Chapter 8 Working Capital Management

... • Aging schedule, which is a breakdown of accounts by length of time outstanding: - Use a weighted average collection period measure to get a better picture of how long accounts are outstanding. - Examine changes from the typical pattern. • Number of days receivable: ...

... • Aging schedule, which is a breakdown of accounts by length of time outstanding: - Use a weighted average collection period measure to get a better picture of how long accounts are outstanding. - Examine changes from the typical pattern. • Number of days receivable: ...

View MDA - Till Capital

... were delisted from the Toronto Stock Exchange (“TSX”). AMB, formerly Golden Predator Corp., was incorporated under the laws of the Province of British Columbia on January 6, 2009. The Company's business was to generate passive royalty income from its royalty properties, conduct mining exploration an ...

... were delisted from the Toronto Stock Exchange (“TSX”). AMB, formerly Golden Predator Corp., was incorporated under the laws of the Province of British Columbia on January 6, 2009. The Company's business was to generate passive royalty income from its royalty properties, conduct mining exploration an ...

a cash flow forecast

... Some costs in the income statement such as profit or loss on sales of non-current assets or depreciation are not cash items but are costs derived from accounting conventions The timing of cash receipts and payments may not coincide with the recording of income statement transactions. To ensure that ...

... Some costs in the income statement such as profit or loss on sales of non-current assets or depreciation are not cash items but are costs derived from accounting conventions The timing of cash receipts and payments may not coincide with the recording of income statement transactions. To ensure that ...

Option Pricing Theory and Applications

... To value synergy, you need to answer two questions: (a) What form is the synergy expected to take? Will it reduce costs as a percentage of sales and increase profit margins (as is the case when there are economies of scale)? Will it increase future growth (as is the case when there is increased mark ...

... To value synergy, you need to answer two questions: (a) What form is the synergy expected to take? Will it reduce costs as a percentage of sales and increase profit margins (as is the case when there are economies of scale)? Will it increase future growth (as is the case when there is increased mark ...

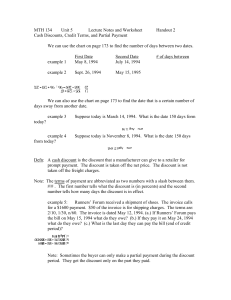

MTH 134 Unit 5 Lecture Notes and Worksheet

... Defn: A cash discount is the discount that a manufacturer can give to a retailer for prompt payment. The discount is taken off the net price. The discount is not taken off the freight charges. Note: The terms of payment are abbreviated as two numbers with a slash between them. #/# . The first number ...

... Defn: A cash discount is the discount that a manufacturer can give to a retailer for prompt payment. The discount is taken off the net price. The discount is not taken off the freight charges. Note: The terms of payment are abbreviated as two numbers with a slash between them. #/# . The first number ...

The Equity Risk Premium

... well from which to draw the capital needed by the equity market. Rational, prudent investors are required, and prudent investors require from the market a return substantially greater than what one would expect to earn in risk-free investments. If one expects to earn 5.0 percent, say, by investing i ...

... well from which to draw the capital needed by the equity market. Rational, prudent investors are required, and prudent investors require from the market a return substantially greater than what one would expect to earn in risk-free investments. If one expects to earn 5.0 percent, say, by investing i ...

Hanke-Guttridge Discounted Cash Flow Methodology

... Currently, the focus of accounting is accrual-based rather than cash-based. This method measures the position and performance of a firm by recognizing economic events regardless of when cash transactions occur. The main concept is that such events are recognized by matching revenues to expenses (the ...

... Currently, the focus of accounting is accrual-based rather than cash-based. This method measures the position and performance of a firm by recognizing economic events regardless of when cash transactions occur. The main concept is that such events are recognized by matching revenues to expenses (the ...

The Portfolio Management Process

... 2. Examine current and project financial, economic, political, and social conditions - Focus: Short-term and intermediate-term expected conditions to use in constructing a specific portfolio 3. Implement the plan by constructing the portfolio - Focus: Meet the investor’s needs at the minimum risk le ...

... 2. Examine current and project financial, economic, political, and social conditions - Focus: Short-term and intermediate-term expected conditions to use in constructing a specific portfolio 3. Implement the plan by constructing the portfolio - Focus: Meet the investor’s needs at the minimum risk le ...

Chapter 2

... same expected return for less risk, or if the security has a higher expected return than another security of comparable risk. Equivalent assets should sell for the same price. This is known as the law of one price. ...

... same expected return for less risk, or if the security has a higher expected return than another security of comparable risk. Equivalent assets should sell for the same price. This is known as the law of one price. ...

Understanding RBC Target Maturity Corporate Bond ETFs

... The index is designed to track the broad corporate bond market and provide the full breadth of its diversity. If a new bond is issued or one is upgraded that meets the inclusion criteria of the index, it will be added at the next designated rebalancing period. This increases diversification. The ind ...

... The index is designed to track the broad corporate bond market and provide the full breadth of its diversity. If a new bond is issued or one is upgraded that meets the inclusion criteria of the index, it will be added at the next designated rebalancing period. This increases diversification. The ind ...

Welcome to Introduction to Accounting Preparing for a User`s

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

Value-at-Risk and Expected Stock Returns

... Estrada (2000, 2002) investigates different risk measures and finds that semi-standard deviation is the relevant measure of risk for emerging markets. Dittmar (2002) determines the influence of a security’s skewness and kurtosis on investors’ expected returns. Bali and Cakici (2004), Bali, Gokcan, a ...

