Discovery Fund - Wells Fargo Funds

... Performance attribution and sector returns are calculated using the Brinson-Fachler attribution model. As such, performance attribution calculations may differ from the fund’s actual investment results. Definition of terms: Alpha measures the difference between a fund’s actual returns and its expect ...

... Performance attribution and sector returns are calculated using the Brinson-Fachler attribution model. As such, performance attribution calculations may differ from the fund’s actual investment results. Definition of terms: Alpha measures the difference between a fund’s actual returns and its expect ...

The Essence of Investing - Allison Spielman Advisors

... achieve a cumulative return less than or equal to -10%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. ...

... achieve a cumulative return less than or equal to -10%, and (3) ends at the most negative cumulative return prior to achieving a positive cumulative return. All data points which are not considered part of a bear market are designated as a bull market. ...

The Efficient Market Hypothesis and its Critics

... time with patterns that do not generalize well. Moreover, such return reversals for the market as a whole may be quite consistent with the efficient functioning of the market since they could result, in part, from the volatility of interest rates and the tendency of interest rates to be mean revert ...

... time with patterns that do not generalize well. Moreover, such return reversals for the market as a whole may be quite consistent with the efficient functioning of the market since they could result, in part, from the volatility of interest rates and the tendency of interest rates to be mean revert ...

A Portfolio Built on Divident Growth - Presentation by Scott Malatesta

... ratio between the number of periods where the manager outperforms the benchmark and the total number of periods; and the average excess return over the respective observation period. For the rolling one year, three year and five year periods, there were one hundred observations, seventy six observat ...

... ratio between the number of periods where the manager outperforms the benchmark and the total number of periods; and the average excess return over the respective observation period. For the rolling one year, three year and five year periods, there were one hundred observations, seventy six observat ...

Session 25- Dividends II (The trade off)

... Basis: Investors may form clienteles based upon their tax brackets. Investors in high tax brackets may invest in stocks which do not pay dividends and those in low tax brackets may invest in dividend paying stocks. Evidence: A study of 914 investors' portfolios was carried out to see if their portfo ...

... Basis: Investors may form clienteles based upon their tax brackets. Investors in high tax brackets may invest in stocks which do not pay dividends and those in low tax brackets may invest in dividend paying stocks. Evidence: A study of 914 investors' portfolios was carried out to see if their portfo ...

VPhase plc (“VPhase” or the “Company”) Placing, Rule 9 Waiver

... investment opportunities. When necessary, other external professionals will be engaged to assist in the due diligence of prospective opportunities. The Proposed Directors will also consider appointing additional directors with relevant experience if the need arises. The objective of the Proposed Dir ...

... investment opportunities. When necessary, other external professionals will be engaged to assist in the due diligence of prospective opportunities. The Proposed Directors will also consider appointing additional directors with relevant experience if the need arises. The objective of the Proposed Dir ...

Chapter 15 Glossary

... corporation. The preferred stockholder may sacrifice certain rights in return for the other special rights and privileges; preferred stock may be nonvoting, noncumulative, and nonparticipating. The accounting for preferred stock is similar to that for common stock, with preferred stock classified in ...

... corporation. The preferred stockholder may sacrifice certain rights in return for the other special rights and privileges; preferred stock may be nonvoting, noncumulative, and nonparticipating. The accounting for preferred stock is similar to that for common stock, with preferred stock classified in ...

Fact Sheet - ProShares

... 2, 2005. Past performance is no guarantee of future results. 4Market returns are based on the composite closing price and do not represent the returns you would receive if you traded shares at other5 times. The first trading date is typically several days after the fund inception date. Therefore, NA ...

... 2, 2005. Past performance is no guarantee of future results. 4Market returns are based on the composite closing price and do not represent the returns you would receive if you traded shares at other5 times. The first trading date is typically several days after the fund inception date. Therefore, NA ...

Annual Financial Report as at December 31, 2010

... market indicators improved in 2010. Activities in the U.S. grew 19% while Canada posted $1.1 billion in investments, which is a 10% increase over the previous year. Québec venture capital activity experienced a slight 9% decline in dollar terms, with investments totalling $391 million. The average a ...

... market indicators improved in 2010. Activities in the U.S. grew 19% while Canada posted $1.1 billion in investments, which is a 10% increase over the previous year. Québec venture capital activity experienced a slight 9% decline in dollar terms, with investments totalling $391 million. The average a ...

The 4% Rule is Not Safe in a Low-Yield World by Michael Finke, Ph

... variety of scenarios than the rather limited historical data can provide (between 1926 and 2012, there are only 58 rolling 30-year periods). Monte Carlo simulation studies generally show slightly higher failure rates for stock allocations in the 50 to 75 percent range. At the same time, if past retu ...

... variety of scenarios than the rather limited historical data can provide (between 1926 and 2012, there are only 58 rolling 30-year periods). Monte Carlo simulation studies generally show slightly higher failure rates for stock allocations in the 50 to 75 percent range. At the same time, if past retu ...

Xinfu Chen Mathematical Finance II - Pitt Mathematics

... (3) Consider a hypothetical investment. Suppose John is a trusted friend of Jesse and promised to take care of Jesse’s investment. So at the beginning of the period, John received $10,000 cash from Jesse who instructed John to make investment on her behalf on a one period investment on Stone’s stock ...

... (3) Consider a hypothetical investment. Suppose John is a trusted friend of Jesse and promised to take care of Jesse’s investment. So at the beginning of the period, John received $10,000 cash from Jesse who instructed John to make investment on her behalf on a one period investment on Stone’s stock ...

