An Assessment of Reserve Adequacy in Caribbean Economies

... these ratios is the share of non-gold reserves to imports, which provides a simple but useful indication of the number of months’ worth of imports that can be purchased by a country if there is a ‘sudden stop’ of foreign exchange due to a payment shock (see Chan, 2007 and Kenan and Yudin, 1965). How ...

... these ratios is the share of non-gold reserves to imports, which provides a simple but useful indication of the number of months’ worth of imports that can be purchased by a country if there is a ‘sudden stop’ of foreign exchange due to a payment shock (see Chan, 2007 and Kenan and Yudin, 1965). How ...

the effect of the minimum wage on the

... the demand and supply of labour but a conscious government’s decision violating the rules of the labour market. Back in 1778 Adam Smith pointed out that that even “the lowest species of common labourers must everywhere earn at least double their own maintenance, in order that, one with another, they ...

... the demand and supply of labour but a conscious government’s decision violating the rules of the labour market. Back in 1778 Adam Smith pointed out that that even “the lowest species of common labourers must everywhere earn at least double their own maintenance, in order that, one with another, they ...

The long history of financial boom-bust cycles in Iceland1 Part I

... too clear. We find that these episodes usually involve a large collapse in demand that in most cases serves as a trigger for the ensuing crisis. What typically follows is a currency crisis, sometimes coinciding with a sudden stop of capital inflows and an inflation crisis, and most often a banking c ...

... too clear. We find that these episodes usually involve a large collapse in demand that in most cases serves as a trigger for the ensuing crisis. What typically follows is a currency crisis, sometimes coinciding with a sudden stop of capital inflows and an inflation crisis, and most often a banking c ...

Chapter 10

... function has shifted upward over time because economic growth has created greater wealth and higher expected future income. The assumed MPC in the figure is 0.9. ...

... function has shifted upward over time because economic growth has created greater wealth and higher expected future income. The assumed MPC in the figure is 0.9. ...

Disappointment Aversion in Asset Allocation

... These analytical results are supported by empirical results with asset allocations in pension funds of 35 OECD countries. The estimated DA levels (standard errors) of stock, bond, and other investments (a portfolio of real estate, infrastructure, private equities, and hedge funds) are 2.33 (0.31), 1 ...

... These analytical results are supported by empirical results with asset allocations in pension funds of 35 OECD countries. The estimated DA levels (standard errors) of stock, bond, and other investments (a portfolio of real estate, infrastructure, private equities, and hedge funds) are 2.33 (0.31), 1 ...

This PDF is a selection from a published volume from... Bureau of Economic Research Volume Title: NBER International Seminar on Macroeconomics

... are equally costly, our focus on de facto fiscal space would be questionable. For example, a high level of tax revenue could be interpreted as leaving little room to raise taxes, thus counting negatively toward fiscal space, unlike our interpretation. Our presumption is that the costs of changing th ...

... are equally costly, our focus on de facto fiscal space would be questionable. For example, a high level of tax revenue could be interpreted as leaving little room to raise taxes, thus counting negatively toward fiscal space, unlike our interpretation. Our presumption is that the costs of changing th ...

here.

... Spending on benefits continued to grow as a proportion of total spending over the period between 1988−89 and 1998−99. Mostly this reflected continuing increases in the numbers receiving some of the main benefits, especially those in respect of disability and lone parenthood. While the number of pen ...

... Spending on benefits continued to grow as a proportion of total spending over the period between 1988−89 and 1998−99. Mostly this reflected continuing increases in the numbers receiving some of the main benefits, especially those in respect of disability and lone parenthood. While the number of pen ...

ALLOCATING FOR IMPACT - Global social impact investment

... and rapid growth in otherwise mature markets. ...

... and rapid growth in otherwise mature markets. ...

The Multiplier

... function was CF0 in 1965. The assumed MPC is 0.9. The U.S. consumption function was CF1 in 2005. The consumption function has shifted upward over time because economic growth has created greater wealth and higher expected future income. ...

... function was CF0 in 1965. The assumed MPC is 0.9. The U.S. consumption function was CF1 in 2005. The consumption function has shifted upward over time because economic growth has created greater wealth and higher expected future income. ...

Foundations of Economics, 3e (Bade/Parkin)

... Answer: The NBER defines a recession as a period of significant decline in total output, income, employment, and trade, usually lasting at least six months to a year, and marked by widespread contractions in many sectors of the economy. From 1992 to until March, 2001, the economy was in an expansion ...

... Answer: The NBER defines a recession as a period of significant decline in total output, income, employment, and trade, usually lasting at least six months to a year, and marked by widespread contractions in many sectors of the economy. From 1992 to until March, 2001, the economy was in an expansion ...

PDF

... government will reduce the e¤cient functioning of the economy. A survey of this argument is presented in Mankiw (1990). However, as noted by Mankiw, there is little empirical evidence to suggest that £uctuations in the rate of technological progress are su¤ciently large to account for the £uctuation ...

... government will reduce the e¤cient functioning of the economy. A survey of this argument is presented in Mankiw (1990). However, as noted by Mankiw, there is little empirical evidence to suggest that £uctuations in the rate of technological progress are su¤ciently large to account for the £uctuation ...

The Term Structure of Money Market Spreads

... The model delivers closed-form solutions for LOIS spreads as a function of the state vector Xt , and I can identify how much of the spreads is due to each of the variables included in Xt . Specifically, I include three different variables in Xt : a benchmark interbank interest rate, a proxy for cred ...

... The model delivers closed-form solutions for LOIS spreads as a function of the state vector Xt , and I can identify how much of the spreads is due to each of the variables included in Xt . Specifically, I include three different variables in Xt : a benchmark interbank interest rate, a proxy for cred ...

