Chapter 5

... relative size, excess return over market index return, monthly equity volatility. • Type 1 error rate of 18.68%. Bond Prices: B = B[t, T, i, (t, X(t)), (t, X(t)), (t,T,X(t)), , S(t,X(t))] Equity Prices: = [ t, T, i, (t, X(t)), , S(t,X(t))] where t is the current period; T is the bond’s time ...

... relative size, excess return over market index return, monthly equity volatility. • Type 1 error rate of 18.68%. Bond Prices: B = B[t, T, i, (t, X(t)), (t, X(t)), (t,T,X(t)), , S(t,X(t))] Equity Prices: = [ t, T, i, (t, X(t)), , S(t,X(t))] where t is the current period; T is the bond’s time ...

The Pros and Cons of Going Public

... There’s no question that the allure of an initial public offering (or IPO) for CEOs and CFOs can be strong. Going public may represent the chance to cash in on a lifetime of hard work spent building a company, or to raise a large amount of capital to fund business growth and expansion. But the lure ...

... There’s no question that the allure of an initial public offering (or IPO) for CEOs and CFOs can be strong. Going public may represent the chance to cash in on a lifetime of hard work spent building a company, or to raise a large amount of capital to fund business growth and expansion. But the lure ...

Fixed Impact: Green Bonds Primer

... Sustainable Investing 101 At Morgan Stanley, we define sustainability as a commitment to economic, social and environmental well-being for both the present and the future, balancing needs of today with the demands of tomorrow. Sustainability encompasses behaviors, processes, tools and technologies t ...

... Sustainable Investing 101 At Morgan Stanley, we define sustainability as a commitment to economic, social and environmental well-being for both the present and the future, balancing needs of today with the demands of tomorrow. Sustainability encompasses behaviors, processes, tools and technologies t ...

Investment Policy Beaufort County Open Land Trust (BCOLT

... Funds,” which describes the purpose, sources of contributions, and spending policies for these Internal Funds: Operating Fund CE Stewardship Fund & CE Legal Defense Fund Endowment Fund Acquisition Fund These Funds shall be used and invested according to the purpose for which each was created. It is ...

... Funds,” which describes the purpose, sources of contributions, and spending policies for these Internal Funds: Operating Fund CE Stewardship Fund & CE Legal Defense Fund Endowment Fund Acquisition Fund These Funds shall be used and invested according to the purpose for which each was created. It is ...

Satrix Top 40 Index Fund

... and service fees. Actual investment performance of the portfolio and the investor will differ depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any gu ...

... and service fees. Actual investment performance of the portfolio and the investor will differ depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any gu ...

BASIC CONCEPTS OF FINANCIAL ACCOUNTING

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

Owners` Equity - Southwest High School

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

Jobby`s guide to the worldwide credit crunch

... takeover activity as a direct result of credit costing more. Also, the fact that many deals are requiring some form of credit and leveraging (debt-based) will invariably create an M&A deal flow slowdown. There is currently a negative yield curve, meaning that interest rates for short-term debt are h ...

... takeover activity as a direct result of credit costing more. Also, the fact that many deals are requiring some form of credit and leveraging (debt-based) will invariably create an M&A deal flow slowdown. There is currently a negative yield curve, meaning that interest rates for short-term debt are h ...

Click here for the LONG version of the 4th Quarter Newsletter

... Note: Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. International investing involves special risks such as currency fluctuation and politica ...

... Note: Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. International investing involves special risks such as currency fluctuation and politica ...

Types of structured equity products

... will result in a high return to the noteholder. The downside risk (ie the risk of a negative return, or a reduction in the principal amount due to negative performance of the underlying investment) is, however, often limited by the insertion of full (as in the above example) or partial principal pro ...

... will result in a high return to the noteholder. The downside risk (ie the risk of a negative return, or a reduction in the principal amount due to negative performance of the underlying investment) is, however, often limited by the insertion of full (as in the above example) or partial principal pro ...

Mutual Fund Intermediation, Equity Issues, and the Real Economy

... Potential future work... Real output v.s. stock returns I Aggregate issues predict lower stock returns (Pontiff and Woodgate 2008) I Long-run underperformance is more pronounced when institutions increase their holdings around the issue (Edelen, Ince and Kadlec 2013) I Maybe due to change in risk f ...

... Potential future work... Real output v.s. stock returns I Aggregate issues predict lower stock returns (Pontiff and Woodgate 2008) I Long-run underperformance is more pronounced when institutions increase their holdings around the issue (Edelen, Ince and Kadlec 2013) I Maybe due to change in risk f ...

CIT Investment Discl..

... Fund Investments and Risks of Investing in the Funds Under normal market conditions, each Fund invests primarily in US and foreign stocks, bonds, private investment funds and cash equivalents primarily through a combination of direct investments, mutual funds, exchange-traded funds (ETFs), bonds, fi ...

... Fund Investments and Risks of Investing in the Funds Under normal market conditions, each Fund invests primarily in US and foreign stocks, bonds, private investment funds and cash equivalents primarily through a combination of direct investments, mutual funds, exchange-traded funds (ETFs), bonds, fi ...

Franco-Nevada Closes US$920 Million Bought Deal Financing

... This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995, respectively, which may include, but are not limited to, statements with respec ...

... This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995, respectively, which may include, but are not limited to, statements with respec ...

Financially Speaking

... from these historically low rates. On May 7, 2013, amid signs of an economy that’s continuing its weakening trend, the Reserve Bank of Australia (RBA) cut its official cash rate to 2.75%, the lowest for more than five decades. The rate was passed down in full by all four major banks. Analysts expect t ...

