Grant Samuel Epoch Global Equity Shareholder Yield

... Total Return Methodology and Fee Structure—Returns are presented gross and net of management fees and include the reinvestment of all income. Composite performance for Global Equity Shareholder Yield is presented net of foreign withholding taxes on dividends, interest income, and capital gains. With ...

... Total Return Methodology and Fee Structure—Returns are presented gross and net of management fees and include the reinvestment of all income. Composite performance for Global Equity Shareholder Yield is presented net of foreign withholding taxes on dividends, interest income, and capital gains. With ...

Financial Distress, Managerial Incentives, and Information

... • Anticipating this problem, debt holders will “discount” or pay less for the debt initially • At the time the debt is issued, shareholders benefit if they limit their ability to exploit debt holders (“tie their hands”) down the road - for example through debt covenants • What firms are most subject ...

... • Anticipating this problem, debt holders will “discount” or pay less for the debt initially • At the time the debt is issued, shareholders benefit if they limit their ability to exploit debt holders (“tie their hands”) down the road - for example through debt covenants • What firms are most subject ...

Why Minimum Standards in Corporate Bonds Communications?

... In recent years, the lack of access to bank credit has forced companies to consider issuing corporate bonds as a means of funding alternative to traditional bank financing or the issuance of shares in the stock markets. This has considerably increased the companies participating in the capital marke ...

... In recent years, the lack of access to bank credit has forced companies to consider issuing corporate bonds as a means of funding alternative to traditional bank financing or the issuance of shares in the stock markets. This has considerably increased the companies participating in the capital marke ...

Prudential Jennison Mid Cap Growth A LW

... Qualified retirement plans from American United Life Insurance Company® (AUL) are funded by an AUL group variable annuity contract. While a participant in an annuity contract may benefit from additional investment and annuity related benefits under the annuity contract, any tax deferral is provided ...

... Qualified retirement plans from American United Life Insurance Company® (AUL) are funded by an AUL group variable annuity contract. While a participant in an annuity contract may benefit from additional investment and annuity related benefits under the annuity contract, any tax deferral is provided ...

- Schroders

... based on the economics outlined in the “growth” example above, but to apply it in practice, let’s apply the logic to one of the current resource boom darlings, Fortescue Metals. Taking nothing away from Mr Forrest and his employees, who have undoubtedly accomplished an amazing feat in developing the ...

... based on the economics outlined in the “growth” example above, but to apply it in practice, let’s apply the logic to one of the current resource boom darlings, Fortescue Metals. Taking nothing away from Mr Forrest and his employees, who have undoubtedly accomplished an amazing feat in developing the ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... With a long history of more than 11years, the MF scheme has been an outperformer compared to both, the benchmark Nifty 50 index and the Large Cap category average. Despite the volatility and uncertainties in the market, the MF scheme has performed better than its peers, giving a return of 20% over t ...

... With a long history of more than 11years, the MF scheme has been an outperformer compared to both, the benchmark Nifty 50 index and the Large Cap category average. Despite the volatility and uncertainties in the market, the MF scheme has performed better than its peers, giving a return of 20% over t ...

DOC - Europa.eu

... Securitisation transactions enable banks to refinance loans by pooling individual assets and converting them into securities that are attractive to institutional investors. For institutional investors, such securities, if of sufficient size, offer liquid investment opportunities in asset classes in ...

... Securitisation transactions enable banks to refinance loans by pooling individual assets and converting them into securities that are attractive to institutional investors. For institutional investors, such securities, if of sufficient size, offer liquid investment opportunities in asset classes in ...

Samuele Murtinu

... • Difficulty in collecting owed money Fire sales of assets • Firms forced to sell assets quickly to raise cash (i.e., acceptance of a lower price; airlines: -15/40% in the selling price of aircrafts) • Subsidiaries ...

... • Difficulty in collecting owed money Fire sales of assets • Firms forced to sell assets quickly to raise cash (i.e., acceptance of a lower price; airlines: -15/40% in the selling price of aircrafts) • Subsidiaries ...

fasb adopts ownership approach in liability and equity debate

... ownership criteria specifically requires that an instrument not have priority over any other in liquidation proceedings of the firm. The direct ownership principle allows instruments that convey the essential return characteristics of common stock to be classified as equity, even if they are not pe ...

... ownership criteria specifically requires that an instrument not have priority over any other in liquidation proceedings of the firm. The direct ownership principle allows instruments that convey the essential return characteristics of common stock to be classified as equity, even if they are not pe ...

Public Capital: Measurement Issues and Policy Implications Matilde

... reflecting the fact that public spending could have crowded out both, private investment and private consumption. Figure 3 considers four alternatives: one endogenous and three exogenous. ...

... reflecting the fact that public spending could have crowded out both, private investment and private consumption. Figure 3 considers four alternatives: one endogenous and three exogenous. ...

Infrastructure - Debt and Equity Investments for UK Insurers

... (c) the expected cash-flows of the assigned portfolio of assets replicate each of the expected cashflows of the portfolio of insurance or reinsurance obligations (h) the cash-flows of the assigned portfolio of assets are fixed and cannot be changed by the issuers of the assets or any third parties [ ...

