* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download fiscal policy homework

Survey

Document related concepts

Transcript

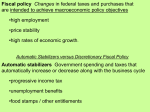

ABSE 102 Homework 1. If the government wishes to encourage the economic activity it should: a) reduce the budget deficit; b) reduce taxes; c) reduce government purchases; d) none of the above. 2. A € 100 billion tax cut has: a) the same effect on AD as a €100 billion increase in G; b) a weaker effect on AD than a €100 billion increase in G; c) a stronger effect on AD than a €100 billion increase in G; d) no effect on AD, since it affects only the "supply side" of the economy. 3. Fiscal policy is more effective: a) the lower is the multiplier; b) the greater the multiplier; c) the greater the time lag. d) none of the above. 4. An inflationary gap: a) occurs when AS falls; b) would occur if total output were less then aggregate demand; c) is the amount by which AD exceeds the potential GDP; d) is the amount by which AE exceeds GDP 5. Which of the following statements best indicates that the government is pursuing a restrictive fiscal policy: a) the government budget is at a deficit; b) the budget deficit turns into a surplus; c) the budget surplus turns into a budget deficit; d) none of the above. 6. The government is definitely pursuing an expansionary fiscal policy if, whatever the value of the budget: a) it increases its spending and reduces tax rates; b) it increases its spending and increases tax rates; c) it reduces its spending and reduces tax rates; d) it reduces its spending and increases tax rates. 7. In an economy where potential GDP exceeds AE, more G would result in: a) a smaller recessionary gap; b) a smaller inflationary gap; c) a larger recessionary gap; d) a larger inflationary gap. 8. Other things being equal, when the economy enters a recession, the government budget tends to: a) move toward a surplus; b) move toward a deficit; c) remain unchanged. 9. If in a closed economy with G = 0, MPC = 0.6, and planned Investment increase by €10 million, GDP will increase by: а) €10 million; b) €6 million ; c) €25 million; d) none of the above. 10. Consider the macroeconomic data about OZ: С I G X S T M 300 + 0.8 Y 700 500 900 - 200 + 0.1 Y 0.25 Y 100 + 0.15 Y a) Find the multiplier b) Find the taxation multiplier c) find injections d) find leakages e) find equilibrium income f) Find the increase in G, needed to raise GDP by 300.