset use transaction: Distribution and expenses both result in decreases in retained earnings and thus, in equity. ...

... Friends Company transfers $500 of assets to its owners. This is an asset use transaction: Distribution and expenses both result in decreases in retained earnings and thus, in equity. ...

Risk, Return and Capital Budgeting

... In a no-tax world, if we know about a project’s risk, then we can use the CAPM (or other risk/return models) to determine the discount rate for the project. A project or firm’s asset risk, as measured by βassets, is influenced by the cyclicality of revenues and the degree of operating leverage. Fina ...

... In a no-tax world, if we know about a project’s risk, then we can use the CAPM (or other risk/return models) to determine the discount rate for the project. A project or firm’s asset risk, as measured by βassets, is influenced by the cyclicality of revenues and the degree of operating leverage. Fina ...

CCT-eu: a new type of nominal floating rate bonds, indexed to

... Two bonds belonging to the new asset class were offered to the market: the CCT-eu 2015 and the CCT-eu 2017. Both were launched using the syndication issuance method. The subsequent re-openings were carried out at regular auctions held at the end of the month. In April 2011, MEF launched the new CCT- ...

... Two bonds belonging to the new asset class were offered to the market: the CCT-eu 2015 and the CCT-eu 2017. Both were launched using the syndication issuance method. The subsequent re-openings were carried out at regular auctions held at the end of the month. In April 2011, MEF launched the new CCT- ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... respectively, have no place in a portfolio with such long time horizon. His strategy, which has produced excellent returns for the past two years, has been to invest the portfolio as follows: ...

... respectively, have no place in a portfolio with such long time horizon. His strategy, which has produced excellent returns for the past two years, has been to invest the portfolio as follows: ...

Emerging Markets Fund

... The CPF interest rate for the Ordinary Account (OA) is based on the 12-month fixed deposit and month-end savings rates of the major local banks. Under the CPF Act, the Board pays a minimum interest of 2.5% per annum when this interest formula yields a lower rate. The CPF Board pays an extra interest ...

... The CPF interest rate for the Ordinary Account (OA) is based on the 12-month fixed deposit and month-end savings rates of the major local banks. Under the CPF Act, the Board pays a minimum interest of 2.5% per annum when this interest formula yields a lower rate. The CPF Board pays an extra interest ...

Idiosyncratic risk and long-run stock performance following

... We exclude samples when SEOs have the following conditions: (1) offer prices less than $5; (2) spin-offs; (3) reverse LBOs; (4) closed-end funds, unit investment trusts, REITs and limited partnerships; (5) rights and standby issues; (6) simultaneous or combined offers of several classes of securitie ...

... We exclude samples when SEOs have the following conditions: (1) offer prices less than $5; (2) spin-offs; (3) reverse LBOs; (4) closed-end funds, unit investment trusts, REITs and limited partnerships; (5) rights and standby issues; (6) simultaneous or combined offers of several classes of securitie ...

Risk free Rates, Risk Premiums and Betas

... instance, if you go back to 1928 (about 80 years of history) and you assume a standard deviation of 20% in annual stock returns, you arrive at a standard error of greater than 2%: Standard Error in Premium = 20%/√80 = 2.26% (An aside: The implied standard deviation in equities rose to almost 50% dur ...

... instance, if you go back to 1928 (about 80 years of history) and you assume a standard deviation of 20% in annual stock returns, you arrive at a standard error of greater than 2%: Standard Error in Premium = 20%/√80 = 2.26% (An aside: The implied standard deviation in equities rose to almost 50% dur ...

Overview Presentation

... • The fund uses PICTET’s best practice in portfolio investment through a balance of money market tools, bonds and equities. Futures, options and other derivative tools may be used for management of liquidity. ...

... • The fund uses PICTET’s best practice in portfolio investment through a balance of money market tools, bonds and equities. Futures, options and other derivative tools may be used for management of liquidity. ...

Promoting and supporting SME development – the case of Kenya

... Investment in SMEs (Approx $50 000 to $2,5million): Risk based transactions, i.e. private equity Applications assessed on viability, not collateral Property Management Services: Management of commercial and industrial property for entrepreneurs or multi-tenanted properties Technical Assistance ...

... Investment in SMEs (Approx $50 000 to $2,5million): Risk based transactions, i.e. private equity Applications assessed on viability, not collateral Property Management Services: Management of commercial and industrial property for entrepreneurs or multi-tenanted properties Technical Assistance ...

THEORETICAL MODEL

... techniques, and procedures relevant prior to product commercialization. Traditionally, industry incumbents have used three means to obtain new technology from smaller innovators: (1) non-equity forms of collaboration such as research contracts, licensing agreements, or nonequity joint ventures; (2) ...

... techniques, and procedures relevant prior to product commercialization. Traditionally, industry incumbents have used three means to obtain new technology from smaller innovators: (1) non-equity forms of collaboration such as research contracts, licensing agreements, or nonequity joint ventures; (2) ...

Slide 0 - Astana Economic Forum 2013

... Average size: ~$300 million Players: Managed mostly by MDBs and other development agencies Growth prospects: Limited ...

... Average size: ~$300 million Players: Managed mostly by MDBs and other development agencies Growth prospects: Limited ...

Regional Equity Market Integration in South America

... By the time Phase II of the integration is complete, individual investors will have direct access to markets in all three countries. Benefits for investors include portfolio diversification & a reduction of transaction costs, while stock issuers benefit primarily from greater access to capital marke ...

