Catalyst - dealmakers.co.za

... on the recent purchase of a stake in Food Lover’s Market. Its ability to do such tantalizing deals through all economic cycles is what sets it apart from the rest of the private equity funds. Actis, a leading emerging market investor, lifted the lid on the R760m ($54m) deal in November; it had been ...

... on the recent purchase of a stake in Food Lover’s Market. Its ability to do such tantalizing deals through all economic cycles is what sets it apart from the rest of the private equity funds. Actis, a leading emerging market investor, lifted the lid on the R760m ($54m) deal in November; it had been ...

3rd Quarter 2016 Barometer Capital Management Inc. provides the

... Barometer’s Disciplined Leadership Approach™ is an active, style agnostic process focused on understanding the current market environment and recognizing change. The approach focuses on identifying key underlying trends at play in the marketplace and concentrating portfolio investments in those are ...

... Barometer’s Disciplined Leadership Approach™ is an active, style agnostic process focused on understanding the current market environment and recognizing change. The approach focuses on identifying key underlying trends at play in the marketplace and concentrating portfolio investments in those are ...

EdgePoint Canadian Growth and Income Portfolio 3rd quarter, 2011

... Sound too good to be true? Oftentimes it is. Few P&C companies have demonstrated a consistent ability to operate in this fashion. Most P&C companies pay out more at the end of the year than they take in at the beginning, hoping to break even with the proceeds from their investments. Intact is differ ...

... Sound too good to be true? Oftentimes it is. Few P&C companies have demonstrated a consistent ability to operate in this fashion. Most P&C companies pay out more at the end of the year than they take in at the beginning, hoping to break even with the proceeds from their investments. Intact is differ ...

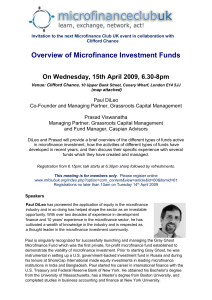

15 April Overview of Microfinance Investment Funds

... Prasad Viswanatha has 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. He is the founder of Caspian Capital Partners, an Indian fund management company and co-founder of The Bellwether Microfinance Fund which was established in 20 ...

... Prasad Viswanatha has 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. He is the founder of Caspian Capital Partners, an Indian fund management company and co-founder of The Bellwether Microfinance Fund which was established in 20 ...

2016-lecture-15

... Through giving up too much ownership, the entrepreneur could lose control of the business to the equity holders. ...

... Through giving up too much ownership, the entrepreneur could lose control of the business to the equity holders. ...

10-year capital market return assumptions

... funds, we add additional return to reflect the residual risk not captured by market returns. The additional return assumes an information ratio of 0.3 multiplied by the residual risk. ...

... funds, we add additional return to reflect the residual risk not captured by market returns. The additional return assumes an information ratio of 0.3 multiplied by the residual risk. ...

1Q16 Market Intelligence Book

... With the United Kingdom’s vote to leave the European Union, the list of factors keeping the dollar strong against other currencies only gets longer and represents a continued headwind for U.S. manufacturing and profits. ...

... With the United Kingdom’s vote to leave the European Union, the list of factors keeping the dollar strong against other currencies only gets longer and represents a continued headwind for U.S. manufacturing and profits. ...

Disruption in the Capital Markets: What Happened? Joseph P. Forte

... Ultimately, there may be subprime loans in upwards of 50% of the outstanding noncommercial real estate (“CRE”) CDO collateral pools. The subprime business began to unravel in early 2007 as subprime loan defaults began to increase and investors began to distrust the AAA rating of CDO structures now ...

... Ultimately, there may be subprime loans in upwards of 50% of the outstanding noncommercial real estate (“CRE”) CDO collateral pools. The subprime business began to unravel in early 2007 as subprime loan defaults began to increase and investors began to distrust the AAA rating of CDO structures now ...

CLOs, CDOs and the Search for High Yield

... We need no reminding that the UK government is forging ahead with its austerity measures in a bid to bring the national debt under control. An inevitable side effect of these has been continued sluggish economic growth as endured in many other developed countries such as the US and France. By contra ...

