cost of capital

... on the projects in which it invest to maintain the market value of it’s stock. It can also be thought of as the rate of return required by the market suppliers of capital to attract their funds to the firm. It acts as a major link between the firm’s long-term investment decisions and the wealth of t ...

... on the projects in which it invest to maintain the market value of it’s stock. It can also be thought of as the rate of return required by the market suppliers of capital to attract their funds to the firm. It acts as a major link between the firm’s long-term investment decisions and the wealth of t ...

top of the line thinking - Northern Funds

... now available to retail investors, who can share the advantages of an approach that annually updates strategic exposures to stocks, bonds, cash and real assets, makes tactical bets to over- and underweight these strategic norms and rebalances regularly. The Fund is designed to provide easy and compe ...

... now available to retail investors, who can share the advantages of an approach that annually updates strategic exposures to stocks, bonds, cash and real assets, makes tactical bets to over- and underweight these strategic norms and rebalances regularly. The Fund is designed to provide easy and compe ...

Are investment certificates too complex?

... connected with a direct investment, such as in equities. In addition, passive investments are usually more cost-effective than actively managed financial products. Investors can now also hedge against the risk of default by an issuer. ...

... connected with a direct investment, such as in equities. In addition, passive investments are usually more cost-effective than actively managed financial products. Investors can now also hedge against the risk of default by an issuer. ...

MID-TERM #1

... Balance Sheet: States the organization’s financial position for a period of time. Income Statement: States the organization’s earnings for a period of time. Statement of Cash Flows: State the organization’s cash receipts and cash disbursements for a period of time. Statement of Owner’s Equity: State ...

... Balance Sheet: States the organization’s financial position for a period of time. Income Statement: States the organization’s earnings for a period of time. Statement of Cash Flows: State the organization’s cash receipts and cash disbursements for a period of time. Statement of Owner’s Equity: State ...

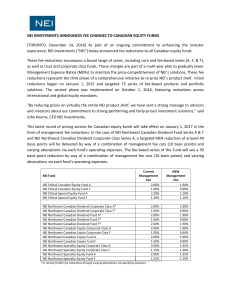

NEI Investments announces fee changes to Canadian equity funds

... as well as trust and corporate class funds. These changes are part of a multi-year plan to gradually lower Management Expense Ratios (MERs) to maintain the price-competitiveness of NEI’s solutions. These fee reductions represent the third phase of a comprehensive initiative to re-price NEI’s product ...

... as well as trust and corporate class funds. These changes are part of a multi-year plan to gradually lower Management Expense Ratios (MERs) to maintain the price-competitiveness of NEI’s solutions. These fee reductions represent the third phase of a comprehensive initiative to re-price NEI’s product ...

Value Creation in Private Equity

... research study analyzing the determinants of value creation across 241 private equity exits . Results showed that leverage accounted for just one-third of value creation. Furthermore, the results offered evidence that operational improvements were more important in driving value at private equity po ...

... research study analyzing the determinants of value creation across 241 private equity exits . Results showed that leverage accounted for just one-third of value creation. Furthermore, the results offered evidence that operational improvements were more important in driving value at private equity po ...

course syllabus

... – Ana Gonzalez Ribeiro. Greenshoe Options: An IPO's Best Friend / Investopedia. November 2008. – Jay R. Ritter. Differences between European and American IPO Markets / European Financial Management. Vol. 9, № 4. December 2003. Pp. 421-434. – Simeon Djankov. When Will Stocks Rebound in Eastern Europe ...

... – Ana Gonzalez Ribeiro. Greenshoe Options: An IPO's Best Friend / Investopedia. November 2008. – Jay R. Ritter. Differences between European and American IPO Markets / European Financial Management. Vol. 9, № 4. December 2003. Pp. 421-434. – Simeon Djankov. When Will Stocks Rebound in Eastern Europe ...

Investment Choice by Plan Members in OECD Countries with

... Balanced Account; Equity Pool; Fixed Income Pool; Money Market Pool A similar concept to the UWO Target Date Funds also implemented: the Money Market Pool is intended to protect from fluctuations in the market The Balanced Account offers auto rebalancing, which might be better performed on fund rath ...