FBLA ACCOUNTING II

... 20. Both Accounts Payable and the vendor’s individual a. True account should be debited when a purchase is made on account. 21. Source documents should be discarded at the end of the a. True fiscal year to make room for next year's documents. 22. Subsidiary ledgers are used to maintain accounts a. T ...

... 20. Both Accounts Payable and the vendor’s individual a. True account should be debited when a purchase is made on account. 21. Source documents should be discarded at the end of the a. True fiscal year to make room for next year's documents. 22. Subsidiary ledgers are used to maintain accounts a. T ...

Slide 0 - Prudential Investments

... Equal weighted monthly returns on E/P, Book to Price (B/P), and Estimate Earnings Revision under alternative market conditions. Estimate Earnings Revision is a factor used by QMA that represents a proprietary measure of EPS estimate revisions and near-term price momentum. The chart shows returns on ...

... Equal weighted monthly returns on E/P, Book to Price (B/P), and Estimate Earnings Revision under alternative market conditions. Estimate Earnings Revision is a factor used by QMA that represents a proprietary measure of EPS estimate revisions and near-term price momentum. The chart shows returns on ...

Value at Risk - dedeklegacy.cz

... repayment of a bond or coupons of the bond, repayment of loan or charged interest); ii) debtors are downgraded by credit agencies iii) credit spreads are widened due to external events beyond debtor’s control (i.e. increased political uncertainty, a higher macroeconomic instability) rating agencies ...

... repayment of a bond or coupons of the bond, repayment of loan or charged interest); ii) debtors are downgraded by credit agencies iii) credit spreads are widened due to external events beyond debtor’s control (i.e. increased political uncertainty, a higher macroeconomic instability) rating agencies ...

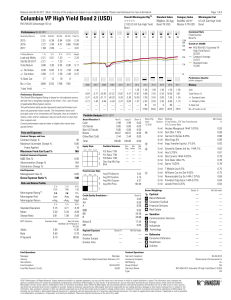

Time and Risk Diversification in Real Estate Investments: the Ex

... by a Bayesian investor falls from 43% for a 1-month horizon to 33% for a five-year horizon, while the optimal average allocation to deposits and T-Bills grows from 21% to 50% because their return is precisely anticipated by several predictors. The optimal average allocation to bonds drops from over ...

... by a Bayesian investor falls from 43% for a 1-month horizon to 33% for a five-year horizon, while the optimal average allocation to deposits and T-Bills grows from 21% to 50% because their return is precisely anticipated by several predictors. The optimal average allocation to bonds drops from over ...

44)

... 1) Which of the following records the payment of the current month's rent bill for a business? A) debit to cash and a credit to rent expense B) debit to rent expense and a credit to cash C) debit to rent expense and a credit to accounts payable D) debit to accounts payable and a credit to cash 2) Re ...

... 1) Which of the following records the payment of the current month's rent bill for a business? A) debit to cash and a credit to rent expense B) debit to rent expense and a credit to cash C) debit to rent expense and a credit to accounts payable D) debit to accounts payable and a credit to cash 2) Re ...

INTERCARDIA INC

... Collaboration and Knoll made initial payments of approximately $2,143,000, which were recognized as contract revenue. During the three months ended December 31, 1995, the Company signed a collaborative agreement with Astra Merck Inc. ("Astra Merck") for the development, commercialization and marketi ...

... Collaboration and Knoll made initial payments of approximately $2,143,000, which were recognized as contract revenue. During the three months ended December 31, 1995, the Company signed a collaborative agreement with Astra Merck Inc. ("Astra Merck") for the development, commercialization and marketi ...

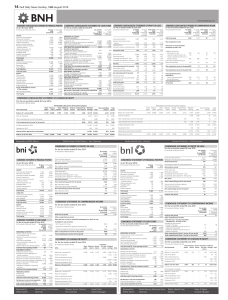

14 Gulf Daily News Sunday, 14th August 2016

... subsequently to profit or loss: Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of equity accounted investee ...

... subsequently to profit or loss: Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of equity accounted investee ...

Global Institutional Consulting An Investor

... An institution’s mission defines its needs and goals, most of which have to be fully or partially supported by investment returns. Institutions have short- and long-term needs and goals and ought to find the right balance in serving both4, 5, 6. The Institutional Resource Allocation Framework sets g ...

... An institution’s mission defines its needs and goals, most of which have to be fully or partially supported by investment returns. Institutions have short- and long-term needs and goals and ought to find the right balance in serving both4, 5, 6. The Institutional Resource Allocation Framework sets g ...

Baseline Assessment Date

... 3. Original transactions are recorded improperly. 4. Transactions affect revenues or expenses of more than one accounting period. 24.The term “depreciation,” as used in accounting, refers to: 1. The amount of cash that is needed to replace an asset when it wears out. 2. The physical deterioration of ...

... 3. Original transactions are recorded improperly. 4. Transactions affect revenues or expenses of more than one accounting period. 24.The term “depreciation,” as used in accounting, refers to: 1. The amount of cash that is needed to replace an asset when it wears out. 2. The physical deterioration of ...

Stock returns and bond yields in Denmark, 1922-99

... the stock market data with firms’ real investment expenditures we may obtain insight into the validity of the Tobin’s q model of investment, and by examining the relationship between consumer expenditures and the stock market, the magnitude of the wealth effect in the consumption function may be ana ...

... the stock market data with firms’ real investment expenditures we may obtain insight into the validity of the Tobin’s q model of investment, and by examining the relationship between consumer expenditures and the stock market, the magnitude of the wealth effect in the consumption function may be ana ...