... Estrada (2000, 2002) investigates different risk measures and finds that semi-standard deviation is the relevant measure of risk for emerging markets. Dittmar (2002) determines the influence of a security’s skewness and kurtosis on investors’ expected returns. Bali and Cakici (2004), Bali, Gokcan, a ...

Slides 1-4 (1m:49s) Welcome to Introduction to Accounting

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

... Example: In 20X1 Jones Co. received $100 cash in advance from Bob Co. for sales commissions he expected to earn in 20X2. As you can see, the cash is received, and since he can’t record the revenue, we’ve got to figure out what the credit in this journal entry is going to be to balance out the receip ...

Sin Stock Returns

... funds, pension funds, and foundations, are managed by fiduciaries who operate under investment guidelines or policy statements with the mandate to make money. In 2003, the California Public Employees’ Retirement System (CalPERS) announced that it would no longer invest in developing countries that f ...

... funds, pension funds, and foundations, are managed by fiduciaries who operate under investment guidelines or policy statements with the mandate to make money. In 2003, the California Public Employees’ Retirement System (CalPERS) announced that it would no longer invest in developing countries that f ...

NBER WORKING PAPER SERIES INFLATION, TAX RULES, AND THE STOCK MARKET

... B=bK be the corresponding aggregate debt. The value of the equity shares are q(K-B) and the total equity earnings are zK. The corporate equity yield is thus zK/q(K-B) = z/q(l-b). 21 assume that d (like b) does not change with the rate of inflation. Although this is done primarily to focus attention ...

... B=bK be the corresponding aggregate debt. The value of the equity shares are q(K-B) and the total equity earnings are zK. The corporate equity yield is thus zK/q(K-B) = z/q(l-b). 21 assume that d (like b) does not change with the rate of inflation. Although this is done primarily to focus attention ...

DRAFT Investment Policy Jan 22 2016(word doc)

... is intended, that all investments will be held until maturity. Projected cash flow requirements are the primary factor to be used in determining investment maturity terms. After cash flow needs have been met, yield considerations will be the next factor in determining maturity terms, with the expect ...

... is intended, that all investments will be held until maturity. Projected cash flow requirements are the primary factor to be used in determining investment maturity terms. After cash flow needs have been met, yield considerations will be the next factor in determining maturity terms, with the expect ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... aggregates. Let K be total capital and B = bK be the corresponding aggregate debt. The value of the equity shares is q(K - B) and the total equity earnings are zK. The corporate equity yield is thus zKlq{K - B) = zlq{\ - b). 12. I assume that d (like b) does not change with the rate of inflation. Al ...

... aggregates. Let K be total capital and B = bK be the corresponding aggregate debt. The value of the equity shares is q(K - B) and the total equity earnings are zK. The corporate equity yield is thus zKlq{K - B) = zlq{\ - b). 12. I assume that d (like b) does not change with the rate of inflation. Al ...

Fulltext

... is found by the results that stock market related variables like book to market and firm size successfully forecasted the returns variations in stock / equity portfolio. However, this Fama and French three factor model is successful in capturing the bond returns variation except only for low graded ...

... is found by the results that stock market related variables like book to market and firm size successfully forecasted the returns variations in stock / equity portfolio. However, this Fama and French three factor model is successful in capturing the bond returns variation except only for low graded ...

Launch by GBL of an exchangeable bond for GDF SUEZ shares

... Moreover, in compliance with IFRS, GBL will recognize for 2012 an impairment of EUR 758 million on its participation in GDF SUEZ, adjusting the net book value of these shares to their stock market value at 31 December 2012 (EUR 15.6 per share). This depreciation which reflects only ordinary accounti ...

... Moreover, in compliance with IFRS, GBL will recognize for 2012 an impairment of EUR 758 million on its participation in GDF SUEZ, adjusting the net book value of these shares to their stock market value at 31 December 2012 (EUR 15.6 per share). This depreciation which reflects only ordinary accounti ...

monThlY SEASonAlITY In CUrrEnCY rETUrnS: 1972-2010

... This study examines the monthly seasonality of foreign exchange (FX) returns for eight major currencies (against the US dollar) from 1972 to 2010. It finds that five currencies exhibit significantly higher returns in the month of December and a significant reversal in January. Previous research has ...

... This study examines the monthly seasonality of foreign exchange (FX) returns for eight major currencies (against the US dollar) from 1972 to 2010. It finds that five currencies exhibit significantly higher returns in the month of December and a significant reversal in January. Previous research has ...

Thesis - Kyiv School of Economics

... most of the cases. The capital flows were divided into three broad categories: government bonds, corporate bonds and corporate equities. For all of the capital categories market interest rate volatility as well as inflation volatility are significant and enter regressions with negative sign. This is ...

... most of the cases. The capital flows were divided into three broad categories: government bonds, corporate bonds and corporate equities. For all of the capital categories market interest rate volatility as well as inflation volatility are significant and enter regressions with negative sign. This is ...

Do Mergers and Acquisitions Create Shareholder Wealth In The

... companies only and the second includes acquirer and acquired summed together. The first analysis is used to determine if the acquired company benefited from the transaction while the second looks at the effects on the whole[7]. We follow Healy, Palepu and Ruback’s (1992) method of using pretax opera ...

... companies only and the second includes acquirer and acquired summed together. The first analysis is used to determine if the acquired company benefited from the transaction while the second looks at the effects on the whole[7]. We follow Healy, Palepu and Ruback’s (1992) method of using pretax opera ...