... Balanced Account; Equity Pool; Fixed Income Pool; Money Market Pool A similar concept to the UWO Target Date Funds also implemented: the Money Market Pool is intended to protect from fluctuations in the market The Balanced Account offers auto rebalancing, which might be better performed on fund rath ...

Word Document - Maine Legislature

... Sec. 3. 10 MRSA §1100-T, sub-§2, as amended by PL 2011, c. 454, §§3 and 4, is further amended to read: 2. Eligibility for tax credit certificate for individuals and entities other than venture capital funds. The authority shall adopt rules in accordance with the Maine Administrative Procedure Act, T ...

... Sec. 3. 10 MRSA §1100-T, sub-§2, as amended by PL 2011, c. 454, §§3 and 4, is further amended to read: 2. Eligibility for tax credit certificate for individuals and entities other than venture capital funds. The authority shall adopt rules in accordance with the Maine Administrative Procedure Act, T ...

here

... After extensive consultation and preparation, the private sector U.S. National Advisory Board to the Social Impact Investing Taskforce – born out of the 2013 G8 process – issued their new report, Private Capital, Public Good: How Smart Federal Policy Can Galvanize Impact Investing – and Why It’s Urg ...

... After extensive consultation and preparation, the private sector U.S. National Advisory Board to the Social Impact Investing Taskforce – born out of the 2013 G8 process – issued their new report, Private Capital, Public Good: How Smart Federal Policy Can Galvanize Impact Investing – and Why It’s Urg ...

Shenkman Capital Management, Inc - Profile

... The foundation of the investment decision-making process is in-depth fundamental credit analysis conducted by an experienced research team. The analytical process includes a thorough review of the issuers using public information and financial statements, discussions with company management, and in ...

... The foundation of the investment decision-making process is in-depth fundamental credit analysis conducted by an experienced research team. The analytical process includes a thorough review of the issuers using public information and financial statements, discussions with company management, and in ...

Practice set and Solutions 1

... The financial crisis and the collapse in stock and other security prices produced a sharp drop in mutual fund activity. At the end of 2008, total assets fell to $9,601.1 billion and the number of accounts to 264,499. Investor demand for certain types of mutual funds plummeted, driven in large part b ...

... The financial crisis and the collapse in stock and other security prices produced a sharp drop in mutual fund activity. At the end of 2008, total assets fell to $9,601.1 billion and the number of accounts to 264,499. Investor demand for certain types of mutual funds plummeted, driven in large part b ...

Hedge against Rising Interest Rates with QAI

... There are risks involved with investing in any such products, including the possible loss of principal. Investors in the Funds should be willing to accept a high degree of volatility and the possibility of significant losses. The Fund’s investment performance, because it is a fund of funds, depends ...

... There are risks involved with investing in any such products, including the possible loss of principal. Investors in the Funds should be willing to accept a high degree of volatility and the possibility of significant losses. The Fund’s investment performance, because it is a fund of funds, depends ...

Consider the risks - Guinness Asset Management

... The tax reliefs referred to in the Information Memorandum for each offering in the Guinness EIS Service are those currently applicable. However, investors should be aware that tax reliefs can change. Their applicability and value will depend upon the individual circumstances of a given investor, and ...

... The tax reliefs referred to in the Information Memorandum for each offering in the Guinness EIS Service are those currently applicable. However, investors should be aware that tax reliefs can change. Their applicability and value will depend upon the individual circumstances of a given investor, and ...

Guide to Diversification

... Diversify by geography Geography also allows some of the impact of stock market movements to be dissipated, as you are not exposed only to the economics and government decisions of one country. Different markets are affected by different economic and financial factors and are therefore not perfectly ...

... Diversify by geography Geography also allows some of the impact of stock market movements to be dissipated, as you are not exposed only to the economics and government decisions of one country. Different markets are affected by different economic and financial factors and are therefore not perfectly ...

Multi-product Firms and Trade Liberalization

... Heterogeneity within industries is often as large as heterogeneity across industries ...

... Heterogeneity within industries is often as large as heterogeneity across industries ...