... We need no reminding that the UK government is forging ahead with its austerity measures in a bid to bring the national debt under control. An inevitable side effect of these has been continued sluggish economic growth as endured in many other developed countries such as the US and France. By contra ...

tax equity investments overview

... predetermined amount of capital required by a project. The remaining capital is usually funded by other equity investors (typically the project sponsors or “Sponsors”) through a mix of equity contributions and debt. In return for its contributions, the Investor receives 99% of the ownership of the p ...

... predetermined amount of capital required by a project. The remaining capital is usually funded by other equity investors (typically the project sponsors or “Sponsors”) through a mix of equity contributions and debt. In return for its contributions, the Investor receives 99% of the ownership of the p ...

What is a Mutual Fund?

... of investors and managed by a professional investment advisory firm. The investment firm collects money from investors, pools it and invests it. The mutual fund manager, working with a team of analysts, decides which stocks and securities to include in the fund, often investing in 100 or more securi ...

... of investors and managed by a professional investment advisory firm. The investment firm collects money from investors, pools it and invests it. The mutual fund manager, working with a team of analysts, decides which stocks and securities to include in the fund, often investing in 100 or more securi ...

A Case for Active Management - Mawer Investment Management

... are securities that trade like a stock on an exchange. Passive investing holds to the theory that markets are basically efficient (Efficient Market Hypothesis) and because existing stock prices have incorporated all relevant information into their value, it should be impossible to beat the market. J ...

... are securities that trade like a stock on an exchange. Passive investing holds to the theory that markets are basically efficient (Efficient Market Hypothesis) and because existing stock prices have incorporated all relevant information into their value, it should be impossible to beat the market. J ...

Entrepreneurial Valuation Techniques

... Source: Venture Economics’ US Private Equity Performance Index (PEPI) 12/31/2004 Venture Economics’ Private Equity Performance Index is calculated quarterly from Venture Economics’ Private Equity Performance Database (PEPD). The PEPD tracks the performance of over 1,400 US venture capital and buyout ...

... Source: Venture Economics’ US Private Equity Performance Index (PEPI) 12/31/2004 Venture Economics’ Private Equity Performance Index is calculated quarterly from Venture Economics’ Private Equity Performance Database (PEPD). The PEPD tracks the performance of over 1,400 US venture capital and buyout ...

Strategy Guide - Standard Life Investments

... The opinions expressed are those of Standard Life Investments and are subject to change at any time due to changes in market or economic conditions. This material is for informational purposes only. This should not be relied upon as a forecast, research or investment advice. It does not constitute a ...

... The opinions expressed are those of Standard Life Investments and are subject to change at any time due to changes in market or economic conditions. This material is for informational purposes only. This should not be relied upon as a forecast, research or investment advice. It does not constitute a ...

Financial Products You Should Avoid – Ty J. Young

... return of 2.25%. As I mentioned, a more appropriate benchmark for this product is a zero-coupon bond. A 15-year zerocoupon Treasury bond, purchased at the beginning of the period, would have returned approximately 6% (I had to interpolate between the 10- and 20-year rates to get that number), more ...

... return of 2.25%. As I mentioned, a more appropriate benchmark for this product is a zero-coupon bond. A 15-year zerocoupon Treasury bond, purchased at the beginning of the period, would have returned approximately 6% (I had to interpolate between the 10- and 20-year rates to get that number), more ...

Fact Sheet - Columbia Management

... market capitalization, which represents approximately 98% of the investable U.S. equity market. The Bloomberg Barclays U.S. Aggregate Bond Index is a market-value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly-placed, dollar-denomin ...

... market capitalization, which represents approximately 98% of the investable U.S. equity market. The Bloomberg Barclays U.S. Aggregate Bond Index is a market-value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly-placed, dollar-denomin ...

Market Failure - Economics @ Tallis

... • If social costs exceed private costs then a negative externality exists; the private optimum level of output is greater than the social optimum level of output – the individual or consumer does not take into account the effects of externalities into their calculations • PC/SC are usually referred ...

