America`s Social Contract

... These results also show a support for Halstead and Lind’s argument that there needs to be a new healthcare system in the United States. The results show the United States with the second lowest years of life expectancy. This means that individuals in the United States have the second lowest life exp ...

... These results also show a support for Halstead and Lind’s argument that there needs to be a new healthcare system in the United States. The results show the United States with the second lowest years of life expectancy. This means that individuals in the United States have the second lowest life exp ...

fiscal policy homework

... b) the budget deficit turns into a surplus; c) the budget surplus turns into a budget deficit; d) none of the above. 6. The government is definitely pursuing an expansionary fiscal policy if, whatever the value of the budget: a) it increases its spending and reduces tax rates; b) it increases its sp ...

... b) the budget deficit turns into a surplus; c) the budget surplus turns into a budget deficit; d) none of the above. 6. The government is definitely pursuing an expansionary fiscal policy if, whatever the value of the budget: a) it increases its spending and reduces tax rates; b) it increases its sp ...

Kazimierz Laski

... Short and long period Basic macroeconomic relations: injections IP (private investment), G (Government expenditure) and X (exports) are given in any short period, hence exogenous. Leakages SP (private savings), T (taxation) and M (imports) are dependent on GDP, hence endogenous. Empirical long-term ...

... Short and long period Basic macroeconomic relations: injections IP (private investment), G (Government expenditure) and X (exports) are given in any short period, hence exogenous. Leakages SP (private savings), T (taxation) and M (imports) are dependent on GDP, hence endogenous. Empirical long-term ...

Implications of EU Environmental Policy for the new EU

... • sectors affected (household, industry, transport, etc.) • revenue recycling measures applied • part of a larger fiscal reform process ...

... • sectors affected (household, industry, transport, etc.) • revenue recycling measures applied • part of a larger fiscal reform process ...

Objective of MP - qazieconometrics

... policy may be defined as “that branch of economic policy which is concerned with the regulation of the availability (or supply), the costs and the directions of credit”. It is effected by various techniques (methods) in the hands of the central bank. ...

... policy may be defined as “that branch of economic policy which is concerned with the regulation of the availability (or supply), the costs and the directions of credit”. It is effected by various techniques (methods) in the hands of the central bank. ...

What to Expect From Rising Interest Rates

... example, the price of the current 3-year U.S. Treasury note would fall by 2% if the yield a year from now were one percentage point higher. By contrast, the current 10-year U.S. Treasury bond would experience a nearly 8% price decline under the same scenario. Thus, by investing in shorter maturities ...

... example, the price of the current 3-year U.S. Treasury note would fall by 2% if the yield a year from now were one percentage point higher. By contrast, the current 10-year U.S. Treasury bond would experience a nearly 8% price decline under the same scenario. Thus, by investing in shorter maturities ...

Talking Points Presentation - Federal Reserve Bank of St. Louis

... spending and/or increases in taxes, in theory are thought to decrease overall demand for goods and services. These actions move the budget position toward a surplus. Contractionary policies are rarely used. 4. If the government runs a deficit, it borrows to cover the deficit spending. This borrowing ...

... spending and/or increases in taxes, in theory are thought to decrease overall demand for goods and services. These actions move the budget position toward a surplus. Contractionary policies are rarely used. 4. If the government runs a deficit, it borrows to cover the deficit spending. This borrowing ...

2014 federal budget summary

... incentivise businesses to employ Australians over the age of 50 through the new Restart programme. ...

... incentivise businesses to employ Australians over the age of 50 through the new Restart programme. ...

... Lower international commodity prices and the economic slowdown kept annual inflation just under 0% at end-2015, well below the central bank’s target range (4% +/- 1 percentage point). The current account deficit of around 4% of GDP will be smaller than at the end of the previous year (4.8%), owing t ...

Agricultural Economics 430 - Department of Agricultural Economics

... Assume national income in 2007 was $1,500 and is projected to be 2 percent higher in 2008. Also assume the reserve requirement ratio is 0.20 and total reserves are equal to 150. (15 points) ...

... Assume national income in 2007 was $1,500 and is projected to be 2 percent higher in 2008. Also assume the reserve requirement ratio is 0.20 and total reserves are equal to 150. (15 points) ...

Economics 203/Quiz 5

... 11. To find a recession equal to the most recent one in length and intensity, you would need to go back to a. 1929-33 b. 1969-70 c. 1980-82 d. 1990-91 12. In order for monetary stimulus or and fiscal stimulus to work, a. individuals must be willing to live with higher than normal interest rates b. ...

... 11. To find a recession equal to the most recent one in length and intensity, you would need to go back to a. 1929-33 b. 1969-70 c. 1980-82 d. 1990-91 12. In order for monetary stimulus or and fiscal stimulus to work, a. individuals must be willing to live with higher than normal interest rates b. ...

Economics Semester Review!

... Repetition of tasks based on the past and distributed by a strict hierarchy. ...

... Repetition of tasks based on the past and distributed by a strict hierarchy. ...

Fiscal policy and Stablization

... Tip: Simplify your calculations, the tax multiplier is always 1 less than the spending multiplier and the opposite sign. When taxes and government spending both increase or decrease by the same amount, the net change in real GDP is simply the change in government spending. ( the balance budget multi ...

