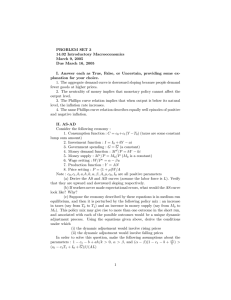

PROBLEM SET 3 14.02 Introductory Macroeconomics March 9, 2005 Due March 16, 2005

... that they are upward and downward sloping respectively. (b) If workers never made expectational errors, what would the AS curve look like? Why? (c) Suppose the economy described by these equations is in medium run equilibrium, and then it is perturbed by the following policy mix : an increase in tax ...

... that they are upward and downward sloping respectively. (b) If workers never made expectational errors, what would the AS curve look like? Why? (c) Suppose the economy described by these equations is in medium run equilibrium, and then it is perturbed by the following policy mix : an increase in tax ...

Economic growth - Danica Popović

... One of the main points of Table 3.4 is that the numbers of the population and the numbers of employed have grown at roughly the same rates over the course of the twentieth century for these countries, meaning that many trends (people entering the labour force later, retiring earlier, living longer ...

... One of the main points of Table 3.4 is that the numbers of the population and the numbers of employed have grown at roughly the same rates over the course of the twentieth century for these countries, meaning that many trends (people entering the labour force later, retiring earlier, living longer ...

Financial Repression – what does it mean for savers and investors?

... expectations to rise and equities to rally – 6 months later these markets were back where they started. ...

... expectations to rise and equities to rally – 6 months later these markets were back where they started. ...

Fiscal Policy and Saving Under Distortionary Taxation

... An empirical investigation of the effects of fiscal policy on saving is carried out using Israeli data, which display large variability in both the saving rate and the fiscal variables. The framework is a small open economy model with distortionary taxation. The theoretical analysis of the partial e ...

... An empirical investigation of the effects of fiscal policy on saving is carried out using Israeli data, which display large variability in both the saving rate and the fiscal variables. The framework is a small open economy model with distortionary taxation. The theoretical analysis of the partial e ...

Recent Economic Developments: September–December 2011

... In contrast to the slowdown in growth, there were a number of positive trends in 2011: the expansion of high-tech manufacturing production and exports; the return of indirect tax collection back up to its level in January–April, following the sharp decline in the previous period; and the greater wil ...

... In contrast to the slowdown in growth, there were a number of positive trends in 2011: the expansion of high-tech manufacturing production and exports; the return of indirect tax collection back up to its level in January–April, following the sharp decline in the previous period; and the greater wil ...

Gini Index - Social Watch

... Total number of malaria cases reported to the World Health Organization by countries in which malaria is endemic, per 100,000 people. Many countries report only laboratory-confirmed cases, but many in Sub-Saharan Africa report clinically diagnosed cases as well. Defined by: UNDP. Measles immunized ...

... Total number of malaria cases reported to the World Health Organization by countries in which malaria is endemic, per 100,000 people. Many countries report only laboratory-confirmed cases, but many in Sub-Saharan Africa report clinically diagnosed cases as well. Defined by: UNDP. Measles immunized ...

DGK tax data description - NYU Stern School of Business

... In order to calculate effective tax rates a number of assumptions need to be made. We define a base case that makes the following assumptions: ...

... In order to calculate effective tax rates a number of assumptions need to be made. We define a base case that makes the following assumptions: ...

2017-04-17 Econ 115 S 2017 PS 2 #TCEH.pages

... interest rate they control—the i, the short-term safe nominal interest rate—from its 2007 value of 5% as far as they could. But in general central bank reductions in the short-term safe nominal interest rate i induce only half as large a reduction in the real interest rate r: financiers and others b ...

... interest rate they control—the i, the short-term safe nominal interest rate—from its 2007 value of 5% as far as they could. But in general central bank reductions in the short-term safe nominal interest rate i induce only half as large a reduction in the real interest rate r: financiers and others b ...

Powerpoint Presentation Day 2 Part 4

... One part we have not discussed is why that Vo is important to the determination of the long run debt/GDP ratio. Write MVo = PY in the alternative form of M/P = Y/Vo. Here we see that in equilibrium, Y/Vo is just the real demand for money. The term 1/Vo is the proportion of our income we hold in the ...

... One part we have not discussed is why that Vo is important to the determination of the long run debt/GDP ratio. Write MVo = PY in the alternative form of M/P = Y/Vo. Here we see that in equilibrium, Y/Vo is just the real demand for money. The term 1/Vo is the proportion of our income we hold in the ...

Presentation

... Has the real exchange rate appreciated? Not on this basis! Ratio of Trade Deflators to GDP deflator (Px+ PM)/2)/PGDP ...

... Has the real exchange rate appreciated? Not on this basis! Ratio of Trade Deflators to GDP deflator (Px+ PM)/2)/PGDP ...

Homework 3

... increases the demand for reserves. Draw a graph of the interbank market when a central bank increases the reserve ratio while maintaining a fixed money level of reserves. If there is a given level of reserves and the reserve to deposit ratio rises, what effect will this have on the money supply. Dra ...