... from these historically low rates. On May 7, 2013, amid signs of an economy that’s continuing its weakening trend, the Reserve Bank of Australia (RBA) cut its official cash rate to 2.75%, the lowest for more than five decades. The rate was passed down in full by all four major banks. Analysts expect t ...

TCP Capital Corp. Receives Investment Grade Ratings from

... TCP Capital Corp. (NASDAQ: TCPC) is a specialty finance company focused on performing credit lending to middle-market companies as well as small businesses. TCPC lends primarily to companies with established market positions, strong regional or national operations, differentiated products and servic ...

... TCP Capital Corp. (NASDAQ: TCPC) is a specialty finance company focused on performing credit lending to middle-market companies as well as small businesses. TCPC lends primarily to companies with established market positions, strong regional or national operations, differentiated products and servic ...

Regulatory Risk, Cost of Capital and Investment

... The determination of the cost of capital is an important part of any regulatory decision. The application of a WACC to a regulated asset base is done with the purpose to determine an explicit return on assets employed by the telecommunications firms. In most cases the CAPM is used to determine the c ...

... The determination of the cost of capital is an important part of any regulatory decision. The application of a WACC to a regulated asset base is done with the purpose to determine an explicit return on assets employed by the telecommunications firms. In most cases the CAPM is used to determine the c ...

sources of capital and economic growth - u.s.

... for the failure of small businesses is lack of access to funding. Put differently, when small businesses do succeed and create employment and growth, an important factor in their success is access to the financing needed to support growth. The strength of the financial system has also been a signifi ...

... for the failure of small businesses is lack of access to funding. Put differently, when small businesses do succeed and create employment and growth, an important factor in their success is access to the financing needed to support growth. The strength of the financial system has also been a signifi ...

Hargita_Eszter_30_May_Ankara_not State aid_uj

... • State cannot use its privileges (cheap resources, no bankrupcy), normal market profit level has to be required • Reasonable decision – not the highest profit expectation is required • Risk assessment case by case ...

... • State cannot use its privileges (cheap resources, no bankrupcy), normal market profit level has to be required • Reasonable decision – not the highest profit expectation is required • Risk assessment case by case ...

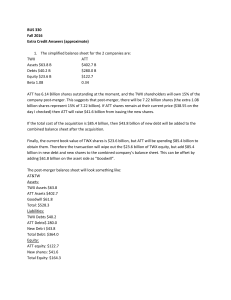

Bonus Assignment solution

... Each dollar of equity of the new company will absorb the risk from 653.4/289.4 = $2.26 of assets, so the resulting beta of the shares should be 2.26 * 0.26 = 0.59 3. If the combined company is able to absorb all the revenues from TWX and eliminate half of the selling, general, and administrative ex ...

... Each dollar of equity of the new company will absorb the risk from 653.4/289.4 = $2.26 of assets, so the resulting beta of the shares should be 2.26 * 0.26 = 0.59 3. If the combined company is able to absorb all the revenues from TWX and eliminate half of the selling, general, and administrative ex ...

Financial Innovations and Macroeconomic Volatility

... net debt repurchases in the nonfarm business sector. Both variables are expressed as a fraction of nonfarm business GDP. Equity payout is defined as dividends minus equity issues (net of share repurchases) of nonfinancial corporate businesses, minus net proprietor’s investment in nonfarm noncorporat ...

... net debt repurchases in the nonfarm business sector. Both variables are expressed as a fraction of nonfarm business GDP. Equity payout is defined as dividends minus equity issues (net of share repurchases) of nonfinancial corporate businesses, minus net proprietor’s investment in nonfarm noncorporat ...

February 9, 2004

... Mr. Talarek distributed copies of the 4th quarter (October through December ) reports for fiscal year 2003, showing interest earned as follows in the General Fund: CD’s STAROHIO CUSTODIAL/EST 5/3 SAVINGS SWEEP Star J.C.P. U.S. Bank Bus. ...

... Mr. Talarek distributed copies of the 4th quarter (October through December ) reports for fiscal year 2003, showing interest earned as follows in the General Fund: CD’s STAROHIO CUSTODIAL/EST 5/3 SAVINGS SWEEP Star J.C.P. U.S. Bank Bus. ...

The case for low-cost index-fund investing for Asian investors

... The information does not take into account your specific investment objectives, financial situation and individual needs and is not designed as a substitute for professional advice. You should seek independent professional advice regarding the suitability of an investment product, taking into accoun ...

... The information does not take into account your specific investment objectives, financial situation and individual needs and is not designed as a substitute for professional advice. You should seek independent professional advice regarding the suitability of an investment product, taking into accoun ...

NBER WORKING PAPER SERIES FINANCIAL INNOVATIONS AND MACROECONOMIC VOLATILITY Urban Jermann Vincenzo Quadrini

... swings. Moreover, the debt exposure tends to decline dramatically during or after a recession. This suggests that recessions lead firms to restructure their financial exposure and the magnitude of restructuring is severe when the debt exposure is high. The bottom panel of Figure 2 plots net payments ...

... swings. Moreover, the debt exposure tends to decline dramatically during or after a recession. This suggests that recessions lead firms to restructure their financial exposure and the magnitude of restructuring is severe when the debt exposure is high. The bottom panel of Figure 2 plots net payments ...

Extended Stay America (ESA) – A Case Study

... previously announced cash tender offers for the Notes. All Notes validly tendered and not withdrawn in the offers have been accepted for payment. In addition, ESA announced that it has successfully completed the related consent solicitations for the Notes. The offer to acquire all of the outstanding ...

... previously announced cash tender offers for the Notes. All Notes validly tendered and not withdrawn in the offers have been accepted for payment. In addition, ESA announced that it has successfully completed the related consent solicitations for the Notes. The offer to acquire all of the outstanding ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.