NFU Mutual Flexible Retirement Account fund switch form

... request. We have the right to delay a fund switch from the Property Fund for up to 12 months. We may also delay a fund switch from one of the other funds for up to 3 months. If we delay a fund switch we will use the prices that apply for the date it takes place, rather than those which applied when ...

... request. We have the right to delay a fund switch from the Property Fund for up to 12 months. We may also delay a fund switch from one of the other funds for up to 3 months. If we delay a fund switch we will use the prices that apply for the date it takes place, rather than those which applied when ...

Silicon Clocks raises $8M financing as Lux Capital joins existing

... Internet solutions. The founders of Formative believe that in today’s tough environment, technology start-ups are looking for investors with “real-world” start-up experience, and in very specific areas such as sales and marketing processes, scaling an organization for revenue or launching a product ...

... Internet solutions. The founders of Formative believe that in today’s tough environment, technology start-ups are looking for investors with “real-world” start-up experience, and in very specific areas such as sales and marketing processes, scaling an organization for revenue or launching a product ...

Investment policy statement - Giving to CU

... The LTIP’s strategy shall focus on developed economies with diversification among countries and currencies and may also include exposure to emerging markets. The LTIP intends to diversify its international investments by selecting specialist managers representing different styles and market capitali ...

... The LTIP’s strategy shall focus on developed economies with diversification among countries and currencies and may also include exposure to emerging markets. The LTIP intends to diversify its international investments by selecting specialist managers representing different styles and market capitali ...

Global Equity Outlook 2Q2015: Preparing for the New Market Leaders

... as interest rates and net interest margins (NIM) rise. However, with the Fed signaling that it is likely to raise rates in June or September, we believe large banks, which look attractively valued in a relatively full-priced market, will benefit. Yet many stocks that offer investors high income coul ...

... as interest rates and net interest margins (NIM) rise. However, with the Fed signaling that it is likely to raise rates in June or September, we believe large banks, which look attractively valued in a relatively full-priced market, will benefit. Yet many stocks that offer investors high income coul ...

PPT

... • Allow for better comparison through time or between companies • Used both internally and externally • For each ratio, ask yourself: – What the ratio is trying to measure – Why that information is important ...

... • Allow for better comparison through time or between companies • Used both internally and externally • For each ratio, ask yourself: – What the ratio is trying to measure – Why that information is important ...

Journal of Monetary Economics 22 (1988) 133-136. North

... 5. Neede& historical support Additional historical evidence in support of Rietz's hypothesis is needed for it to be taken seriously. Perhaps the implication of the Rietz theory t h ~ the rea~ m~er¢~ rate ~,!d the ?robabflity of the extreme event move inversely wouid be useful m rationalizing movemen ...

... 5. Neede& historical support Additional historical evidence in support of Rietz's hypothesis is needed for it to be taken seriously. Perhaps the implication of the Rietz theory t h ~ the rea~ m~er¢~ rate ~,!d the ?robabflity of the extreme event move inversely wouid be useful m rationalizing movemen ...

minutes - San Antonio Fire and Police Pension Fund

... Income Fund, L.P. (the “Fund”) is a Delaware limited partnership organized on December 8, 1994 that commenced operations on May 17, 1996. The Fund’s original investment objective was to achieve a high total return by investing in secured loans to small domestic independent energy producers, with acc ...

... Income Fund, L.P. (the “Fund”) is a Delaware limited partnership organized on December 8, 1994 that commenced operations on May 17, 1996. The Fund’s original investment objective was to achieve a high total return by investing in secured loans to small domestic independent energy producers, with acc ...

China`s First PERE+REITs Product Launched EBP

... Management Company is acting as Product Manager, with EBA Investment Management Co., Ltd acting as Fund Manager and China Everbright Limited (CEL) as co-participant. The product is backed by fund manager EBA (Beijing) Investment Management Co., Ltd., which provides a highly experienced team with man ...

... Management Company is acting as Product Manager, with EBA Investment Management Co., Ltd acting as Fund Manager and China Everbright Limited (CEL) as co-participant. The product is backed by fund manager EBA (Beijing) Investment Management Co., Ltd., which provides a highly experienced team with man ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.