... increases the demand for reserves. Draw a graph of the interbank market when a central bank increases the reserve ratio while maintaining a fixed money level of reserves. If there is a given level of reserves and the reserve to deposit ratio rises, what effect will this have on the money supply. Dra ...

ppt presentation

... 2. However, the Polish economy was not heated by the crisis, though the situation with regards to public finances worsened dramatically. The reason is that errors in fiscal policies among all former governments have accumulated over time. 3. One of the main factors behind this occurrence concerns fi ...

... 2. However, the Polish economy was not heated by the crisis, though the situation with regards to public finances worsened dramatically. The reason is that errors in fiscal policies among all former governments have accumulated over time. 3. One of the main factors behind this occurrence concerns fi ...

The Developed World`s Demographic Demise

... more money to repay what it owes. The resulting inflation waters down the real value of the repayment and leaves creditors with watered-down dollars. History is replete with examples of what happens when countries can’t pay their bills. They raise taxes to exorbitant levels, begin printing money, an ...

... more money to repay what it owes. The resulting inflation waters down the real value of the repayment and leaves creditors with watered-down dollars. History is replete with examples of what happens when countries can’t pay their bills. They raise taxes to exorbitant levels, begin printing money, an ...

Document

... sector conditions are stabilizing. In other ways, though, the crisis and its repercussions are still acute, most visibly in the sizeable and continuing build up of public debt and a tightening liquidity squeeze in the economy. The immediate priority is a substantial reduction in the fiscal financing ...

... sector conditions are stabilizing. In other ways, though, the crisis and its repercussions are still acute, most visibly in the sizeable and continuing build up of public debt and a tightening liquidity squeeze in the economy. The immediate priority is a substantial reduction in the fiscal financing ...

Public finance consolidation in Slovakia

... – Corporate income tax up from 19% to 23% (since 2013 decreased to 22%; new tax licences ) – Special tax levies on banks and regulated monopolies – Higher payroll-taxes for self-employed and non-standard ...

... – Corporate income tax up from 19% to 23% (since 2013 decreased to 22%; new tax licences ) – Special tax levies on banks and regulated monopolies – Higher payroll-taxes for self-employed and non-standard ...

Zamac-pen05 450872 en

... economy, then it emerged that the pension system should not be of FC type, irrespective of the design of the education system. This since the effect from capital dilution had to be accounted for. This study only investigated the extreme cases: no effect on factor prices vs. fully closed economy, pur ...

... economy, then it emerged that the pension system should not be of FC type, irrespective of the design of the education system. This since the effect from capital dilution had to be accounted for. This study only investigated the extreme cases: no effect on factor prices vs. fully closed economy, pur ...

principles of finance

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

The liberalisation of the capital market

... On 1 November 1770 the king (Struensee) sent out orders for release of the interest rate. This decree meant that the previously fixed interest rate of 4 percent was lifted. This release of the interest rate solved one of the major economic problems of the day: lack of venture capital. ...

... On 1 November 1770 the king (Struensee) sent out orders for release of the interest rate. This decree meant that the previously fixed interest rate of 4 percent was lifted. This release of the interest rate solved one of the major economic problems of the day: lack of venture capital. ...

Managing Government Finances: A General Evaluation

... is this ratio; the lower is the amount available from borrowing for application for current services. This ratio was 72.73 percent in 1990-91. It increased to 86.74 percent in 1999-00 indicating that only about 13 percent of current borrowing is useable for current services. The ratio of interest pa ...

... is this ratio; the lower is the amount available from borrowing for application for current services. This ratio was 72.73 percent in 1990-91. It increased to 86.74 percent in 1999-00 indicating that only about 13 percent of current borrowing is useable for current services. The ratio of interest pa ...

UK GDP 2004-2009

... Massive housing crisis – both quality + quantity Commitment to upgrade the building stock 2013-2030 Urgent need for infrastructure improvements – but SME builders don’t usually have civil engineering skills UK must have GE by June ‘10 – change of Govt likely Risks – need to reduce public e ...

... Massive housing crisis – both quality + quantity Commitment to upgrade the building stock 2013-2030 Urgent need for infrastructure improvements – but SME builders don’t usually have civil engineering skills UK must have GE by June ‘10 – change of Govt likely Risks – need to reduce public e ...

Travel Study Project

... produced per person GDP composition by Sector: percent of industry that is agricultural, industry, and services GDP growth rate Primary agricultural goods Primary industries Percent of population below poverty line Unemployment Rate Minimum wage Currency value per US dollar Personal Income Tax Rate ...

... produced per person GDP composition by Sector: percent of industry that is agricultural, industry, and services GDP growth rate Primary agricultural goods Primary industries Percent of population below poverty line Unemployment Rate Minimum wage Currency value per US dollar Personal Income Tax Rate ...

public fund management in mena

... • CDG deducts a significant spread and pays a lower return to its captive clientele of pension funds. • It is currently improving its asset management capabilities and is likely to adopt a more modern approach in the future, while its client funds may be allowed to hire other asset managers. • The r ...

... • CDG deducts a significant spread and pays a lower return to its captive clientele of pension funds. • It is currently improving its asset management capabilities and is likely to adopt a more modern approach in the future, while its client funds may be allowed to hire other asset managers. • The r ...