... By the time Phase II of the integration is complete, individual investors will have direct access to markets in all three countries. Benefits for investors include portfolio diversification & a reduction of transaction costs, while stock issuers benefit primarily from greater access to capital marke ...

STRATEGIES OF ENTERING IN FOREIGN MARKET Sonia

... become identified with its trademark, to sell its products or services, and often to use its business format and system. In some cases, key components are provided by franchiser to franchisee. For example soft drink manufacturer like Pepsi and coca-cola provide the key part ...

... become identified with its trademark, to sell its products or services, and often to use its business format and system. In some cases, key components are provided by franchiser to franchisee. For example soft drink manufacturer like Pepsi and coca-cola provide the key part ...

Guide to Private Equity and Venture Capital for

... Private equity funds often organise deals as buyouts – that is, partnering with the management team, taking a majority stake and providing capital to buy the business from, for example, a corporate, another private equity house, the public markets or a family owner. At the larger end of the deal spe ...

... Private equity funds often organise deals as buyouts – that is, partnering with the management team, taking a majority stake and providing capital to buy the business from, for example, a corporate, another private equity house, the public markets or a family owner. At the larger end of the deal spe ...

Investment Guidelines

... 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee exists, investment will be permitted up to a maximum of 50% of the portfolio’s value • Structured Notes will only be accepted at t ...

... 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee exists, investment will be permitted up to a maximum of 50% of the portfolio’s value • Structured Notes will only be accepted at t ...

File - The Institute of International Finance

... Contraction of securities lending would deprive end-users and beneficial owners (including mutual funds, pension funds, and others) of the revenue associated with lending securities; loss of such revenue would result in increased net costs, which would likely be passed on to investors and beneficiar ...

... Contraction of securities lending would deprive end-users and beneficial owners (including mutual funds, pension funds, and others) of the revenue associated with lending securities; loss of such revenue would result in increased net costs, which would likely be passed on to investors and beneficiar ...

ALLIANCE HEALTHCARE AND BOOTS RETIREMENT SAVINGS

... investing and highlight some of the things you need to think about before making any investment. In addition, you’ll be able to access Legal & General’s online Attitude to Risk and Retirement Planner tools, which can help you to understand how you feel about investment risk and consider what you nee ...

... investing and highlight some of the things you need to think about before making any investment. In addition, you’ll be able to access Legal & General’s online Attitude to Risk and Retirement Planner tools, which can help you to understand how you feel about investment risk and consider what you nee ...

Equity Award Grant Policy

... The Board of Directors and the Compensation Committee have delegated to the Company’s Chief Executive Officer (the “CEO”) and/or Chief Financial Officer (the “CFO”), the power and authority to award Annual Grants, New Hire Grants or Performance Grants under the Plans to Employees (other than executi ...

... The Board of Directors and the Compensation Committee have delegated to the Company’s Chief Executive Officer (the “CEO”) and/or Chief Financial Officer (the “CFO”), the power and authority to award Annual Grants, New Hire Grants or Performance Grants under the Plans to Employees (other than executi ...

Leverage

... Buying stocks on margin is one form of leverage. When buying on margin, an investor puts up a certain percentage of the purchase price (at least half, according to current regulations) and borrows the rest from a broker. Suppose you put up a $50 margin to buy $100 worth of stock; that means you're l ...

... Buying stocks on margin is one form of leverage. When buying on margin, an investor puts up a certain percentage of the purchase price (at least half, according to current regulations) and borrows the rest from a broker. Suppose you put up a $50 margin to buy $100 worth of stock; that means you're l ...

CF072M

... Latest available share price of the comparable companies should be used in calculating the market capitalization and price earnings ratio. The Sponsor(s) should provide details of the selection basis of the comparable companies, including but not limited to, how each of the comparable companies’ sca ...

... Latest available share price of the comparable companies should be used in calculating the market capitalization and price earnings ratio. The Sponsor(s) should provide details of the selection basis of the comparable companies, including but not limited to, how each of the comparable companies’ sca ...

Understanding Life Science Partnership Structures

... by Pfizer’s announced acquisition of Wyeth), the partnership options described in this article offer options for pharmaceutical and device companies in these challenging economic times. Dramatic declines in the capital markets have been in part caused by, and accompanied by the credit crunch. This r ...

... by Pfizer’s announced acquisition of Wyeth), the partnership options described in this article offer options for pharmaceutical and device companies in these challenging economic times. Dramatic declines in the capital markets have been in part caused by, and accompanied by the credit crunch. This r ...

Kalashian V - Velocity Law, LLC

... shareholders and/or obtaining an independent valuation to set a fair price for the financing. In any case, it is important to consider and evaluate the legal risks and issues that occur in a down round financing. Kalashian Case These issues were on public display in the seminal case of Michael Kalas ...

... shareholders and/or obtaining an independent valuation to set a fair price for the financing. In any case, it is important to consider and evaluate the legal risks and issues that occur in a down round financing. Kalashian Case These issues were on public display in the seminal case of Michael Kalas ...

Law for Business

... Companies can issue stocks to raise funds for startups, expansion projects or other uses Rather than borrowing funds, companies can sell slices of ownership of the company “Shares” entitle owners to a slice of future profits and, generally, some slice of the decision-making ...

... Companies can issue stocks to raise funds for startups, expansion projects or other uses Rather than borrowing funds, companies can sell slices of ownership of the company “Shares” entitle owners to a slice of future profits and, generally, some slice of the decision-making ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.