... Tip: Simplify your calculations, the tax multiplier is always 1 less than the spending multiplier and the opposite sign. When taxes and government spending both increase or decrease by the same amount, the net change in real GDP is simply the change in government spending. ( the balance budget multi ...

This PDF is a selection from a published volume from... Bureau of Economic Research Volume Title: NBER International Seminar on Macroeconomics

... debt impacts more significantly (with a negative sign) on expenditures in Canada, the United Kingdom, and in the United States, while it has instead a borderline significant (positive) coefficient on taxes in France. Italian fiscal policy reacts to fluctuations in the debt/GDP ratio by adjusting bot ...

... debt impacts more significantly (with a negative sign) on expenditures in Canada, the United Kingdom, and in the United States, while it has instead a borderline significant (positive) coefficient on taxes in France. Italian fiscal policy reacts to fluctuations in the debt/GDP ratio by adjusting bot ...

Thema

... • reserves averaged over a monthly maintenance period during which they are remunerated at Bank Rate • How can we explain these changes in average cash reserve ratio across the entire United Kingdom banking system ? ...

... • reserves averaged over a monthly maintenance period during which they are remunerated at Bank Rate • How can we explain these changes in average cash reserve ratio across the entire United Kingdom banking system ? ...

DOC

... tax revenue would be greater than if the tax rate was zero percent. no one would be willing to work. tax revenue would be less than if the tax rate was zero percent. there would be a strong incentive to work. tax revenue would be maximized. ...

... tax revenue would be greater than if the tax rate was zero percent. no one would be willing to work. tax revenue would be less than if the tax rate was zero percent. there would be a strong incentive to work. tax revenue would be maximized. ...

module 12 review

... Check Your Understanding 1. Suppose that employment websites enable job-seekers to find suitable jobs more quickly. What effect will this have on the unemployment rate over time? Also suppose that these websites encourage job-seekers who had given up their searches to begin looking again. What effec ...

... Check Your Understanding 1. Suppose that employment websites enable job-seekers to find suitable jobs more quickly. What effect will this have on the unemployment rate over time? Also suppose that these websites encourage job-seekers who had given up their searches to begin looking again. What effec ...

Chp. 1.1 Simple Interest

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

The ABCs of Hardships and Loans

... into plan assets to meet payroll or pay other bills and then pay it back later. This is never permitted. Another common problem in tough economic times is when an employer withholds salary deferrals from employees’ pay intending to deposit the money in its 401(k) or SIMPLE IRA plan, but does not. Th ...

... into plan assets to meet payroll or pay other bills and then pay it back later. This is never permitted. Another common problem in tough economic times is when an employer withholds salary deferrals from employees’ pay intending to deposit the money in its 401(k) or SIMPLE IRA plan, but does not. Th ...

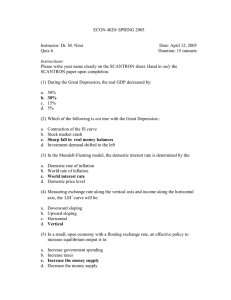

Quiz 6

... c. Allow the money supply to adjust to whatever level will ensure that the equilibrium exchange rate equals the announced exchange rate d. Follow a rule specifying the constant growth of money supply. (8) In a small open economy with a fixed exchange rate, an effective policy to increase equilibrium ...

... c. Allow the money supply to adjust to whatever level will ensure that the equilibrium exchange rate equals the announced exchange rate d. Follow a rule specifying the constant growth of money supply. (8) In a small open economy with a fixed exchange rate, an effective policy to increase equilibrium ...

SOCIAL SECURITY’S FINANCIAL OUTLOOK: THE 2012 UPDATE IN PERSPECTIVE Introduction RETIREMENT

... They also updated starting values for benefit levels, which were higher than expected because of the 2011 cost-of-living adjustment, and for payroll taxes, which were lower than expected because of the weak economy. In terms of the disability program, the Trustees increased the ultimate assumption a ...

... They also updated starting values for benefit levels, which were higher than expected because of the 2011 cost-of-living adjustment, and for payroll taxes, which were lower than expected because of the weak economy. In terms of the disability program, the Trustees increased the ultimate assumption a ...

INTERPRETATION AND METHODOLOGY Financial ratios Return

... The value of Total assets are calculated from the last audited annual financial report. ...

... The value of Total assets are calculated from the last audited annual financial report. ...

A Summary of Indian Economy

... • In many Asian countries the ratio of male to female population is higher than in the West • As high as 1.07 in China and India, and even higher in Pakistan. ...

... • In many Asian countries the ratio of male to female population is higher than in the West • As high as 1.07 in China and India, and even higher in Pakistan. ...

Document

... employment is 62,500, the nominal wage is 20, and the price level is 10. Demand for output is 250,000 at the given price, so all output is sold. Suddenly, demand at the given price drops to 200,000, but the firm does not lower its price. It lowers output and lays off workers. a. Assuming that the fi ...

... employment is 62,500, the nominal wage is 20, and the price level is 10. Demand for output is 250,000 at the given price, so all output is sold. Suddenly, demand at the given price drops to 200,000, but the firm does not lower its price. It lowers output and lays off workers. a. Assuming that the fi ...