The securities described in this prospectus are offered

... purchase using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required under its terms remains the same even if the securities decrease in value. There is no market for trading Class “A” shares and it is not expected that su ...

... purchase using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required under its terms remains the same even if the securities decrease in value. There is no market for trading Class “A” shares and it is not expected that su ...

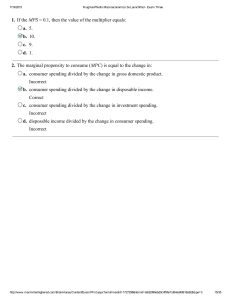

1. If the MPS = 0.1, then the value of the multiplier

... Correct Answer: The multiplier process relies upon spending at every step. If disposable income rises, consumers increase spending at every stage of the process, by an amount equal to the marginal propensity to consume multiplied by the increase in disposable income. If the MPC is large, the MPS is ...

... Correct Answer: The multiplier process relies upon spending at every step. If disposable income rises, consumers increase spending at every stage of the process, by an amount equal to the marginal propensity to consume multiplied by the increase in disposable income. If the MPC is large, the MPS is ...

My world is bigger than my grandmother`s.

... our shareowners as FedEx increased revenues and earnings to record levels. We also expanded our portfolio of services through the strategic acquisition of Kinko’s, and we developed new opportunities for sustained, profitable growth. For the fiscal year ended May 31, 2004, FedEx reported record reven ...

... our shareowners as FedEx increased revenues and earnings to record levels. We also expanded our portfolio of services through the strategic acquisition of Kinko’s, and we developed new opportunities for sustained, profitable growth. For the fiscal year ended May 31, 2004, FedEx reported record reven ...

Time and Risk Diversification in Real Estate Investments: the Ex

... and forecast multi-period means, variances, and covariances of returns on all asset classes, which allow to determine optimal portfolio weights. This exercise is repeated the following month, using data up to January 1995 to compute afresh forecasts of return moments and select portfolio weights. It ...

... and forecast multi-period means, variances, and covariances of returns on all asset classes, which allow to determine optimal portfolio weights. This exercise is repeated the following month, using data up to January 1995 to compute afresh forecasts of return moments and select portfolio weights. It ...

NBER WORKING PAPER SERIES GOVERNMENT SPENDING AND PRIVATE ACTIVITY Valerie A. Ramey

... payments to military and civilian personnel, and consumption of government capital. Rotemberg and Woodford (1992) made this distinction in their empirical work by examining shocks to total defense spending after conditioning on lags of the number of military personnel. Wynne (1992) was the first to ...

... payments to military and civilian personnel, and consumption of government capital. Rotemberg and Woodford (1992) made this distinction in their empirical work by examining shocks to total defense spending after conditioning on lags of the number of military personnel. Wynne (1992) was the first to ...

The Effects of Fiscal Policy on Employment: an

... 2009), the evidence supports that spending cuts affect employment more than tax increases, while changes in tax levels are more effective on real per capita GDP. Second, I analyze the role of monetary policy, which has a different reaction between the fiscal policy tools. Monetary policy seems to be ...

... 2009), the evidence supports that spending cuts affect employment more than tax increases, while changes in tax levels are more effective on real per capita GDP. Second, I analyze the role of monetary policy, which has a different reaction between the fiscal policy tools. Monetary policy seems to be ...

Reinsurance Market Report

... approximately a 2.6 percentage point impact after tax on the aggregate annualised RoE (FY 2015: 0.9 percentage points). ...

... approximately a 2.6 percentage point impact after tax on the aggregate annualised RoE (FY 2015: 0.9 percentage points). ...

Forecasting stock market returns: The sum of the parts is more than

... We obtain an out-of-sample R-square (relative to the historical mean) of 1.32% with monthly data and 13.43% with yearly data (and nonoverlapping observations). This compares with out-of-sample R-squares ranging from !1.78% to 0.69% (monthly) and from ! 17.57% to 7.54% (yearly) obtained using the pre ...

... We obtain an out-of-sample R-square (relative to the historical mean) of 1.32% with monthly data and 13.43% with yearly data (and nonoverlapping observations). This compares with out-of-sample R-squares ranging from !1.78% to 0.69% (monthly) and from ! 17.57% to 7.54% (yearly) obtained using the pre ...

The volatility of banks in the financial crisis

... Whereas the real economic activity always has a major impact on volatility, financial leverages’ impact depends on the state of the economy. To clarify, financial leverage is the degree to which an investor or business is using borrowed money. Highly leveraged companies may be at risk of bankruptcy ...

... Whereas the real economic activity always has a major impact on volatility, financial leverages’ impact depends on the state of the economy. To clarify, financial leverage is the degree to which an investor or business is using borrowed money. Highly leveraged companies may be at risk of bankruptcy ...

Economic Review, 2nd Quarter, 1999

... Taylor presented his rule as a simple, representative specification that captured the general framework for policy discussed earlier. Because there is a lack of consensus about the exact specification, evaluating alternative similar specifications is important when assessing the usefulness of rule r ...

... Taylor presented his rule as a simple, representative specification that captured the general framework for policy discussed earlier. Because there is a lack of consensus about the exact specification, evaluating alternative similar specifications is important when assessing the usefulness of rule r ...

ExamView Pro - ec1001june2009.tst

... b. the Fed takes awhile to figure out what it wants to do. c. the Congress takes awhile to figure out what it wants to do. d. it takes time to observe the effects of monetary policy on the economy. ____ 27. In the long run, large and continuing budget surpluses a. mean higher taxes and a lower stand ...

... b. the Fed takes awhile to figure out what it wants to do. c. the Congress takes awhile to figure out what it wants to do. d. it takes time to observe the effects of monetary policy on the economy. ____ 27. In the long run, large and continuing budget surpluses a. mean higher taxes and a lower stand ...