... (c) the expected cash-flows of the assigned portfolio of assets replicate each of the expected cashflows of the portfolio of insurance or reinsurance obligations (h) the cash-flows of the assigned portfolio of assets are fixed and cannot be changed by the issuers of the assets or any third parties [ ...

Sophie Foret - brightspark

... • To be invested predominantly in Montreal – Toronto and Ottawa (offices in Mtl and Toronto) • Seed and early stage software • Very involved in portfolio companies • Focus on IP creation and market opportunity • Pro-active to invest in interesting sectors • Entrepreneur/experts in residence ...

... • To be invested predominantly in Montreal – Toronto and Ottawa (offices in Mtl and Toronto) • Seed and early stage software • Very involved in portfolio companies • Focus on IP creation and market opportunity • Pro-active to invest in interesting sectors • Entrepreneur/experts in residence ...

Session 3-Project Development under PPP

... Capital and operating costs are paid for by the public sector, who take the risk of cost overruns and late delivery.. ...

... Capital and operating costs are paid for by the public sector, who take the risk of cost overruns and late delivery.. ...

Public and Private Capital Markets are Not Substitutes

... Public managers are driven to maximize profits with a side concern for decreasing corporate income taxes. Private owner-managers are driven to increase the cash available to increase their personal wealth with direct and specific objectives to limit all taxes. Public managers organize their companie ...

... Public managers are driven to maximize profits with a side concern for decreasing corporate income taxes. Private owner-managers are driven to increase the cash available to increase their personal wealth with direct and specific objectives to limit all taxes. Public managers organize their companie ...

A Dynamic Blend of Global Stocks and Bonds

... right to withhold release of information with respect to holdings that would otherwise be included in the top 5 holdings list. 4. Holdings are subject to change. Due to rounding, the sum of portfolio breakdown holdings may not equal 100%. For updated information, call Franklin Templeton Investments ...

... right to withhold release of information with respect to holdings that would otherwise be included in the top 5 holdings list. 4. Holdings are subject to change. Due to rounding, the sum of portfolio breakdown holdings may not equal 100%. For updated information, call Franklin Templeton Investments ...

II. Private Debt - University of Sussex

... Which is better: buy and hold primary issuance, versus secondary market trading? ...

... Which is better: buy and hold primary issuance, versus secondary market trading? ...

Analysis and Interpretation of Financial Statements

... This is part of the information to calculate the equity, or long-term solvency ratios of Norton Corporation. ...

... This is part of the information to calculate the equity, or long-term solvency ratios of Norton Corporation. ...

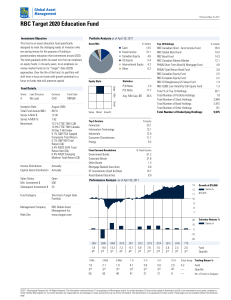

RBC Target 2020 Education Fund

... based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 to September 30, 2016, expressed on an annualized basis. Adjusted MER is prov ...

... based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 to September 30, 2016, expressed on an annualized basis. Adjusted MER is prov ...

To the Point: New rules may affect how entities classify and

... fees don’t stop redemptions, they reduce incentives for investors to flee and compensate funds for the cost of liquidating assets to meet redemption requests. ...

... fees don’t stop redemptions, they reduce incentives for investors to flee and compensate funds for the cost of liquidating assets to meet redemption requests. ...

Alternatives Special Report

... We believe this is one of the reasons that has exacerbated the weaker performance of many funds of hedge funds. It is rare that hedge fund managers increase their assets under management when they are underperforming. However, we do believe in mean reversion in asset-class returns or the beta to a s ...

... We believe this is one of the reasons that has exacerbated the weaker performance of many funds of hedge funds. It is rare that hedge fund managers increase their assets under management when they are underperforming. However, we do believe in mean reversion in asset-class returns or the beta to a s ...

Chapter 11

... can be diversified by industry or by size of capitalization (small-cap, mid-cap, and large-cap stock portfolios). ...

... can be diversified by industry or by size of capitalization (small-cap, mid-cap, and large-cap stock portfolios). ...

RTF - Review of Business Taxation

... The impact of Australian tax laws on access to venture capital loomed large in these discussions. Many participants indicated that the problem facing small and medium sized enterprises (SMEs) in financing high technology initiatives was not a lack of venture capital funds per se. This is corroborate ...

... The impact of Australian tax laws on access to venture capital loomed large in these discussions. Many participants indicated that the problem facing small and medium sized enterprises (SMEs) in financing high technology initiatives was not a lack of venture capital funds per se. This is corroborate ...

Hedge Fund Fee Structure Study

... time frame; we note that the number of new distressed funds was relatively low during this period. Growing investor interest, a more acute willingness to allocate to niche and/or illiquid strategies, and market conditions post-financial crisis may ...

... time frame; we note that the number of new distressed funds was relatively low during this period. Growing investor interest, a more acute willingness to allocate to niche and/or illiquid strategies, and market conditions post-financial crisis may ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.