... • If social costs exceed private costs then a negative externality exists; the private optimum level of output is greater than the social optimum level of output – the individual or consumer does not take into account the effects of externalities into their calculations • PC/SC are usually referred ...

(BPM6) and Fourth Edition

... should be classified by its industrial activity in the host country and by the industrial activity of its direct investor where possible. (Outward FDI flows may be of more interest to some member states than to others) For both inward and outward FDI compilation by country of origin for the former ...

... should be classified by its industrial activity in the host country and by the industrial activity of its direct investor where possible. (Outward FDI flows may be of more interest to some member states than to others) For both inward and outward FDI compilation by country of origin for the former ...

Mirae Asset Trigger Investment Plan (TRIP)

... **Mirae Asset Tax Saver Fund shall act as the source scheme subject to completion of 3 year lock in period. This leaet is as on 31st December, 2015. #The scheme eligible for TRIP facility may undergo a change, please visit www.miraeassetmf.co.in for updated list. ...

... **Mirae Asset Tax Saver Fund shall act as the source scheme subject to completion of 3 year lock in period. This leaet is as on 31st December, 2015. #The scheme eligible for TRIP facility may undergo a change, please visit www.miraeassetmf.co.in for updated list. ...

View - Financial Advice Centre Ltd

... You worry much less than most people about the possibility of poor investment outcomes and accept that periodic poor returns are a necessary part of long-term investment. You are prepared to take a very high level of investment risk over the medium to long term and ensuring preservation of capital i ...

... You worry much less than most people about the possibility of poor investment outcomes and accept that periodic poor returns are a necessary part of long-term investment. You are prepared to take a very high level of investment risk over the medium to long term and ensuring preservation of capital i ...

Monetizing Your Parking Assets

... financing, enter into any transaction or to purchase or sell or underwrite the sale of any security in connection therewith. This presentation and any other Materials have each been prepared as of the date on the cover of this presentation and reflect information made available to Guggenheim Securit ...

... financing, enter into any transaction or to purchase or sell or underwrite the sale of any security in connection therewith. This presentation and any other Materials have each been prepared as of the date on the cover of this presentation and reflect information made available to Guggenheim Securit ...

Corporate Taxation Chapter Three: Capital Structure Professors Wells Presentation:

... Business Stock (100% exclusion for investments through 2013 where held for 5 years). Code §1045 gain rollover provision – postponement when investment in qualified small business stock. ...

... Business Stock (100% exclusion for investments through 2013 where held for 5 years). Code §1045 gain rollover provision – postponement when investment in qualified small business stock. ...

chapter 2 2

... Studies of the comparisons between the financial characteristics and performance of SMEs and large enterprises have been difficult and therefore limited, especially in Australia. SMEs that have a corporate structure are generally proprietary limited companies whose shares are not traded on a stock e ...

... Studies of the comparisons between the financial characteristics and performance of SMEs and large enterprises have been difficult and therefore limited, especially in Australia. SMEs that have a corporate structure are generally proprietary limited companies whose shares are not traded on a stock e ...

Macquarie Group - The Energy Roundtable

... Range of options (and depth of market) for debt financing has increased substantially over the last year Increased focus by Canadian lenders Introduction of European lenders brings increased options and significant ...

... Range of options (and depth of market) for debt financing has increased substantially over the last year Increased focus by Canadian lenders Introduction of European lenders brings increased options and significant ...

Weekly Commentary 08-08-16

... The Chicago Board of Options Exchange (CBOE) Volatility Index, also known as the VIX, tracks the prices of options on the Standard & Poor’s 500 (S&P 500) Index. Since options often are used to hedge portfolio risk, the VIX is considered to be a ‘fear gauge’ that has value with regard to market volat ...

... The Chicago Board of Options Exchange (CBOE) Volatility Index, also known as the VIX, tracks the prices of options on the Standard & Poor’s 500 (S&P 500) Index. Since options often are used to hedge portfolio risk, the VIX is considered to be a ‘fear gauge’ that has value with regard to market volat ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.